UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

DEEP

GREEN WASTE & RECYCLING, INC.

(Exact

name of registrant as specified in its charter)

|

Wyoming

|

|

7349

|

|

30-1035174

|

|

(State

or other Jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

Number)

|

13110

NE 177th Place, Suite 293, Woodinville, WA 98072

(833)

304-7336

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Registered

Agent Solutions, Inc.

125

S. King St.

P.O.

Box 2922

Jackson,

WY 83001

(800)

246-2677

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send copies of all communications to:

McMurdo

Law Group, LLC

Matthew

McMurdo, Esq.

1185

Avenue of the Americas, 3rd Floor

New

York, New York 10036

(917)

318-2865

As

soon as practicable after the effective date of this Registration Statement.

(Approximate

date of commencement of proposed sale to the public)

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box: [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933,

please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration

statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box

and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same

offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box

and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same

offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

[ ]

|

Smaller

reporting company

|

[X]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[ ]

EXPLANATORY

NOTE

Prior

to the effectiveness of this Form S-1, we, “The Company”, are not subject to the periodic reporting requirements of

the Exchange Act. We intend, with the filing of this Form S-1, and ultimate effectiveness of this Form S-1, to become SEC Reporting

in which case we will be subject to comply with the periodic reporting requirements of the Exchange Act for so long as we are

subject to those requirements.

Calculation

of Registration Fee

|

Title

of Each Class of

Securities

To Be Registered

|

|

Amount

to

be

Registered

(4)(5)(6)

|

|

Proposed

Maximum

Offering

Price

Per

Share (1)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount

of

Registration

Fee (2)

|

|

|

Common

stock, par value $.001 per share

|

|

27,206,637

shares

|

|

$

|

0.04

|

|

|

$

|

1,088,265

|

|

|

$

|

141.25

|

|

|

(1)

|

The

Offering price has been estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c)

of the Securities Act and is based upon a $0.04 per share price on the OTC Market on March 13, 2020, the most

recent day that the Registrant’s shares traded on the OTC Markets.

|

|

|

|

|

(2)

|

Calculated

pursuant to Rule 457(a) based on an estimate of the proposed maximum aggregate offering price

|

|

|

|

|

(3)

|

Pursuant

to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional

shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(4)

|

This

Registration Statement covers the resale by our selling shareholders of up to 6,000,000

shares of common stock issuable upon conversion of a convertible note.

|

|

|

|

|

(5)

|

This

Registration Statement covers the resale by our selling shareholders of up to 20,403,706 shares of common stock previously

issued to such selling shareholders.

|

|

|

|

|

(6)

|

This

Registration Statement covers the resale by our selling shareholders of up to 802,931 shares of common stock issuable upon

the exercise of multiple warrants with exercise prices ranging from $0.04 to $0.20.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS - SUBJECT TO COMPLETION Dated March 18, 2020

DEEP

GREEN WASTE & RECYCLING, INC.

27,206,637

Shares

of

Common

Stock

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”).

This prospectus relates to the offering of up to 27,206,637 shares of our common stock, par value $0.0001 per share

(“Common Stock”) by selling shareholders. This registration statement covers the resale by our selling shareholders

of up to 20,403,706 shares of common stock previously issued to such selling shareholders, 802,931 shares of

common stock issuable upon the exercise of multiple warrants and 6,000,000 shares of common stock issuable

upon conversion of a convertible note. The information in this prospectus is not complete and may be changed. The selling shareholders

may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.

This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where

the offer or sale is not permitted.

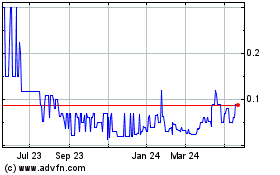

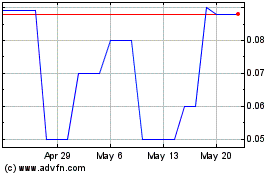

Our

Common Stock is subject to quotation on OTC Markets “PINK” under the symbol “DGWR.” On March 13, 2020,

the last reported sales price for our Common Stock was $0.04 per share. We urge prospective purchasers of our Common Stock

to obtain current information about the market prices of our Common Stock. The shares of our Common Stock may be offered and sold

by the Selling Shareholders at a fixed price of $0.04 per share until our Common Stock is quoted on the OTC Bulletin Board, OTCQX

or OTCQB, and thereafter at prevailing market prices or privately negotiated prices or in

transactions that are not in the public market. Notwithstanding our belief that upon the effective date of this registration statement

our Common Stock will qualify for quotation on the OTCQB and we intend to pursue application for admission to the OTCQB, we cannot

assure you that our Common Stock will, in fact, be quoted on the OTCQB tier. We will not receive proceeds from the sale

of shares from the selling shareholders.

There

are no underwriting commissions involved in this offering. We have agreed to pay all the costs and expenses of this offering.

Selling shareholders will pay no offering expenses. As of the date of this prospectus, our common stock is quoted under the symbol

“DGWR.” On March 13, 2020, the last reported sale price of our common stock on the OTC Markets “PINK”

was $0.04 per share.

This

offering is highly speculative and these securities involve a high degree of risk and should be considered only by persons who

can afford the loss of their entire investment. Additionally, our auditor has expressed substantial doubt as to our Company’s

ability to continue as a going concern. See “Risk Factors” beginning on page, infra.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is March 18, 2020.

Our

Common Stock is quoted on the OTC Markets Pink under the symbol “DGWR.”

Our

common stock involves a high degree of risk. You should read the “RISK FACTORS” section beginning on page 11 before

you decide to purchase any of our Common Stock.

The

Company has minimal revenues to date and there can be no assurance that the Company will be successful in furthering its operations

and/or revenues. Persons should not invest unless they can afford to lose their entire investment. Investing in our securities

involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment.

See “Risk Factors” beginning on page 11 of this prospectus.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is March 18, 2020.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf.

