UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

(Mark

One)

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

|

For the

fiscal year ended December 31, 2008

|

o

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

|

For the

transition period from ________________ to

________________

Commission

file number 000-21369

(Exact

name of registrant as specified in its charter)

|

Delaware

|

6770

|

26-1762478

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(IRS

Employer

Identification

No.)

|

2202

N. West Shore Blvd, Suite 200, Tampa, FL 33607

(Address

of principal executive offices) (Zip Code)

702-448-7113

(Registrant’s

telephone number, including area code)

Securities

Registered pursuant to Section 12(b) of the Exchange Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

None

|

None

|

Securities

Registered pursuant to Section 12(g) of the Exchange Act:

Common

Stock, $0.000001 Par Value

(Title of

class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

o

Yes

x

No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

o

Yes

x

No

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

x

Yes

o

No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of the registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-k

or any amendment to this Form 10-K.

x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

o

|

Accelerated

filer

|

o

|

|

Non-accelerated

filer

|

o

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

x

Yes

o

No

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

last sold, or the average bid price of such common equity, as of the last

business day of the registrant’s most recently completed second fiscal

quarter.

As of

December 31, 2008 the market value was $20,535. There are

approximately 20,534,655 shares of our common voting stock held by

non-affiliates. This valuation is based upon the bid price of our

common stock as quoted on the OTC Pink Sheets on that date

($0.001).

APPLICABLE

ONLY TO REGISTRANT’S INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act

1934 subsequent to the distribution of securities under plan confirmed by a

court.

x

Yes

o

No

(APPLICABLE

ONLY TO CORPORATE REGISTRANTS)

Indicate

the number of shares outstanding of each of the issuer’s classes of common

stock, as of the latest practicable date: 20,534,655 shares of Common Stock,

$0.000001 par value, as of December 31, 2008.

(DOCUMENTS

INCORPORATED BY REFERENCE)

None

|

|

Index

|

Page

Number

|

|

|

|

|

|

|

PART

I

|

|

|

|

|

|

|

ITEM

1.

|

Business

|

4

|

|

|

|

|

|

ITEM

1A.

|

Risk

Factors

|

7

|

|

|

|

|

|

ITEM

2.

|

Properties

|

10

|

|

|

|

|

|

ITEM

3.

|

Legal

Proceedings

|

10

|

|

|

|

|

|

ITEM

4.

|

Submission

of Matter to a Vote of Security Holders

|

10

|

|

|

|

|

|

|

PART

II

|

|

|

|

|

|

|

ITEM

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

10

|

|

|

|

|

|

ITEM

6.

|

Selected

Financial Data

|

11

|

|

|

|

|

|

ITEM

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

11

|

|

|

|

|

|

ITEM

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

13

|

|

|

|

|

|

ITEM

8.

|

Financial

Statements and Supplementary Data

|

14

|

|

|

|

|

|

ITEM

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

15

|

|

|

|

|

|

ITEM

9A.

|

Controls

and Procedures

|

16

|

|

|

|

|

|

ITEM

9B.

|

Other

Information

|

16

|

|

|

|

|

|

|

PART

III

|

|

|

|

|

|

|

ITEM

10.

|

Directors,

Executive Officers and Corporate Governance

|

16

|

|

|

|

|

|

ITEM

11.

|

Executive

Compensation

|

17

|

|

|

|

|

|

ITEM

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

18

|

|

|

|

|

|

ITEM

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

18

|

|

|

|

|

|

ITEM

14.

|

Principal

Accounting Fees and Services

|

18

|

|

|

|

|

|

ITEM

15.

|

Exhibits,

Financial Statements, Schedules

|

19

|

|

|

|

|

|

SIGNATURES

|

|

19

|

INDEX

TO FINANCIAL STATEMENTS

|

|

Page No.

|

|

|

|

|

Report

of Independent Registered Public Accounting Firm

|

F-1

|

|

|

|

|

Balance

Sheets as of December 31, 2008 and December 31, 2007

|

F-3

|

|

|

|

|

Statements

of Operations for the years ended December 31, 2008 and December 31,

2007

|

F-4

|

|

|

|

|

Statements

of Stockholders' Equity as of December 31, 2008

|

F-5

|

|

|

|

|

Statements

of Cash Flows

|

F-6

|

|

|

|

|

Notes to Financial

Statements

|

F-7

|

|

|

|

PART

I

This

Annual Report on Form 10-K contains statements which, to the extent they do not

recite historical fact, constitute "forward looking" statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. You can identify these

statements by the use of words like "may," "will," "could," "should," "project,"

"believe," "anticipate," "expect," "plan," "estimate," "forecast," "potential,"

"intend," "continue," and variations of these words or comparable words. Forward

looking statements do not guarantee future performance and involve risks and

uncertainties. Therefore, actual outcomes and results may differ

materially from what is expressed or forecast in such forward-looking

statements. Except as required under federal securities laws and the

rules and regulations of the SEC, we do not have any intentions or obligation to

update publicly any forward-looking statements after the filing of this Form

10-K, whether as a result of new information, future events, changes in

assumptions or otherwise.

Unless

the context otherwise requires, throughout this Annual Report on Form 10-K the

words “Company,” “we,” “us” and “our” refer to Darwin Resources, Inc. and its

consolidated subsidiaries.

ITEM

1.

BUSINESS

General

Non-Operating

Shell Company.

Currently,

we are a non-operation shell corporation. We intend to effect a

merger, acquisition or other business combination with an operating company by

using a combination of capital stock, cash on hand, or other funding sources, if

available. We intend to devote substantially all of our time to

identifying potential merger or acquisition candidates. There can be

no assurances that we will enter into such a transaction in the near future or

on favorable terms, or that other funding sources will be

available. A more detailed discussion of the current business plan is

set forth below.

History

Darwin

Resources, Inc. (the "Company") was originally incorporated on June 24, 1993 in

the State of Florida as Vitech America, Inc. On September 28, 2007, Darwin

Resources, Inc., merged with Vitech America, Inc., so as to effect a redomicile

to Delaware and a name change. Darwin Resources, Inc., was incorporated in

Delaware for the purpose of merging with Vitech America, Inc.

