UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the

Period: August 16,

2010 File

No.

001-33503

DEJOUR ENTERPRISES

LTD.

(Name of

Registrant)

598-999 Canada Place,

Vancouver, British Columbia, Canada, V6C 3E1

(Address

of principal executive offices)

Indicate

by check mark whether the Registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.

Indicate

by check mark whether the Registrant by furnishing the information contained in

this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Dejour

Announces $559K Operating Cash Flow for Q2 2010

Quarterly

Production Increased by 89%

Vancouver

, British

Columbia

,

August 16,

2010

--

Dejour

Enter

prises Ltd.

(

NYSE-AMEX: DEJ / TSX: DEJ)

(“Dejour”)

,

a

n independent

oil

and natural gas company operating

multiple exploration and production projects in Northeastern British Columbia

and

Western

Colorado

,

today announced the

release of its

financial

results for the

second

quarter

period ended

June 30, 2010

.

During the second quarter, Dejour placed

two new wells into production at the company operated Drake/Woodrush Field. The

success of the first quarter drilling program at Drake/Woodrush

was an important step towards meeting

Dejour’s growth targets for 2010. Key to the Company’s 2010

strategy was expected improvement in the operating performance in the 2nd

quarter

(

as referred to in the Company’s

May 13, 2010 news

release)

. In Q2, the

production was almost double the production for the

1st quarter. This substantial production

improvement provided the Company with the generation of positive operating cash

flow for the quarter. In addition, according to the recently updated reserve

evaluation report from an independent consultant, Dejour raised the net present

value of Proved and Probable Reserves at Drake/Woodrush by 150% to $17 million

at June 30, 2010. In view of its strong production growth and significant

increase in reserve value at Drake/Woodrush, the Company will continue its focus

on exploiting development opportunities in these properties.

Q2 2010

Key

a

chievements

|

|

·

|

Successfully

brought two new wells into production, generating positive operating cash

flow of $559,000.

|

|

|

·

|

Increased

Proved and Probable Producing Reserves at Drake/Woodrush to 534,000

Barrels of Oil Equivalent (58% oil), with a Present Value 10% (PV 10) at

$15.7 million, an increase of 140% from December 31, 2009 PV 10 value of

$6.5 million.

|

|

|

·

|

Increased

net production to 599 BOE/D (58% oil) in Q2 2010, an 89% increase over Q1

2010.

|

|

|

·

|

Increased

operating netback to $1.5 million in Q2 2010, a 416% improvement over Q1

2010.

|

|

|

·

|

Increased

EBTIDA by $1,575,000 delivering a positive EBITDA of $658,000, and yielded

a positive Adjusted EBITDA of $808,000 in

Q2.

|

Key corporate objectives for

the remainder of 2010

|

|

·

|

Generate

operating profits by 2010

Q4;

|

|

|

·

|

Increase oil production

and

reserves with the

drilling of additional wells, in Q3 2010, at the Drake/Woodrush

Field;

|

|

|

·

|

Confirm the waterflood potential

with Q3 drilling and begin project implementation in

Q4;

|

|

|

·

|

Complete the

permitting/

engineering

for th

e Phase 1 drilling at Gibson

Gulch; and

|

|

|

·

|

Procure

a

commitment on a

competitive

non-equity project

funding package for Phase 1

drilling at Gibson Gulch

.

|

Summary of Selected

Financial Highlights

|

|

|

|

Three

months ended June 30,

|

|

|

|

|

|

2010

|

|

|

2009

|

|

|

|

|

|

$

|

|

|

$

|

|

|

Revenue

|

Note

(1)

|

|

|

2,768,000

|

|

|

|

1,682,000

|

|

|

Net

loss

|

Note

(2)

|

|

|

(344,000

|

)

|

|

|

(781,000

|

)

|

|

Net

loss per share

|

Note

(3)

|

|

|

(0.003

|

)

|

|

|

(0.011

|

)

|

|

Operating

cash flow

(1)

|

Note

(4)

|

|

|

559,000

|

|

|

|

(243,000

|

)

|

|

Operating

netback

(1)

|

Note

(5)

|

|

|

1,464,000

|

|

|

|

830,000

|

|

|

EBITDA

(1)

|

Note

(6)

|

|

|

658,000

|

|

|

|

490,000

|

|

|

Adjusted

EBITDA

(1)

|

Note

(6)

|

|

|

808,000

|

|

|

|

560,000

|

|

|

|

(1)

|

Operating

cash flow, Operating netback, EBITDA and Adjusted EBITDA are non-GAAP

measures and are defined in details in the “Non-GAAP Measures”

below.

