- Report of Foreign Issuer (6-K)

March 05 2010 - 3:15PM

Edgar (US Regulatory)

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the

Period: March 5,

2010 File

No.

001-33493

DEJOUR ENTERPRISES

LTD.

(Name of

Registrant)

598-999 Canada Place,

Vancouver, British Columbia, Canada, V6C 3E1

(Address

of principal executive offices)

Indicate

by check mark whether the Registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.

Indicate

by check mark whether the Registrant by furnishing the information contained in

this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Dejour Closes

$1M

Flow Through

Financing

March 5,

2010

,

Vancouver, Canada. Dejour Enterprises Ltd. (NYSE AMEX: DEJ/TSX: DEJ)

announces that it has closed its

non-brokered private placement. Gross proceeds from this flow through financing

totaled C$1,0

17,5

00 corresponding to 2,

907,300

u

nits sold at $0.35.

Each Unit

consists of one flow-through common share and half of one share purchase

warrant. Each whole warrant allows the holder to purchase one non-flow-through

common share at $0.45 within 12 months from closing; Dejour has the right to

accelerate the expiry date of the warrants if the average closing price of a

Dejour share is above $0.65 during any twenty day period, following the

mandatory hold period.

Insiders

of Dejour purchased approximately 15% of this offering.

The Company paid finders' fees of up to

6.

2

5% of the proceeds in cash in connection

with this sale

and up to 1.5% warrants on the number of Units sold

through the agent.

F

und

s will be used for completion

of

the current drilling program at

Wo

odrush in NE BC project, where 2-3 new

pool Halfway oil wells are to be drilled prior to the end of March. Dejour holds

a 75% WI and operates this project. These wells are being drilled pursuant to

the acquisition of new 3D seismic data. There are currently six wells in

production at Woodrush producing about 630 gross BOE per

day.

This flow-through share private

placement was for Canadian investors only. This announcement does not constitute

an offer to sell, nor is it a solicitation of an offer to buy, securities. The

shares have not been registered under the United States Securities Act of 1933,

as amended (the “Securities Act”) or the securities laws of any other

jurisdiction, and may not be offered or sold in the United States without

registration under, or an applicable exemption from, the registration

requirements of the Securities Act.

About

Dejour

Dejour

Enterprises Ltd. is a high growth oil and natural gas company operating multiple

exploration and production projects in North America’s Piceance / Uinta Basins

(128,000 net acres) and Peace River Arch region (15,000 net acres). Dejour’s

veteran management team has consistently been among early identifiers of premium

energy assets, repeatedly timing investments and transactions to realize their

value to shareholders' best advantage. Current production is from less than 4000

acres of the Company's 143,000 net acres of landholdings.

Dejour,

headquartered in Vancouver, Canada, maintains operations offices in Denver,

Colorado and Calgary, Canada. The company is publicly traded on the New York

Stock Exchange Amex (NYSE- Amex: DEJ) and Toronto Stock Exchange (TSX: DEJ).

http://www.dejour.com

.

The

TSX does not accept responsibility for the adequacy or accuracy of this news

release.

Robert L.

Hodgkinson, Co-Chairman & CEO

DEJOUR

ENTERPRISES LTD.

598 – 999

Canada Place,

Vancouver,

BC Canada V6C 3E1

Phone:

604.638.5050 Facsimile: 604.638.5051

Email:

investor@dejour.com

This

release contains forward-looking information and statements, as defined by law

including without limitation Canadian securities laws and the "safe harbor"

provisions of the US Private Securities Litigation Reform Act of 1995

(“forward-looking statements”), respecting the Company’s plans and intentions

with respect to this private placement and the plans, intentions, beliefs and

current expectations of the Company, its directors, or its officers with respect

to the future business, well drilling and operating activities and performance

of the Company. Forward-looking statements involve risks, uncertainties and

other factors that may cause actual results to be materially different from

those expressed or implied by the forward-looking statements, including without

limitation the ability to obtain government and other necessary approvals;

dependence on third parties for services; non-performance by contractual

counterparties; the risks associated with the oil and gas industry (e.g.

operational risks in development; exploration and production; delays or changes

in plans with respect to exploration or exploration projects or capital

expenditures; the ability to obtain financing on satisfactory terms: the

uncertainties of reserves estimates; the uncertainty of estimates and

projections relating to production, costs and expenses, safety and environmental

risks), commodity price, price and exchange rate fluctuation and uncertainties

from potential delays or changes in plans with respect to exploration or

development projects or capital expenditures. Forward-looking statements are

based on a number of assumptions that may prove to be incorrect, including

without limitation assumptions about: general business and economic conditions;

the timing and receipt of required approvals; and ongoing relations with

employees, partners and joint venturers. The foregoing list is not exhaustive

and we undertake no obligation to update any of the foregoing except as required

by law. Important additional factors are described in the Company's period

reports and other filings with the Canadian Securities Commissions which may be

viewed at sedar.com and with the Securities and Exchange Commission which may be

viewed at the Commission's website at http:www.sec.gov.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this Form 6-K to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Dejour Enterprises

Ltd.

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Dated:

March 5, 2010

|

By:

|

/s/

Mathew Wong

|

|

|

|

|

Mathew

Wong,

|

|

|

|

|

Chief

Financial Officer

|

|

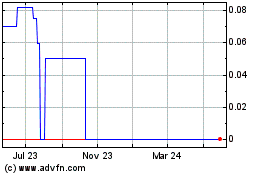

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

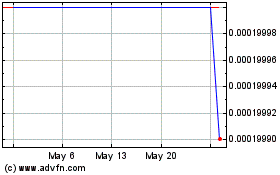

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jul 2023 to Jul 2024