The

Company was originally engaged as a manufacturer and distributor of computer

equipment and related markets in Brazil. The Company evolved into a

vertically integrated manufacturer and integrator of complete computer systems

and business network systems selling directly to end-users. A

diversified customer base widely distributed throughout Brazil was

developed. In September of 1996, the Company had over 8,000 customers

and established a clearly defined channel for marketing additional hardware

products, such as updated peripheral products, new computers, new network

products as well as services, such as internet access services. The

Company marketed its products throughout Brazil under the trademarks EasyNet,

MultiShow, and Vitech Vision.

On August

17, 2001, the Company filed a voluntary Chapter 7 petition under the U.S.

Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of

Florida (case no. 01-18857). As a result of the filing, all of the Company's

properties were transferred to a United States Trustee and the Company

terminated all of its business operations. The Bankruptcy Trustee has disposed

of all of the assets. On March 14, 2007, the Chapter 7 bankruptcy was closed by

the U.S. Bankruptcy Court Southern District of Florida.

On June

21, 2007, pursuant to its Order Granting the "plaintiff’s motion for acceptance

of receiver’s report and release of receiver" (the "Order") and to close the

case, Brian Goldenberg as receiver of the Company pursuant to Florida Statue

607, the Eleventh Judicial Circuit, In and For Miami-Dade County, Florida was

released as receiver of the Company. The purpose of appointing

the receiver was to determine if the Company could be reactivated and operated

in such a manner so that the Company can be productive and

successful. Pursuant to Section 607.1432 of the Florida Statutes,

alternative remedies to dissolution and liquidation would be determined as to

whether the Company could be saved. The actions of the receivership

include:

|

-

|

To

settle the affairs, collect the outstanding debts, sell and convey the

property, real and personal

|

|

-

|

To

demand, sue for, collect, receive and take into his or their possession

all the goods and chattels, rights and credits, moneys and effects, lands

and tenements, books, papers, choices in action, bills, notes and

property, of every description of the

Company.

|

|

-

|

To

institute suits at law or in equity for the recovery of any estate,

property, damages or demands existing in favor of the

Company.

|

|

-

|

Provided

that the authority of the receivership is to continue the business of the

Company and not to liquidate its affairs or distribute its

assets

|

|

-

|

To

exercise the rights and authority of a Board of Directors and Officers in

accordance with state law, the articles and

bylaws

|

In

accordance with the Order, Mr. Goldenberg appointed Mark Rentschler as sole

interim Director and President.

In

September 2007, the Company changed its name to Darwin Resources, Inc. The

Company raised operating capital through the sale of equity securities, which

the Company used to recruit and organize management, and to finance the initial

costs associated with corporate strategic planning and development.

Change of

Control

On May

15, 2007, Mark Rentschler contributed an estimated $50,000 as paid in capital to

the Company. The Company is to use these funds to pay the costs and expenses

necessary to revive the registrant's business operations. Such expenses include,

without limitation, fees to reinstate the Company's corporate charter with the

State of Florida; payment of all past due franchise taxes; settling all past due

accounts with the registrant's transfer agent; accounting and legal fees; and

costs associated with bringing the registrant current with its filings with the

Securities and Exchange Commission, etc.

On June

28, 2007, in consideration for the capital contribution by Mark Rentschler, the

Company issued Downing Street Corp., 5,000,000 shares of its newly created

Series B Preferred Stock, which represented approximately 19.58% of the total

ownership of the Company as of June 6, 2008 in accordance with the

Order. The preferred stock carried voting rights which effectively

made Downing Street Corp., the holder of approximately 99% of the voting rights

in the Company's outstanding common and preferred stock. The voting

rights also provided that in no event will the preferred stock voting rights

consist of less than 51% of the total voting rights in the Company's outstanding

common and preferred stock.

Downing

Street Corp., (“DSC”) is a business consulting firm, for the purpose of advising

the company as to potential business combinations. Mr. Rentschler is

the managing director of DSC.

Accordingly,

DSC is an affiliated entity.

On

September 28, 2007, Darwin Resources Inc. was incorporated in Delaware for the

purpose of merging

with Vitech

America, Inc., a Florida Corporation, so as to effect a re-domicile to

Delaware. The Delaware Corporation is authorized to issue 500,000,000

shares of $0.000001 par value common stock and 8,000,000 shares of $0.000001 par

value preferred stock. On September 28, 2007, both Vitech America, the Florida

corporation and Darwin Resources, the Delaware corporation, signed and filed

Articles of Merger, with the respective states, pursuant to which the Delaware

corporation, Darwin Resources, was the surviving entity. The

shareholders of record of Vitech America, Inc. received 1 share of

new common

stock for every 1 share of Vitech America common stock and 1 share for every 1

share of preferred stock they owned.

On

September 28, 2007, the Company changed its name to Darwin Resources Inc. The

name was not

meant to be

indicative of the Company's business plan or purpose. As more fully described

herein under the

heading

"Current Business Plan", Darwin Resources’ current business plan is to seek,

investigate and, if

such

investigation warrants, acquire an interest in business opportunities presented

to it by persons or firms

who or which

desire to seek the perceived advantages of an Exchange Act registered

corporation.

On

January 31, 2008, the Company's trading symbol

was changed

to "DRWN.PK."

On or

about November 14, 2008, our registrations statement filed with the SEC on Form

10 became effective. Accordingly, we resumed the filing of reporting

documentation in an effort to maximize shareholder value. Our best

use and primary attraction as a merger partner or acquisition vehicle is our

status as a reporting public company. Any business combination or

transaction may potentially result in significant issuance of shares and

substantial dilution to our stockholders.

As of

December 31, 2008, the Company is not in negotiations with, nor does it have any

agreements with any potential merger candidates.

