- Report of Foreign Issuer (6-K)

November 15 2010 - 6:01AM

Edgar (US Regulatory)

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the

Period: November 15,

2010 File

No.

001-33511

DEJOUR ENTERPRISES

LTD.

(Name of

Registrant)

598-999 Canada Place,

Vancouver, British Columbia, Canada, V6C 3E1

(Address

of principal executive offices)

Indicate

by check mark whether the Registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.

Indicate

by check mark whether the Registrant by furnishing the information contained in

this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Institution

to Invest $2 Million in Dejour

Vancouver, British

Columbia,

November

1

5

, 2010

-- Dejour Enterprises Ltd.

(

NYSE-AMEX: DEJ / TSX:

DEJ)

announces

the

Company has entered into a definitive agreement to sell 7,142,858 common shares

and 4,642,858 share purchase warrants to a New York based institutional

investor, resulting in expected gross proceeds of approximately CAD$2 million.

The warrants have an exercise price of CAD$0.40 per share and a 5 year term from

the closing date of the transaction.

Dejour

intends to use the net proceeds from the offering to accelerate the previously

announced waterflood program at its Woodrush oil project in northeastern British

Columbia, retire certain debt obligations and supplement working

capital.

The

offering is expected to be completed or about November 16, 2010, subject to the

satisfaction of customary closing conditions, including the approval of the NYSE

Amex and the TSX.

A

portion of the offered securities have not been and will not be registered under

the United States Securities Act of 1933, as amended (the “1933 Act”), and such

securities may not be offered or sold in the United States or to, or for the

account or benefit of, U.S. persons (as defined in Regulation S under the 1933

Act absent registration or an applicable exemption from the registration

requirements of the 1933 Act. This announcement shall not constitute

an offer to sell or the solicitation of an offer to buy these securities, nor

shall there be any offer or sale of these securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

Statements

Regarding Forward-Looking Information:

This news release contains statements

that may constitute "forward-looking statements" or “

forward-looking information”

w

ithin the meaning of applicable

securities legislation, including without limitation statements regarding the

expected

proceeds and

expected

closing date of

the offering, the use of proceeds from the offering, and the company

’

s growth potential.

Forward-lo

oking statements

are based on current expectations, estimates and projections that involve a

number of risks, uncertainties and other factors that could cause actual results

to differ materially from those anticipated by Dejour and described in the

forwar

d

-looking statements. These risks,

uncertainties and other factors include, but are not limited to, risks that the

closing conditions will not be satisfied and the offering will not close, risks

that the financial condition of Dejour, the condition of its

p

roperties, the conditions in the oil

& gas industry or conditions in the market will change and necessitate a

change in the use of the proceeds from this offering, adverse general economic

conditions, operating hazards, drilling risks, inherent uncertaint

i

es in interpreting engineering and

geologic data, competition, reduced availability of drilling and other well

services, fluctuations in oil and gas prices and prices for drilling and other

well services, government regulation and foreign political risks,

fluctuations in the exchange rate

between Canadian and US dollars and other currencies, as well as other risks

commonly associated with the exploration and development of oil and gas

properties. Additional information on these and other factors, which

cou

l

d affect Dejour

’

s operations or financial results, are

included in Dejour

’

s reports on file with Canadian and

United States securities regulatory authorities, including the

Dejour

’

s Annual Report of Form 20-F for

the year ended December 31,

2009

, as filed

with the United States Securities and

Exchange Commission. We assume no obligation to update forward-looking

statements should circumstances or management's estimates or opinions change

unless otherwise required under securities law.

The

TSX has not reviewed and does not accept responsibility for the adequacy or

accuracy of this news release.

|

Robert L.

Hodgkinson

, Co-Chairman &

CEO

|

Investor Relations

–

New

Yor

k

|

|

598

–

999 Canada

Place,

|

Craig

Allison

|

|

Vancouver, BC Canada V6C

3E1

|

Phone:

914.882.0960

|

|

Phone: 604.638

.5050 Facsimile:

604.638.5051

|

Email:

callison@dejour.com

|

|

Email:

investor@dejour.com

|

|

|

|

Dejour

Enterprises Ltd.

(Registrant)

|

|

|

|

|

|

|

|

Dated:

November 15, 2010

|

By:

|

/s/ Mathew

Wong

|

|

|

|

|

Mathew

Wong,

|

|

|

|

|

Chief

Financial Officer

|

|

|

|

|

|

|

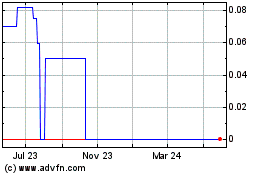

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

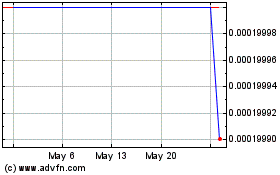

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jul 2023 to Jul 2024