|

Notes:

|

|

(1)

|

Revenue

for Q2 2010 increased to $2,768,000 from $1,682,000 for Q2 2009. The

increase was mainly attributable to the two new wells commenced production

in May 2010.

|

|

|

(2)

|

Net

loss for Q2 2010 decreased to $344,000 from $781,000 for Q2 2009. The

decrease was due to higher revenues and lower operating and transportation

and depletion expenses, partially offset by higher

royalties.

|

|

|

(3)

|

Net

loss per share for Q2 2010 was $0.003 compared to $0.011 for Q2 2009. The

decrease was mainly the result of lower net loss for the current

quarter.

|

|

|

(4)

|

The

Company generated a positive operating cash flow of $559,000 for Q2 2010

compared to a negative operating cash flow of $243,000 for Q2 2009. It was

mainly the result of the two new wells commenced production in May

2010.

|

|

|

(5)

|

Operating

netback for Q2 2010 increased to $1,464,000 from $830,000 for Q2 2009. The

increase was due to the two new wells commenced production in May

2010.

|

|

|

(6)

|

EBITDA

for Q2 2010 increased to $658,000 from $490,000 for Q2

2009. Adjusted EBITDA for Q2 2010 increased to $808,000 from

$560,000 for Q2 2009. The increase was mainly attributable to

lower net loss.

|

Summary of Selected

Operational Highlights

DEAL Production and Netback

Summary

|

|

|

|

Three Months Ended June

30,

|

|

|

|

|

|

2010

|

|

|

2009

|

|

|

Production

Volumes:

|

|

|

|

|

|

|

|

|

Oil

and natural gas liquids

(bbls)

|

|

|

|

31,

753

|

|

|

|

15,

777

|

|

|

Gas (mcf)

|

|

|

|

136,538

|

|

|

|

207,748

|

|

|

Total (BOE)

|

Note (1)

|

|

|

54,509

|

|

|

|

50,402

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Price

Received:

|

|

|

|

|

|

|

|

|

|

|

Oil

and natural gas liquids

($/bbls)

|

|

|

|

65.79

|

|

|

|

59.43

|

|

|

Gas ($/mcf)

|

|

|

|

4.29

|

|

|

|

3.88

|

|

|

Total

($/BOE)

|

|

|

|

49.08

|

|

|

|

34.61

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties

($/BOE)

|

Note (2)

|

|

|

10.11

|

|

|

|

(0.45

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

($/BOE)

|

Note (3)

|

|

|

12.11

|

|

|

|

18.60

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Netbacks

($/BOE)

|

Note (4)

|

|

|

26.87

|

|

|

|

16.45

|

|

Notes:

|

|

(1)

|

The

increase in production was mainly due to the two new wells commenced

production in May 2010.

|

|

|

(2)

|

Royalties

of $10.11 per BOE for Q2 2010 were substantially higher than the prior

year’s quarter of $(0.45) per BOE. The increase was consistent with higher

revenues generated. In Q2 2009, the British Columbia government approved a

royalty holiday for the first 72,000 barrels of oil production on one of

the Company’s oil wells. The Company received a royalty credit

of $280,000 from the BC provincial government, resulting in a net royalty

recovery for the quarter. This 72,000 barrels royalty holiday

was used up in 2009 and the Company is subject to regular royalty rates in

2010.

|

|

|

(3)

|

Operating

and transportation expenses for Q2 2010 decreased to $12.11 per BOE

compared to $18.60 per BOE for Q2 2009 despite higher revenues. The

installation of the compressor in January 2010 resulted in minimal

compression costs, which accounted for the reduction in operating and

transportation expenses for the current

quarter.