Current Business Plan

We are a shell company in that we

conduct nominal operations and have nominal assets. At this time, our purpose is

to seek,

investigate and, if such investigation

warrants, acquire an interest in business opportunities presented to us by

persons or firms who or

which desire the perceived advantages

of an Exchange Act registered corporation. We will not restrict our search to

any specific

business, industry, or geographical

location and we may participate in a business venture of virtually any kind or

nature. This

discussion of the proposed business is

purposefully general and is not meant to be restrictive of our virtually

unlimited discretion to

search for and enter into potential

business opportunities. We anticipate that we may be able to participate in only

one potential

business venture because we have

nominal assets and limited financial resources. This lack of diversification

should be considered a

substantial risk to our shareholders

because it will not permit us to offset potential losses from one venture

against gains from

another.

We may seek a business opportunity with

entities which have recently commenced operations, or which wish to utilize the

public

marketplace in order to raise

additional capital in order to expand into new products or markets, to develop a

new product or service,

or for other corporate

purposes. We may acquire assets and establish wholly owned

subsidiaries in various businesses or acquire

existing businesses as

subsidiaries.

We intend

to promote ourselves privately. We have not yet prepared any notices or

advertisement. We anticipate that the selection of

a business

opportunity in which to participate will be complex and extremely risky. Due to

general economic conditions, rapid

technological

advances being made in some industries and shortages of available capital,

management believes that there are

numerous

firms seeking the perceived benefits of a publicly registered corporation. Such

perceived benefits may include facilitating

or improving

the terms on which additional equity financing may be sought, providing

liquidity for incentive stock options or similar

benefits to

key employees, providing liquidity (subject to restrictions of applicable

statutes), for all shareholders and other factors.

Potentially,

available business opportunities may occur in many different industries and at

various stages of development, all of which

will make the

task of comparative investigation and analysis of such business opportunities

extremely difficult and complex.

We will

continue to have, little or no capital with which to provide the owners of

business opportunities with any significant cash or

other assets.

However, we believe that we will be able to offer owners of acquisition

candidates the opportunity to acquire a

controlling

ownership interest in a publicly registered company without incurring the cost

and time required to conduct an initial

public

offering. The owners of the business opportunities will, however, incur

significant legal and accounting costs in connection

with

acquisition of a business opportunity, including the costs of preparing Form

8K's, 10K's, 10Q’s, agreements and related reports

and

documents. The Securities Exchange Act of 1934 (the "Exchange Act"),

specifically requires that any merger or acquisition

candidate

comply with all applicable reporting requirements, which include providing

audited financial statements to be included

within the

numerous filings relevant to complying with the Exchange Act.

The

analysis of new business opportunities will be undertaken by, or under the

supervision of, our officers and directors. We intend to

concentrate

on identifying preliminary prospective business opportunities, which may be

brought to its attention through present

associations

of our officers and directors. In analyzing prospective business opportunities,

we will consider such matters as the

available

technical, financial and managerial resources; working capital and other

financial requirements; history of operations, if any;

prospects for

the future; nature of present and expected competition; the quality and

experience of management services which may

be available

and the depth of that management; the potential for further research,

development, or exploration; specific risk factors not

now

foreseeable but which then may be anticipated to impact our proposed activities;

the potential for growth or expansion; the

potential for

profit; the perceived public recognition of acceptance of products, services, or

trades; name identification; and other

relevant

factors. Our officers and directors expect to meet personally with management

and key personnel of the business opportunity

as part of

their investigation. To the extent possible, we intend to utilize written

reports and investigation to evaluate the above

factors.

Our

officers have limited experience in managing companies similar to the Company

and shall rely upon their own efforts, in

accomplishing

our business purpose. We may from time to time utilize outside consultants or

advisors to effectuate its business

purposes

described herein. No policies have been adopted regarding use of such

consultants or advisors, the criteria to be used in

selecting

such consultants or advisors, the services to be provided, the term of service,

or regarding the total amount of fees that may

be paid.

However, because of our limited resources, it is likely that any such fee would

be paid in stock and not in cash.

We will

not restrict its search for any specific kind of firms, but may acquire a

venture that is in its preliminary or development

stage, which

is already in operation, or in essentially any stage of its corporate life. It

is impossible to predict at this time the status of

any business

in which we may become engaged, in that such business may need to seek

additional capital, may desire to have its

shares

publicly traded, or may seek other perceived advantages which we may offer.

However, we do not intend to obtain funds in

one or more

private placements to finance the operation of any acquired business opportunity

until such time as we have successfully

consummated

such a merger or acquisition.

Acquisition

of Opportunities

In implementing a structure for a

particular business acquisition, we may become a party to a merger,

consolidation, reorganization,

joint venture, or licensing agreement

with another corporation or entity. We may also acquire stock or assets of an

existing business.

On the consummation of a transaction,

it is probable that the present management and our shareholders will no longer

control

us. Furthermore, our

directors may, as part of the terms of the acquisition transaction, resign and

be replaced by new directors without

a vote of our shareholders.

It is anticipated that any securities

issued in any such reorganization would be issued in reliance upon exemption

from registration

under applicable federal and state

securities laws. In some circumstances, however, as a negotiated element of a

transaction, we may

agree to register all or a part of such

securities immediately after the transaction is consummated or at specified

times thereafter.

As part of our investigation, our

officers and directors may personally meet with management and key personnel,

may visit and

inspect material facilities, obtain

analysis and verification of certain information provided, check references of

management and key

personnel, and take other reasonable

investigative measures. The manner in which we participate in an opportunity

will depend on the

nature of the opportunity, our

respective needs and desires, the management of the opportunity and the relative

negotiation strength.

With respect to any merger or

acquisition, negotiations with target company management are expected to focus

on the percentage of

the Company which the target company

shareholders would acquire in exchange for all of their shareholdings in the

target company.

Depending upon, among other things, the

target company's assets and liabilities, our shareholders will in all likelihood

hold a

substantially lesser percentage

ownership interest in the Company following any merger or acquisition. The

percentage ownership

may be subject to significant reduction

in the event we acquire a target company with substantial assets. Any merger or

acquisition

can be expected to have a significant

dilutive effect on the percentage of shares held by our then

shareholders.

