Core Scientific, Inc./tx 0001839341 false NONE NONE 0001839341 2023-12-04 2023-12-04 0001839341 us-gaap:CommonStockMember 2023-12-04 2023-12-04 0001839341 us-gaap:WarrantMember 2023-12-04 2023-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2023

Core Scientific, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40046 |

|

86-1243837 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

210 Barton Springs Road, Suite 300 Austin, Texas |

|

78704 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (512) 402-5233

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

CORZQ |

|

* |

| Warrants, exercisable for shares of common stock |

|

CRZWQ |

|

* |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| * |

The registrant’s common stock and warrants began trading exclusively on the OTC Pink Marketplace on January 3, 2023 under the Symbols “CORZQ” and “CRZWQ,” respectively. |

As previously disclosed, on December 21, 2022, Core Scientific, Inc. (the “Company”) and certain of its affiliates (collectively, the “Debtors”) filed voluntary petitions (the “Chapter 11 Cases”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) seeking relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”). The Debtors continue to operate their business and manage their properties as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. Additional information about the Chapter 11 Cases, including access to Court documents, is available online at cases.stretto.com/CoreScientific/, a website administered by Stretto, Inc., a third-party bankruptcy claims and noticing agent. The information on this web site is not incorporated by reference into, and does not constitute part of, this Form 8-K.

Also, as previously disclosed, on November 16, 2023, the Debtors filed the Third Amended Joint Chapter 11 Plan of Reorganization of Core Scientific, Inc. and its Debtor Affiliates (the “Plan”) and a related Disclosure Statement for the Plan (the “Disclosure Statement”) with the Bankruptcy Court.

| Item 7.01 |

Regulation FD Disclosure. |

On December 4, 2023, the Company shared a presentation summarizing certain aspects of the Plan and Disclosure Statement on the Company’s website. Also, on December 4, 2023, the Company issued a press release announcing the presentation and an accompanying webcast, which the Company also shared on its website. Copies of the presentation and press release are attached as Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K, respectively, and are incorporated by reference herein.

The presentation is solely for informational purposes. Investors should not rely upon it or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. The presentation is “as is” and neither the Company nor any affiliates or agents of the Company, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in the presentation or any oral information provided in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein.

The presentation does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. The presentation does not constitute and should not be considered as any form of legal or financial opinion or recommendation by the Company or any of its affiliates. The presentation is not a research report nor should it be construed as such.

The presentation, including any financial projections and forecasts, was not prepared with a view toward public disclosure or compliance with the published guidelines of the Securities and Exchange Commission or the guidelines established by the Public Company Accounting Oversight Board and should not be relied upon to make an investment decision with respect to the Company. The presentation does not purport to present the Company’s financial condition in accordance with GAAP. The Company’s independent registered public accounting firm has not examined, compiled or otherwise applied procedures to the presentation and, accordingly, does not express an opinion or any other form of assurance with respect to the presentation. Any financial projections or forecasts were prepared for internal use, capital budgeting and other management decisions and are subjective in many respects. Any such financial projections or forecasts reflect numerous assumptions made by management of the Company with respect to financial condition, business and industry performance, general economic, market and financial conditions, and other matters, all of which are difficult to predict, and many of which are beyond the Company’s control. The disclosure of the presentation should not be regarded as an indication that the Company or its affiliates or representatives consider the presentation to be a reliable prediction of future events, and the presentation should not be relied upon as such. The statements in the presentation speak only as of the date such statements were made, or any earlier date indicated therein. Neither the Company nor any of its affiliates or representatives has made or makes any representation to any person regarding the ultimate outcome of the foregoing, and none of them undertakes any obligation to publicly update the presentation to reflect circumstances existing after the date when the presentation was made available to stakeholders or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying the presentation are shown to be in error. The statements provided in the presentation are subject to all of the cautionary statements and limitations described herein, therein and under the caption “Forward-Looking Statements.”

In accordance with General Instruction B.2 of Form 8-K, the information being furnished under this Item 7.01 pursuant to this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other document filed by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference therein.

Cautionary Statement Regarding Forward-Looking Information

This Form 8-K includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. The Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and other factors, which could include the following: risks and uncertainties relating to the Company’s Chapter 11 Cases including but not limited to, the Company’s ability to obtain Bankruptcy Court approval with respect to motions in its Chapter 11 Cases, successfully enter into and implement a restructuring plan, emerge from Chapter 11 and achieve significant cash flows from operations; the effects of the Chapter 11 Cases on the Company and on the interests of various constituents, Bankruptcy Court rulings in the Chapter 11 Cases and the outcome of the Chapter 11 Cases in general, the length of time the Company will operate under the Chapter 11 Cases, risks associated with any third-party motions in the Chapter 11 Cases, the potential adverse effects of the Chapter 11 Cases on the Company’s liquidity or results of operations and increased legal and other professional costs necessary to execute the Company’s reorganization; finalization and receipt of the replacement debtor-in-possession facility; satisfaction of any conditions to which the Company’s debtor-in-possession financing is subject and the risk that these conditions may not be satisfied for various reasons, including for reasons outside of the Company’s control; the consequences of the acceleration of the Company’s debt obligations; the trading price and volatility of the Company’s common stock and the risks related to trading on the OTC Pink Market; as well as other risk factors set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. These statements are provided for illustrative purposes only and are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on the current expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the U.S. Securities & Exchange Commission, and if any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits:

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Presentation |

|

|

| 99.2 |

|

Press Release |

|

|

| 104 |

|

Cover page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Core Scientific, Inc. |

|

|

|

|

| Date: December 4, 2023 |

|

|

|

By: |

|

/s/ Todd M. DuChene |

|

|

|

|

Name: |

|

Todd M. DuChene |

|

|

|

|

Title: |

|

Chief Legal Officer and Chief Administrative Officer |

Exhibit 99.1 Core Scientific, Inc. Emergence Overview* December 4, 2023

* This is only a summary. All shareholders and creditors should read the Plan and Disclosure Statement for details. 1

Legal Disclaimer This document is solely for informational purposes. You

should not rely upon it or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. This document is “as is” and neither Core Scientific, Inc. (the

“Company”) nor any affiliates or agents of the Company, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided

in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. All share and

warrant numbers in this document are rounded down to the nearest whole share or warrant, as applicable, which reflects that no fractional shares or warrants will be issued in connection with the Company’s Chapter 11 Plan. You are encouraged to

read the Company’s Chapter 11 Plan and the related Disclosure Statement, each as amended or supplemented, which are available (i) on the website of Stretto, the Company’s voting and solicitation agent, at

https://cases.stretto.com/corescientific/, (ii) by calling Stretto at (949) 404-4152 (in the U.S. and Canada; toll-free) or +1 (888) 765-7875 (outside of the U.S. and Canada), or (iii) by sending an electronic mail message to

CoreScientificInquiries@stretto.com. This document does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or

purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient.

This document does not constitute and should not be considered as any form of legal or financial opinion or recommendation by the Company or any of its affiliates. This document is not a research report nor should it be construed as such. The

document, including any projections and forecasts, was not prepared with a view toward public disclosure or compliance with the published guidelines of the Securities and Exchange Commission or the guidelines established by the Public Company

Accounting Oversight Board and should not be relied upon to make an investment decision with respect to the Company. This document does not purport to present the Company’s financial condition in accordance with GAAP. The Company’s

independent registered public accounting firm has not examined, compiled or otherwise applied procedures to this document and, accordingly, does not express an opinion or any other form of assurance with respect to this document. Any projections or

forecasts were prepared for internal use, capital budgeting and other management decisions and are subjective in many respects. Any such projections or forecasts reflect numerous assumptions made by management of the Company with respect to

financial condition, business and industry performance, general economic, market and financial conditions, and other matters, all of which are difficult to predict, and many of which are beyond the Company’s control. The disclosure of this

document should not be regarded as an indication that the Company or its affiliates or representatives consider this document to be a reliable prediction of future events, and this document should not be relied upon as such. The statements in this

document speak only as of the date such statements were made, or any earlier date indicated therein. Neither the Company nor any of its affiliates or representatives has made or makes any representation to any person regarding the ultimate outcome

of the foregoing, and none of them undertakes any obligation to publicly update this document to reflect circumstances existing after the date when this document was made available to stakeholders or to reflect the occurrence of future events, even

in the event that any or all of the assumptions underlying this document are shown to be in error. The statements provided in this document are subject to all of the cautionary statements and limitations described herein, therein and under the

caption “Forward-Looking Statements.” Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements about plans, expectations and intentions with respect to the future and other statements identified by words such as will likely result, are expected to, will continue, is anticipated, estimated, believe, intend, plan, projection,

“forecast,” outlook or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of the management of the Company and are inherently subject to significant contingencies, many of

which are difficult to predict and generally beyond the control of the parties. Actual performance or achievements may differ materially, and potentially adversely, from any forward-looking statements and the assumptions on which those

forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of

future performance as such information is based on estimates and assumptions. The forward-looking statements are subject to various risks, uncertainties and other factors, many of which are beyond the Company’s control. 2

Agenda I. Business Overview II. Post-Emergence Capital Structure III.

Stakeholder Recoveries IV. Emergence Timeline V. Additional Information 3

Plan Highlights: Maximizing Value for All Stakeholders Common

Shareholders as of the Plan Effective Date (expected to be January 5, 2024) are expected to receive $1.08 per share of pre-exchange value based on current assumptions (see page 17 for assumptions) • Includes non-contingent recovery of ~$0.85

per share and expected additional distributions of ~$0.23 per share • Existing equity to receive new common shares and two tranches of warrants • If the Tranche 1 and 2 Warrants are exercised, existing shareholders may own as much as

~65% of equity in the Reorganized Company (including on account of equity rights offering / backstop) The Convertible Notes are receiving original par plus accrued interest and accretion in the form of New Secured Notes, New Secured Convertible

Notes, and New Common Shares Executive • The April Convertible Noteholders are expected to receive $1.628 of value for every $1 original par face amount • The August Convertible Noteholders are expected to receive $1.201 of value for

every $1 original par face amount Summary Recapitalized projected Core balance sheet reflects agreements with majority of key stakeholders • $55 million equity rights offering and $80 million exit facility (of which $40 million is new money)

provide liquidity upon emergence • Plan results in deleveraging via equitization of claims • New debt schedule reflects less than $50 million of required paydown through year-end 2025 The $55 million Equity Rights Offering

(“ERO”) is currently anticipated to occur at $0.34 per share • Common shareholders as of November 16, 2023 have a right to participate in the ERO • ERO shares will not be diluted by expected equity distributions on account of

disputed claims and unvested RSUs / (1) unvested RSAs / stock options 1) ERO shares are calculated as if such equity distributions are already made. 4 4

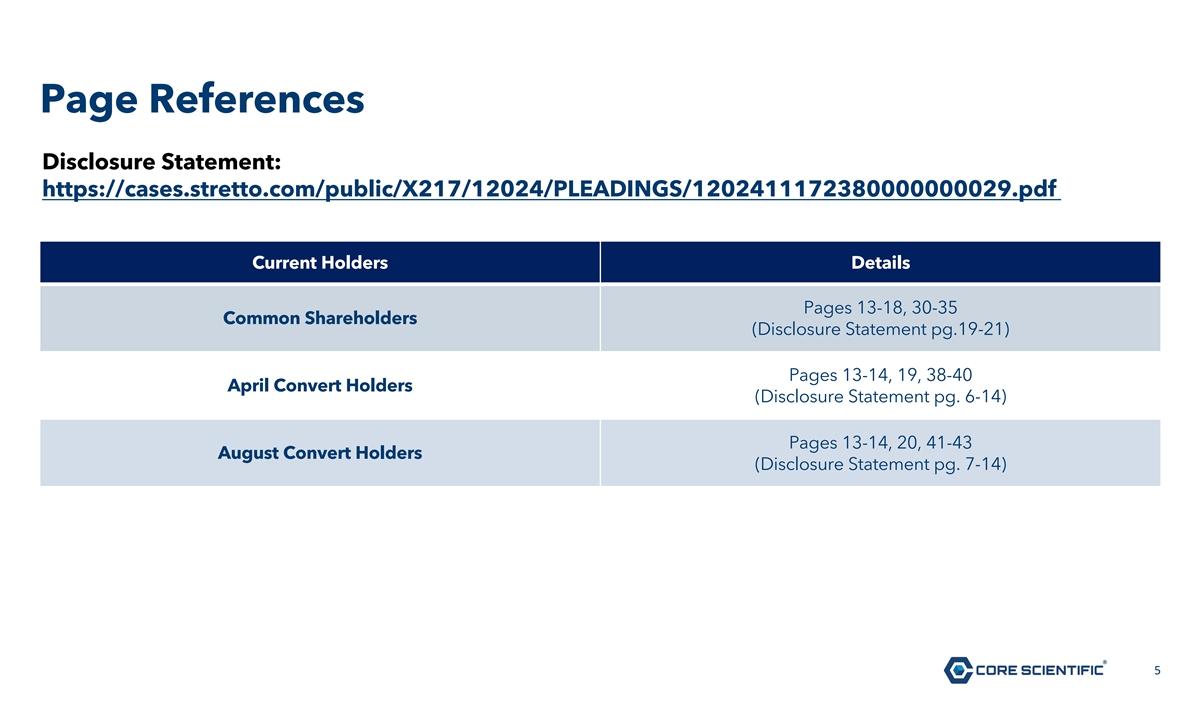

Page References Disclosure Statement:

https://cases.stretto.com/public/X217/12024/PLEADINGS/1202411172380000000029.pdf Current Holders Details Pages 13-18, 30-35 Common Shareholders (Disclosure Statement pg.19-21) Pages 13-14, 19, 38-40 April Convert Holders (Disclosure Statement pg.