We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or

additional information, you should not rely on it. The information in this prospectus is accurate only as of the date on the front

of this prospectus. Our business, financial condition, results of operations and prospects may have changed since the date of

this prospectus. This prospectus is not an offer or solicitation relating to the securities in any jurisdiction in which such

an offer or solicitation relating to the securities is not authorized. You should not consider this prospectus to be an offer

or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it

is unlawful for you to receive such an offer or solicitation.

PROSPECTUS

SUMMARY

This

summary highlights certain information appearing elsewhere in this prospectus. This summary is not complete and does not contain

all of the information you should consider prior to investing. After you read this summary, you should read and consider carefully

the more detailed information and financial statements and related notes that we include in this prospectus, especially the sections

entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations.” If you invest in our securities, you are assuming a high degree of risk.

Unless we have indicated otherwise or

the context otherwise requires, references in the prospectus to “Deep Green Waste,” “Deep Green’”

the “Company,” “we,” “us” and “our” or similar terms are to Deep Green Waste

& Recycling, Inc.

DESCRIPTION

OF BUSINESS

Overview

Deep

Green Waste & Recycling, Inc. (f/k/a Critic Clothing, Inc.) (“Deep Green”, the “Company”, “we”,

“us”, or “our”) was organized as a Nevada Corporation on August 24, 1995 under the name of Evader,

Inc. On May 25, 2012, the Company filed its Foreign Profit Corporation Articles of Domestication to change the domicile of

the Company from Nevada to Wyoming. On November 4, 2015, the Company filed an Amendment to its Articles of Incorporation to change

the name of the Company to Critical Clothing, Inc. and on August 28, 2017 an Amendment was filed to change the Company name to

Deep Green Waste & Recycling, Inc.

Deep

Green was a full-service waste & recycling company that managed services to and logistics for large commercial

properties throughout the continental U.S. The Company served retail malls and shopping centers, multi-family apartment

and townhome communities, hospitals, hotels, correctional institutions, office parks and more. Our unique value proposition was

in the design and execution of end-to-end waste management programs for our clients. Our programs not only saved

money on direct waste disposal, lower administrative costs and equipment costs, but they also provided income from

direct recycling rebates. We had a presence in over 30 states across all regions of the United States and served

approximately 300 commercial customers.

On

August 10, 2017, our majority shareholder and our board of directors approved an amendment to our Articles of Incorporation for

the purpose of approving a reverse split of one to one thousand in which each shareholder will be issued one common share in exchange

for every one thousand common shares of their currently issued common stock. Prior to approval of the reverse split, we had a

total of 99,997,102,862 issued and outstanding shares of common stock, par value $0.0001. On September 27, 2017, the effective

date of the reverse split, we had a total of 99,997,102 issued and 90,697,102 outstanding shares of common stock, par value $0.0001.

Please see NOTE G - CAPITAL STOCK for further information.

On

August 24, 2017, the Company entered into an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations

(the “Agreement”) with St. James Capital Management, LLC. Under the terms of the Agreement, the Company transferred

and assigned all of the assets of the Company related to its extreme sports apparel design and manufacturing business in exchange

for the assumption of certain liabilities and cancellation of 3,000,000,000 shares of common stock of the Company.

On

August 24, 2017, the Company entered into a Merger Agreement (the “Merger Agreement”) with Deep Green Acquisition,

LLC, a Georgia limited liability company and wholly owned subsidiary of the Company (“Merger Sub”) and Deep Green

Waste and Recycling, LLC, a privately held Georgia limited liability company (“Deep Green Waste”). In connection with

the closing of this merger transaction, Merger Sub merged with and into Deep Green Waste (the “Merger”) on August

24, 2017, with the filing of Articles of Merger with the Georgia Secretary of State.

On

October 1, 2017, the Company acquired Compaction and Recycling Equipment, Inc. (“CARE”), a Portland, Oregon

based company that sells and services waste and recycling equipment. The Company purchased 100% of the common stock for $902,700,

of which $586,890 was paid in cash at closing and a promissory note was executed in the amount of $315,810. The note pays simple

interest at the rate of 7% per annum on the outstanding balance due, amortized over forty-eight months and payable in quarterly

installments, with the first payment being due on the first day of the first month following 90 days after closing.

On

October 1, 2017, the Company acquired Columbia Financial Services, Inc. (“CFSI”), a Portland, Oregon based

company that finances the purchases of waste and recycling equipment. Deep Green purchased 100% of the common stock for $597,300,

of which $418,110 was paid in cash at closing and a promissory note was executed in the amount of $179,190. The note pays simple

interest at the rate of 7% per annum on the outstanding balance due, amortized over forty-eight months and payable in quarterly

installments, with the first payment being due on the first day of the first month following 90 days after closing.

On August 7, 2018,

the Company entered into an Agreement of Conveyance, Transfer and Assignment of Subsidiaries and Assumption of Obligations with

Mirabile Corporate Holdings, Inc. (the “Agreement”). Under the terms of the Agreement, the Company transferred all

capital stock of its two wholly owned subsidiaries, Compaction and Recycling Equipment, Inc. and Columbia Financial Services,

Inc., to Mirabile Corporate Holdings, Inc. in exchange for the assumption and cancellation of certain liabilities. Please see

NOTE C – DISCONTINUED OPERATIONS for further information.

Going

forward, the company plans to re-launch its waste and recycling services business. The Company plans to:

|

|

●

|

Provide

sustainable waste management services that minimizes costs based on volume and content of waste streams, and methods of disposal,

including landfills, transfer stations and recycling centers; and

|

|

|

●

|

Offer

innovative recycling services that significantly reduce the disposal of plastics, electronic wastes, food wastes, and hazardous

wastes; and

|

|

|

●

|

Establish

partnerships with innovative universities and companies, and acquire profitable waste and recycling services companies, that

can help the Company achieve these objectives; and

|

|

|

●

|

Attract

investment funds who will actively work with the Company to achieve these goals and help the Company grow into a leading waste

and recycling services supplier in North America.

|

Licenses:

None.

Patents/Trademarks:

We

currently hold no patents or trademarks.