We will participate in a business

opportunity only after the negotiation and execution of appropriate written

agreements. Although the

terms of such agreements cannot be

predicted, generally such agreements will require some specific representations

and warranties by

all of the parties thereto, will

specify certain events of default, will detail the terms of closing and the

conditions which must be

satisfied by each of the parties prior

to and after such closing, will outline the manner of bearing costs, including

costs associated with

our attorneys and accountants, will set

forth remedies on default and will include miscellaneous other

terms.

Competition

We will remain an insignificant

participant among the firms which engage in the acquisition of business

opportunities. There are

many established venture capital and

financial concerns which have significantly greater financial and personnel

resources and

technical expertise. In view of our

combined extremely limited financial resources and limited management

availability, we will

continue to be at a significant

competitive disadvantage compared to our competitors.

Employees

We have

no employees. Our business will be managed by our officer and directors, who may

become employees. We do not

anticipate a

need to engage any fulltime employees at this time. The need for employees and

their availability will be addressed in

connection

with our proposed operations.

ITEM

1A.

RISK

FACTORS

An investment in our Common Stock is

highly speculative, involves a high degree of risk and should be considered only

by those

persons who are able to afford a

loss of their entire investment. In evaluating the Company and our business,

prospective investors

should carefully consider the

following risk factors in addition to the other information included in this

Annual Report.

We

Are A Non-Operating Shell Company.

We are a

public shell company with no operations and we are seeking to effect a merger,

acquisition or other business combination

with an

operating company by using a combination of capital stock, cash on hand, or

other funding sources, if available. There can be

no assurances

that we will be successful in identifying acquisition candidates or that if

identified we will be able to consummate a

transaction

on terms acceptable to us.

We

Have Minimal Assets And Have Had No Operations And Generated No Revenues For

Several Years.

We have

had no operations and no revenues or earnings from operations for several years.

We have no significant assets or financial

resources. We

will, in all likelihood, sustain operating expenses without corresponding

revenues, at least until the consummation of a

business

combination. This may result in us incurring a net operating loss, which will

increase continuously until we can consummate

a business

combination with a target company. There is no assurance that we can identify

such a target company and consummate

such a

business combination.

Our

Auditor Has Risen Doubt As To Whether We Can Continue As A Going

Concern.

We have

not generated any revenues nor have we had any operations for several years. As

of December 31, 2008, we had an

accumulated

deficit of $180,276. These factors among others indicate that we may be unable

to continue as a going concern,

particularly

in the event that we cannot obtain additional financing and/or attain profitable

operations. The accompanying financial

statements do

not include any adjustments that might result from the outcome of this

uncertainty and if we cannot continue as a going

concern, your

investment in us could become devalued or even worthless.

We

Have Not Paid Dividends To Our Stockholders.

We have

never paid, nor do we anticipate paying, any cash dividends on our common stock.

Future debt, equity instruments or

securities

may impose additional restrictions on our ability to pay cash

dividends.

Shareholders Who Hold Unregistered

Shares Of Our Common Stock Are Not Eligible To Sell Our Securities Pursuant

To

Rule 144, Due To Our Status As A

“Blank Check” Company And A “Shell Company

”

We are

characterized as both a “blank check” company and a “shell company.” The term

"blank check company" is defined as a

company that

is a development stage company that has no specific business plan or purpose or

has indicated that its business plan is

to engage in

a merger or acquisition with an unidentified company or companies, or other

entity or person; and is issuing "penny

stock," as

defined in Rule 3a51-1 under the Securities Exchange Act of

1934. Because we are a “blank check” company, Rule 144 of

the

Securities Act of 1933, as amended (“ Rule 144 ”) is not available to our

shareholders and we are required to comply with

additional

SEC rules regarding any offerings we may undertake.

Additionally,

pursuant to Rule 144, a “shell company” is defined as a company that has no or

nominal operations; and, either no or

nominal

assets; assets consisting solely of cash and cash equivalents; or assets

consisting of any amount of cash and cash equivalents

and nominal

other assets. As such, we are a “shell company” pursuant to Rule 144,

and as such, sales of our securities pursuant to

Rule 144 are

not able to be made until: (a) we have ceased to be a “shell company; (b) we are

subject to Section 13 or 15(d) of the

Securities

Exchange Act of 1934, as amended, and have filed all of our required periodic

reports for a period of one year; and a period

of at least

twelve months has elapsed from the date “Form 10 information” has been filed

with the Commission reflecting the

Company’s

status as a non-shell company. Because none of our securities can be

sold pursuant to Rule 144, until at least a year after

we cease to

be a shell company, any securities we issue to consultants, employees, in

consideration for services rendered or for any

other purpose

will have no liquidity until and unless such securities are registered with the

Commission and/or until a year after we

cease to be a

shell company and have complied with the other requirements of Rule 144, as

described above.

As a

result of us being a blank check company and a shell company, it will be harder

for us to fund our operations and pay our

consultants

with our securities instead of cash. Additionally, as we may not ever

cease to be a blank check company or a shell

company,

investors who hold our securities may be forced to hold such securities

indefinitely.

There

May Be Conflicts Of Interest Between Our Management And Our Non-Management

Stockholders.

Conflicts

of interest create the risk that management may have an incentive to act

adversely to the interests of other investors. A

conflict of

interest may arise between our management's personal pecuniary interest and its

fiduciary duty to our stockholders.

Further, our

management's own pecuniary interest may at some point compromise its fiduciary

duty to our stockholders.

The Nature Of Our Proposed Operations

Is Highly Speculative.

The

success of our proposed plan of operation will depend to a great extent on the

operations, financial condition and management of

the

identified target company. While management will prefer business combinations

with entities having established operating

histories,

there can be no assurance that we will be successful in locating candidates

meeting such criteria. In the event we complete a

business

combination, of which there can be no assurance, the success of our operations

will be dependent upon management of the

target

company and numerous other factors beyond our control.

The

Competition For Business Opportunities And Combinations Is Great.