|

|

|

(4)

|

Operating

netbacks for the current quarter increased to $26.87 per BOE from $16.45

per BOE for Q2 2009. The increase was mainly due to higher revenues and

lower operating and transportation expenses. This was partially offset by

increased royalties for Q2 2010.

|

Liquidity and Capital

Resources

Cash

Flow

The

Company had cash and cash equivalents of $3 million as of June 30,

2010. In addition to the cash balance, the Company also had accounts

receivable of $1.4 million, most of which was related to June 2010 oil and gas

sales and had been received subsequent to June 30, 2010.

Bank

Loan and Bridge Loan Financing

In March

2010, the Company completely paid off its line of credit with a Canadian

Bank.

Additionally,

in March 2010, the Company acquired a new credit facility for up to $5,000,000.

The first $2,000,000 of the facility was available. The remaining $3 million is

subject to lenders’ engineering review. In June 2010, the Company received

lender’s approval for the availability of an additional $1,500,000 of the

facility. As of June 30, 2010, a total of $3,500,000 of this facility

was utilized.

Dejour is

in discussions with this bridge loan lender to extend and increase this credit

facility.

For more

information and for Dejour’s detailed quarterly report, please visit SEDAR or

the Company’s website at

http://www.dejour.com

.

All amounts above are in CAD$, unless

otherwise noted. 1

US

$ = 1.0

646

CAD$.

Consolidated

Condensed Balance Sheets

|

|

|

As

at June 30, 2010

|

|

|

As

at December 31, 2009

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

3,020,000

|

|

|

$

|

2,733,000

|

|

|

Other

current assets

|

|

|

1,909,000

|

|

|

|

1,280,000

|

|

|

Equipment

|

|

|

102,000

|

|

|

|

115,000

|

|

|

Other

non-current assets

|

|

|

43,510,000

|

|

|

|

41,758,000

|

|

|

Total

assets

|

|

$

|

48,541,000

|

|

|

$

|

45,886,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

and shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank

line of credit and bridge loan

|

|

$

|

3,500,000

|

|

|

$

|

850,000

|

|

|

Current

liabilities

|

|

|

3,674,000

|

|

|

|

2,753,000

|

|

|

Loans

from related parties

|

|

|

2,402,000

|

|

|

|

2,346,000

|

|

|

Other

long-term liabilities

|

|

|

313,000

|

|

|

|

248,000

|

|

|

Shareholders’

equity

|

|

|

38,652,000

|

|

|

|

39,689,000

|

|

|

Total

liabilities and shareholders’ equity

|

|

$

|

48,541,000

|

|

|

$

|

45,886,000

|

|

Consolidated

Statements of Operations

|

|

|

For

the three months ended June 30,

|

|

|

For

the

six

m

onths

ended June 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil

and natural gas revenue

|

|

$

|

2,676,000

|

|

|

$

|

1,682,000

|

|

|

$

|

4,023,000

|

|

|

$

|

4,095,000

|

|

|

Realized

financial instrument gain (loss)

|

|

|

93,

000

|

|

|

|

-

|

|

|

|

51,000

|

|

|

|

289,000

|

|

|

|

|

|

2,769,0

00

|

|

|

|

1,682

,000

|

|

|

|

4,074,000

|

|

|

|

4,384,000

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties

|

|

|

551

,000

|

|

|

|

(23,

000

|

)

|

|

|

772,000

|

|

|

|

504,000

|

|

|

Operating

and transportation

|

|

|

660,

000

|

|

|

|

875

,000

|

|

|

|

1,502,000

|

|

|

|

1,873,000

|

|

|

Amortization,

depletion and accretion

|

|

|

727

,000

|

|

|

|

1,264

,000

|

|

|

|

1,473,000

|

|

|

|

3,975,000

|

|

|

Interest

expense and finance fee

|

|

|

275

,000

|

|

|

|

306

,000

|

|

|

|

528,000

|

|

|

|

506,000

|

|

|

General

and administrative

|

|

|

769

,000

|

|

|

|

852

,000

|

|

|

|

1,756,000

|

|

|

|

1,789,000

|

|

|

Non-cash

stock-based compensation

|

|

|

151

,000

|

|

|

|

107,

000

|

|

|

|

315,000

|

|

|

|

317,000

|

|

|

|

|

|

3,

133

,000

|

|

|

|

3,381

,000

|

|

|

|

6,346,000

|

|

|

|

8,964,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

before the following and income taxes

|

|

|

(

364,

000

|

)

