--Net Loans Increased 18.5 Percent in

Year-to-Date Performance--

Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the third quarter ended September

30, 2014.

“Farmers & Merchant’s third-quarter results reflect strength

in the Bank’s lending activities, as we continue to enhance our

footprint throughout Los Angeles and Orange Counties,” said Henry

Walker, president of Farmers & Merchants Bank of Long Beach.

“Steady growth and profitability have been hallmarks of F&M

since its inception, and the Bank’s third-quarter results are a

testament to these core characteristics.”

Income Statement

For the 2014 third quarter, interest income rose to $46.8

million from $40.9 million in the 2013 third quarter, reflecting

strength in the Bank’s loan portfolio. Interest income for the

nine-month period ended September 30, 2014 advanced to $135.1

million from $119.7 million reported for the same period in

2013.

Interest expense for the 2014 third quarter was $1.8 million,

compared with $1.6 million in last year’s third quarter. Interest

expense for the nine-month period ended September 30, 2014 was $5.1

million, versus $4.6 million reported for the same period last

year.

Net interest income for the 2014 third quarter rose to $45.0

million from $39.3 million for the third quarter of 2013, and

increased to $130.0 million for the first nine months of 2014,

versus $115.1 million for the same period in 2013.

Farmers & Merchants’ net interest margin was 3.48% for the

2014 third quarter, compared with 3.28% for the 2013 third quarter.

Net interest margin was 3.45% for the first nine months of 2014,

compared with 3.25% for the same period in 2013.

The Bank did not have a provision for loan losses in the first

nine months of 2014, nor in the same period a year ago, amid

continued strength in its loan portfolio. The Bank’s allowance for

loan losses as a percentage of loans outstanding was 1.78% at

September 30, 2014, compared with 2.09% at December 31, 2013.

Non-interest income was $8.4 million for the 2014 third quarter,

compared with $9.4 million in the third quarter a year ago.

Non-interest income was $24.8 million for the nine-month period

ended September 30, 2014, compared with $30.6 million for the same

period in 2013.

Non-interest expense for the 2014 third quarter was $29.4

million, versus $26.9 million for the same period last year.

Non-interest expense for the first nine months of 2014 was $87.2

million, compared with $77.0 million last year.

Net income for the 2014 third quarter increased to $16.4

million, or $125.29 per diluted share, from $15.1 million, or

$114.95 per diluted share, in the year-ago period. The Bank’s net

income for the first nine months of 2014 was $46.6 million, or

$355.73 per diluted share, compared with $47.2 million, or $360.39

per diluted share, for the same period in 2013.

Balance Sheet

At September 30, 2014, net loans totaled $2.85 billion, compared

with $2.40 billion at December 31, 2013. The Bank’s deposits

totaled $4.11 billion at the end of the 2014 third quarter,

compared with $3.83 billion at December 31, 2013. Non-interest

bearing deposits represented 40.0% of total deposits at September

30, 2014, versus 38.5% of total deposits at December 31, 2013.

Total assets increased to $5.53 billion at the close of the 2014

third quarter, compared with $5.21 billion at the close of the

prior year.

At September 30, 2014, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 23.76%, a Tier 1 risk-based capital

ratio of 22.51%, and a Tier 1 leverage ratio of 14.35%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“Maintaining a healthy balance sheet has been imperative for

keeping F&M Bank in sound condition, and our year-to-date

results reflect the Bank’s solid standing,” said Daniel Walker,

chief executive officer and chairman of the board. “As we enter the

final stretch of 2014, the Bank’s strong financial health will

serve as an excellent foundation for attracting new clients and

helping them achieve their goals.”

About Farmers & Merchants Bank

Founded in Long Beach in 1907 by C.J. Walker, Farmers &

Merchants Bank has 23 branches in Los Angeles and Orange Counties.

The Bank specializes in commercial and small business banking along

with business loan programs. Farmers & Merchants Bank of Long

Beach is a California state chartered bank with deposits insured by

the Federal Deposit Insurance Corporation (Member FDIC) and an

Equal Housing Lender. For more information about F&M, please

visit www.fmb.com.

FARMERS & MERCHANTS BANK OF LONG

BEACH

Income Statements (Unaudited) (In thousands except per

share data) Three Months Ended Sept.