Research

& Development

We

had no expenses in Research and Development costs during the years ended December 31, 2019 and 2018.

Compliance

Expenses

Our

company incurs annual expenses to comply with state corporate governance and business licensing requirements. We estimate these

costs to be under $2,000 per year for the establishment of foreign corporations in other states that we plan to operate.

Labor

and Other Supplies

We

currently have three part time employees. We contract all labor for public company governance services, website development, accounting,

legal and daily activities outside of management.

Principal

Products or Services and Markets

The

principal markets for the Company’s future and recycling services will comprise property management companies, construction

and demolition companies, restaurants and retail stores, industrial and manufacturing businesses, and healthcare.

Seasonality

The

waste and recycling industry experiences little seasonal variance, and the Company does not anticipate significant seasonality

in its business.

Leases

The

Company anticipates its most significant lease obligations will be classified as fixed assets that will be used in the normal

course of its business. Some lease obligations may include renewal or purchase options, escalation clauses, restrictions,

penalties or other obligations that we will consider in determining minimum lease payments. The leases will be classified as either

operating leases or capital leases, as appropriate.

Governmental

Regulation

Our

operations are subject to certain foreign, federal, state and local regulatory requirements relating to environmental, waste management,

and health and safety matters. We believe we operate in substantial compliance with all applicable requirements. However, material

costs and liabilities may arise from these requirements or from new, modified or more stringent requirements. Material cost may

rise due to additional manufacturing cost of raw or made parts with the application of new regulations. Our liabilities may also

increase due to additional regulations imposed by foreign, federal, state and local regulatory requirements relating to environmental,

waste management, and health and safety matters. In addition, our past, current and future operations and those of businesses

we acquire, may give rise to claims of exposure by employees or the public or to other claims or liabilities relating to environmental,

waste management or health and safety concerns.

Our

markets can be positively or negatively impacted by the effects of governmental and regulatory matters. We are affected not only

by energy policy, laws, regulations and incentives of governments in the markets into which we sell, but also by rules, regulations

and costs imposed by utilities. Utility companies or governmental entities could place barriers on the installation of our product

or the interconnection of the product with the electric grid. Further, utility companies may charge additional fees to customers

who install on-site power generation, thereby reducing the electricity they take from the utility, or for having the capacity

to use power from the grid for back-up or standby purposes. These types of restrictions, fees or charges could hamper the ability

to install or effectively use our products or increase the cost to our potential customers for using our systems in the future.

This could make our systems less desirable, thereby adversely affecting our revenue and profitability potential. In addition,

utility rate reductions can make our products less competitive which would have a material adverse effect on our future operations.

These costs, incentives and rules are not always the same as those faced by technologies with which we compete. Additionally,

reduced emissions and higher fuel efficiency could help our future customers combat the effects of global warming. Accordingly,

we may benefit from increased government regulations that impose tighter emission and fuel efficiency standards.

Environmental

Regulation

Upon

the completion of a waste and recycling service business, the Company will become subject to federal, state or provincial and

local environmental, health, safety and transportation laws and regulations. These laws and regulations are administered by the

EPA, Environment Canada, and various other federal, state, provincial and local environmental, zoning, transportation, land use,

health and safety agencies in the U.S. and Canada. Many of these agencies will examine our subsidiary operations to monitor compliance

with these laws and regulations and have the power to enforce compliance, obtain injunctions or impose civil or criminal penalties

in case of violations. Because the primary mission of our business is to collect, manage and recycle waste in an environmentally

sound manner, a significant portion of our capital expenditures will be related, either directly or indirectly, to supporting

the Company’s subsidiary operations as they relate to compliance with federal, state, provincial and local rules.

Competition

We

expect to encounter intense competition with large national waste management companies, counties and municipalities that maintain

their own waste collection and disposal operations and regional and local companies of varying sizes and financial resources.

The industry also includes companies that specialize in certain discrete areas of waste management, operators of alternative disposal

facilities, companies that seek to use parts of the waste stream as feedstock for renewable energy and other by-products, and

waste brokers that rely upon haulers in local markets to address customer needs. In recent years, the industry has seen some consolidation,

though the industry remains intensely competitive. Operating costs, disposal costs and collection fees vary widely throughout

the areas in which we operate. The prices that we charge are determined locally, and typically vary by volume and weight, type

of waste collected, treatment requirements, risk of handling or disposal, frequency of collections, distance to final disposal

sites, the availability of airspace within the geographic region, labor costs and amount and type of equipment furnished to the

customer.

Competitors

include: Waste Management (WM), Rubicon Global, Republic Services, Stericycle, Waste Connections, Casella Waste Systems, Bioenergy

DevCo, PegEx, Recycle Track Systems and Liquid Environmental Solutions.

Employees

As

of the date of this Report, we have one full-time employee that serves in the roles of President/Chief Executive Officer/Corporate

Secretary, and two part time employees that serve in the roles of Chief Operating Officer and Interim Chief Financial Officer.

We plan to expand our management team within the next 12 months

to include certain officers for any acquisitions and any new subsidiaries or operational activities management deems necessary.

We consider our relations with our employees and consultants to be in good standing. Please see DIRECTORS, EXECUTIVE

OFFICERS, PROMOTERS, AND CONTROL PERSONS for additional information.

Report

to Shareholders

The

public may read and copy these reports, statements, or other information we file at the SEC’s public reference room at 100

F Street, NE., Washington, DC 20549 on official business days during the hours of 10 a.m. to 3 p.m. State that the public may

obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains

an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the Commission at (http://www.sec.gov).

Going

Concern

The

Company had minimal revenues and has incurred losses of $7,043,784 for the period August 24, 1995 (inception) through

the twelve months ended December 31, 2019 and negative working capital of $4,021,949 at December 31, 2019. These factors

raise substantial doubt about the Company’s ability to continue as a going concern.

There

can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that

funds will be available from external sources such as debt or equity financings or other potential sources. The lack of additional

capital resulting from the inability to generate cash flow from operations or to raise capital from external sources would force

the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business.

