Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the fourth quarter and full year

ended December 31, 2011.

“Farmers & Merchants Bank has reported double-digit percent

increases in year-over-year net income for the past three years,

coupled with a strong balance sheet,” said Henry Walker, chief

executive officer of Farmers & Merchants Bank of Long Beach.

“As the global and domestic economies continue to challenge the

banking industry as a whole, we believe Farmers & Merchants is

well positioned to attract customers who seek a community bank with

financial strength and personalized service.”

Income Statement

For the 2011 fourth quarter, total interest income was $43.3

million, compared with $44.0 million in the fourth quarter of 2010.

Total interest income for the year ended December 31, 2011 was

$178.6 million, compared with $178.9 million reported for the same

period in 2010.

Interest expense for the 2011 fourth quarter declined to $2.0

million from $2.7 million in the same quarter of 2010, attributed

primarily to the roll over of long-term time deposits. Interest

expense for the year totaled $9.5 million, compared with $12.0

million for the same period in 2010.

The Bank’s net interest income for the 2011 fourth quarter was

$41.3 million, in line with the $41.3 million of net interest

income for the same quarter of 2010. Net interest income for 2011

was $169.2 million, versus $166.9 million in 2010. Farmers &

Merchant’s net interest margin was 4.08% for the year ended

December 31, 2011, compared with 4.23% in the previous year.

The Bank’s provision for loan losses decreased to $5.5 million

in the fourth quarter of 2011 from $6.5 million in the 2010 fourth

quarter amid stabilizing economic conditions. Provision for loan

losses declined to $14.2 million in 2011 from $26.0 million for

2010. The Bank’s allowance for loan losses as a percentage of loans

outstanding was 2.80% at December 31, 2011, compared with 2.69% at

December 31, 2010.

Non-interest income was $4.0 million for the 2011 fourth

quarter, compared with $4.2 million in the 2010 fourth quarter.

Non-interest income for the full 2011 year totaled $13.9 million,

compared with $15.4 million for 2010.

Non-interest expense for the 2011 fourth quarter was $19.9

million, compared with $16.7 million for the same period last year.

Non-interest expense for the year ended December 31, 2011 was $78.4

million, compared with $74.4 million last year.

The Bank’s net income for the 2011 fourth quarter was $13.8

million, or $105.29 per diluted share, compared with $15.3 million,

or $117.16 per diluted share, in the 2010 fourth quarter. The

Bank’s net income for 2011 rose to $59.1 million, or $451.53 per

diluted share, from $53.0 million, or $405.06 per diluted share,

for 2010.

Balance Sheet

At December 31, 2011, net loans increased to $2.03 billion from

$2.01 billion at December 31, 2010. The Bank’s deposits grew 13.0%

to $3.39 billion at the end of 2011, from $3.00 billion at December

31, 2010. Non-interest bearing deposits represented 37.2% of total

deposits at December 31, 2011, versus 33.4% of total deposits at

December 31, 2010. Total assets increased to $4.66 billion at the

close of 2011 from $4.26 billion at December 31, 2010.

At December 31, 2011, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 27.94%, a Tier 1 risk-based capital

ratio of 26.67%, and a Tier 1 leverage ratio of 14.26%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“Farmers & Merchants Bank finished 2011 with an 11 percent

increase in full-year net income and a 13 percent increase in total

deposits, a testament to our strength and stability in a tough

economic environment,” said Daniel Walker, president and chairman

of the board. “We remain focused on the fundamentals that have

contributed to the Bank’s success for 105 years.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 21 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG BEACH

Income Statements (Unaudited) (In Thousands)

Three Months

Ended Dec 31, Year ended December 31, 2011

2010 2011 2010 Interest income: Loans $

28,667 $ 28,796 $ 115,395 $ 115,928 Securities held to maturity

11,303 11,768 48,734 47,563 Securities available for sale 3,118

3,311 13,980 14,666 Deposits with banks 224 85 497 774 Total

interest income 43,312 43,960 178,606 178,931

Interest expense: Deposits 1,709 2,219 7,920 9,999

Securities sold under agreement to repurchase 294 449 1,535

2,043 Total interest expense 2,003 2,668 9,455 12,042 Net

interest income 41,309 41,292 169,151 166,889

Provision

for loan losses 5,450 6,500 14,200 25,950 Net int.

income after provision for loan losses 35,859 34,792 154,951

140,939

Non-interest income: Service charges on

deposit accounts 1,481 1,240 5,114 5,073 Gains on sale of

securities 71 - 174 870 Merchant bankcard fees 354 286 1,257 1,209

Escrow fees 220 188 924 790 Other 1,888 2,504 6,436 7,489

Total non-interest income 4,014 4,218 13,905 15,431

Non-interest expense: Salaries and employee benefits 9,850

9,631 41,814 40,165 FDIC and other insurance expense 1,643 1,265

4,671 4,881 Occupancy expense 1,374 1,465 5,501 5,696 Equipment

expense 1,322 1,345 5,435 5,102 Other real estate owned expense,

net 1,081 (520 ) 3,441 6,298 Legal and professional fees 1,321 689

3,896 2,436 Marketing and promotional expense 1,096 692 3,934 3,004

Other 2,177 2,166 9,736 6,846 Total non-interest expense

19,864 16,733 78,428 74,428 Income before income tax expense

20,009 22,277 90,428 81,942

Income tax expense 6,223 6,938

31,310 28,909

Net income $ 13,786

$ 15,339 $ 59,118 $

53,033 Basic and diluted earnings per common share $ 105.29

$ 117.16 $ 451.53 $ 405.06

FARMERS & MERCHANTS BANK OF LONG

BEACH

Balance Sheets (Unaudited) (In Thousands)

Dec. 31, 2011 Dec. 31, 2010

Assets Cash and due from banks: Noninterest-bearing balances

$ 57,394 $ 49,628 Interest-bearing balances 278,525 48,509

Investment securities 2,113,130 1,977,343 Gross loans 2,087,388

2,070,493 Less allowance for loan losses (58,463 ) (55,627 ) Less

unamortized deferred loan fees, net (418 ) (426 ) Net loans

2,028,507 2,014,440 Bank premises and equipment

55,155 51,650 Other real estate owned 23,036 37,300 Accrued

interest receivable 16,464 17,134 Deferred tax asset 28,583 27,032

Other assets 58,551 39,370

Total assets

$ 4,659,345 $ 4,262,406

Liabilities and stockholders' equity

Liabilities: Deposits: Demand, non-interest bearing $

1,263,162 $ 1,004,272 Demand, interest bearing 300,984 261,961

Savings and money market savings 909,794 754,446 Time deposits

919,538 983,314 Total deposits 3,393,478 3,003,993

Securities sold under agreements to repurchase 555,992 628,192

Accrued interest payable and other liabilities 39,659 7,141

Total liabilities 3,989,129

3,639,326 Stockholders' Equity:

Common Stock, par value $20; authorized

250,000 shares; issued and outstanding

130,928 shares

2,619 2,619 Surplus 12,044 12,044 Retained earnings 646,708 601,861

Other comprehensive income 8,845 6,556

Total

stockholders' equity 670,216 623,080

Total liabilities and stockholders' equity

$ 4,659,345 $ 4,262,406

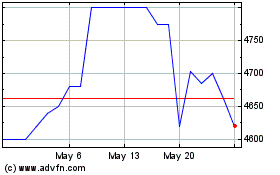

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025