6-14) Pages 13-14, 20, 41-43 August Convert Holders (Disclosure Statement pg. 7-14) 5

I. Business Overview 6

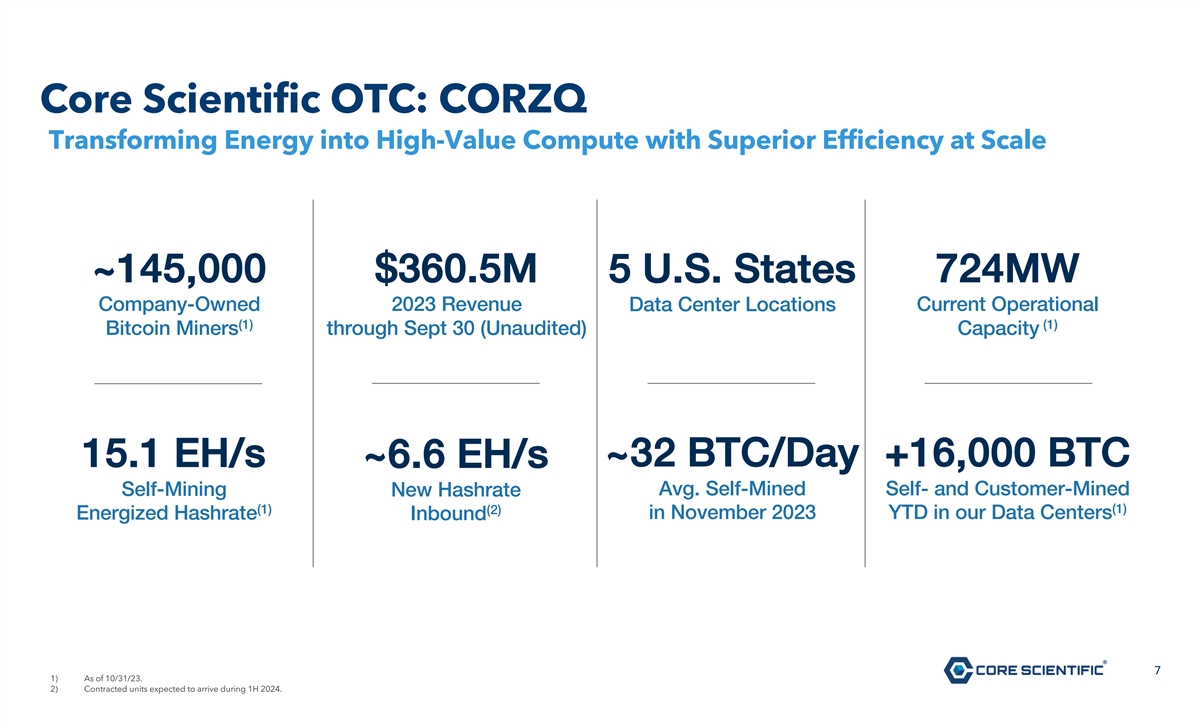

Core Scientific OTC: CORZQ Transforming Energy into High-Value Compute

with Superior Efficiency at Scale ~145,000 $360.5M 5 U.S. States 724MW Company-Owned 2023 Revenue Data Center Locations Current Operational (1) (1) Bitcoin Miners through Sept 30 (Unaudited) Capacity 15.1 EH/s ~32 BTC/Day +16,000 BTC ~6.6 EH/s

Self-Mining Avg. Self-Mined Self- and Customer-Mined New Hashrate (1) (1) (2) Energized Hashrate Inbound in November 2023 YTD in our Data Centers 7 1) As of 10/31/23. 2) Contracted units expected to arrive during 1H 2024.

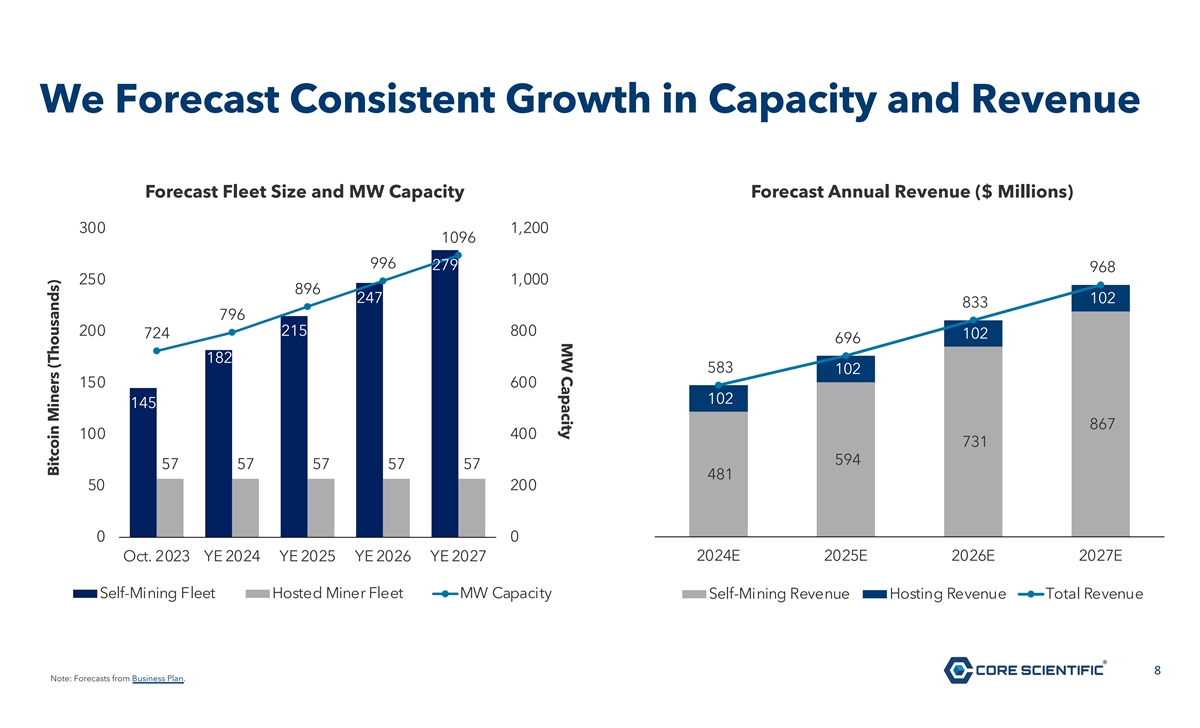

MW Capacity We Forecast Consistent Growth in Capacity and Revenue

Forecast Fleet Size and MW Capacity Forecast Annual Revenue ($ Millions) 300 1,200 1096 996 279 968 250 1,000 896 247 102 833 796 200 215 800 724 102 696 182 583 102 150 600 102 145 867 100 400 731 594 57 57 57 57 57 481 50 200 0 0 Oct. 2023 YE 2024

YE 2025 YE 2026 YE 2027 2024E 2025E 2026E 2027E Self-Mining Fleet Hosted Miner Fleet MW Capacity Self-Mining Revenue Hosting Revenue Total Revenue 8 Note: Forecasts from Business Plan. Bitcoin Miners (Thousands)

II. Post-Emergence Capital Structure 9

Post-Emergence Capital Structure Reflects agreements reached with

majority of key stakeholders through bankruptcy process The below chart is illustrative, subject to change, and based on certain assumptions. It does not reflect the impact of the conversion of the New Secured Convertible Notes, the exercise of the

Tranche 1 or Tranche 2 Warrants, or the issuance of shares to management under the Management Incentive Plan. ($ in millions, unless otherwise specified) PF Capital Structure Amount New Delayed Draw Term Loan $61 New Secured Notes 150 Miner

Equipment Loans 177 Other Secured Debt 76 Total Non-Convertible Debt $464 New Secured Convertible Notes 260 ⁽ ⁾ Total Debt $724 (-) Excess Cash ¹ (15) Net Debt $709 Memo: Cash on Balance Sheet at Emergence $56 Plan TEV $1,500 (-)

Net Debt (709) Plan Equity Value $791 Equity Ownership % If the Tranche 1 and Tranche 2 Warrants are Existing Shareholders ⁽ ⁾ exercised, existing shareholders may own Shares Distributed at Emergence 23% up to ~65% of equity in the

Reorganized Shares Expected to Be Distributed Post-Emergence (e.g., Disputed Claims) ² 15% (3) Company. Equity Rights Offering (Subscription, Backstop Shares, and Backstop Fee) 11% Convertible Noteholders 33% Other Creditors 11% Bitmain 7%

Total 100% Note: Does not reflect cash on account of exercise of Tranche 1 Warrants, which, if exercised in full, would generate ~$600 million of cash, deleveraging the balance sheet. 1) Excess Cash reflects cash balance (at Company’s

forecasted cash trough) less $20 million anticipated minimum cash level based on Company’s business plan and post-emergence debt service, illustratively assuming a 12/31/23 Effective Date. Reflects $55 million of ERO proceeds. 10 2) The

Company’s books and records reflect that certain disputed claims should be disallowed in the future, in which case the equity value (and warrants) will be distributed to existing equity; however, the outcome of any litigation is uncertain.

Includes 510(b) claims. 3) Assumes the New Secured Convertible Notes are converted in full.

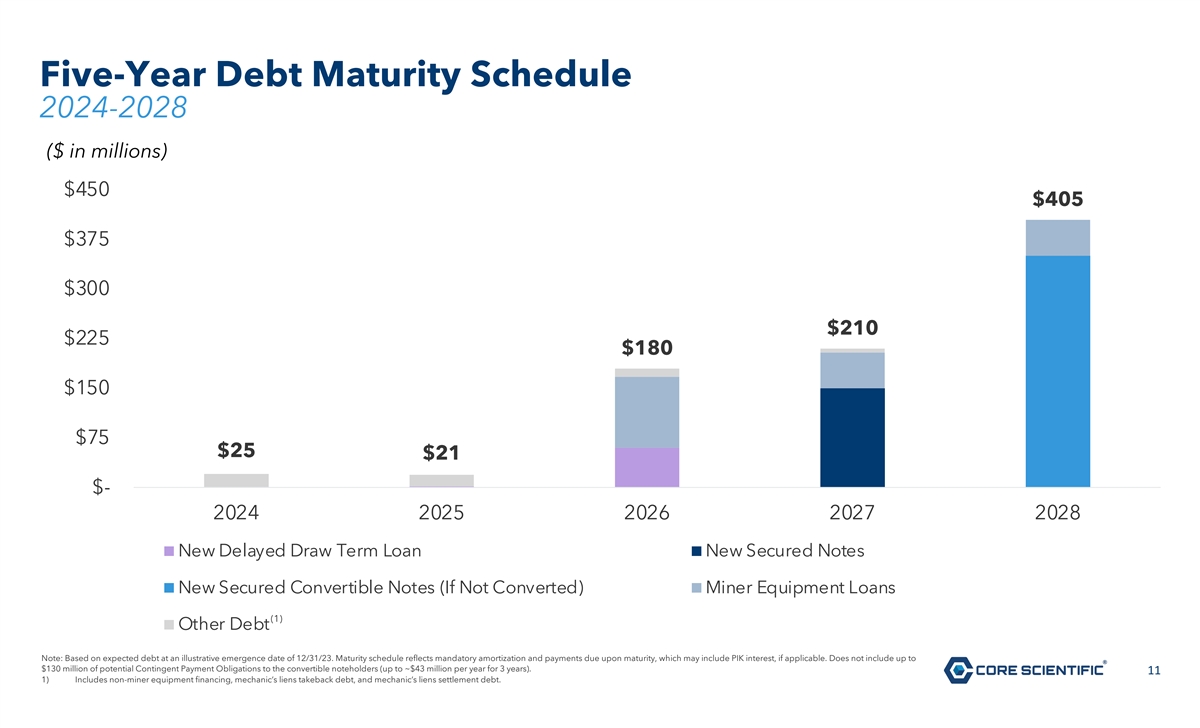

Five-Year Debt Maturity Schedule 2024-2028 ($ in millions) $450 $405

$375 $300 $210 $225 $180 $150 $75 $25 $21 $- 2024 2025 2026 2027 2028 New Delayed Draw Term Loan New Secured Notes New Secured Convertible Notes (If Not Converted) Miner Equipment Loans (1) Other Debt Total Note: Based on expected debt at an

illustrative emergence date of 12/31/23. Maturity schedule reflects mandatory amortization and payments due upon maturity, which may include PIK interest, if applicable. Does not include up to $130 million of potential Contingent Payment Obligations

to the convertible noteholders (up to ~$43 million per year for 3 years). 11 1) Includes non-miner equipment financing, mechanic’s liens takeback debt, and mechanic’s liens settlement debt.