Furthermore, there can be no assurance that any such required funds, if available, will be available on attractive terms or that

they will not have a significant dilutive effect on the Company’s existing stockholders.

The

Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of the commencement

of revenues, with interim cash flow deficiencies being addressed through additional equity and debt financing. The Company anticipates

raising additional funds through public or private financing, strategic relationships or other arrangements in the near future

to support its business operations; however, the Company may not have commitments from third parties for a sufficient amount of

additional capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and

its failure to raise capital when needed could limit its ability to continue its operations. The Company’s ability to obtain

additional funding will determine its ability to continue as a going concern. Failure to secure additional financing in a timely

manner and on favorable terms would have a material adverse effect on the Company’s financial performance, results of operations

and stock price and require it to curtail or cease operations, sell off its assets, seek protection from its creditors through

bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of the Company’s

common stock, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary,

to raise additional funds, and may require that the Company relinquish valuable rights. Please see NOTE J - GOING

CONCERN UNCERTAINITY for further information.

Company

Information

We

are a Wyoming for-profit corporation. Our corporate address is 13110 NE 177th Place, Suite 293, Woodinville, WA 98072,

our telephone number is (833) 304-7336 and our website address is www.deepgreenwaste.com. The information on our website is not

a part of this prospectus. The Company’s stock is quoted under the symbol “DGWR” on the OTC Markets “PINK.”

The Company’s transfer agent is Transfer Online whose address is 512 SE Salmon St., Portland, OR 97214 and phone number

is (503) 227-2950.

Smaller

Reporting Company

We

also qualify as a “smaller reporting company” under Rule 12b-2 of the Exchange Act, which is defined as a company

with a public equity float of less than $75 million. To the extent that we remain a smaller reporting company at such time as

we are no longer an emerging growth company, we will still have reduced disclosure requirements for our public filings some of

which are similar to those of an emerging growth company, including having to comply with the auditor attestation requirements

of Section 404 of the Sarbanes-Oxley Act and the reduced disclosure obligations regarding executive compensation in our periodic

reports and proxy statements.

THE

OFFERING

|

Securities

offered

|

|

Up

to 27,206,637 shares of our Common Stock

|

|

|

|

|

|

Offering

Amount

|

|

$1,088,265

|

|

|

|

|

|

Terms

of the Offering

|

|

The

Selling Shareholders will determine when and how they will sell the Common Stock offered in this Prospectus. The

shares of our Common Stock may be offered and sold by Selling Shareholders at a fixed price of $0.04 per share until our Common

Stock is quoted on the OTCQB tier of the OTC Markets, and thereafter at prevailing market prices or privately negotiated prices

or in transactions that are not in the public market. Notwithstanding our belief that upon the effective date of this registration

statement our Common Stock will satisfy the admission requirements for the OTCQB and our intention to make application for

quotation on the OTCQB Market, we cannot assure you that our Common Stock will be quoted on the OTCQB tier.

|

|

|

|

|

|

Common

Stock Issued and Outstanding Before This Offering

|

|

105,891,540

(1)

|

|

|

|

|

|

Common

Stock Issued and Outstanding After This Offering

|

|

112,694,471

(2)(3)(4)(5)(6)

|

|

|

|

|

|

Risk

Factors

|

|

See

“Risk Factors” beginning on page 11 and the other information set forth in this prospectus for a discussion

of factors you should consider before deciding to invest in our securities.

|

|

|

|

|

|

Market

for Common Stock

|

|

Our

Common Stock is subject to quotation on the OTC Pink Market under the symbol “DGWR.”

|

|

|

|

|

|

Dividends

|

|

We

have not declared or paid any cash dividends on our common stock since our inception, and we do not anticipate paying any

such dividends for the foreseeable future.

|

|

(1)

|

The

number of shares of our common stock outstanding before this Offering is 105,891,540 as of March 13, 2020.

|

|

|

|

|

(2)

|

On

March 12, 2020, the Company issued to Armada Investment Fund, LLC (“ARMADA”) a Convertible Promissory Note (the “Note”)

in the amount of Twenty-Three Thousand and NO/100 Dollars ($23,000). On March 6, 2020, ARMADA entered into an Assignment Agreement

(the “Agreement”) with Sylios Corp (“Assignor”). Under the terms of the Agreement, the Assignor sells,

assigns, conveys and transfers its interest into the Securities Purchase Agreement, Convertible Promissory Note (principal amount

of $23,000), Stock Purchase Warrant Agreement (262,500 shares of common stock) and Registration Rights Agreement entered into

by the Assignor and Company all dated January 13, 2020. This Registration Statement covers the resale by ARMADA of up to 6,000,000

shares of common stock issuable upon conversion of the Note.

|

|

|

|

|

(3)

|

In

addition, ARMADA was issued a warrant to purchase 262,500 shares of the Company’s

common stock. The shares to be issued under the warrant are included in the offering

and are included in the calculation of beneficial ownership. In the event that ARMADA

were to fully exercise their warrant, the total number of shares outstanding would increase

to 112,694,471. Please see NOTE G - CAPITAL STOCK for further information.

|

|

|

|

|

(4)

|

We

will receive proceeds from the issuance of 262,500 shares of our common stock underlying

the warrant issued to ARMADA pursuant to the Securities Purchase Agreement dated January

13, 2020 and the Assignment Agreement dated March 12, 2020. The warrants have an exercise

price of $0.04 and are exercisable for a period of five years.

|

|

|

|

|

(5)

|

This

Registration Statement covers the resale by our selling shareholders of up to 20,403,706

shares of common stock previously issued to such selling shareholders.

|

|

|

|

|

(6)

|

This

Registration Statement covers the resale of 540,431 shares of our common stock underlying

the warrants previously issued to multiple warrant holders, not inclusive of ARMADA.