|

|

|

(

1,699

,000

|

)

|

|

|

(2,272,000

|

)

|

|

|

(4,580,000

|

)

|

|

Interest

and other income

|

|

|

8,

000

|

|

|

|

105

,000

|

|

|

|

17,000

|

|

|

|

363,000

|

|

|

Gain

(l

oss

)

on

disposition of investment

|

|

|

-

|

|

|

|

37

,000

|

|

|

|

-

|

|

|

|

(274,000

|

)

|

|

Equity

loss from Titan

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(142,000

|

)

|

|

Foreign

exchange

gain

(

loss

)

|

|

|

12,

000

|

|

|

|

477,000

|

|

|

|

(3,000

|

)

|

|

|

325,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

before income taxes

|

|

|

(

344,

000

|

)

|

|

|

(

1,080

,000

|

)

|

|

|

(2,258,000

|

)

|

|

|

(4,308,000

|

)

|

|

Future

income taxes recovery

|

|

|

-

|

|

|

|

299

,000

|

|

|

|

-

|

|

|

|

1,078,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss for the period

|

|

$

|

(344,000

|

)

|

|

$

|

(781,000

|

)

|

|

$

|

(2,258,000

|

)

|

|

$

|

(3,230,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss per share – basic and diluted

|

|

$

|

0.003

|

|

|

$

|

0.011

|

|

|

$

|

0.023

|

|

|

$

|

0.044

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average number of common shares outstanding – basic and

diluted

|

|

|

98,698,372

|

|

|

|

7

4,343,228

|

|

|

|

98,220,180

|

|

|

|

74,034,042

|

|

Consolidated

Condensed Statements of Cash Flows

|

|

|

For

the three months ended March 31,

|

|

|

For

the six months ended June 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash,

beginning of period

|

|

$

|

1,336,000

|

|

|

$

|

1,679,000

|

|

|

$

|

2,733,000

|

|

|

$

|

744,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

from (used in) operating activities

|

|

|

55

3

,000

|

|

|

|

(1,148,

000

|

)

|

|

|

-

|

|

|

|

(1,044,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

from (used in) investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase

of equipment

|

|

|

(

2,000

|

)

|

|

|

-

|

|

|

|

(2,000

|

)

|

|

|

(5,000

|

)

|

|

Proceeds

on disposal of investment

|

|

|

-

|

|

|

|

118,000

|

|

|

|

-

|

|

|

|

2,306,000

|

|

|

Proceeds

from sales of oil and gas properties

|

|

|

-

|

|

|

|

4,282,000

|

|

|

|

-

|

|

|

|

4,282,000

|

|

|

Resource

properties expenditures

|

|

|

(883,000

|

)

|

|

|

(

301

,000

|

)

|

|

|

(3,141,000

|

)

|

|

|

(795,000

|

)

|

|

Total

cash from (used in) investing activities

|

|

|

(

885

,000

|

)

|

|

|

4,099

,000

|

|

|

|

(3,143,000

|

)

|

|

|

5,788,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

from (used) in financing activities

|

|

|

2,016

,000

|

|

|

|

(

3,572,

000

|

)

|

|

|

3,430,000

|

|

|

|

(4,430,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash,

end of period

|

|

$

|

3,020,000

|

|

|

$

|

1,058,000

|

|

|

$

|

3,020,000

|

|

|

$

|

1,058,000

|

|

A

bout

Dejour

Dejour

Enterprises Ltd. is a

n

independent

oil

and natural gas company operating multiple exploration and production projects

in North America’s Piceance / Uinta Basin

(109,000 net acres) and Peace River Arch regions

(20,000 net acres). Dejour’s veteran management team has

consistently been among early identifiers of premium energy assets, repeatedly

timing investments and transactions to realize their value

to shareholders' best advantage.