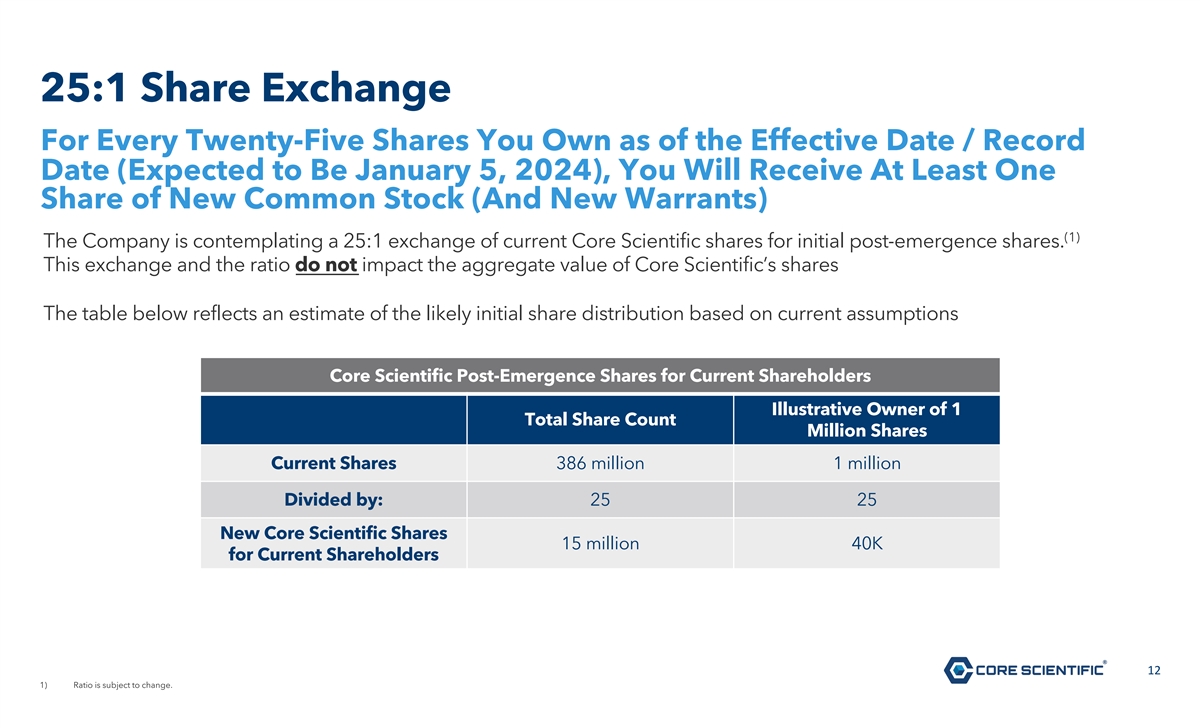

25:1 Share Exchange For Every Twenty-Five Shares You Own as of the

Effective Date / Record Date (Expected to Be January 5, 2024), You Will Receive At Least One Share of New Common Stock (And New Warrants) (1) The Company is contemplating a 25:1 exchange of current Core Scientific shares for initial post-emergence

shares. This exchange and the ratio do not impact the aggregate value of Core Scientific’s shares The table below reflects an estimate of the likely initial share distribution based on current assumptions Core Scientific Post-Emergence Shares

for Current Shareholders Illustrative Owner of 1 Total Share Count Million Shares Current Shares 386 million 1 million Divided by: 25 25 New Core Scientific Shares 15 million 40K for Current Shareholders 12 1) Ratio is subject to change.

III. Stakeholder Recoveries 13

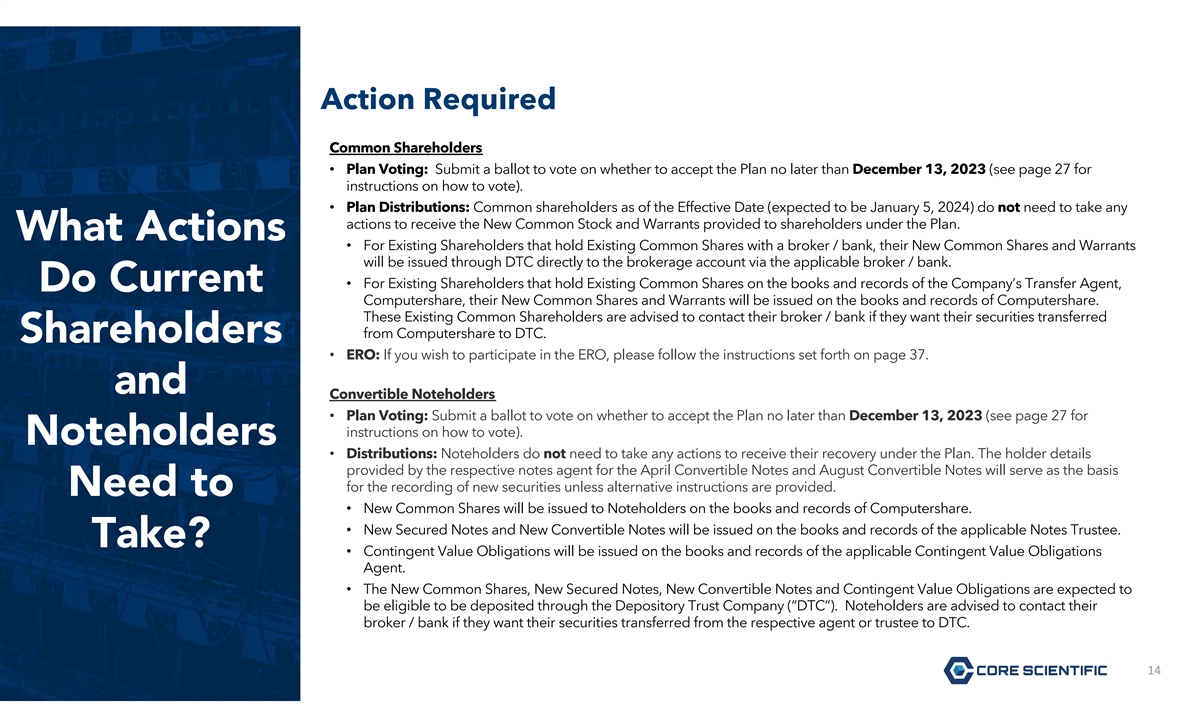

Action Required Common Shareholders • Plan Voting: Submit a

ballot to vote on whether to accept the Plan no later than December 13, 2023 (see page 27 for instructions on how to vote). • Plan Distributions: Common shareholders as of the Effective Date (expected to be January 5, 2024) do not need to take

any actions to receive the New Common Stock and Warrants provided to shareholders under the Plan. What Actions • For Existing Shareholders that hold Existing Common Shares with a broker / bank, their New Common Shares and Warrants will be

issued through DTC directly to the brokerage account via the applicable broker / bank. • For Existing Shareholders that hold Existing Common Shares on the books and records of the Company’s Transfer Agent, Do Current Computershare, their

New Common Shares and Warrants will be issued on the books and records of Computershare. These Existing Common Shareholders are advised to contact their broker / bank if they want their securities transferred from Computershare to DTC. Shareholders

• ERO: If you wish to participate in the ERO, please follow the instructions set forth on page 37. and Convertible Noteholders • Plan Voting: Submit a ballot to vote on whether to accept the Plan no later than December 13, 2023 (see page

27 for instructions on how to vote). Noteholders • Distributions: Noteholders do not need to take any actions to receive their recovery under the Plan. The holder details provided by the respective notes agent for the April Convertible Notes

and August Convertible Notes will serve as the basis for the recording of new securities unless alternative instructions are provided. Need to • New Common Shares will be issued to Noteholders on the books and records of Computershare. •

New Secured Notes and New Convertible Notes will be issued on the books and records of the applicable Notes Trustee. Take? • Contingent Value Obligations will be issued on the books and records of the applicable Contingent Value Obligations

Agent. • The New Common Shares, New Secured Notes, New Convertible Notes and Contingent Value Obligations are expected to be eligible to be deposited through the Depository Trust Company (“DTC”). Noteholders are advised to contact

their broker / bank if they want their securities transferred from the respective agent or trustee to DTC. 14 14

Common Shareholder Recovery and Rights Offering Overview Common

Shareholders as of the Effective Date / Record Date (Expected to Be January 5, 2024) Receive, for Every 25 Shares Owned Initial Distribution at Emergence 1) 1 share of New Common Stock 2) 2.4 Tranche 1 Warrants 3) 2.0 Tranche 2 Warrants (1) Expected

Possible Additional Post-Emergence Distributions What Will 4) 0.5 shares of New Common Stock 5) 0.05 Tranche 1 Warrants Current 6) 0.04 Tranche 2 Warrants New Common Stock and Warrants will be issued to Shareholders of Record as of the Plan

Shareholders Effective Date (expected to be January 5, 2024). Receive? Rights Offering • Shareholders also have the opportunity to purchase up to $55 million of shares at a discount in the Equity Rights Offering • The right to purchase

shares is issued to Shareholders of Record as of November 16, 2023 • Shares purchased in the Equity Rights Offering will not receive warrants and are not eligible to receive the possible additional New Common Stock (referenced above) •

Shares acquired in the Equity Rights Offering will be issued at emergence as New Common Stock Note: Figures reflect current assumptions. Actual amounts could vary. 1) The Company’s books and records reflect that certain disputed claims should

be disallowed in the future, in which case the equity 15 15 value (and warrants) will be distributed to existing equity; however, the outcome of any litigation is uncertain. Includes 510(b) claims. Warrants only reserved on account of 510(b)

claims.

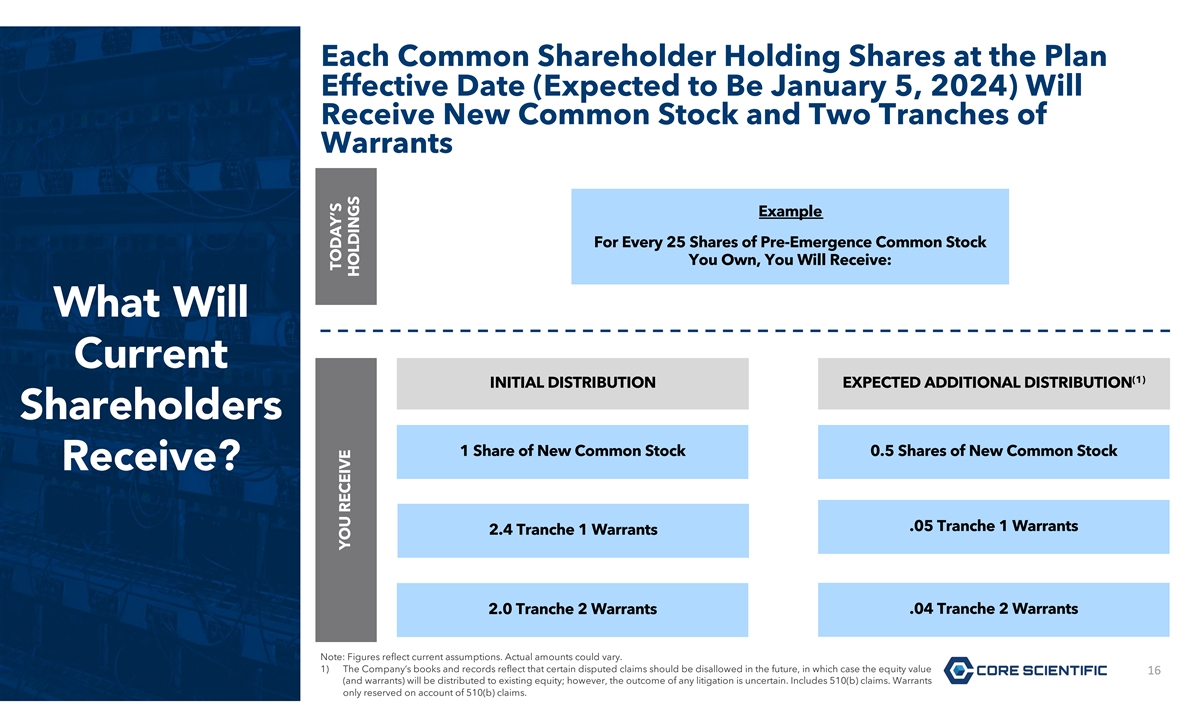

Each Common Shareholder Holding Shares at the Plan Effective Date

(Expected to Be January 5, 2024) Will Receive New Common Stock and Two Tranches of Warrants Example For Every 25 Shares of Pre-Emergence Common Stock You Own, You Will Receive: What Will Current (1) INITIAL DISTRIBUTION EXPECTED ADDITIONAL

DISTRIBUTION Shareholders 1 Share of New Common Stock 0.5 Shares of New Common Stock Receive? .05 Tranche 1 Warrants 2.4 Tranche 1 Warrants 2.0 Tranche 2 Warrants .04 Tranche 2 Warrants Note: Figures reflect current assumptions. Actual amounts could

vary. 1) The Company’s books and records reflect that certain disputed claims should be disallowed in the future, in which case the equity value 16 16 (and warrants) will be distributed to existing equity; however, the outcome of any

litigation is uncertain. Includes 510(b) claims. Warrants only reserved on account of 510(b) claims. TODAY’S YOU RECEIVE HOLDINGS

