Toronto Stocks Rally as Brexit Worries Ease

June 29 2016 - 4:01PM

Dow Jones News

By Ezequiel Minaya

Canadian stocks rallied Wednesday, joining markets in the U.S.,

Europe and Asia, as fears eased following the U.K. vote to leave

the European Union.

Over all, the S&P/TSX Composite Index gained 194.05 points,

or 1.4%, to 14036.74. Advancers led decliners by the wide margin of

1,296 to 356. Trading volume was 419.7 million shares, compared

with 355.1 million on Tuesday.

The blue chip S&P/TSX 60 Index closed up 10.72 points, or

1.3%, at 816.56.

Investors appeared increasingly convinced that the so-called

Brexit vote wouldn't produce the global fallout seen with the

financial crisis of 2008 and that any significant aftershocks would

largely be contained to the U.K.

"People are starting to take stock that this is more

country-specific and is not affecting markets everywhere," said

Andrew Sheets, chief cross-asset strategist at Morgan Stanley. "So

far, it doesn't appear to be a big risk to global growth."

Markets are poised to be further buttressed if economic data

from the U.S. and China show growth. U.S. consumer spending picked

up in May from a month earlier, the Commerce Department said

Wednesday.

In Canada, energy companies were among the biggest gainers

Wednesday, supported by the weaker U.S. dollar and tightening crude

stockpiles in the U.S. Canadian Energy Services & Technology

Corp. rose 8.9%, and Kelt Exploration Ltd. climbed 7%

Gem companies were among the top losers amid the failure of

Lucara Diamond Corp. to auction the second-largest diamond ever

mined Wednesday night in London. Lucara fell 14.5%, and Dominion

Diamond Corp. declined 2.3%. Grocer Empire Co. Ltd. also posted

among the leading decliners, dropping 11%.

Among other companies whose shares made notable moves were

Canadian Imperial Bank of Commerce, Teck Resources, Lundin Mining

and HudBay Minerals.

Canadian Imperial Bank of Commerce, Canada's fifth-biggest

lender, said it would buy Chicago-based PrivateBancorp Inc., a

Chicago-based middle-market commercial bank, for about $3.8 billion

in cash and stock, as CIBC looks to expand its reach in North

America. CIBC shares fell 2.5%.

Copper prices extended new eight-week gains amid U.S. dollar

weakness as markets returned to solid footing. This helped shares

of copper producers like Teck Resources Ltd., Lundin Mining Corp.

and HudBay Minerals Inc. Each of those stocks rose at least

3.8%.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

June 29, 2016 16:46 ET (20:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

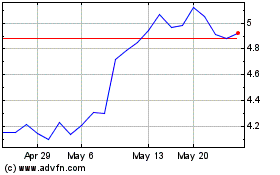

Ces Energy Solutions (PK) (USOTC:CESDF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ces Energy Solutions (PK) (USOTC:CESDF)

Historical Stock Chart

From Nov 2023 to Nov 2024