We are and will continue to be an

insignificant participant in the business of seeking mergers with and

acquisitions of business

entities. A large number of established

and well-financed entities, including venture capital firms, are active in

mergers and

acquisitions of companies, which may be

merger or acquisition target candidates for us. Nearly all such entities have

significantly

greater financial resources, technical

expertise and managerial capabilities than us and, consequently, we will be at a

competitive

disadvantage in identifying possible

business opportunities and successfully completing a business combination.

Moreover, we will

also compete with numerous other small

public companies in seeking merger or acquisition

candidates.

We Have No Current

Agreements In Place For A Business Combination Or Other Transaction, And We

Currently Have No

Standards For

Potential Business Combinations, And As A Result, Our Management Has Sole

Discretion Regarding Any

Potential Business

Combination.

We have

no current arrangement, agreement or understanding with respect to engaging in a

business combination with a specific

entity.

There can be no assurance that we will be successful in identifying and

evaluating suitable business opportunities or in

concluding

a business combination. Management has not identified any particular industry or

specific business within an industry for

evaluation

by us. There is no assurance that we will be able to negotiate a business

combination on terms favorable to us. We have

not

established a specific length of operating history or a specified level of

earnings, assets, net worth or other criteria, which we will

require

a target company to have achieved, or without which we would not consider a

business combination with such business entity.

Accordingly,

we may enter into a business combination with a business entity having no

significant operating history, losses, limited

or

no potential for immediate earnings, limited assets, negative net worth or other

negative characteristics.

We depend on the management

experience of our sole officer and director and if we were to lose him it would

affect our ability to implement our business plan

.

We depend

upon the continued services of our sole officer and director, Mark Rentschler.

To the extent that his services become unavailable, we will be required to

retain one or more other qualified personnel and we may not be able to identify

or have the resources to retain such personnel. Additionally, Mr.

Rentschler controls 99% voting control in our Company and it is unlikely other

qualified personnel would participate in management without a similar

controlling stake which Mr. Rentschler may not agree to transfer or

sell. If Mr. Rentschler were to stop providing services to our

Company or funding our operations, we would likely not find another person or

entity to replace Mr. Rentschler in a timely manner, if at

all. If Mr. Rentschler were to leave our Company prior to our

Company consummating an acquisition that anticipated a change in management, it

is likely our business would fail and you would lose your

investment.

Our

sole officer and director works on a part-time basis and a conflict of interest

could potentially arise if he were to serve in a similar capacity for another

company and, as a result, our goal to identify and complete a merger may be

delayed.

Our sole

officer and director is not required to commit his full time to our affairs and

is not precluded from serving as an officer or director of any other entity

engaged in

similar

business

activities. Mr. Rentschler is also an officer and director of the following

companies:

-

Andorra

Capital Corp.;

-

Avenue

Exchange Corp.;

-

Frontier

Resource Corp.;

-

Macau

Capital Investments, Inc.;

-

Pinecrest

Investment Group, Inc.;

-

Scandia

Inc.; and

-

Windsor

Resources Corp.

Mr.

Rentschler has not identified and is not currently negotiating a new business

opportunity

for us. He is

associated or affiliated with entities engaged in business

activities

similar to those which we intend to conduct. Consequently, he may have conflicts

of interest in

determining

to which entity a particular business opportunity should be presented. In the

event that a conflict of

interest

shall arise, he will consider factors such as reporting status, availability of

audited

financial

statements, current capitalization and the laws of the appropriate

jurisdictions. However,

he will act

in what he believes will be in the best interests of our stockholders and our

Company. However, due to such conflicts of interest, we may

experience a delay in pursuing our business plan. If our business

plan is delayed our stock price will likely remain at very low prices and you

may lose all or part of your investment.

Reporting

Requirements May Delay Or Preclude An Acquisition.

Section 13 of the Securities Exchange

Act of 1934 (the " Exchange Act ") requires companies subject thereto to provide

certain

information about significant

acquisitions including audited financial statements for the company acquired and

a detailed description

of the business operations and risks

associated with such company's operations. The time and additional costs that

may be incurred by

some target companies to prepare such

financial statements and descriptive information may significantly delay or

essentially preclude

consummation of an otherwise desirable

acquisition by us. Additionally, acquisition prospects that do not have or are

unable to obtain

the required audited statements may not

be appropriate for acquisition so long as the reporting requirements of the

Exchange Act are

applicable.

We Have Not

Conducted Any Market Research Regarding Any Potential Business

Combinations

.

We have neither conducted, nor have

others made available to it, market research indicating that demand exists for

the transactions

contemplated by us. Even in the event

demand exists for a transaction of the type contemplated by us, there is no

assurance we will be

successful in completing any such

business combination.

We Do Not Plan To

Diversify Our Operations In The Event Of A Business Combination.

Our proposed operations, even if

successful, will in all likelihood result in our engaging in a business

combination with only one

target company. Consequently, our

activities will be limited to those engaged in by the business entity which we

will merge with or

acquire. Our inability to diversify our

activities into a number of areas may subject us to economic fluctuations within

a particular

business or industry and therefore

increase the risks associated with our operations.

Any Business

Combination Will Likely Result In A Change In Control And In Our

Management.

A business combination involving the

issuance of our common stock will, in all likelihood, result in shareholders of

a target company

obtaining a controlling interest in the

Company. Any such business combination may require our shareholder to sell or

transfer all or a

portion of their common stock. The

resulting change in control of the Company will likely result in removal of the

present

management of the Company and a

corresponding reduction in or elimination of participation in the future affairs

of the Company.

Reduction

Of Percentage Share Ownership Following Business Combination.

Our primary plan of operation is based

upon a business combination with a business entity, which, in all likelihood,

will result in our

issuing securities to shareholders of

such business entity. The issuance of previously authorized and unissued common

stock would

result in a reduction in percentage of

shares owned by our present shareholders and could therefore result in a change

in control of our

management.

We May Be Forced To

Rely On Unaudited Financial Statements In Connection With Any Business

Combination.

We will require audited financial

statements from any business entity we propose to acquire. No assurance can be

given; however,

that audited financials will be

available to us prior to a business combination. In cases where audited

financials are unavailable, we

will have to rely upon unaudited

information that has not been verified by outside auditors in making our

decision to engage in a

transaction with the business entity.