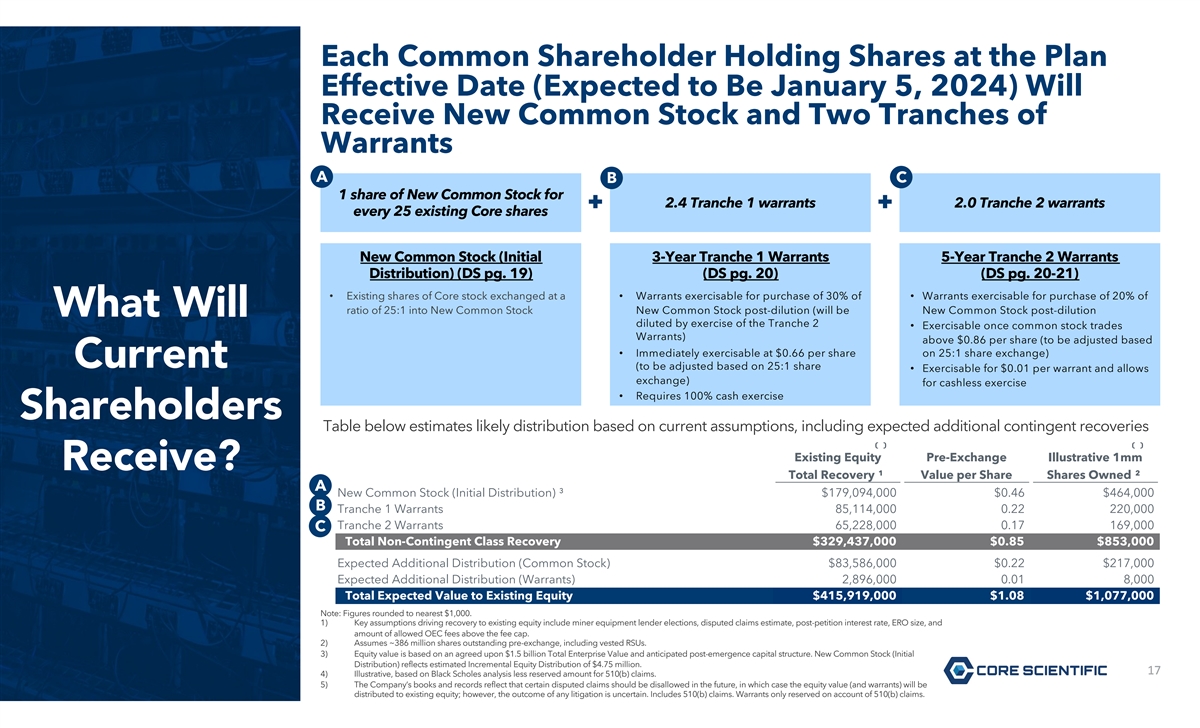

Each Common Shareholder Holding Shares at the Plan Effective Date

(Expected to Be January 5, 2024) Will Receive New Common Stock and Two Tranches of Warrants A B C 1 share of New Common Stock for 2.4 Tranche 1 warrants 2.0 Tranche 2 warrants every 25 existing Core shares New Common Stock (Initial 3-Year Tranche 1

Warrants 5-Year Tranche 2 Warrants Distribution) (DS pg. 19) (DS pg. 20) (DS pg. 20-21) • Existing shares of Core stock exchanged at a • Warrants exercisable for purchase of 30% of • Warrants exercisable for purchase of 20% of

ratio of 25:1 into New Common Stock New Common Stock post-dilution (will be New Common Stock post-dilution What Will diluted by exercise of the Tranche 2 • Exercisable once common stock trades Warrants) above $0.86 per share (to be adjusted

based • Immediately exercisable at $0.66 per share on 25:1 share exchange) Current (to be adjusted based on 25:1 share • Exercisable for $0.01 per warrant and allows exchange) for cashless exercise • Requires 100% cash exercise

Shareholders Table below estimates likely distribution based on current assumptions, including expected additional contingent recoveries ⁽ ⁾ ⁽ ⁾ Existing Equity Pre-Exchange Illustrative 1mm Receive? ⁽ ⁾ Total

Recovery ¹ Value per Share Shares Owned ² ⁽⁴⁾ A New Common Stock (Initial Distribution) ³ $179,094,000 $0.46 $464,000 ⁽⁴⁾ B Tranche 1 Warrants 85,114,000 0.22 220,000 Tranche 2 Warrants 65,228,000

0.17 169,000 C ⁽⁵⁾ Total Non-Contingent Class Recovery $329,437,000 $0.85 $853,000 ⁽⁵⁾ Expected Additional Distribution (Common Stock) $83,586,000 $0.22 $217,000 Expected Additional Distribution (Warrants)

2,896,000 0.01 8,000 Total Expected Value to Existing Equity $415,919,000 $1.08 $1,077,000 Note: Figures rounded to nearest $1,000. 1) Key assumptions driving recovery to existing equity include miner equipment lender elections, disputed claims

estimate, post-petition interest rate, ERO size, and amount of allowed OEC fees above the fee cap. 2) Assumes ~386 million shares outstanding pre-exchange, including vested RSUs. 3) Equity value is based on an agreed upon $1.5 billion Total

Enterprise Value and anticipated post-emergence capital structure. New Common Stock (Initial Distribution) reflects estimated Incremental Equity Distribution of $4.75 million. 17 17 4) Illustrative, based on Black Scholes analysis less reserved

amount for 510(b) claims. 5) The Company’s books and records reflect that certain disputed claims should be disallowed in the future, in which case the equity value (and warrants) will be distributed to existing equity; however, the outcome of

any litigation is uncertain. Includes 510(b) claims. Warrants only reserved on account of 510(b) claims.

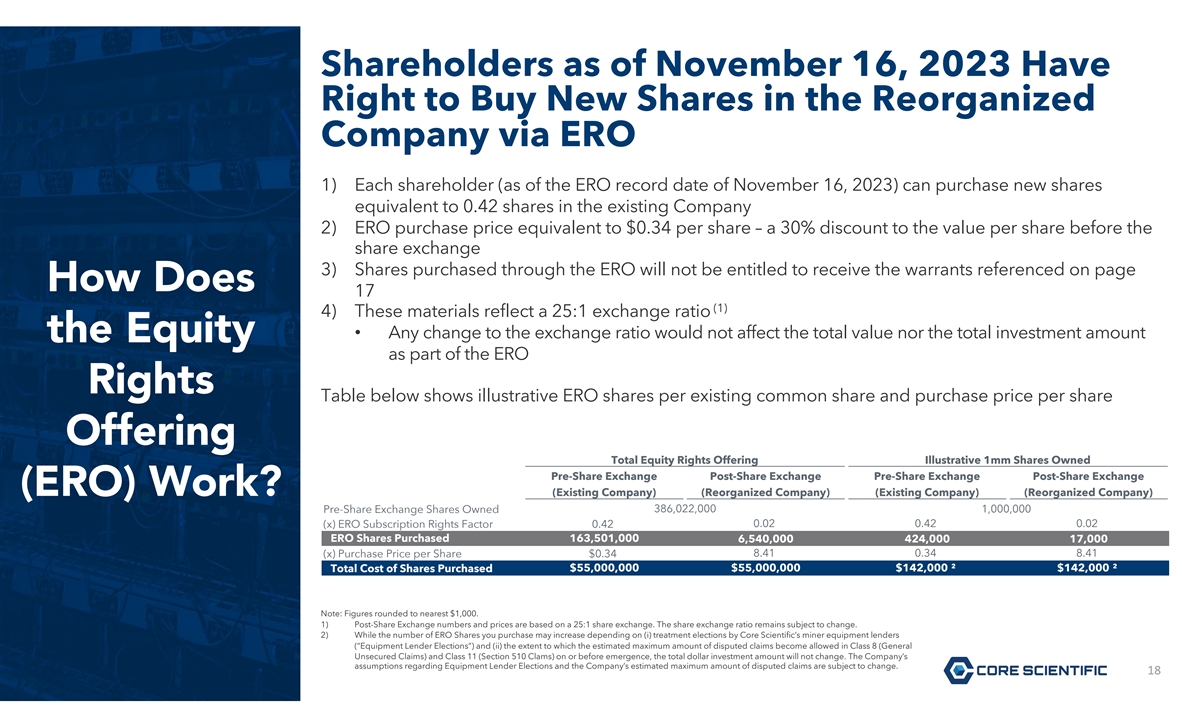

Shareholders as of November 16, 2023 Have Right to Buy New Shares in

the Reorganized Company via ERO 1) Each shareholder (as of the ERO record date of November 16, 2023) can purchase new shares equivalent to 0.42 shares in the existing Company 2) ERO purchase price equivalent to $0.34 per share – a 30% discount

to the value per share before the share exchange 3) Shares purchased through the ERO will not be entitled to receive the warrants referenced on page How Does 17 (1) 4) These materials reflect a 25:1 exchange ratio • Any change to the exchange

ratio would not affect the total value nor the total investment amount the Equity as part of the ERO Rights Table below shows illustrative ERO shares per existing common share and purchase price per share Offering Total Equity Rights Offering

Illustrative 1mm Shares Owned Pre-Share Exchange Post-Share Exchange Pre-Share Exchange Post-Share Exchange (ERO) Work? (Existing Company) (Reorganized Company) (Existing Company) (Reorganized Company) Pre-Share Exchange Shares Owned 386,022,000

1,000,000 0.02 0.42 0.02 (x) ERO Subscription Rights Factor 0.42 ERO Shares Purchased 163,501,000 6,540,000 424,000 17,000 ⁽ ⁾ ⁽ ⁾ 8.41 0.34 8.41 (x) Purchase Price per Share $0.34 Total Cost of Shares Purchased $55,000,000

$55,000,000 $142,000 ² $142,000 ² Note: Figures rounded to nearest $1,000. 1) Post-Share Exchange numbers and prices are based on a 25:1 share exchange. The share exchange ratio remains subject to change. 2) While the number of ERO Shares

you purchase may increase depending on (i) treatment elections by Core Scientific’s miner equipment lenders (“Equipment Lender Elections”) and (ii) the extent to which the estimated maximum amount of disputed claims become allowed

in Class 8 (General Unsecured Claims) and Class 11 (Section 510 Clams) on or before emergence, the total dollar investment amount will not change. The Company’s assumptions regarding Equipment Lender Elections and the Company’s estimated

maximum amount of disputed claims are subject to change. 18 18

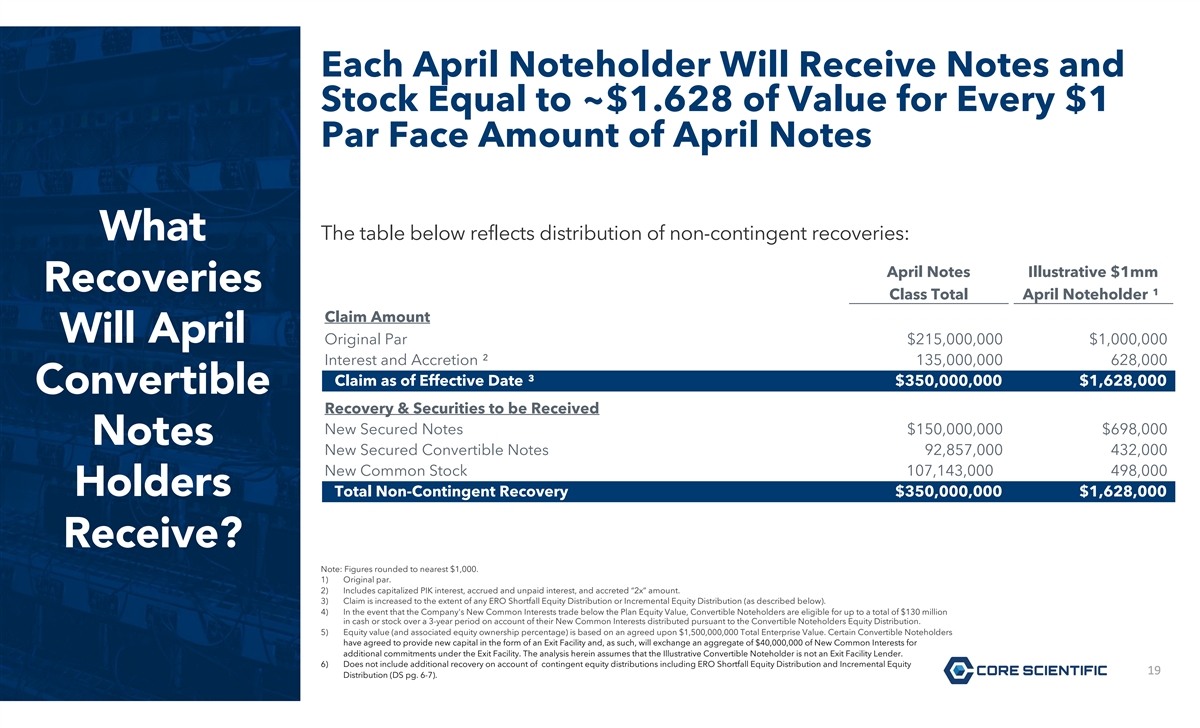

Each April Noteholder Will Receive Notes and Stock Equal to ~$1.628 of

Value for Every $1 Par Face Amount of April Notes What The table below reflects distribution of non-contingent recoveries: ⁽ ⁾ April Notes Illustrative $1mm Recoveries Class Total April Noteholder ¹ Claim Amount ⁽ ⁾ Will

April Original Par $215,000,000 $1,000,000 ⁽ ⁾ Interest and Accretion ² 135,000,000 628,000 Claim as of Effective Date ³ $350,000,000 $1,628,000 Convertible Recovery & Securities to be Received New Secured Notes

$150,000,000 $698,000 ⁽⁴⁾ ⁽⁵⁾ Notes New Secured Convertible Notes 92,857,000 432,000 ⁽⁶⁾ New Common Stock 107,143,000 498,000 Holders Total Non-Contingent Recovery $350,000,000 $1,628,000

Receive? Note: Figures rounded to nearest $1,000. 1) Original par. 2) Includes capitalized PIK interest, accrued and unpaid interest, and accreted “2x” amount. 3) Claim is increased to the extent of any ERO Shortfall Equity Distribution

or Incremental Equity Distribution (as described below). 4) In the event that the Company's New Common Interests trade below the Plan Equity Value, Convertible Noteholders are eligible for up to a total of $130 million in cash or stock over a 3-year

period on account of their New Common Interests distributed pursuant to the Convertible Noteholders Equity Distribution. 5) Equity value (and associated equity ownership percentage) is based on an agreed upon $1,500,000,000 Total Enterprise Value.

