By Patricia Kowsmann

Interest rates have been negative in Europe for years. But it

took the flood of savings unleashed in the pandemic for banks

finally to charge depositors in earnest.

Germany's biggest lenders, Deutsche Bank AG and Commerzbank AG,

have told new customers since last year to pay a 0.5% annual rate

to keep large sums of money with them. The banks say they can no

longer absorb the negative interest rates the European Central Bank

charges them. The more customer deposits banks have, the more they

have to park with the central bank.

That is creating an unusual incentive, where banks that usually

want deposits as an inexpensive form of financing, are essentially

telling customers to go away. Banks are even providing new online

tools to help customers take their deposits elsewhere.

Banks in Europe resisted passing negative rates on to customers

when the ECB first introduced them in 2014, fearing backlash. Some

did it only with corporate depositors, who were less likely to

complain to local politicians. The banks resorted to other ways to

pass on the costs of negative rates, charging higher fees, for

instance.

The pandemic has changed the equation. Savings rates skyrocketed

with consumers at home. And huge relief programs from the ECB have

flooded banks with excess deposits. Banks also have used the

economic dislocation of the pandemic to make operational changes

they have long resisted.

Alex Bierhaus, a managing director at a fintech company in

Düsseldorf, received a letter from his bank, a unit of Commerzbank,

last year saying it was going to start charging a 0.5% interest on

deposits above EUR100,000, equivalent to $121,000.

To avoid paying, Mr. Bierhaus, whose savings ballooned without

trips to restaurants and vacations, shifted some EUR60,000 to a

bank in Italy and one in Sweden through an online platform called

Raisin, which allows customers to shop for better rates at banks

across Europe.

Mr. Bierhaus can't even remember the name of his new banks but

said he felt comfortable given that Europe has domestic guarantees

on all deposits up to EUR100,000. He is receiving 0.8% interest on

the one-year fixed deposits, similar to a certificate of

deposit.

"I wouldn't mind receiving nothing for my deposit, but being

asked to pay is just too much," the 34-year-old said, adding that

he plans to use the money to buy a house before the birth of his

second child this year.

"Our primary objective is not to collect such a deposit, but to

advise and reallocate funds to other forms of investment," said a

Commerzbank spokesman.

According to price-comparison portal Verivox, 237 banks in

Germany currently charge negative interest rates to private

customers, up from 57 before the pandemic hit in March of last

year. Charges range between 0.4% and 0.6% for deposits beginning

anywhere from EUR25,000 to EUR100,000.

Raisin said business in Germany, its largest market, has risen

sharply as more banks have begun charging for deposits. The number

of customers using its platforms across Europe rose more than 40%

to 325,000 in 2020. The volume of deposits that moved through the

platforms rose by 50% to about EUR30 billion.

It also works with a handful of banks in Germany and elsewhere

in Europe, embedding its service inside bank websites, making it

easy for customers to shift their money.

Deutsche Bank, which charges a negative rate to new customers

holding more than EUR100,000, bought a stake in a Raisin competitor

called Deposit Solutions. Deutsche Bank clients use Deposit

Solutions to pick deposit offerings currently at five different

banks, including in Italy, Austria and France.

"Our job is to show clients ways to earn a return on their

investments despite negative interest rates," a Deutsche Bank

spokeswoman said.

The ECB's deposit rate, which it charges banks, is minus 0.5%.

The central bank has signaled it is unlikely to change that level

anytime soon. Government bond yields, against which borrowing costs

are measured, are negative despite a recent uptick. German 10-year

bunds yield minus 0.3%. Similar U.S. bonds yield 1.5%.

Banks in Germany are particularly hit by negative rates because

Germans are big savers. About 30% of all household deposits in the

eurozone are in Germany, according to the ECB. Last year, deposits

in the country rose 6% to a record EUR2.55 trillion as people

became wary of spending under the pandemic or simply had nowhere to

spend, with restaurants closed and travel restricted.

In Denmark, where interest rates were cut to below zero two

years before the eurozone, banks have gone from charging wealthier

clients to smaller ones over the past year. The Danish central bank

estimates about a quarter of the country's depositors are currently

being affected.

Nordea Bank Abp recently lowered the deposit threshold for a

0.75% charge to 250,000 danish krone, equivalent to $41,000, from

750,000 danish krone as the pandemic will likely prolong the era of

negative rates.

The flip side for customers there, is that in some cases, while

they pay to deposit money, they don't have to pay anything to

borrow. Nordea in January started offering 20-year mortgages at

0%.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

March 01, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

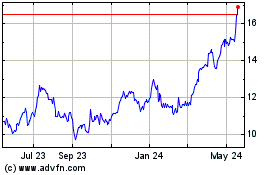

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

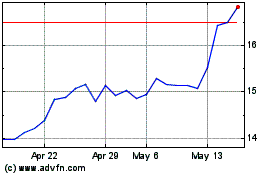

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Feb 2024 to Feb 2025