The lack of the type of independent verification which audited financial

statements would provide

increases the risk that we, in

evaluating a transaction with such a target company, will not have the benefit

of full and accurate

information about the financial

condition and operating history of the target company. This risk increases the

prospect that a business

combination with such a business entity

might prove to be an unfavorable one for us.

Investors May Face

Significant Restrictions On The Resale Of Our Common Stock Due To Federal

Regulations Of Penny

Stocks.

Our common stock will be subject to the

requirements of Rule 15(g)-9, promulgated under the Securities Exchange Act as

long as the

price of our common stock is below

$5.00 per share. Under such rule, broker-dealers who recommend low-priced

securities to

persons other than established

customers and accredited investors must satisfy special sales practice

requirements, including a

requirement that they make an

individualized written suitability determination for the purchaser and receive

the purchaser's consent

prior to the transaction. The

Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also

requires additional

disclosure in connection with any

trades involving a stock defined as a penny stock. Generally, the Commission

defines a penny stock

as any equity security not traded on an

exchange or quoted on NASDAQ that has a market price of less than $5.00 per

share. The

required penny stock disclosures

include the delivery, prior to any transaction, of a disclosure schedule

explaining the penny stock

market and the risks associated with

it. Such requirements could severely limit the market liquidity of the

securities and the ability of

purchasers to sell their securities in

the secondary market.

ITEM

2.

PROPERTIES

We share office space and a phone

number with our principals at 2202 N. West Shore BLVD, Suite 200, Tampa, Florida

33607. We do

not have a lease and we do not pay rent

for the leased space. We do not own any properties nor do we lease any other

properties. We

do not believe we will need to maintain

an office at any time in the foreseeable future in order to carry out our plan

of operations as

described herein.

ITEM 3.

LEGAL PROCEEDINGS

We are

not a party to any pending legal proceedings nor are any of our property the

subject of any pending legal proceedings.

ITEM 4.

SUBMISSION OF MATTERS TO A VOTE OF

SECURITY HOLDERS

We have

had no matters to submit for a vote of security holders.

PART

II

ITEM

5.

MARKET REGISTRANT”S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY

SECURITIES

Our

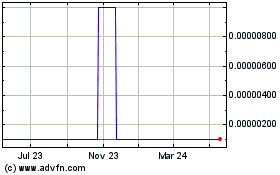

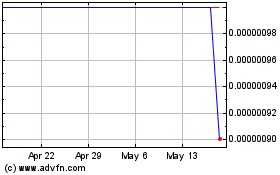

common stock is quoted on the Over-the-Counter Pink Sheets under the symbol

“DRWN.PK”. Such trading of our common stock is limited and

sporadic.

The

following Table reflects the high and the low bid information for our common

stock for each fiscal quarter during the fiscal year ended December 31, 2008 and

2007. The bid information was obtained from the National Quotation

Bureau and reflects inter-dealer prices, without retail mark-up, markdown or

commission, and may not necessarily represent actual transactions.

|

Quarter

Ended

|

|

Bid

High

|

|

|

Bid

Low

|

|

|

|

|

|

|

|

|

|

|

Fiscal

Year 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31, 2008

|

|

$

|

0.008

|

|

|

$

|

0.001

|

|

|

September

30, 2008

|

|

$

|

0.010

|

|

|

$

|

0.002

|

|

|

June

30, 2008

|

|

$

|

0.010

|

|

|

$

|

0.002

|

|

|

March

31, 2008

|

|

$

|

0.030

|

|

|

$

|

0.003

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal

Year 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31, 2007

|

|

$

|

0.012

|

|

|

$

|

0.003

|

|

|

September

30, 2007

|

|

$

|

0.015

|

|

|

$

|

0.005

|

|

|

June

30, 2007

|

|

$

|

0.005

|

|

|

$

|

0.005

|

|

|

March

31, 2007

|

|

$

|

0.005

|

|

|

$

|

0.005

|

|

As of

December 31, 2008, there were 163 holders of record of our common

stock.

We have

never declared or paid cash dividends on our capital stock. We

currently intend to retain all available funds and any future earnings for use

in the operation and expansion of our business and do not anticipate paying any

cash dividends in the foreseeable future.

Recent

Sale of Unregistered Securities.

None

ITEM

6.

SELECTED FINANCIAL

DATA

We are a

small reporting company as defined by Rule 12b-2 of the Securities Exchange Act

1934 and are not required to provide information under this item.

ITEM

7.

MANAGEMENT DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The

following presentation of management's discussion and analysis of the Company's

financial condition and results of operations should be read in conjunction

with the Company's consolidated financial statements, the accompanying

notes thereto and other financial information appearing elsewhere in

this report. This section and other parts of this report contain

forward-looking statements that involve risks and uncertainties. The

Company's actual results may differ significantly from the results discussed in

the forward-looking statements.

Plan

of Operations - Overview

Our

current business objective for the next twelve (12) months is to investigate

and, if such investigation warrants, acquire a target company or business

seeking the perceived advantages of being a publicly held

corporation. Our principle business objective will be to achieve

long-term growth potential through a combination with a business rather than

immediate, short-term earnings. We will not restrict our potential

candidates target companies to any specific business, industry or geographical

location and, thus, may acquire any type of business.

We do not

currently engage in any business activities that provide us with positive cash

flow. As such, the costs of investigating and analyzing business

combinations for the next approximately twelve (12) months beyond will be paid

out of current cash and other current assets on hand and through funds raised

through other sources, which may not be available on favorable terms, if at

all. Such costs include filing of Exchange Act reports, and costs

related to consummating and acquisition.

RESULTS

OF OPERATIONS

FISCAL

YEAR ENDED DECEMBER 31, 2008 COMPARED TO

FISCAL

YEAR ENDED DECEMBER 31, 2007

Revenues

Revenues

were $0 for the fiscal year ended December 31, 2008 and December 31,

2007.