Certain Convertible Noteholders have agreed to provide new capital in the form of an Exit Facility and, as such, will exchange an aggregate of $40,000,000 of New Common Interests for additional commitments under the Exit Facility. The analysis

herein assumes that the Illustrative Convertible Noteholder is not an Exit Facility Lender. 6) Does not include additional recovery on account of contingent equity distributions including ERO Shortfall Equity Distribution and Incremental Equity 19

19 Distribution (DS pg. 6-7).

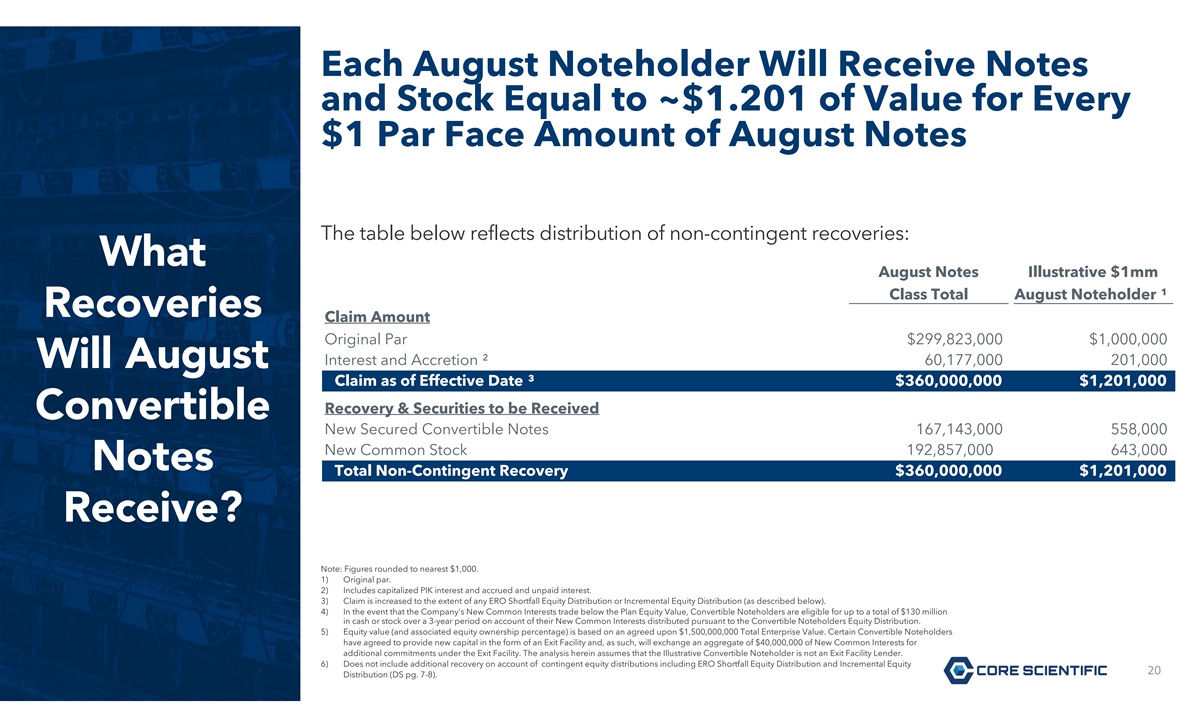

Each August Noteholder Will Receive Notes and Stock Equal to ~$1.201 of

Value for Every $1 Par Face Amount of August Notes The table below reflects distribution of non-contingent recoveries: What ⁽ ⁾ August Notes Illustrative $1mm Class Total August Noteholder ¹ Recoveries Claim Amount ⁽ ⁾

Original Par $299,823,000 $1,000,000 ⁽ ⁾ Interest and Accretion ² 60,177,000 201,000 Will August Claim as of Effective Date ³ $360,000,000 $1,201,000 Recovery & Securities to be Received Convertible ⁽⁴⁾

⁽⁵⁾ New Secured Convertible Notes 167,143,000 558,000 ⁽⁶⁾ New Common Stock 192,857,000 643,000 Notes Total Non-Contingent Recovery $360,000,000 $1,201,000 Receive? Note: Figures rounded to nearest $1,000. 1)

Original par. 2) Includes capitalized PIK interest and accrued and unpaid interest. 3) Claim is increased to the extent of any ERO Shortfall Equity Distribution or Incremental Equity Distribution (as described below). 4) In the event that the

Company's New Common Interests trade below the Plan Equity Value, Convertible Noteholders are eligible for up to a total of $130 million in cash or stock over a 3-year period on account of their New Common Interests distributed pursuant to the

Convertible Noteholders Equity Distribution. 5) Equity value (and associated equity ownership percentage) is based on an agreed upon $1,500,000,000 Total Enterprise Value. Certain Convertible Noteholders have agreed to provide new capital in the

form of an Exit Facility and, as such, will exchange an aggregate of $40,000,000 of New Common Interests for additional commitments under the Exit Facility. The analysis herein assumes that the Illustrative Convertible Noteholder is not an Exit

Facility Lender. 6) Does not include additional recovery on account of contingent equity distributions including ERO Shortfall Equity Distribution and Incremental Equity 20 20 Distribution (DS pg. 7-8).

IV. Emergence Timeline 21

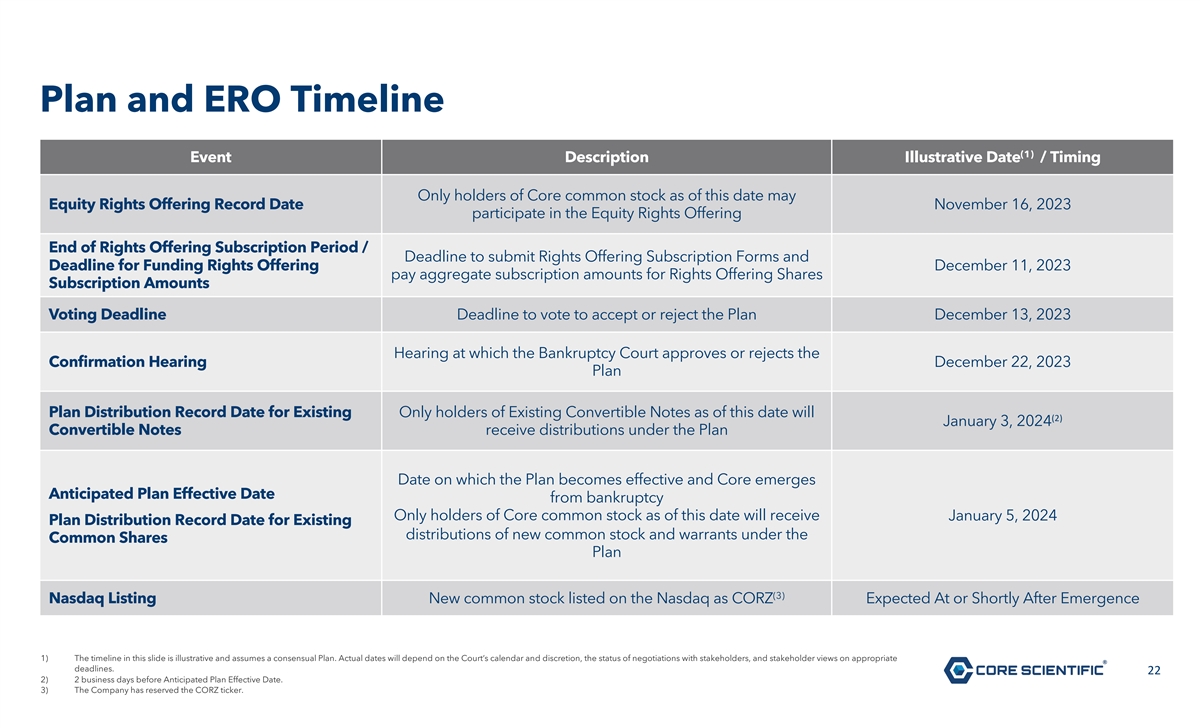

Plan and ERO Timeline (1) Event Description Illustrative Date / Timing

Only holders of Core common stock as of this date may Equity Rights Offering Record Date November 16, 2023 participate in the Equity Rights Offering End of Rights Offering Subscription Period / Deadline to submit Rights Offering Subscription Forms

and Deadline for Funding Rights Offering December 11, 2023 pay aggregate subscription amounts for Rights Offering Shares Subscription Amounts Voting Deadline Deadline to vote to accept or reject the Plan December 13, 2023 Hearing at which the

Bankruptcy Court approves or rejects the Confirmation Hearing December 22, 2023 Plan Plan Distribution Record Date for Existing Only holders of Existing Convertible Notes as of this date will (2) January 3, 2024 Convertible Notes receive

distributions under the Plan Date on which the Plan becomes effective and Core emerges Anticipated Plan Effective Date from bankruptcy Only holders of Core common stock as of this date will receive January 5, 2024 Plan Distribution Record Date for

Existing distributions of new common stock and warrants under the Common Shares Plan (3) Nasdaq Listing New common stock listed on the Nasdaq as CORZ Expected At or Shortly After Emergence 1) The timeline in this slide is illustrative and assumes a

consensual Plan. Actual dates will depend on the Court’s calendar and discretion, the status of negotiations with stakeholders, and stakeholder views on appropriate deadlines. 22 2) 2 business days before Anticipated Plan Effective Date. 3)

The Company has reserved the CORZ ticker.

Q&A 23

Thank You. Chapter 11 Hotline: +1 (949) 404-4152, Toll-Free: +1 (888)

765-7875 TeamCoreScientific@stretto.com corescientific.com 24

V. Additional Information 25

A. Plan Voting FAQs 26

Plan Voting (Existing Common Shareholders) What am I being asked to

vote on and what do I need to do to vote? • You are being asked to vote on two matters: 1) whether to vote to accept the Plan, to reject the Plan, or to abstain and 2) whether to “opt out” of the release provisions contained in

section 10.6(b) of the Plan. • You make your decision on whether to vote to accept the Plan in Item 2 of the Ballot and whether to “opt out” in Item 3 of the Ballot (your broker’s forms may list these differently). Does the

Company recommend that I vote to accept the Plan? • Yes. The special committee of independent directors of Core’s Board has unanimously approved the Plan. The Company believes the Plan is in the best interests of all stakeholders and

recommends that all creditors and equity holders vote to accept the Plan. Does the Equity Committee recommend that I vote to accept the Plan? • Yes. The Equity Committee supports the Plan and recommends that equity holders vote to accept the

Plan. What are they asking me regarding whether I should “opt out” of the release provisions? • For Item 3, only check the “OPT OUT” box if you elect not to grant the release of claims and causes of actions contained in

section 10.6(b) of the Plan. Election to withhold consent is at your option. If you vote to accept the Plan, you may not check the “opt out” box. 27

B. Other FAQs 28

Supporting FAQs • What is the purpose of these FAQ? • On

Nov. 17, 2023, the Bankruptcy Court authorized Core Scientific, Inc. and affiliated debtors (collectively, the “Debtors”) to solicit votes on the Chapter 11 Plan of Reorganization. • The Debtors prepared these FAQ to provide

responses to questions from (i) Holders of Convertible Notes and (ii) Holders of Existing Common Stock. • You should have received copies of the Plan and related Disclosure Statement from our solicitation and voting agent Stretto, Inc. - The

documents are also available (i) on Stretto’s website https://cases.stretto.com/CoreScientific/court-docket/court-docket-category/1367-plan-solicitation/, (ii) by calling Stretto at (949) 404-4152 (in the U.S. and Canada; toll-free) or +1

(888) 765-7875 (outside of the U.S. and Canada), or (iii) by sending an electronic mail message to: CoreScientificInquiries@stretto.com. • Is the information in these FAQ comprehensive? • No. The information in these FAQ is intended to

provide a simplified explanation of certain aspects of a complex chapter 11 plan. These slides only discuss treatment and recoveries for convertible noteholders and existing shareholders, as well as voting and the Equity Rights Offering

(“ERO”). - There are nuances, exceptions, and other significant aspects of the Plan that are not discussed in these FAQ slides. - Also, the estimates in these slides are subject to change. • It is important that creditors and

shareholders review the Plan and Disclosure Statement before voting on the Plan or participating in the ERO. • These FAQs include references to the Disclosure Statement as DS-#, which corresponds with the relevant page number. • Please

consult the Plan and Disclosure Statement for the definitions of any capitalized terms. • What will happen to existing common stock under the Plan? • Holders of existing common stock in Core Scientific as of the Effective Date will be

issued new stock in exchange for their current holdings at a 25:1 ratio as described on page 12. - Once new common stock is issued, all existing stock will be cancelled. • What will happen to existing debt under the plan? • Most existing

debt of Core Scientific will be cancelled under the Plan. - Holders will be issued new debt in exchange for current holdings. • Reorganized Core Scientific, Inc. will have a completely new capital structure after emergence from chapter 11.