The warrants have exercise prices ranging from $0.20 to $0.175. The shares to be issued

under the warrants are included in the offering and are included in the calculation of

beneficial ownership. We will receive proceeds from the issuance of the 540,431 shares

underlying the warrants. In the event that the multiple warrant holders were to fully

exercise their warrants, the total number of shares outstanding would increase to 112,694,471.

Please see SELLING SHAREHOLDERS for further information.

|

SUMMARY

FINANCIAL DATA

The

following summary of our financial data should be read in conjunction with, and is qualified in its entirety by reference to,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated

financial statements, appearing elsewhere in this prospectus.

Statements

of Operations Data

|

|

|

For

the

year-ended

December

31, 2019

|

|

|

For

the

year-ended

December 31, 2018

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

6,375,693

|

|

|

Loss

from operations

|

|

$

|

(41,403

|

)

|

|

$

|

(1,302,084

|

)

|

|

Net

income (loss)

|

|

$

|

(92,376

|

)

|

|

$

|

(2,549,458

|

)

|

Balance

Sheet Data

|

|

|

As

of

December

31, 2019

|

|

|

As

of

December

31, 2018

|

|

|

Cash

|

|

$

|

735

|

|

|

$

|

1,694

|

|

|

Total

assets

|

|

$

|

29,199

|

|

|

$

|

52,501

|

|

|

Total

liabilities

|

|

$

|

4,149,109

|

|

|

$

|

4,080,035

|

|

|

Total

stockholders’ (deficiency)

|

|

$

|

(4,119,910

|

)

|

|

$

|

(4,027,534

|

)

|

RISK

FACTORS

You

should carefully consider the risks described below and other information in this prospectus, including the financial statements

and related notes that appear at the end of this prospectus, before deciding to invest in our securities. These risks should be

considered in conjunction with any other information included herein, including in conjunction with forward-looking statements

made herein. If any of the following risks actually occur, they could materially adversely affect our business, financial condition,

operating results or prospects. Additional risks and uncertainties that we do not presently know or that we currently deem immaterial

may also impair our business, financial condition, operating results and prospects.

Risks

Relating to Our Financial Condition

Our

independent registered accounting firm has expressed concerns about our ability to continue as a going concern.

The

report of our independent registered accounting firm expresses concern about our ability to continue as a going concern based

on the absence of significant revenues, our significant losses from operations and our need for additional financing to fund all

of our operations. It is not possible at this time for us to predict with assurance the potential success of our business. The

revenue and income potential of our proposed business and operations are unknown. If we cannot continue as a viable entity, we

may be unable to continue our operations and you may lose some or all of your investment in our common stock.

We

have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operation.

As

we have approximately ten years of corporate operational history and have yet to generate substantial revenue, it is extremely

difficult to make accurate predictions and forecasts on our finances. This is compounded by the fact that we operate in both the

technology, retail and cannabis industries, which are three rapidly transforming industries. There is no guarantee that our products

or services will remain attractive to potential and current users as these industries undergo rapid change or that potential customers

will utilize our services.

As

a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We

have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow, we have not

achieved profitability and cannot be certain that we will be able to sustain our current growth rate or realize sufficient revenue

to achieve profitability. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions,

increasing revenue throughout the year and keeping operating expenses below our revenue levels in order to achieve positive cash

flows, none of which can be assured.

We

may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at

all.

We

intend to continue to make investments to support our business growth and may require additional funds to respond to business

challenges, including the need to develop new features and products or enhance our existing products, improve our operating infrastructure

or acquire complementary businesses and technologies. Accordingly, we may need to engage in continued equity or debt financings

to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our

existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences

and privileges superior to those of our common stock. Any debt financing we secure in the future could involve restrictive covenants

relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us

to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain

additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms

satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges

could be impaired, and our business may be harmed.

We

expect our quarterly financial results to fluctuate.

We

expect our revenue and operating results to vary significantly from quarter to quarter due to a number of factors, including changes

in:

|

|

●

|

General

economic conditions, both domestically and in foreign markets;

|

|

|

|

|

|

|

●

|

The

performance of the two spin-offs of which we hold an equity investment;

|

|

|

|

|

|

|

●

|

Production

from the oil and natural gas wells in which we maintain ownership;

|

|

|

|

|

|

|

●

|

Our

ability to identify future acquisition targets;

|

|

|

|

|

|

|

●

|

Our

ability to raise capital to implement our business plan; and

|

|

|

|

|

|

|

●

|

General

acceptance and growth of the cannabis and blockchain technology industries.

|

As

a result of the variability of these and other factors, our operating results in future quarters may be below the expectations

of our stockholders.

General

Business Risks

Conflicts

of interest may arise from other business activities of our directors and officers.

We

are highly dependent on the services of key executives, the loss of whom could materially harm our business and our strategic

direction. If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other

personnel or experience increases in our compensation costs, our business may materially suffer.

We

are highly dependent on our management team, specifically Lloyd Spencer, the Company’s President and Chief Executive Officer.

If we lose key employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service

of our management personnel and our ability to identify, hire, and retain additional key personnel. We do not carry “key-man”

life insurance on the lives of any of our executives, employees or advisors. We experience intense competition for qualified personnel

and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition,

our compensation costs may increase significantly.

We

will need to raise additional capital to continue operations over the coming year.

We

anticipate the need to raise approximately $500,000 in capital to fund our operations through December 31, 2020. We expect to

use these cash proceeds, primarily for future acquisitions, expansion of our business plan and to remain in full legal and accounting

compliance with the SEC. We cannot guarantee that we will be able to raise these required funds or generate sufficient revenue

to remain operational.

We

may be unable to manage growth, which may impact our potential profitability.

Successful

implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management

and financial resources. To manage growth effectively, we will need to:

|

|

●

|

Establish

definitive business strategies, goals and objectives;

|

|

|

|

|

|

|

●

|

Maintain

a system of management controls; and

|

|

|

|

|

|

|

●

|

Attract

and retain qualified personnel, as well as, develop, train and manage management-level and other employees.

|

If

we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed, and

our stock price may decline.