Operating

Expenses

Operating

expenses excluding the cost of revenues for the fiscal year ended December 31,

2008 were $74,336 compared to $102,915 for the year ended December 31,

2007. This 28% decrease in operating expenses was the result of

reduced professional fees and a lack of administrative costs attributed to the

lack of negotiations and activity related to prospective merger or acquisition

candidate.

(Loss)

From Operations

Loss from operations for the year ended

December 31, 2008 was $76,738 as compared to $103,538 for the year ended

December 31,

2007. The reduction in net

loss is directly attributable to the reduction in operating expenses described

above.

Net Income (Loss)

Applicable to Common Stock

Net loss applicable to Common Stock was

($76,738) for the fiscal year ended December 31, 2008 compared to net loss

of

$103,538 for the year ended December

31, 2007. Net loss per common share was ($0.00) and ($0.01) for the years ended

December 31, 2008 and December 31, 2007, respectively.

LIQUIDITY

AND CAPITAL RESOURCES

We currently plan to satisfy the

Company's cash requirements for the next 12 months by borrowing from affiliated

companies with common

ownership or control or directly from

our officers and directors and we believe we can satisfy the Company's cash

requirements so long as it is

able to obtain financing from these

affiliated companies. We currently expect that money borrowed will be

used during the next 12

months to satisfy our operating costs,

professional fees and for general corporate purposes. We have also been

exploring alternative

financing sources.

We will use our limited personnel and

financial resources in connection with seeking new business opportunities,

including seeking

an acquisition or merger with an

operating company. It may be expected that entering into a new business

opportunity or business

combination will involve the issuance

of a substantial number of restricted shares of common stock. If such

additional restricted shares

of common stock are issued, our

shareholders will experience a dilution in their ownership interest. If a

substantial number of

restricted shares are issued in

connection with a business combination, a change in control may be expected to

occur.

As of

December 31, 2008, the Company had current assets consisting of cash and cash

equivalents in the amount of $2,218. As of

December

31, 2008, the Company had current liabilities consisting of a related party

payable and accrued expenses of $71,757 and 60,847, respectively.

In connection with the plan to seek new

business opportunities and/or effecting a business combination, we may determine

to seek to

raise funds from the sale of restricted

stock or debt securities. We have no agreements to issue any debt or

equity securities and

cannot predict whether equity or debt

financing will become available at acceptable terms, if at

all.

There are

no limitations in our certificate of incorporation restricting our ability to

borrow funds or raise funds through the issuance of

restricted

common stock to effect a business combination. Our limited resources and lack of

recent operating history may make it

difficult

to borrow funds or raise capital. Such inability to borrow funds or raise funds

through the issuance of restricted common

stock

required to effect or facilitate a business combination may have a material

adverse effect on our financial condition and future

prospects,

including the ability to complete a business combination. To the extent that

debt financing ultimately proves to be

available,

any borrowing will subject us to various risks traditionally associated with

indebtedness, including the risks of interest rate

fluctuations

and insufficiency of cash flow to pay principal and interest, including debt of

an acquired business.

RECENT

ACCOUNTING PRONOUNCEMENTS

We continue to assess the effects of

recently issued accounting standards. The impact of all recently adopted and

issued accounting

standards has been disclosed in the

Footnotes to the financial statements.

CRITICAL

ACCOUNTING ESTIMATES

We are a shell company and, as such, we

do not employ critical accounting estimates. Should we resume operations we will

employ

critical accounting estimates and will

make any and all disclosures that are necessary and

appropriate.

OFF-BALANCE

SHEET ARRANGEMENTS

As of December 31, 2008, we did not

have any relationships with unconsolidated entities or financial partners, such

as entities often

referred to as structured finance or

special purpose entities, that had been established for the purpose of

facilitating off-balance sheet

arrangements or other contractually

narrow or limited purposes. As such, we are not materially exposed to any

financing, liquidity,

market or credit risk that could arise

if we were engaged in such relationships.

ITEM 7A.

QUANTITATIVE AND

QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as

defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not

required to provide

information under this

item.

ITEM

8.

FINANCIAL STATEMENTS

AND SUPPLEMENTARY DATA.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Directors of Darwin Resources, Inc.:

We have

audited the accompanying balance sheet of Darwin Resources, Inc. (a development

stage company) (the “Company”) as of December 31, 2008, and the related

statements of operations, changes in shareholders’ equity and cash flows for the

year ended December 31, 2008. These financial statements are the

responsibility of the Company’s management. Our responsibility is to express an

opinion on these financial statements based upon our audit.

We

conducted our audit in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement. The Company is not required to

have, nor were we engaged to perform, an audit of its internal control over

financial reporting. Our audit included consideration of internal control over

financial reporting as a basis for designing audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements, assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall

financial statement presentation. We believe that our audit provides a

reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of Darwin Resources, Inc. (a

development stage company), as of December 31, 2008, and the results of its

operations and its cash flows for the year ended December 31, 2008 in conformity

with accounting principles generally accepted in the United States of

America.

The

accompanying financial statements have been prepared assuming the Company will

continue as a going concern. As discussed in Note 3 to the financial statements,

the Company has no present revenue, had losses of $(76,738) for the year ended

December 31, 2008, and has limited working capital. The execution of the

Company’s business plan is also dependant upon the ability to obtain outside

sources of working capital. These conditions raise substantial doubt about the

Company’s ability to continue as a going concern. Management’s plans regarding

these matters are described in Note 3 to the financial statements. The financial

statements do not include any adjustments that might result from the outcome of

the uncertainty.

/s/

Bartolomei Pucciarelli, LLC

Lawrenceville,

New Jersey

April 15,

2009

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Directors of Darwin Resources, Inc.

We have

audited the accompanying balance sheets of Darwin Resources, Inc. (a development

stage company) (the “Company”) as of December 31, 2007 and 2006, and the related

statements of operations, changes in stockholders’ deficit and cash flows for

the years ended December 31, 2007 and 2006. These financial statements are the

responsibility of the Company’s management. Our responsibility is to express an

opinion on these financial statements based upon our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform the audits to obtain reasonable assurance about whether the

financial statements are free of material misstatement. The Company is not

required to have, nor were we engaged to perform, an audit of its internal

control over financial reporting. Our audits included consideration of internal

control over financial reporting as a basis for designing audit procedures that

are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements, assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall

financial statement presentation. We believe that our audits provide a

reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of Darwin Resources, Inc., (a

development stage company), as of December 31, 2007 and 2006, and the results of

its operations and its cash flows for the years then ended in conformity with

accounting principles generally accepted in the United States of

America.