• When will the common stock exchange occur? • The exchange will happen on the “Effective Date” – after the Bankruptcy Court approves the Plan and other conditions are satisfied, expected to be Jan. 2024 (may be

delayed). • What is the assumed value under the Plan? • Reorganized Core Scientific is deemed to have a Total Enterprise Value of $1.5 billion for purposes of valuing recoveries under the Plan. • The Plan Equity Value (value of new

common stock) will be equal to Total Enterprise Value minus total expected debt (plus excess cash). - Core Scientific estimates the Plan Equity Value will be approximately $750-$800 million, subject to change based on the final total debt. •

Will the new common stock trade on Nasdaq? • Core Scientific expects its new stock to trade on the Nasdaq on or shortly after the Effective Date under the symbol CORZ. 29

C. Current Common Shareholders Additional Information 30

Current Common Shareholders What is the total value of current common

shareholders’ recovery under the Plan? • The precise value current common shareholders will receive under the Plan is unknown at this time. It will depend on certain contingencies that may occur before or after the Effective Date.

• The table on page 17 demonstrates the recoveries and expected value to existing shareholders, including the recovery per million shares, based on current assumptions. • These recoveries are divided into: i. Stock and Warrants estimated

to be distributed to existing common shareholders on the Effective Date ii. Stock and Warrants estimated to be distributed to existing shareholders after certain contingencies are resolved (such as Disputed Claims) • These estimates of both

categories will continue to be refined as more information is known. • However, there are certain contingences that will not be resolved before the Effective Date, as described on the next slide. • Pages 34-35 explain the various

assumptions underlying the expected recoveries and how existing shareholders will be impacted if actual outcomes differ from the assumptions. 31

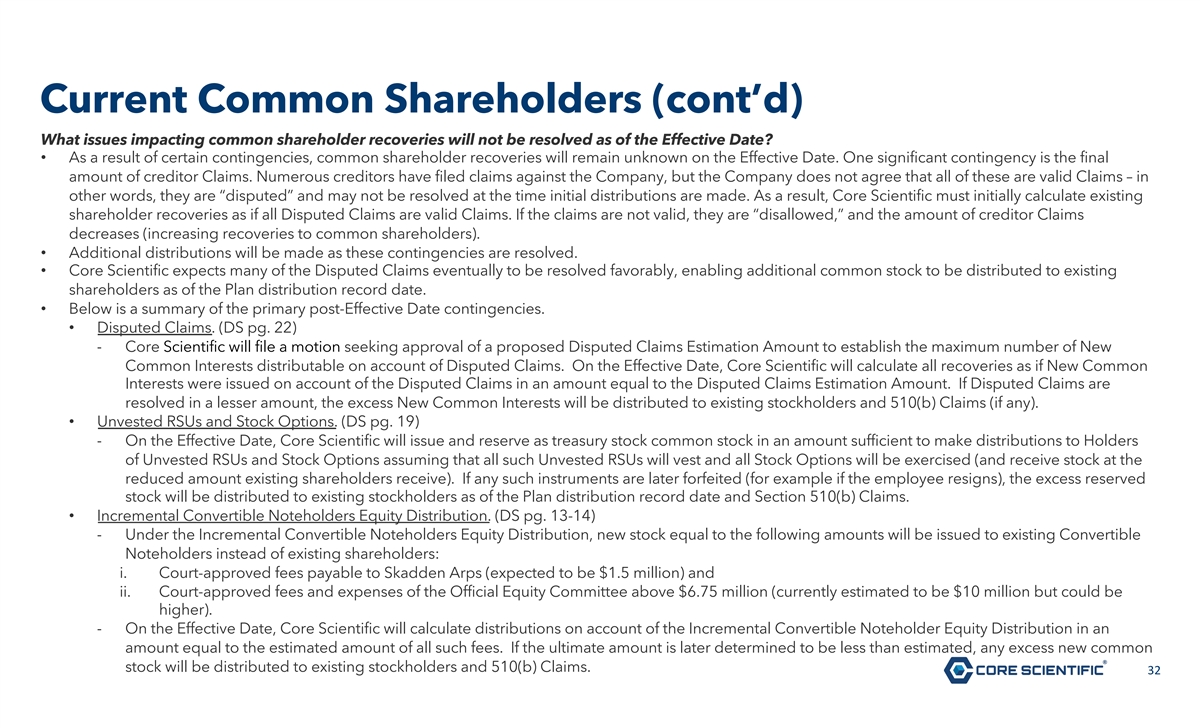

Current Common Shareholders (cont’d) What issues impacting common

shareholder recoveries will not be resolved as of the Effective Date? • As a result of certain contingencies, common shareholder recoveries will remain unknown on the Effective Date. One significant contingency is the final amount of creditor

Claims. Numerous creditors have filed claims against the Company, but the Company does not agree that all of these are valid Claims – in other words, they are “disputed” and may not be resolved at the time initial distributions are

made. As a result, Core Scientific must initially calculate existing shareholder recoveries as if all Disputed Claims are valid Claims. If the claims are not valid, they are “disallowed,” and the amount of creditor Claims decreases

(increasing recoveries to common shareholders). • Additional distributions will be made as these contingencies are resolved. • Core Scientific expects many of the Disputed Claims eventually to be resolved favorably, enabling additional

common stock to be distributed to existing shareholders as of the Plan distribution record date. • Below is a summary of the primary post-Effective Date contingencies. • Disputed Claims. (DS pg. 22) - Core Scientific will file a motion

seeking approval of a proposed Disputed Claims Estimation Amount to establish the maximum number of New Common Interests distributable on account of Disputed Claims. On the Effective Date, Core Scientific will calculate all recoveries as if New

Common Interests were issued on account of the Disputed Claims in an amount equal to the Disputed Claims Estimation Amount. If Disputed Claims are resolved in a lesser amount, the excess New Common Interests will be distributed to existing

stockholders and 510(b) Claims (if any). • Unvested RSUs and Stock Options. (DS pg. 19) - On the Effective Date, Core Scientific will issue and reserve as treasury stock common stock in an amount sufficient to make distributions to Holders of

Unvested RSUs and Stock Options assuming that all such Unvested RSUs will vest and all Stock Options will be exercised (and receive stock at the reduced amount existing shareholders receive). If any such instruments are later forfeited (for example

if the employee resigns), the excess reserved stock will be distributed to existing stockholders as of the Plan distribution record date and Section 510(b) Claims. • Incremental Convertible Noteholders Equity Distribution. (DS pg. 13-14) -

Under the Incremental Convertible Noteholders Equity Distribution, new stock equal to the following amounts will be issued to existing Convertible Noteholders instead of existing shareholders: i. Court-approved fees payable to Skadden Arps (expected

to be $1.5 million) and ii. Court-approved fees and expenses of the Official Equity Committee above $6.75 million (currently estimated to be $10 million but could be higher). - On the Effective Date, Core Scientific will calculate distributions on

account of the Incremental Convertible Noteholder Equity Distribution in an amount equal to the estimated amount of all such fees. If the ultimate amount is later determined to be less than estimated, any excess new common stock will be distributed

to existing stockholders and 510(b) Claims. 32

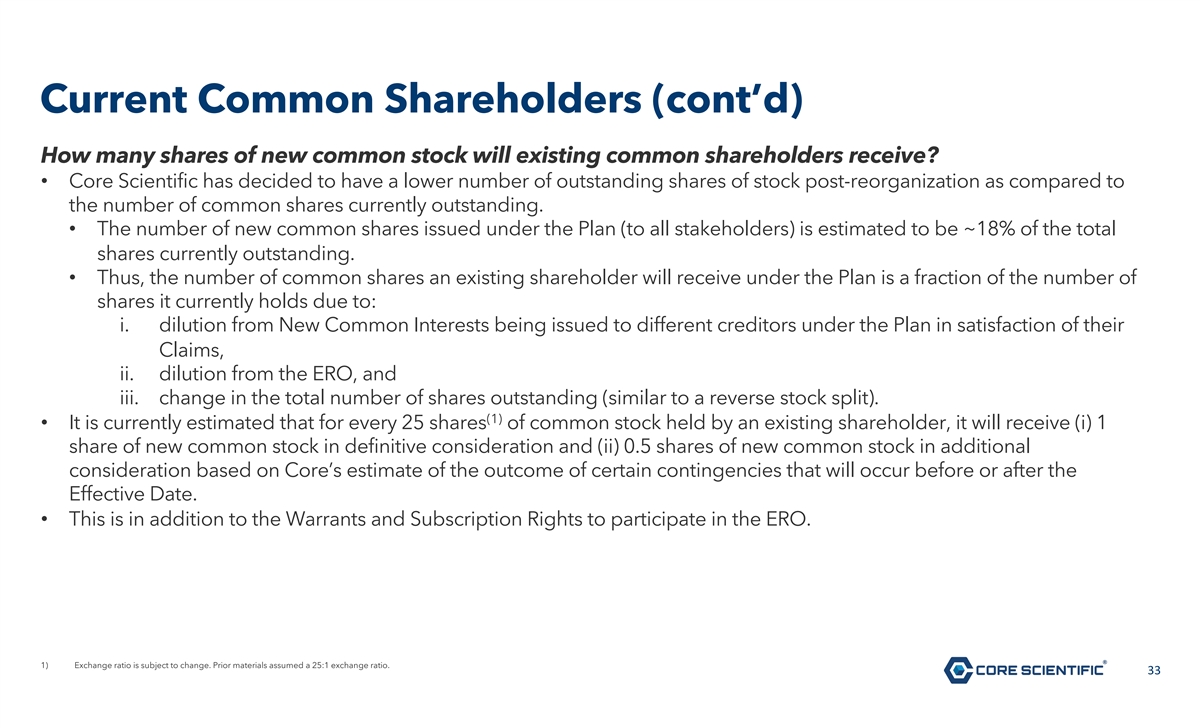

Current Common Shareholders (cont’d) How many shares of new

common stock will existing common shareholders receive? • Core Scientific has decided to have a lower number of outstanding shares of stock post-reorganization as compared to the number of common shares currently outstanding. • The

number of new common shares issued under the Plan (to all stakeholders) is estimated to be ~18% of the total shares currently outstanding. • Thus, the number of common shares an existing shareholder will receive under the Plan is a fraction of

the number of shares it currently holds due to: i. dilution from New Common Interests being issued to different creditors under the Plan in satisfaction of their Claims, ii. dilution from the ERO, and iii. change in the total number of shares

outstanding (similar to a reverse stock split). (1) • It is currently estimated that for every 25 shares of common stock held by an existing shareholder, it will receive (i) 1 share of new common stock in definitive consideration and (ii) 0.5

shares of new common stock in additional consideration based on Core’s estimate of the outcome of certain contingencies that will occur before or after the Effective Date. • This is in addition to the Warrants and Subscription Rights to

participate in the ERO. 1) Exchange ratio is subject to change. Prior materials assumed a 25:1 exchange ratio. 33

