Current Report Filing (8-k)

February 05 2020 - 4:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

January 30, 2020

Date of Report (Date of Earliest event reported)

|

DLT Resolution Inc.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Nevada

|

|

333-148546

|

|

20-8248213

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

5940 S. Rainbow Blvd, Ste 400-32132 Las Vegas NV 89118

(Address of principal executive offices) (Zip Code)

1 (702) 796-6363

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Item 1.01 Entry into a Material Definitive Agreement

Acquisition of Union Strategies Inc.

On January 30, 2020, DLT Resolution Inc. (the “Company” or “we”) entered into transactions contemplated by the definitive share for share exchange agreement and plan of re-organization (the “Purchase Agreement”) by and among the Company, Union Strategies Inc. a corporation organized under the laws of Ontario (“Union Strategies”), the stockholders of Union Strategies Inc. (“Stockholders”) and other parties signatory thereto to acquire all the issued and outstanding capital stock of Union Strategies Inc. for 1,500,000 restricted common shares of DLT Resolution. The acquisition will result in Union Strategies becoming a wholly owned subsidiary of The Company.

In addition to the consideration on closing an additional 1,000,000 restricted common shares may potentially be issued upon meeting the following milestones:

|

·

|

Gross sales of Union Strategies to exceed CAD $3,100,000 with a minimum $75,000 in EBITDA for final 2020.

|

Share issuances will be issued under reliance of appropriate exemptions from registration with the Securities & Exchange Commission and will contain substantial resale restrictions.

The Stock Purchase Agreement contains customary representations, warranties and covenants by Union Strategies Inc., as well as customary indemnification provisions among the parties.

Closing on the transaction is expected to be completed in the first quarter of 2020. Upon closing the Company will file a Current Report 8-K updating shareholders

Prior to the transactions described in this Current Report on Form 8-K, no material relationships between the Company or Union Strategies or any affiliate of Union Strategies Inc. and the Company existed, other than pertaining to the Acquisition.

The foregoing summary of the Asset Purchase Agreement is not complete and is qualified in its entirety by reference to the complete text of the definitive agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. The Asset Purchase Agreement is filed as an exhibit to this report in order to provide investors and shareholders with information regarding its terms. It is not intended to provide any other factual information about the Company or any of the other parties thereto. In particular, the assertions embodied in the representations and warranties contained in the Asset Purchase Agreement are given only as of the dates specified in the agreement and are qualified by information contained in confidential disclosure schedules provided by the parties. Accordingly, investors should not rely on the representations and warranties in the Stock Purchase Agreement as characterizations of the actual state of facts or condition of the Company, Union Strategies Inc., the Sellers or any other party to the Purchase Agreement.

Item 9.01 Financial Statements and Exhibits

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DLT Resolution Inc.

|

|

|

|

|

|

|

|

Date: February 5, 2020

|

By:

|

/s/ John S. Wilkes

|

|

|

|

Name:

|

John S. Wilkes

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

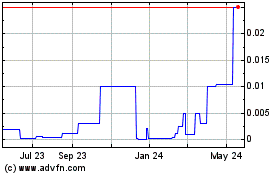

DLT Resolution (CE) (USOTC:DLTI)

Historical Stock Chart

From Dec 2024 to Jan 2025

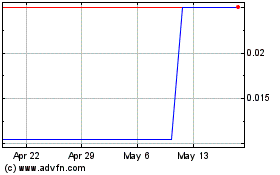

DLT Resolution (CE) (USOTC:DLTI)

Historical Stock Chart

From Jan 2024 to Jan 2025