The

accompanying financial statements have been prepared assuming the Company will

continue as a going concern. As discussed in Note 3 to the financial statements,

the Company has no present revenue. The Capitalization of the Company’s business

plan is also dependent upon the amount of additional funds the Company is able

to raise in the near future and the time and expenses the Company incurs as it

searches for a merger candidate. The Company’s capital resources as of December

31, 2007 are not sufficient to sustain operations or complete its planned

activities for the upcoming year unless the Company raises additional funds.

These conditions raise substantial doubt about the Company’s ability to continue

as a going concern. Management’s plans regarding these matters are described in

Note 3 to the financial statements. The financial statements do not include any

adjustments that might result from the outcome of the uncertainty.

/s/ J.

Crane CPA, P.C.

Cambridge,

Massachusetts, U.S.A.

July 2,

2008

DARWIN

RESOURCES, INC.

(A

DEVELOPMENT STAGE COMPANY)

BALANCE

SHEETS

AS OF

DECEMBER 31, 2008 AND DECEMBER 31, 2007

|

|

|

2008

|

|

|

2007

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

Assets

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

2,218

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Assets

|

|

$

|

2,218

|

|

|

$

|

-

|

|

|

|

|

2008

|

|

|

2007

|

|

|

LIABILITIES

AND STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

Current

Liabilities

|

|

|

|

|

|

|

|

Related

Party Payable (Note 4)

|

|

$

|

71,757

|

|

|

$

|

32,701

|

|

|

Accrued

Expenses

|

|

|

60,847

|

|

|

|

20,947

|

|

|

Total

Liabilities

|

|

|

132,604

|

|

|

|

53,648

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments

and Contingencies (Note 6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders'

Deficit (Note 8)

|

|

|

|

|

|

|

|

|

|

Series

A Preferred stock, $0.000001 par value, 3,000,000 shares

authorized,

0

shares issued and outstanding at December 31, 2008

0

shares issued as outstanding at December 31, 2007

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Series

B Preferred stock, $0.000001 par value, 5,000,000 shares

authorized,

5,000,000

shares issued and outstanding at December 31, 2008

0

share issued as outstanding at December 31, 2007

|

|

$

|

5

|

|

|

$

|

5

|

|

|

Common

stock, $0.000001 par value, 500,000,000 shares authorized,

|

|

|

|

|

|

|

|

|

|

20,534,655

shares issued and outstanding at December 31, 2008

|

|

|

|

|

|

|

|

|

|

20,534,655

shares issued and outstanding at December 31, 2007

|

|

|

21

|

|

|

|

21

|

|

|

Additional

Paid in Capital

|

|

|

49,864

|

|

|

|

49,864

|

|

|

Deficit

Accumulated During the Development Stage *

|

|

|

(180,276

|

)

|

|

|

(103,538

|

)

|

|

Total

Stockholders' Deficit

|

|

$

|

(130,386

|

)

|

|

$

|

(53,648

|

)

|

|

Total

Liabilities and Stockholders' Deficit

|

|

$

|

2,218

|

|

|

$

|

-

|

|

*

Accumulated since June 21, 2007, deficit eliminated of $92,511,065.

The

accompanying notes are an integral part of these financial

statements.

DARWIN

RESOURCES, INC.

(A

DEVELOPMENT STAGE COMPANY)

STATEMENTS

OF OPERATIONS

|

|

|

Year Ended

December 31,

|

|

|

Cumulative

Period From June 21, 2007(inception of the development stage)

to

|

|

|

|

|

2008

|

|

|

2007

|

|

|

December

31, 2008

|

|

|

Net

Sales

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cost

of Sales

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Gross

Profit

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board

Compensation

|

|

|

24,000

|

|

|

|

12,600

|

|

|

|

36,600

|

|

|

Consulting

|

|

|

36,000

|

|

|

|

18,900

|

|

|

|

54,900

|

|

|

Investor

Relations

|

|

|

-

|

|

|

|

6,670

|

|

|

|

6,670

|

|

|

Legal

Fees

|

|

|

3,600

|

|

|

|

11,081

|

|

|

|

14,681

|

|

|

Other

Operating Expenses

|

|

|

10,736

|

|

|

|

53,664

|

|

|

|

64,400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Operating Expenses

|

|

|

74,336

|

|

|

|

102,915

|

|

|

|

177,251

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

From Operations

|

|

|

(74,336

|

)

|

|

|

(102,915

|

)

|

|

|

(177,251

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Expense

|

|

|

(2,402

|

)

|

|

|

(623

|

)

|

|

|

(3,025

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Loss Before Income Taxes

|

|

|

(76,738

|

)

|

|

|

(103,538

|

)

|

|

|

(180,276

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision

for Income Taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Loss

|

|

$

|

(76,738

|

)

|

|

$

|

(103,538

|

)

|

|

$

|

(180,276

|

)

|

|

Loss

Per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.00

|

)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

Diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

Weighted-Average

Shares Used to Compute:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

Loss Per Common Share

|

|

|

20,534,655

|

|

|

|

20,534,655

|

|

|

|

|

|

|

Diluted

Loss Per Common Share

|

|

|

20,534,655

|

|

|

|

20,534,655

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial

statements.

DARWIN

RESOURCES, INC.

(A

DEVELOPMENT STAGE COMPANY)

STATEMENTS

OF STOCKHOLDERS' EQUITY (DEFICIT)

AS OF

DECEMBER 31, 2008

|

|

|

Preferred Stock,

Series B

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Par

$.000001

|

|

|

Shares

|

|

|

Par

$.000001

|

|

|

Additional

Paid In Capital

|

|

|