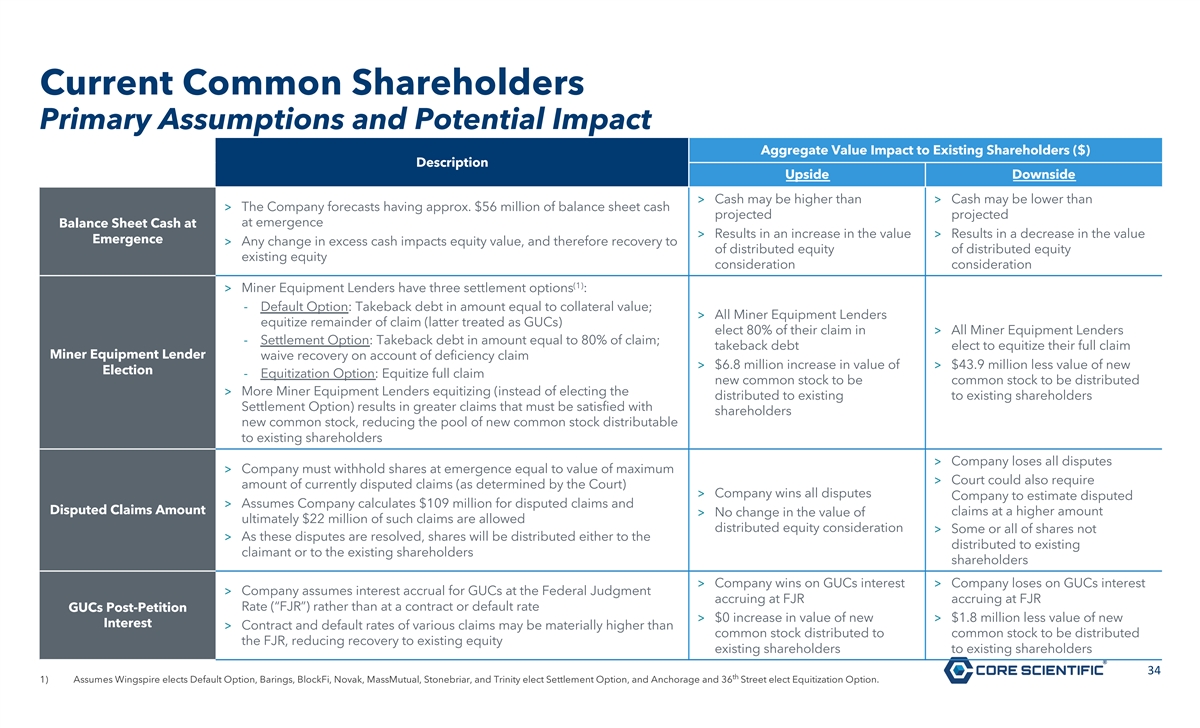

Current Common Shareholders Primary Assumptions and Potential Impact

Aggregate Value Impact to Existing Shareholders ($) Description Upside Downside > Cash may be higher than > Cash may be lower than > The Company forecasts having approx. $56 million of balance sheet cash projected projected at emergence

Balance Sheet Cash at > Results in an increase in the value > Results in a decrease in the value Emergence > Any change in excess cash impacts equity value, and therefore recovery to of distributed equity of distributed equity existing

equity consideration consideration (1) > Miner Equipment Lenders have three settlement options : - Default Option: Takeback debt in amount equal to collateral value; > All Miner Equipment Lenders equitize remainder of claim (latter treated as

GUCs) elect 80% of their claim in > All Miner Equipment Lenders - Settlement Option: Takeback debt in amount equal to 80% of claim; takeback debt elect to equitize their full claim Miner Equipment Lender waive recovery on account of deficiency

claim > $6.8 million increase in value of > $43.9 million less value of new Election - Equitization Option: Equitize full claim new common stock to be common stock to be distributed > More Miner Equipment Lenders equitizing (instead of

electing the distributed to existing to existing shareholders Settlement Option) results in greater claims that must be satisfied with shareholders new common stock, reducing the pool of new common stock distributable to existing shareholders >

Company loses all disputes > Company must withhold shares at emergence equal to value of maximum > Court could also require amount of currently disputed claims (as determined by the Court) > Company wins all disputes Company to estimate

disputed > Assumes Company calculates $109 million for disputed claims and Disputed Claims Amount claims at a higher amount > No change in the value of ultimately $22 million of such claims are allowed distributed equity consideration >

Some or all of shares not > As these disputes are resolved, shares will be distributed either to the distributed to existing claimant or to the existing shareholders shareholders > Company wins on GUCs interest > Company loses on GUCs

interest > Company assumes interest accrual for GUCs at the Federal Judgment accruing at FJR accruing at FJR Rate (“FJR”) rather than at a contract or default rate GUCs Post-Petition > $0 increase in value of new > $1.8 million

less value of new Interest > Contract and default rates of various claims may be materially higher than common stock distributed to common stock to be distributed the FJR, reducing recovery to existing equity existing shareholders to existing

shareholders 34 th 1) Assumes Wingspire elects Default Option, Barings, BlockFi, Novak, MassMutual, Stonebriar, and Trinity elect Settlement Option, and Anchorage and 36 Street elect Equitization Option.

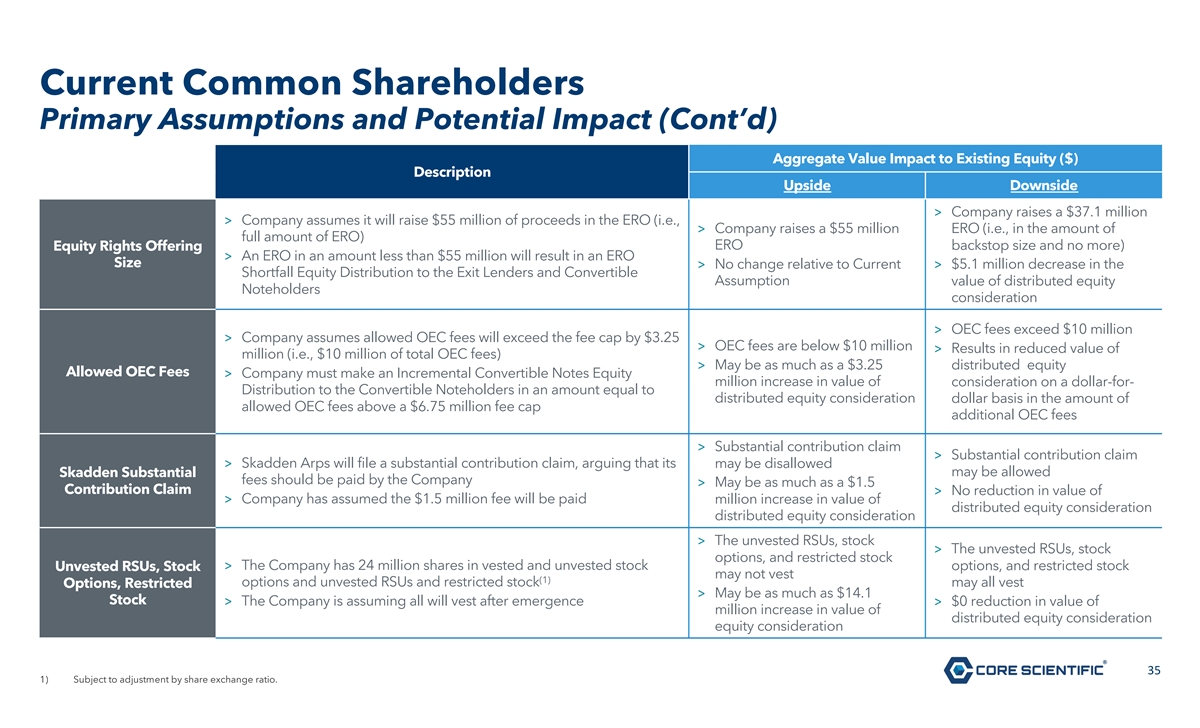

Current Common Shareholders Primary Assumptions and Potential Impact

(Cont’d) Aggregate Value Impact to Existing Equity ($) Description Upside Downside > Company raises a $37.1 million > Company assumes it will raise $55 million of proceeds in the ERO (i.e., > Company raises a $55 million ERO (i.e., in

the amount of full amount of ERO) ERO backstop size and no more) Equity Rights Offering > An ERO in an amount less than $55 million will result in an ERO Size > No change relative to Current > $5.1 million decrease in the Shortfall Equity

Distribution to the Exit Lenders and Convertible Assumption value of distributed equity Noteholders consideration > OEC fees exceed $10 million > Company assumes allowed OEC fees will exceed the fee cap by $3.25 > OEC fees are below $10

million > Results in reduced value of million (i.e., $10 million of total OEC fees) > May be as much as a $3.25 distributed equity Allowed OEC Fees > Company must make an Incremental Convertible Notes Equity million increase in value of

consideration on a dollar-for- Distribution to the Convertible Noteholders in an amount equal to distributed equity consideration dollar basis in the amount of allowed OEC fees above a $6.75 million fee cap additional OEC fees > Substantial

contribution claim > Substantial contribution claim > Skadden Arps will file a substantial contribution claim, arguing that its may be disallowed Skadden Substantial may be allowed fees should be paid by the Company > May be as much as a

$1.5 Contribution Claim > No reduction in value of > Company has assumed the $1.5 million fee will be paid million increase in value of distributed equity consideration distributed equity consideration > The unvested RSUs, stock > The

unvested RSUs, stock options, and restricted stock > The Company has 24 million shares in vested and unvested stock options, and restricted stock Unvested RSUs, Stock may not vest (1) options and unvested RSUs and restricted stock may all vest

Options, Restricted > May be as much as $14.1 Stock > The Company is assuming all will vest after emergence > $0 reduction in value of million increase in value of distributed equity consideration equity consideration 35 1) Subject to

adjustment by share exchange ratio.

D. Equity Rights Offering Additional Information 36

Equity Rights Offering (ERO) What do holders of Existing Common

Interests need to do to participate in the ERO? • The ERO commenced on November 20, 2023 and ends at 5:00 pm ET on December 11, 2023. • All holders of common stock in Core Scientific, Inc. (and certain other equity interests, including

vested restricted stock units) as of November 16, 2023 may purchase their pro rata share of up to $55 million in shares of Reorganized Core (the “ERO Shares”). • Each equity holder should have received a copy of the Rights Offering

Procedures and a Subscription Form from their broker or nominee. • If you have not received these documents, please visit the following website to obtain such documents and submit a rights offering form:

https://cases.stretto.com/corescientific/content/2529-submit-rights-offering-form/ • You may also send an email to the Company’s Subscription Agent (Stretto, Inc.) at PublicSecurities@stretto.com if you have any questions. • If you

wish to participate in the Equity Rights Offering, you must submit 1) your completed Subscription Form and 2) an IRS form W-9 (if you are U.S. Person) or a IRS Form W-8 (if you are a non-U.S. person) by 5:00 pm ET on December 11, 2023 via the

E-Subscription Portal at the website listed above and pay the total subscription price via wire transfer to the Debtors’ Subscription Agent (Stretto, Inc.). Delivery and Wire instructions are included in Subscription Form. • If you hold

your current Core shares with a bank or broker, you should work with the bank or broker to have your shares tendered into DTC’s Automated Tender Offer Program. 37

E. April Convertible Notes Additional Information 38

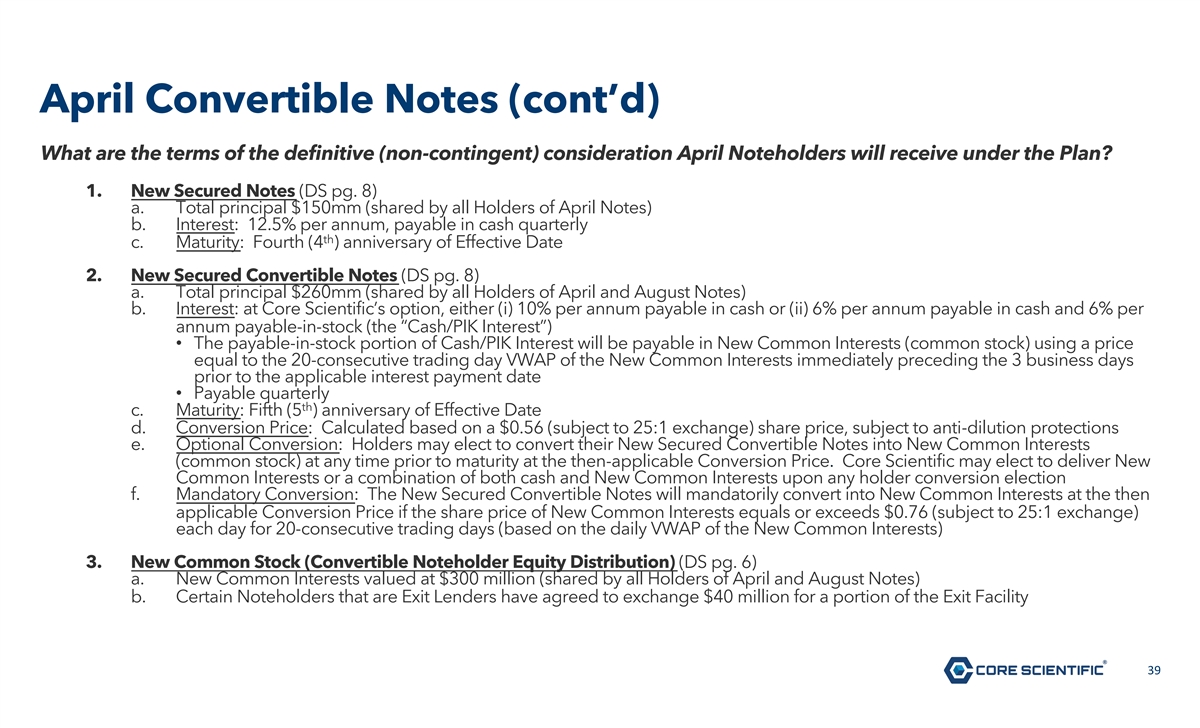

April Convertible Notes (cont’d) What are the terms of the

definitive (non-contingent) consideration April Noteholders will receive under the Plan? 1. New Secured Notes (DS pg. 8) a. Total principal $150mm (shared by all Holders of April Notes) b. Interest: 12.5% per annum, payable in cash quarterly th c.

