OPEC Production Falls as Efforts to Cut Output Start to Pay Off

September 12 2017 - 7:09AM

Dow Jones News

By Christopher Alessi

LONDON--OPEC crude oil production fell last month for the first

time since April, in a boost to the cartel's beleaguered efforts to

reduce output and rein in the global supply glut.

The Organization of the Petroleum Exporting Countries' output

declined by 0.24%, to 32.76 million barrels a day in August, down

by 79,000 barrels from July. The decline was driven mainly by a

precipitous drop in Libyan production, as well as reduced output in

Gabon, Venezuela and Iraq, according to OPEC's closely watched

monthly market report.

The report comes as Saudi Arabia--OPEC's largest member and the

world's biggest crude exporter--has been debating whether to extend

the cartel's production cutting deal after it expires next

year.

OPEC, and 10 producers outside the cartel including Russia,

first agreed late last year to cap production at around 1.8 million

barrels a day lower than peak October 2016 levels, with the aim of

alleviating global oversupply and boosting prices. But the deal,

which was extended in May through March 2018, has failed to have a

significant impact on prices, in part due to a continued surge in

U.S. shale supply.

Soaring production over the past few months in Libya and

Nigeria-- two OPEC nations exempt from the deal because their oil

industries had been crippled by civil unrest--has also weakened the

cartel's effectiveness in cutting global supply. But Libyan

production fell significantly by 112,300 barrels in August, to

890,000 barrels a day, a result of pipeline closures and

disruptions at its oil fields, the report showed.

OPEC's Tuesday report also highlighted non-OPEC oil supply,

which declined in August, by 32,000 barrels a day to, to 57.68

million barrels a day, the cartel said. The decline was driven by

disruptions to U.S. oil production in the Gulf of Mexico due to

Hurricane Harvey and lower crude output from the North Sea and

Kazakhstan on the back of seasonal maintenance.

Commercial inventories in the Organization for Economic

Cooperation and Development--a group of industrialized,

oil-consuming nations--fell for the third consecutive month in

July, to 3.002 million barrels a day. That is 195 million barrels

above OPEC's target of the last five-year average.

The cartel also once again raised its forecast for global oil

demand growth this year, by 50,000 barrels a day. OPEC now expects

oil demand growth of 1.42 million barrels a day in 2017, helped by

"better than expected data" for the OECD region in the second

quarter.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

September 12, 2017 07:54 ET (11:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

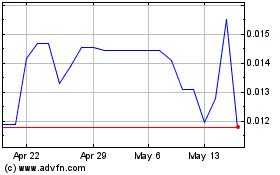

Fuse Science (PK) (USOTC:DROP)

Historical Stock Chart

From Dec 2024 to Jan 2025

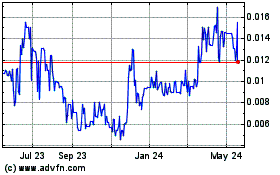

Fuse Science (PK) (USOTC:DROP)

Historical Stock Chart

From Jan 2024 to Jan 2025