Our

lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and

officers.

We

may in the future be subject to additional litigation, including potential class action and stockholder derivative actions. Risks

associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for

significant periods of time. To date, we have not obtained directors and officers liability (“D&O”) insurance.

While neither Florida law nor our Articles of Incorporation or bylaws require us to indemnify or advance expenses to our officers

and directors involved in such a legal action, we have entered into an indemnification agreement with our President and intend

to enter into similar agreements with other officers and directors in the future. Without adequate D&O insurance, the amounts

we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company

could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of

adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which

could adversely affect our business.

If

we are unable to maintain effective internal control over our financial reporting, the reputational effects could materially adversely

affect our business.

Under

the provisions of Section 404(a) of the Sarbanes-Oxley Act of 2002, as amended by the Dodd Frank Wall Street Reform and Consumer

Protection Act of 2010, the SEC adopted rules requiring public companies to perform an evaluation of Internal Control over Financial

Reporting (Internal Controls) and to report on our evaluation in our Annual Report on Form 10-K. Our Internal Controls constitute

a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements in accordance with GAAP. In the event we discover material weakness in our internal controls and our remediation of

such reported material weakness is ineffective, or if in the future we are unable to maintain effective Internal Controls, additional

resulting material restatements could occur, regulatory actions could be taken, and a resulting loss of investor confidence in

the reliability of our financial statements could occur.

The

Company’s bank accounts will not be fully insured

The

Company’s regular bank accounts and the escrow account for this Offering each have federal insurance that is limited to

a certain amount of coverage. It is anticipated that the account balances in each account may exceed those limits at times. In

the event that any of Company’s banks should fail, the Company may not be able to recover all amounts deposited in these

bank accounts.

The

Company’s business plan is speculative

The

Company’s present business and planned business are speculative and subject to numerous risks and uncertainties. There is

no assurance that the Company will generate significant revenues or profits.

The

Company will likely incur debt

The

Company has incurred high level of debt and expects to incur future debt in order to fund operations. Complying with obligations

under such indebtedness may have a material adverse effect on the Company and on your investment. There is high risk of default,

if the Company is not able to raise additional capital and there is no assurance that the Company will be able to do so.

The

Company’s expenses could increase without a corresponding increase in revenues

The

Company’s operating and other expenses could increase without a corresponding increase in revenues, which could have a material

adverse effect on the Company’s consolidated financial results and on your investment. Factors which could increase operating

and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory

charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations

or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

The

Company will be reliant on key suppliers

The

Company intends to enter into agreements with key suppliers and will be reliant on positive and continuing relationships with

such suppliers. Termination of those agreements, variations in their terms or the failure of a key supplier to comply with its

obligations under these agreements (including if a key supplier were to become insolvent) could have a material adverse effect

on the Company’s consolidated financial results and on your investment.

Increased

costs could affect the company

An

increase in the cost of raw materials or energy could affect the Company’s profitability. Commodity and other price changes

may result in unexpected increases in the cost of raw materials, glass bottles and other packaging materials used by the Company.

The Company may also be adversely affected by shortages of raw materials or packaging materials. In addition, energy cost increases

could result in higher transportation, freight and other operating costs. The Company may not be able to increase its prices to

offset these increased costs without suffering reduced volume, sales and operating profit, and this could have an adverse effect

on your investment.

Inability

to maintain and enhance product image

It

is important that the Company maintains and enhances the image of its existing and new products. The image and reputation of the

Company’s products and services may be impacted for various reasons including litigation, complaints from regulatory bodies

resulting from quality failure, illness or other health concerns. Such concerns, even when unsubstantiated, could be harmful to

the Company’s image and the reputation of its products. From time to time, the Company may receive complaints from customers

regarding products purchased from the Company. The Company may in the future receive correspondence from customers requesting

reimbursement. Certain dissatisfied customers may threaten legal action against the Company if no reimbursement is made. The Company

may become subject to product liability lawsuits from customers alleging injury because of a purported defect in products or sold

by the Company, claiming substantial damages and demanding payments from the Company. The Company is in the chain of title when

it manufactures, supplies or distributes products, and therefore is subject to the risk of being held legally responsible for

them. These claims may not be covered by the Company’s insurance policies. Any resulting litigation could be costly for

the Company, divert management attention, and could result in increased costs of doing business, or otherwise have a material

adverse effect on the Company’s business, results of operations, and financial condition. Any negative publicity generated

as a result of customer complaints about the Company’s products could damage the Company’s reputation and diminish

the value of the Company’s brand, which could have a material adverse effect on the Company’s business, results of

operations, and financial condition, as well as your investment. Deterioration in the Company’s brand equity (brand image,

reputation and product quality) may have a material adverse effect on its consolidated financial results as well as your investment.

If

we are unable to protect effectively our intellectual property, we may not be able to operate our business, which would impair

our ability to compete

Our

success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual

property. The names and/or logos of Company brands (whether owned by the Company or licensed to us) may be challenged by holders

of trademarks who file opposition notices, or otherwise contest trademark applications by the Company for its brands. Similarly,

domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name

or URL. Such challenges could have a material adverse effect on the Company’s consolidated financial results as well as

your investment.

Computer,

website or information system breakdown could affect the Company’s business

Computer,

website and/or information system breakdowns as well as cyber security attacks could impair the Company’s ability to service

its customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on

the Company’s consolidated financial results as well as your investment.

Changes

in the economy could have a detrimental impact on the Company

Changes

in the general economic climate could have a detrimental impact on consumer expenditure and therefore on the Company’s revenue.

It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest

rates, higher unemployment and tax increases) may adversely affect customers’ confidence and willingness to spend. Any of

such events or occurrences could have a material adverse effect on the Company’s consolidated financial results and on your

investment.

The

amount of capital the company is attempting to raise in this offering is not enough to sustain the Company’s current business

plan

In

order to achieve the Company’s near and long-term goals, the Company will need to procure funds in addition to the amount

raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we

are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations

will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining

assets, which could cause you to lose all or a portion of your investment.