Dejour,

maintains offices in

Denver

,

USA

,

Calgary

and

Vancouver

,

Canada

.

The company is publicly traded on the New York Stock Exchange Amex

(NYSE

-

Amex: DEJ) and Toronto Stock Exchange (TSX: DEJ).

Non-GAAP

Measures

: This news release contains references to non-GAAP measures as

follows:

Operating

Cash Flow is a non-GAAP measure defined as net cash provided by operating

activities before changes in assets and liabilities.

Operating

Netback is a non-GAAP measure defined as revenues less royalties and operating

and transportation expenses.

EBITDA is

a non-GAAP measure defined as net income (loss) before income tax expense,

interest expense and finance fee, and amortization, depletion and

accretion.

Adjusted

EBITDA excludes certain items that management believes affect the comparability

of operating results. Items excluded generally are non-cash items, one-time

items or items whose timing or amount cannot be reasonably

estimated.

Certain

measures in this document do not have any standardized meaning as prescribed by

Canadian GAAP such as Operating Cash Flow, Operating Netback, EBITDA and

Adjusted EBITDA and therefore are considered non-GAAP measures. These measures

may not be comparable to similar measures presented by other issuers. These

measures have been described and presented in this document in order to provide

shareholders and potential investors with additional information regarding our

liquidity and our ability to generate funds to finance our

operations.

BOE

Presentation

: Barrel of oil equivalent amounts have been calculated using

a conversion rate of six thousand cubic feet of gas to one barrel of

oil. The term “BOE” may be misleading if used in

isolation. A BOE conversion ratio of one barrel of oil to six mcf of

gas is based on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the well head.

Total BOEs are calculated by multiplying the daily production by the number of

days in the period.

Statements

Regarding Forward-Looking Information

: This news release contains

statements that may constitute "forward-looking statements" or "forward-looking

information" within the meaning of applicable securities legislation as they

involve the assessment that the reserves and resources described can be

profitably produced in the future, based on certain estimates and assumptions,

these forward-looking statements include but are not limited to, the

availability of funding for future projects, anticipated recovery per well for

Gibson Gulch, the, risks related prospective resource best estimate being

inaccurate or incomplete or based upon errors in assumptions, adverse general

economic conditions, operating hazards, drilling risks, inherent uncertainties

in interpreting engineering and geologic data, fluctuations in oil and gas

prices and prices for drilling and other well services, government regulation

and foreign political risks, as other risks commonly associated with the

exploration and development of oil and gas properties. Additional information on

these and other factors, which could affect Dejour's operations or financial

results, are included in Dejour's reports on file with Canadian and United

States securities regulatory authorities. We assume no obligation to update

forward-looking statements should circumstances or management's estimates or

opinions change unless otherwise required under securities

law.

The

TSX does not accept responsibility for the adequacy or accuracy of this news

release.

|

|

Ro

bert

L. Hodgkinson, Co-Chairman

&

CEO

|

Investor

Relations –

New

York

|

|

|

598

– 999 Canada Place,

|

Craig

Allison

|

|

|

Vancouver,

BC Canada V6C 3E1

|

Phone:

914.882.0960

|

|

|

Phone: 604.638

.5050 Facsimile:

604.638.5051

|

Email:

callison@dejour.com

|

|

|

Email:

investor@dejour.com

|

|

|

|

Dejour Enterprises

Ltd.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Dated:

August 16, 2010

|

By:

|

/s/ Mathew

Wong

|

|

|

|

|

Mathew

Wong,

|

|

|

|

|

Chief

Financial Officer

|

|

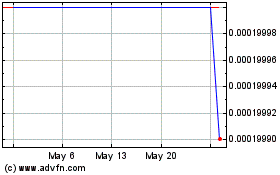

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

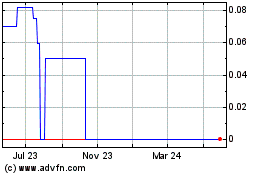

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jul 2023 to Jul 2024