2nd UPDATE: Ranbaxy Settles FDA Issues; Sets Aside $500 Million For Another US Case

December 21 2011 - 3:50AM

Dow Jones News

Ranbaxy Laboratories Ltd. (500359.BY) has resolved all quality

issues with the U.S. health regulator, the Indian company confirmed

Wednesday, adding however that it will set aside $500 million to

settle any liabilities arising from a separate dispute with the

U.S. Justice Department.

News of the provision hurt not just Ranbaxy, but parent Daiichi

Sankyo Co. (4568.TO) as well, forcing Japan's third-biggest

pharmaceuticals company by market capitalization to nearly halve

its profit forecast for this fiscal year through March.

Daiichi Sankyo now expects a group net profit of Y26 billion,

compared with a previously projected Y50 billion. The revised

figure will be 63% lower than the Y70.12 billion profit Daiichi

Sankyo notched up in the past fiscal year.

As part of efforts to offset the $500 million (Y38 billion)

provision, Daiichi Sankyo announced pay cuts for executives for the

next six months: Its president and chairman will receive a 30% pay

reduction for six months while other board members' salaries will

be cut by 5%-10%.

Ranbaxy said the $500 million provision is meant to cover all

potential "civil and criminal liability" arising from a U.S.

Justice Department probe into whether it manufactured substandard

generic drugs.

Investors in Japan took the news in their stride--with Daiichi

Sankyo's stock recently up 2.4% at Y1,509 in Tokyo--because a

near-term U.S. settlement was anticipated.

But Ranbaxy's stock was punished in India because of what market

participants saw as a higher-than-expected settlement provision for

the Justice Department case.

At 0710 GMT, Ranbaxy shares were trading 1.3% lower at INR390.40

in a Bombay Stock Exchange market up 1.4%.

This despite the positives that follow Ranbaxy's settlement with

the U.S. Food and Drug Administration, which the drugmaker said

came after it committed to further strengthen procedures to ensure

data integrity and to comply with good manufacturing practices at

its plants.

It didn't say whether the FDA settlement included any financial

payments.

The settlement with the FDA, which is subject to approval by the

U.S. District Court in Maryland, comes after the regulator banned

the company in 2008 from importing more than 30 of its generic

drugs because of alleged violations of manufacturing practices at

its plants at Dewas and Paonta Sahib in India.

The ban was imposed just months after Daiichi Sankyo acquired a

stake of more than 50% in Ranbaxy for $4.6 billion.

The FDA also halted reviews of drug applications from Paonta

Sahib in 2009, alleging that Ranbaxy falsified data.

The FDA ban had significantly impacted Ranbaxy's sales growth

and profitability over the past two years.

The settlement, which came with a "consent decree," could lead

to the FDA reopening reviews of applications for exports to the

U.S. of drugs manufactured at Paonta Sahib.

It wasn't immediately clear by when Ranbaxy will be allowed to

restart selling drugs manufactured at the two plants, but the

settlement and the provision "bring greater predictability to

Ranbaxy's U.S. operations," said Arun Sawhney, Ranbaxy chief

executive and managing director.

A consent decree is a settlement of a lawsuit or criminal case

in which a person or company agrees to take specific actions

without admitting fault or guilt for the situation that led to the

lawsuit.

Bino Pathiparampil, vice president at brokerage IIFL Capital,

said that, although there is a consent decree now, "it is going to

take at least more than a year [it takes time for the company to

implement the corrective measures laid out in the consent decree]

before we can see some product approvals."

The approvals may come only in small batches and may not be for

the entire facility, he added.

The FDA settlement now leaves the legal dispute with the U.S.

Justice Department as the last major impediment to Ranbaxy's

efforts to boost sales growth in the largest drug market in the

world.

The settlement comes close on the heels of Ranbaxy breaking new

ground by launching the much-awaited copycat of the world's

largest-selling drug--Pfizer Inc.'s Lipitor cholesterol-lowering

drug. Ranbaxy was awarded sales exclusivity under U.S. federal law

as it was the first successful generic challenger to Lipitor.

"...with this resolution in the United States, it will allow

Daiichi Sankyo to expand worldwide sales of its new drugs using the

Ranbaxy network," said Satoru Takaoki, a pharmaceutical analyst at

Tokyo-based SMBC Friend Research Center.

--By Dhanya Ann Thoppil, Dow Jones Newswires; +91-9886929464; dhanya.thoppil@dowjones.com

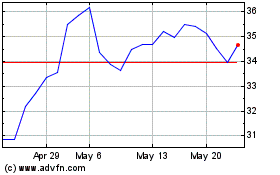

Daiichi Sankyo (PK) (USOTC:DSNKY)

Historical Stock Chart

From Dec 2024 to Jan 2025

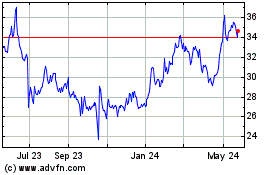

Daiichi Sankyo (PK) (USOTC:DSNKY)

Historical Stock Chart

From Jan 2024 to Jan 2025