Additional

financing may be necessary for the implementation of our growth strategy

The

Company may require additional debt and/or equity financing to pursue our growth and business strategies. These include but are

not limited to enhancing our operating infrastructure and otherwise responding to competitive pressures. Given our limited

operating history and existing losses, there can be no assurance that additional financing will be available, or, if available,

that the terms will be acceptable to us.

The

Company’s business model is evolving

The

Company’s business model is unproven and is likely to continue to evolve. Accordingly, the Company’s initial business

model may not be successful and may need to be changed. The Company’s ability to generate significant revenues will depend,

in large part, on the Company’s ability to successfully market the Company’s products to potential users who may not

be convinced of the need for the Company’s products and services or who may be reluctant to rely upon third parties to develop

and provide these products. The Company intends to continue to develop the Company’s business model as the Company’s

market continues to evolve.

The

Company needs to increase brand awareness

Due

to a variety of factors, the Company’s opportunity to achieve and maintain a significant market share may be limited. Developing

and maintaining awareness of the Company’s brand name, among other factors, is critical. Further, the importance of brand

recognition will increase as competition in the Company’s market increases. Successfully promoting and positioning the Company’s

brand, products and services will depend largely on the effectiveness of the Company’s marketing efforts. Therefore, the

Company may need to increase the Company’s financial commitment to creating and maintaining brand awareness. If the Company

fails to successfully promote the Company’s brand name or if the Company incurs significant expenses promoting and maintaining

the Company’s brand name, it would have a material adverse effect on the Company’s consolidated results of operations.

The

Company faces competition in the Company’s markets from a number of large and small companies, some of which have greater

financial, research and development, production and other resources than does the company

In

many cases, the Company’s competitors have longer operating histories, established ties to the market and consumers, greater

brand awareness, and greater financial, technical and marketing resources. The Company’s ability to compete depends, in

part, upon a number of factors outside the Company’s control, including the ability of the Company’s competitors to

develop alternatives that are superior. If the Company fails to successfully compete in its markets, or if the Company incurs

significant expenses in order to compete, it would have a material adverse effect on the Company’s consolidated results

of operations.

A

data security breach could expose the Company to liability and protracted and costly litigation, and could adversely affect the

Company’s reputation and operating revenues

To

the extent that the Company’s activities involve the storage and transmission of confidential information, the Company and/or

third-party processors will receive, transmit and store confidential customer and other information. Encryption software and the

other technologies used to provide security for storage, processing and transmission of confidential customer and other information

may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such

security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper

access to the Company’s or these third parties’ systems or databases could result in the theft, publication, deletion

or modification of confidential customer and other information. A data security breach of the systems on which sensitive account

information is stored could lead to fraudulent activity involving the Company’s products and services, reputational damage,

and claims or regulatory actions against us. If the Company issued in connection with any data security breach, the Company could

be involved in protracted and costly litigation. If unsuccessful in defending that litigation, the Company might be forced to

pay damages and/or change the Company’s business practices or pricing structure, any of which could have a material adverse

effect on the Company’s operating revenues and profitability. The Company would also likely have to pay fines, penalties

and/or other assessments imposed as a result of any data security breach.

The

Company depends on third-party providers for a reliable internet infrastructure and the failure of these third parties, or the

internet in general, for any reason would significantly impair the Company’s ability to conduct its business

The

Company will outsource some or all of its online presence and data management to third parties who host the actual servers and

provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted

access to the Internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency

of a third-party provider, or malicious electronic intrusion into the data center, its business would be significantly damaged.

As has occurred with many Internet-based businesses, the Company may be subject to ‘denial-of-service’ attacks in

which unknown individuals bombard its computer servers with requests for data, thereby degrading the servers’ performance.

The Company cannot be certain it will be successful in quickly identifying and neutralizing these attacks. If either a third-party

facility failed, or the Company’s ability to access the Internet was interfered with because of the failure of Internet

equipment in general or if the Company becomes subject to malicious attacks of computer intruders, its business and operating

results will be materially adversely affected.

We

expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate

financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to

manage our expenses.

We

estimate that it will cost approximately $50,000 annually to maintain the proper management and financial controls for our filings

required as a public reporting company. In addition, if we do not maintain adequate financial and management personnel, processes

and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause a decline

in our stock price and adversely affect our ability to raise capital.

We

have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back

or even cease ongoing business operations.

We

are in the “developmental” stage of business and have yet to commence any substantive commercial operations. We have

limited history of revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will

ever operate profitably. We have a limited operating history and must be considered in the developmental stage. Success is significantly

dependent on a successful drilling, completion and production program. Operations will be subject to all the risks inherent in

the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history.

We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the developmental stage and potential

investors should be aware of the difficulties normally encountered by enterprises in this stage. If the business plan is not successful,

and we are not able to operate profitably, investors may lose some or all of their investment in the Company.

Risk

to Our Common Stock and Offering

If

we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board which would limit the

ability of broker-dealers to sell our securities in the secondary market.

Companies

trading on the Over the Counter Bulletin Board must be reporting issuers under Section 12 of the Securities Exchange Act of 1934,

as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC

Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability

of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In

addition, we may be unable to get relisted on the OTC Bulletin Board, which may have an adverse material effect on the Company.

We

do not expect to pay dividends in the future; any return on investment may be limited to the value of our common stock.

We

do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will

depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors

may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital

base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare

and pay dividends to the holders of our common stock, and in any event, a decision to declare and pay dividends is at the sole

discretion of our board of directors. If we do not pay dividends, our common stock may be less valuable because a return on your

investment will only occur if its stock price appreciates.

Authorization

of preferred stock.

Our

Certificate of Incorporation authorizes the issuance of up to 2,000,000 shares of preferred stock with designations, rights and

preferences determined from time to time by its Board of Directors. Accordingly, our Board of Directors is empowered, without

stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other rights which could adversely

affect the voting power or other rights of the holders of the common stock. In the event of issuance, the preferred stock could

be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company.

