First Bitcoin Capital Today Advised the SEC of its Support for the Pending Bitcoin and Ethereum Exchange Traded Funds (ETF)

May 05 2017 - 9:30AM

Access Wire

VANCOUVER, BC / ACCESSWIRE / May 5, 2017 /

First Bitcoin Capital Corp. (OTC PINK: BITCF):

Hon. Michael S. Piwowar, Acting Chairman

Hon. Kara M. Stein, Commissioner

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

May 4. 2017

Re: File No. SR-BatsBZX-2016-30

Dear Commissioners Piwowar and Stein,

We, First Bitcoin Capital Corp respectfully submit this letter

in support of the Proposed Rule Change to Bats-BZX Rule

14.11(e)(4), and more generally, in support of the Securities and

Exchange Commission's consideration of the underlying request to

create a publicly traded Exchange Traded Fund for the commodity of

Bitcoin.

As the leading public company in the Bitcoin space, we would

like to present our conclusive research for your kind

consideration.

Based on this research, the primary way that the SEC protects

the public is through requiring adequate and accurate disclosures.

In this regard, it appears that COIN has overwhelmingly met those

requirements and the SEC has not raised the adequacy and/or

accuracy of the COIN disclosures as an issue. On the other hand,

the concern about the lack of regulation is covered thereby giving

potential speculators and investors this knowledge to fulfill the

logic behind the SEC's adequate and accurate disclosure

requirements.

The SEC revealed that it fears the ability (presumably of some

billionaire) to manipulate Bitcoin as a commodity, yet that would

likely be more difficult to accomplish than the Hunt Brothers

achieved in their attempt to monopolize silver.

The significant supply and demand and diversity of market

factors driving BTC would easily make such a feat nearly, if not,

impossible.

Imagine trying to move in and out of 300 markets worldwide

needing to wield hundreds of millions of dollars to have any

influence and to what avail? So, say some currency manipulator like

Soros tried this, he could just as easily lose his shirt and how

long could he sustain such an operation? Apparently, it would be in

an effort to buy and sell shares of the EFT named COIN for a

profit. If the manipulator were successful in controlling BTC in

the markets, there would be no need to utilize the EFT to achieve

that goal.

Recent history has already given us a clear view of how COIN

would look and trade in a similar entity trading as Global Bitcoin

Trust (GBTC) on the OTCQX found at

http://www.otcmarkets.com/stock/GBTC/quote where today's price

movements on a smaller scale reflected the substantial increases in

BTC's rising price and volume.

Consider for example that $959,301,000 worth of BTC has traded

in the past 24 hours (at the time of writing this) according to

http://coinmarketcap.com/currencies/bitcoin/ and this covers dozens

of exchanges around the world trading in at least 300 fiat and

cryptocurrencies that charge fees. It does not include those

exchanges that are commission free, nor those that have not

provided their API to coinmarketcap.com.

Another aspect that makes Bitcoin less susceptible to

manipulation is the fact that each transference from wallet to

wallet of Bitcoin can be seen on an open public ledger known as a

blockchain.

The example of the Hunt Brothers is relevant because worldwide

silver daily trading volume is similar in size to Bitcoin, and was

mostly an unregulated commodity decades ago- similar to Bitcoin

today.

Governments around the world are beginning to regulate trading

of Bitcoin, for example, Japan began regulating BTC last month. The

New York banking authority began regulating bitcoin exchanges and

FINCEN requires registration for Bitcoin exchanges in the USA.

Gemini, a regulated exchange affiliated with COIN through their

founders, the Winklevoss Twins, accounts for a very small amount of

Bitcoin trading and would not be a good vehicle for manipulation as

inexplicably envisioned by the SEC.

Imagine if the conclusion were made that due to the Hunt

Brothers attempt to corner the silver market that silver could not

be the basis of a commodity based Exchange Traded Fund?

Similar arguments could be made for the EtherIndex Ether Trust

first filed in July 2016, seeking to launch an ETF backed by a

cache of ethers on the NYSE Arca exchange as well as any other

leading altcoins that would enter into an EFT.

Thank you for your kind consideration.

Respectfully submitted,

Simon Rubin, Chairman of the Board

FIRST BITCOIN CAPITAL CORP.

SOURCE: First Bitcoin Capital Corp.

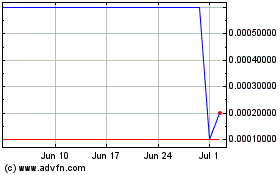

First Bitcoin Capital (PK) (USOTC:BITCF)

Historical Stock Chart

From Nov 2024 to Dec 2024

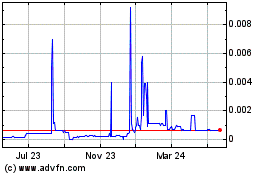

First Bitcoin Capital (PK) (USOTC:BITCF)

Historical Stock Chart

From Dec 2023 to Dec 2024