Phoenix Raises Stake in Barratt, Bellway After Brexit

July 11 2016 - 8:18AM

Dow Jones News

By Olga Cotaga

LONDON--Phoenix Asset Management Partners has bought more stock

in Barratt Developments PLC (BDEV.LN) and Bellway PLC (BWY.LN)

after shares in U.K. house-builders plunged in the wake of the

country's vote to leave the European Union.

Since the close of markets June 22, the day before the U.K.'s

referendum on EU membership, shares of Barratt and Bellway shed 34%

and 30%, respectively.

"The [share] prince was a good opportunity," said Tristan

Chapple, head of research at Phoenix Asset Management Partners.

"Nothing has changed in [house-building] fundamentals," Mr. Chapple

said, adding that he thinks the builders are worth three times as

much as their current market value.

Phoenix Asset Management invests in Barratt and Bellway through

Phoenix U.K. Fund, which has under management more than 500 million

pounds ($657.9 million). After the referendum vote, the fund

increased its shareholding in Barratt to 12% from 11.2% previously.

It did the same with Bellway, rising its interest in the company to

10.5% from 7.1%. The fund also owns shares in Sports Direct

International PLC (SPD.LN) and Tesco PLC (TSCO.LN).

Seven companies last week suspended trading in their property

funds after a number of investors had asked to pull their money

out. Standard Life Investments was the first to halt trading in its

GBP2.9 billion commercial real-estate fund, citing "exceptional

market circumstances." The funds buy commercial real-estate

properties and invest in real-estate investment trust shares.

Mr. Chapple said his investors hadn't asked for any redemptions

since the EU referendum result.

Phoenix Asset Management said that even if the current

uncertainty leads to house price deflation, directly affecting

profits, land prices would fall as well, making houses cheaper to

build in the future. With smaller costs, profits could return to

previous levels, the manager said.

Phoenix Asset Management is among the top 10 shareholders in

both Barratt and Bellway, Mr. Chapple said, adding that the asset

manager has been following the U.K. house-building sector for 18

years. On its website, the asset manager describes itself as a

"long-term value investor," which is patient and waits "for

opportunities to buy shares at attractive prices."

Canaccord Genuity said the house-building industry "is in very

good shape" to react to any potential slowdown caused by Brexit.

"Given recent land-buying behavior, we believe that the sector

could withstand a house price correction of up to 10% without

seeing material asset write-downs," the broker said.

But Canaccord analysts predicted that weaker consumer confidence

would impact house-builders' profits in fiscal 2017 and 2018.

Fiscal 2016 earnings remain protected by forward order books, they

said. The broker predicted house-building volumes falling by 4% to

5% in fiscal 2017 and 2018. It also lowered earnings forecasts by

7% for 2017 and 12% for 2018. Dividend expectations were kept the

same.

Canaccord said it preferred companies with stronger balance

sheets and identified Persimmon PLC (PSN.LN), Bellway and Taylor

Wimpey (TW.LN) as favorites, recommending to buy their stock.

Jefferies said it "remained bullish on the longer term

fundamentals" of the sector and that it wasn't changing its

estimates. But it did cut share price targets for the industry on

average by 25%. It had a "Buy" rating on Taylor Wimpey and Bovis

Homes Group PLC (BVS.LN).

Liberum Capital cut earnings-per-share estimates for the sector

by around 18%, having reevaluated its figures in the wake of the

country's vote to leave the EU. It also cut target share prices by

around 20%.

Still, the broker said "valuations now look compelling across

the board." Liberum warned that the sector is "for the brave," but

encouraged investors to buy shares in Bellway, Berkeley and MJ

Gleeson (GLE.LN).

Directors of U.K. house-builders have bought shares in their

companies since the EU referendum, a move usually seen as a sign of

endorsement. Their investment amounted to a total of GBP1.8

million. This "speaks volumes for management's view of the level of

the share price," Liberum said.

After the U.K. voted to leave the EU, Barratt said it expected a

period of uncertainty as the country negotiates its exit, adding

that it remains confident its business "can respond to the changing

landscape."

Write to Olga Cotaga at olga.cotaga@wsj.com, Twitter

@OlgaCotaga

(END) Dow Jones Newswires

July 11, 2016 09:03 ET (13:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

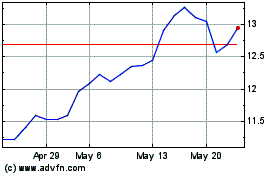

Barratt Redrow (PK) (USOTC:BTDPY)

Historical Stock Chart

From Nov 2024 to Dec 2024

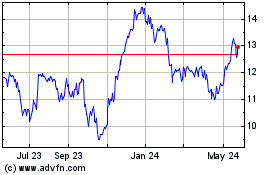

Barratt Redrow (PK) (USOTC:BTDPY)

Historical Stock Chart

From Dec 2023 to Dec 2024