As of December 31, 2019, we have authorized and issued 2,000,000 and 0 shares, respectively, of Preferred stock. Please see

NOTE G - CAPITAL STOCK for further information.

The

Company arbitrarily determined the offering price and terms of the Shares offered through this Prospectus.

The

price of the Shares has been arbitrarily determined and bears no relationship to the assets or book value of the Company, or other

customary investment criteria. No independent counsel or appraiser has been retained to value the Shares, and no assurance can

be made that the offering price is in fact reflective of the underlying value of the Shares offered hereunder. Each prospective

investor is therefore urged to consult with his or her own legal counsel and tax advisors as to the offering price and terms of

the Shares offered hereunder.

The

Shares are an illiquid investment and transferability of the Shares is subject to significant restriction.

There

are substantial restrictions on the transfer of the Shares. Therefore, the purchase of the Shares must be considered a long-term

investment acceptable only for prospective investors who are willing and can afford to accept and bear the substantial risk of

the investment for an indefinite period of time. There is not a public market for the resale of the Shares. A prospective investor,

therefore, may not be able to liquidate its investment, even in the event of an emergency, and Shares may not be acceptable as

collateral for a loan.

The

market price for our common stock may be particularly volatile given our status as a relatively unknown company, with a limited

operating history and lack of profits which could lead to wide fluctuations in our share price. You may be unable to sell your

common stock at or above your purchase price, which may result in substantial losses to you.

Our

stock price may be particularly volatile when compared to the shares of larger, more established companies that trade on a national

securities exchange and have large public floats. The volatility in our share price will be attributable to a number of factors.

First, our common stock will be compared to the shares of such larger, more established companies, sporadically and thinly traded.

As a consequence of this limited liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately

influence the price of those shares in either direction. The price for our shares could decline precipitously in the event that

a large number of shares of our common stock are sold on the market without commensurate demand. Second, we are a speculative

or “risky” investment due to our limited operating history and lack of profits to date, and uncertainty of future

market acceptance for our potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the

fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their

shares on the market more quickly and at greater discounts than would be the case with the stock of a larger, more established

company that trades on a national securities exchange and has a large public float. Many of these factors are beyond our control

and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions

or projections as to what the prevailing market price for our common stock will be at any time. Moreover, the OTC Bulletin Board

is not a liquid market in contrast to the major stock exchanges. We cannot assure you as to the liquidity or the future market

prices of our common stock if a market does develop. If an active market for our common stock does not develop, the fair market

value of our common stock could be materially adversely affected.

Existing

stockholders will experience significant dilution from our sale of shares under potential Securities Purchase Agreements.

The

sale of shares pursuant to any Securities Purchase Agreements executed by the Company in the future will have a dilutive impact

on our stockholders. As a result, the market price of our common stock could decline significantly, as we sell shares pursuant

to the Securities Purchase Agreement. In addition, for any particular advance, we will need to issue a greater number of shares

of common stock under the Securities Purchase Agreement as our stock price declines. If our stock price is lower, then our existing

stockholders would experience greater dilution.

The

Company May Issue Shares of Preferred Stock with Greater Rights than Common Stock.

The

Company’s charter authorizes the Board of Directors to issue one or more series of preferred stock and set the terms of

the preferred stock without seeking any further approval from holders of the Company’s common stock. Any preferred stock

that is issued may rank ahead of the Company’s common stock in terms of dividends, priority and liquidation premiums and

may have greater voting rights than the Company’s common stock.

Being

a Public Company Significantly Increases the Company’s Administrative Costs.

The

Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC and listing requirements subsequently adopted

by the NYSE Amex in response to Sarbanes-Oxley, have required changes in corporate governance practices, internal control policies

and audit committee practices of public companies. Although the Company is a relatively small public company, these rules, regulations,

and requirements for the most part apply to the same extent as they apply to all major publicly traded companies. As a result,

they have significantly increased the Company’s legal, financial, compliance and administrative costs, and have made certain

other activities more time consuming and costly, as well as requiring substantial time and attention of our senior management.

The Company expects its continued compliance with these and future rules and regulations to continue to require significant resources.

These rules and regulations also may make it more difficult and more expensive for the Company to obtain director and officer

liability insurance in the future and could make it more difficult for it to attract and retain qualified members for the Company’s

Board of Directors, particularly to serve on its audit committee.

Our

shares are subject to the U.S. “Penny Stock” Rules and investors who purchase our shares may have difficulty re-selling

their shares as the liquidity of the market for our shares may be adversely affected by the impact of the “Penny Stock”

Rules.

Our

stock is subject to U.S. “Penny Stock” rules, which may make the stock more difficult to trade on the open market.

Our common shares are not currently traded on the OTC Bulletin Board, but it is the Company’s plan that the common shares

be quoted on the OTC Bulletin Board. A “penny stock” is generally defined by regulations of the U.S. Securities and

Exchange Commission (“SEC”) as an equity security with a market price of less than US$5.00 per share. However, an

equity security with a market price under US $5.00 will not be considered a penny stock if it fits within any of the following

exceptions:

|

|

(i)

|

the

equity security is listed on NASDAQ or a national securities exchange;

|

|

|

|

|

|

|

(ii)

|

the

issuer of the equity security has been in continuous operation for less than three years, and either has (a) net tangible

assets of at least US $5,000,000, or (b) average annual revenue of at least US $6,000,000; or

|

|

|

|

|

|

|

(iii)

|

the

issuer of the equity security has been in continuous operation for more than three years and has net tangible assets of at

least US $2,000,000.

|

Our

common stock does not currently fit into any of the above exceptions.

If

an investor buys or sells a penny stock, SEC regulations require that the investor receive, prior to the transaction, a disclosure

explaining the penny stock market and associated risks. Furthermore, trading in our common stock will be subject to Rule 15g-9

of the Exchange Act, which relates to non-NASDAQ and non-exchange listed securities. Under this rule, broker/dealers who recommend