Current Report Filing (8-k)

February 22 2022 - 4:08PM

Edgar (US Regulatory)

0001164256

false

0001164256

2022-02-22

2022-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February

22, 2022 (February 14, 2022)

DAYBREAK OIL AND GAS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Washington |

000-50107 |

91-0626366 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

1101 N. Argonne Road, Suite A 211

Spokane Valley, WA |

|

99212 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(509) 232-7674

(Former Name or Former Address if Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

o |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange

on which registered |

| n/a |

n/a |

n/a |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On February 22, 2022, Daybreak

Oil and Gas, Inc. (OCT PINK:DBRM), a Washington corporation (“Daybreak” or the “Company”), entered into an amendment

(the “Amendment”) with Gaelic Resources Ltd., a private company incorporated in the Isle of Man and the 100% owner of Reabold

(“Gaelic”), to amend the Equity Exchange Agreement (the “Exchange Agreement”) dated as of October 20, 2021 by

and between Daybreak, Reabold California LLC, a California limited liability company (“Reabold”), and Gaelic. Pursuant to

the Amendment, effective February 14, 2022, Daybreak and Gaelic agreed to amend the “Long-Stop Date” set forth in the Exchange

Agreement from February 14, 2022 to April 29, 2022 (the “Long-Stop Date”). As part of the Amendment, Daybreak acknowledges

that in order to carry out certain operational activities in advance of the completion of the Exchange Agreement, Reabold may borrow up

to US$250,000 from its parent company, Reabold Resources PLC and that this money will be repaid in full to Reabold Resources PLC, by Daybreak,

as soon as is practicably possible following the completion of the Exchange Agreement. If the Exchange Agreement has not been completed

by the amended Long-Stop Date, Daybreak agrees to compensate Gaelic through the payment of a break fee, in the amount of US$500,000, to

be paid in Daybreak common stock shares (the “Break Fee Shares”) priced according to the VWAP calculated over the five trading

days prior to and including the Long-Stop Date, with payment (to be satisfied by the issuance of the Break Fee Shares) made as soon as

practicably possible after the amended Long-Stop Date has expired. However, if the Exchange Agreement is completed after an agreed upon

date after April 29, 2022, then 50% of the Break Fee Shares issued to Gaelic will be applied in part satisfaction of the number of the

Parent Shares that are due to Gaelic under the Exchange Agreement. Further, Gaelic consented to the Company selling a convertible promissory

note to a Private Investor (the “purchaser”) in the amount of US$200,000 (the “Convertible Note”).

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information in Item 1.01 is

incorporated by reference herein. The Convertible Note is being issued pursuant to a Convertible Note Purchase Agreement by and between

the Company and the purchaser dated as of February 15, 2022 (the “Purchase Agreement”). The Convertible Note will convert

into shares of the Company’s common stock, par value, $0.001, upon the earlier of the closing of the Exchange Agreement or the purchaser’s

instruction any time on or after the Long-Stop Date. If the Convertible Note converts at the closing of the Exchange Agreement, it will

convert at a price of $0.017 per share. If the Convertible Note converts upon the Long-Stop Date, it will convert at a price of $0.0085

per share. Payable-in-kind interest will accrue on the Convertible Note at a rate of 18% per annum; provided, that a minimum of one year

of interest is payable. The terms of the Purchase Agreement also provide that if the Company sells shares over the next six months for

a price less than $0.02 per share, the Company will adjust the number of conversion shares issued under the Convertible Note accordingly,

at a conversion price equal to the sale price with a 15% discount.

The Convertible Note was issued

pursuant to the exemption from registration promulgated under Regulation S of the Securities Act of 1933, as amended. The sale and purchase

of the Convertible Note did not involve any public offering, the offer and sale of the Convertible Note took place outside the United

States, the purchaser is an “accredited investor” as that term is defined under Rule 501 of Regulation D, the purchaser had

access to information about the Company and its investment, the purchaser took the securities for investment and not resale, and the Company

took appropriate measures to restrict the transfer of the securities.

[signature page follows]

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

DAYBREAK OIL AND GAS, INC.

| By: /s/ JAMES F. WESTMORELAND |

James F. Westmoreland, President and Chief Executive Officer

Date: February 22, 2022

4

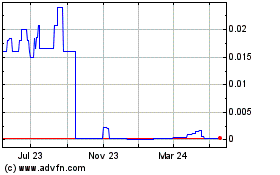

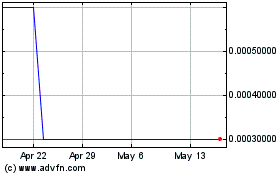

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From May 2024 to Jun 2024

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Jun 2023 to Jun 2024