Fortitude Group, Inc. Agrees to Specific Asset Sale

June 09 2014 - 8:56AM

Marketwired

Fortitude Group, Inc. Agrees to Specific Asset Sale

ERIE, PA--(Marketwired - Jun 9, 2014) - Thomas Parilla, CEO of

Fortitude Group, Inc. (PINKSHEETS: FRTD) proudly announces a

Specific Asset Purchase Agreement with Cascade Technologies Inc.

(PINKSHEETS: CSDT). As part of this agreement all medical assets

currently held by Fortitude Group Inc. will be sold to Cascade

Technologies. Cascade has agreed to pay Fortitude $2,000,000

in common stock as consideration for this purchase. All Fortitude

shareholders of record as of 5:00 EDT on June 13, 2014 will qualify

to receive the shares of Cascade. The Official Effective date will

be June 13, 2014 at 5:00 pm EDT.

Parilla further added, "Even under very tough circumstances,

we've kept the shareholders of this company at the forefront of our

planning, and we're very pleased to be able to close this

acquisition with Cascade Technologies. We believe this is in the

best interest of our company going forward, and the shareholders

that have put their support in us. We are actively pursuing the

sale of our non-core assets and will continue to distribute the

proceeds to our shareholders at each subsequent closing. We

feel that by divesting ourselves of our non-core assets, we can

achieve a premium closer to our previously announced .12 per

share. I want our shareholders to know that this process will

not happen overnight but this announced acquisition is the first

step in accomplishing this goal."

"Cascade Technologies offers Fortitude shareholders a fresh

start, and a very nice premium to their current holdings. Although

CSDT is currently a Non-SEC Filing Pink Sheet stock, management

believes Cascade will have their past filings back to current

status within the next quarter," stated Thomas Parilla.

On May 18, 2014, the company had entered into an LOI with a

fully reporting OTCQB company, to be acquired in its entirety

through a share-for-share acquisition. Unfortunately, with the

recent trading suspension by the SEC, the LOI was rescinded until

such time as Fortitude completes an updated 15c211.

The company further announces the immediate termination of two

separate corporate actions. First, according to the company, it has

become clear that the Marijuana industry is under intense scrutiny

by regulatory bodies therefore, effective immediately Fortitude

will be rescinding the acquisition of Mari-Medical Pharmaceuticals.

Fortitude firmly believes Mari-Medical is on the right path,

unfortunately, given the current regulatory environment both

parties are better served by moving forward separately. Management

of Fortitude wish the management team at Mari-Medical the best of

luck, and they appreciate all of their hard work to date.

Second, effective immediately, the company has terminated the

LOI with Primarq. This action was based on Primarq's failure

to perform in providing Fortitude the previously agreed to Legal

Opinion required to close the transaction.

About Fortitude

Group, Inc. is a diversified company with investments in multiple

sectors of the economy targeting joint ventures, wholly owned

subsidiaries and/or majority/minority positions that cross various

market segments with the goal of creating a quality company that

builds intrinsic value for its shareholders.

Forward Looking

Statements This press release contains forward-looking

statements. Such forward-looking statements are subject to a number

of risks, assumptions and uncertainties that could cause the

Company's actual results to differ materially from those projected

in such statements. Forward-looking statements speak only as of the

date made and are not guarantees of future performance. We

undertake no obligation to publicly revise any forward-looking

statements.

Contact Fortitude Group, Inc. Investor Relations Phone:

888-447-5501 Email: Email Contact

Fortitude (CE) (USOTC:FRTD)

Historical Stock Chart

From Nov 2024 to Dec 2024

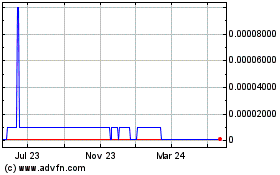

Fortitude (CE) (USOTC:FRTD)

Historical Stock Chart

From Dec 2023 to Dec 2024