Maturity: Fourth (4 ) anniversary of Effective Date 2. New Secured Convertible Notes (DS pg. 8) a. Total principal $260mm (shared by all Holders of April and August Notes) b. Interest: at Core Scientific’s option, either (i) 10% per annum

payable in cash or (ii) 6% per annum payable in cash and 6% per annum payable-in-stock (the “Cash/PIK Interest”) • The payable-in-stock portion of Cash/PIK Interest will be payable in New Common Interests (common stock) using a

price equal to the 20-consecutive trading day VWAP of the New Common Interests immediately preceding the 3 business days prior to the applicable interest payment date • Payable quarterly th c. Maturity: Fifth (5 ) anniversary of Effective Date

d. Conversion Price: Calculated based on a $0.56 (subject to 25:1 exchange) share price, subject to anti-dilution protections e. Optional Conversion: Holders may elect to convert their New Secured Convertible Notes into New Common Interests (common

stock) at any time prior to maturity at the then-applicable Conversion Price. Core Scientific may elect to deliver New Common Interests or a combination of both cash and New Common Interests upon any holder conversion election f. Mandatory

Conversion: The New Secured Convertible Notes will mandatorily convert into New Common Interests at the then applicable Conversion Price if the share price of New Common Interests equals or exceeds $0.76 (subject to 25:1 exchange) each day for

20-consecutive trading days (based on the daily VWAP of the New Common Interests) 3. New Common Stock (Convertible Noteholder Equity Distribution) (DS pg. 6) a. New Common Interests valued at $300 million (shared by all Holders of April and August

Notes) b. Certain Noteholders that are Exit Lenders have agreed to exchange $40 million for a portion of the Exit Facility 39

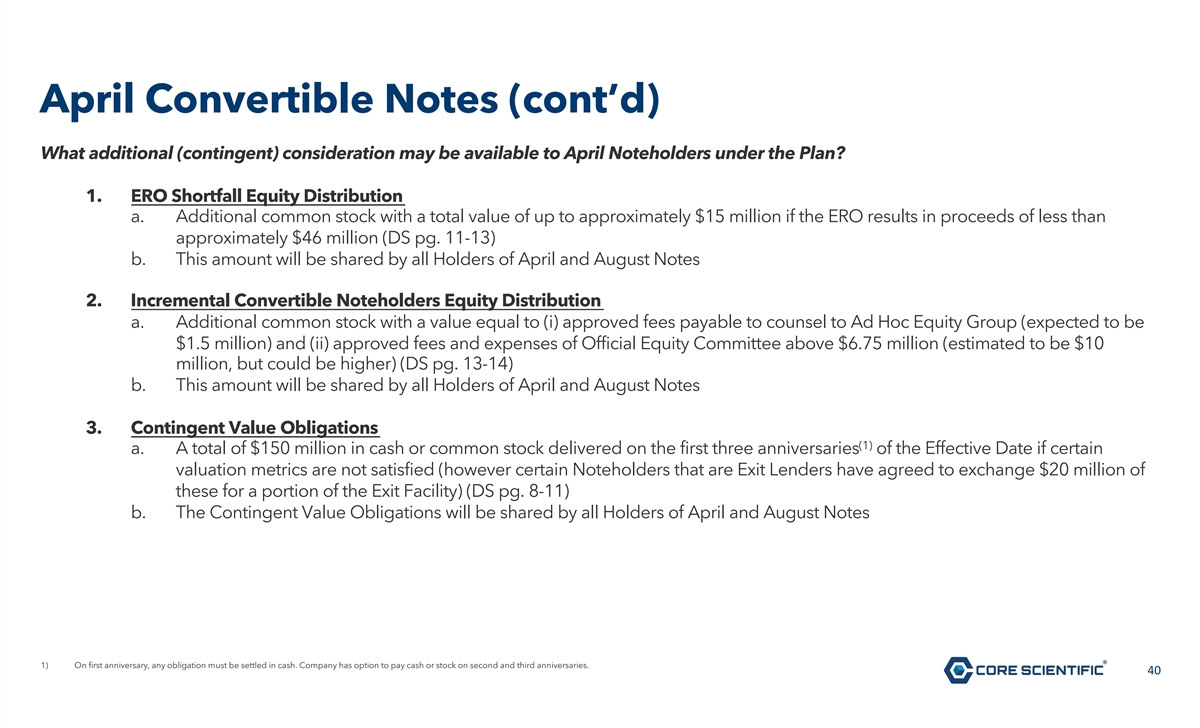

April Convertible Notes (cont’d) What additional (contingent)

consideration may be available to April Noteholders under the Plan? 1. ERO Shortfall Equity Distribution a. Additional common stock with a total value of up to approximately $15 million if the ERO results in proceeds of less than approximately $46

million (DS pg. 11-13) b. This amount will be shared by all Holders of April and August Notes 2. Incremental Convertible Noteholders Equity Distribution a. Additional common stock with a value equal to (i) approved fees payable to counsel to Ad Hoc

Equity Group (expected to be $1.5 million) and (ii) approved fees and expenses of Official Equity Committee above $6.75 million (estimated to be $10 million, but could be higher) (DS pg. 13-14) b. This amount will be shared by all Holders of April

and August Notes 3. Contingent Value Obligations (1) a. A total of $150 million in cash or common stock delivered on the first three anniversaries of the Effective Date if certain valuation metrics are not satisfied (however certain Noteholders that

are Exit Lenders have agreed to exchange $20 million of these for a portion of the Exit Facility) (DS pg. 8-11) b. The Contingent Value Obligations will be shared by all Holders of April and August Notes 1) On first anniversary, any obligation must

be settled in cash. Company has option to pay cash or stock on second and third anniversaries. 40

F. August Convertible Notes Additional Information 41

August Convertible Notes (cont’d) What are the terms of the

definitive (non-contingent) consideration August Noteholders will receive under the Plan? 1. New Secured Convertible Notes (DS pg. 8) a. Total principal $260mm (shared by all Holders of April and August Notes) b. Interest: at Core Scientific’s

option, either (i) 10% per annum payable in cash or (ii) 6% per annum payable in cash and 6% per annum payable-in-stock (the “Cash/PIK Interest”) • The payable-in-stock portion of Cash/PIK Interest will be payable in New Common

Interests (common stock) using a price equal to the 20-consecutive trading day VWAP of the New Common Interests immediately preceding the 3 business days prior to the applicable interest payment date • Payable quarterly th c. Maturity: Fifth

(5 ) anniversary of Effective Date d. Conversion Price: Calculated based on a $0.56 (subject to 25:1 exchange) share price, subject to anti-dilution protections e. Optional Conversion: Holders may elect to convert their New Secured Convertible Notes

into New Common Interests (common stock) at any time prior to maturity at the then-applicable Conversion Price. Core Scientific may elect to deliver New Common Interests or a combination of both cash and New Common Interests upon any holder

conversion election f. Mandatory Conversion: The New Secured Convertible Notes will mandatorily convert into New Common Interests at the then applicable Conversion Price if the share price of New Common Interests equals or exceeds $0.76 (subject to

25:1 exchange) each day for 20-consecutive trading days (based on the daily VWAP of the New Common Interests) 2. New Common Stock (Convertible Noteholder Equity Distribution) (DS pg. 6) a. New Common Interests valued at $300 million (shared by all

Holders of April and August Notes) b. Certain Noteholders that are Exit Lenders have agreed to exchange $40 million for a portion of the Exit Facility 42

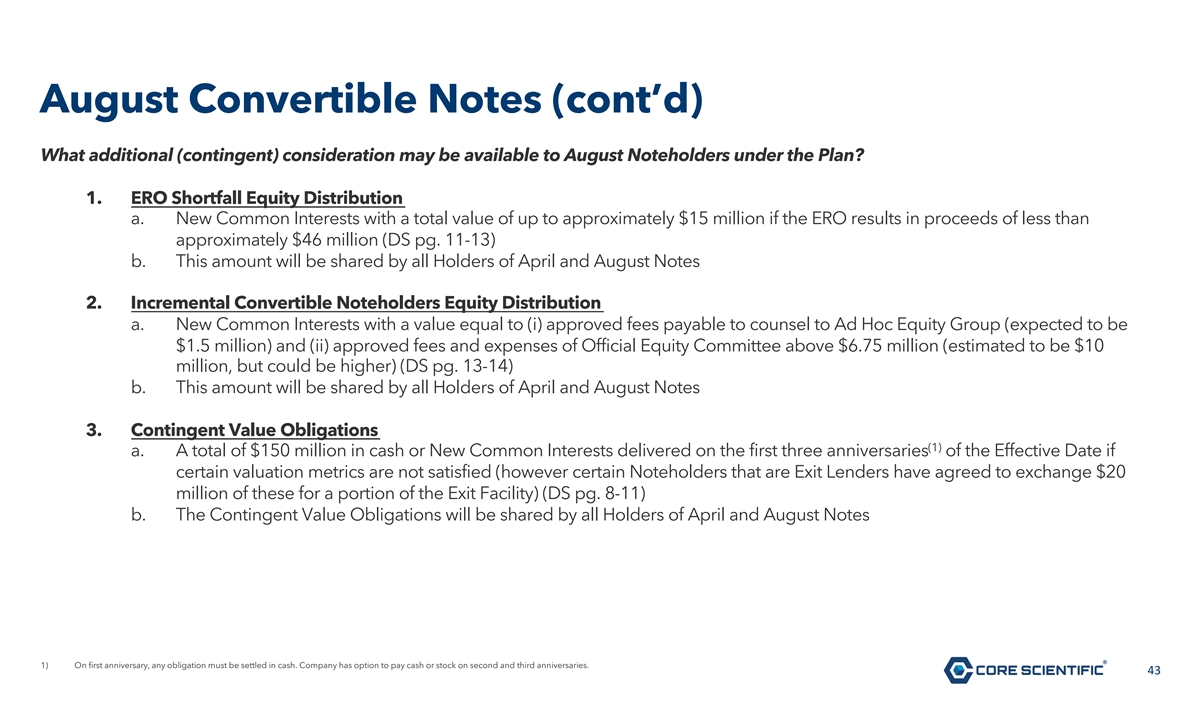

August Convertible Notes (cont’d) What additional (contingent)

consideration may be available to August Noteholders under the Plan? 1. ERO Shortfall Equity Distribution a. New Common Interests with a total value of up to approximately $15 million if the ERO results in proceeds of less than approximately $46

million (DS pg. 11-13) b. This amount will be shared by all Holders of April and August Notes 2. Incremental Convertible Noteholders Equity Distribution a. New Common Interests with a value equal to (i) approved fees payable to counsel to Ad Hoc

Equity Group (expected to be $1.5 million) and (ii) approved fees and expenses of Official Equity Committee above $6.75 million (estimated to be $10 million, but could be higher) (DS pg. 13-14) b. This amount will be shared by all Holders of April

and August Notes 3. Contingent Value Obligations (1) a. A total of $150 million in cash or New Common Interests delivered on the first three anniversaries of the Effective Date if certain valuation metrics are not satisfied (however certain

Noteholders that are Exit Lenders have agreed to exchange $20 million of these for a portion of the Exit Facility) (DS pg. 8-11) b. The Contingent Value Obligations will be shared by all Holders of April and August Notes 1) On first anniversary, any

obligation must be settled in cash. Company has option to pay cash or stock on second and third anniversaries. 43

Exhibit 99.2

|

|

|

|

|

PRESS RELEASE

www.corescientific.com |

Core Scientific, Inc. Releases Webcast with Key Highlights and

Updates on Planned January Chapter 11 Emergence

AUSTIN, Texas, Dec. 4, 2023 – Core Scientific, Inc. (OTC: CORZQ) (“Core Scientific” or “the

Company”), a leader in high-performance blockchain computing data centers and software solutions, today released a webcast by its CEO Adam Sullivan outlining key elements of its planned emergence from Chapter 11 in early January.

The webcast and accompanying presentation highlight the strength of Core Scientific’s business, potential recovery value to shareholders and noteholders,

the Equity Rights Offering, its post-emergence capital structure, an emergence timeline and answers to questions received from investors. The webcast can be accessed here.

The webcast and a downloadable copy of the presentation will be available for 90 days in the Events and Presentations section of the Company’s

website.

This press release is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy any security.

ABOUT CORE SCIENTIFIC

Core Scientific (OTC:

CORZQ) is one of the largest blockchain computing data center providers and miners of digital assets in North America. Core Scientific has operated blockchain computing data centers in North America since 2017, using its facilities and

intellectual property portfolio for colocated digital asset mining and self-mining. Core Scientific operates data centers in Georgia, Kentucky, North Carolina, North Dakota and Texas. Core Scientific’s proprietary Minder® fleet management software combines the Company’s colocation expertise with data analytics to deliver maximum uptime, alerting, monitoring and management of all miners in the Company’s

network. To learn more, visit http://www.corescientific.com.

-more-

Core Scientific, Inc. Emergence Update Presentation - 2

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Please follow us on:

https://www.linkedin.com/company/corescientific/

https://twitter.com/core_scientific

CONTACTS

Investors:

ir@corescientific.com

Media:

press@corescientific.com

-end-

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|