30, Nine Months Ended Sept. 30, 2014

2013 2014 2013

Interest and dividend income: Loans $ 32,981 $ 26,002

$ 92,973 $ 76,813 Securities available-for-sale 1,309 1,980 4,167

6,289 Securities held-to-maturity 12,074 12,800 37,373 36,117

Investments in FHLB and FRB stock 321 7 334 20 Deposits with banks

109 105 250 457 Total interest and dividend income 46,794

40,894 135,097 119,696

Interest expense:

Deposits 1,482 1,268 4,254 3,753 Federal funds purchased - - 4 -

Securities sold under repurchase agreements 319 283 873 839

Total interest expense 1,801 1,551 5,131 4,592 Net interest

income before provision for loan losses 44,993 39,343 129,966

115,104

Provision for loan losses - - - - Net

interest income after provision for loan losses 44,993 39,343

129,966 115,104

Non-interest income: Service

charges on deposit accounts 1,185 1,135 3,472 3,403 Gains on sale

of securities - - 425 1,048 Other real estate owned income 253

2,812 756 3,275 Merchant bankcard income 2,381 2,448 7,084 7,010

Other income 4,592 3,041 13,024 15,865 Total non-interest

income 8,411 9,436 24,761 30,601

Non-interest

expense: Salaries and employee benefits 15,473 13,536

47,399 40,260 FDIC and other insurance expense 785 1,303 2,306

4,702 Occupancy expense 2,213 1,765 5,966 5,036 Equipment expense

1,843 1,619 4,913 4,591 Other real estate owned expense 721 249

2,504 243 Amortization of public welfare investments 2,117 2,020

6,351 6,061 Merchant bankcard expense 1,847 1,904 5,572 5,564 Legal

and professional services 832 970 2,558 2,719 Marketing expense

1,640 1,560 4,408 2,934 Other expense 1,885 1,952 5,245 4,906 Total

non-interest expense 29,356 26,878 87,222 77,016 Income

before income tax expense 24,048 21,901 67,505 68,689

Income tax expense 7,645 6,851 20,931 21,504

Net

income $ 16,403 $ 15,050 $

46,574 $ 47,185 Basic and diluted

earnings per common share $ 125.29 $ 114.95 $ 355.73 $ 360.39

FARMERS & MERCHANTS BANK OF LONG

BEACH

Balance Sheets (Unaudited) (In thousands except share and

per share data) Sept. 30, 2014 Dec. 31,

2013 Assets Cash and due from

banks: Noninterest-bearing balances $ 60,429 $ 65,261

Interest-bearing balances 25,967 20,755 Securities

available-for-sale 288,530 427,942 Securities held-to-maturity

2,091,718 2,145,289 Loans held for sale 4,489 465 Gross loans

2,899,972 2,454,302 Less allowance for loan losses (51,701 )

(51,251 ) Less unamortized deferred loan fees, net (2,345 ) (1,704

) Net loans 2,845,926 2,401,347 Other real estate

owned, net 7,534 14,502 Investments in FHLB and FRB stock 28,440

440 Public welfare investments 47,974 27,722 Bank premises and

equipment, net 86,090 66,212 Net deferred tax assets 22,305 23,512

Other assets 22,281 21,139

Total assets

$ 5,531,683 $ 5,214,586

Liabilities and Stockholders' Equity

Liabilities: Deposits: Demand, non-interest bearing $

1,642,550 $ 1,475,888 Demand, interest bearing 417,715 413,291

Savings and money market savings 1,208,166 1,080,774 Time deposits

837,863 861,489 Total deposits 4,106,294

3,831,442 Securities sold under repurchase agreements

597,003 595,991 Other liabilities 30,875 27,986

Total liabilities 4,734,172

4,455,419 Stockholders' Equity:

Common Stock, par value $20;authorized

250,000 shares;issued and outstanding 130,928 shares

2,619

2,619

Additional paid-in capital 112,044 12,044 Retained earnings 680,340

742,408 Accumulated other comprehensive income 2,508 2,096

Total stockholders' equity 797,511

759,167 Total liabilities and

stockholders' equity $ 5,531,683 $

5,214,586

Farmers & Merchants BankJohn HinrichsExecutive Vice

President562-437-0011, ext. 5035orPondelWilkinson Inc.Investor

RelationsEvan Pondel, 310-279-5980investor@pondel.com

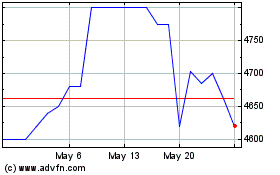

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025