Gafisa Initiates Studies to Separate Business Units into Two Independent Publicly Traded Companies

February 07 2014 - 9:34AM

Business Wire

GAFISA S.A. (Bovespa: GFSA3; NYSE: GFA) (“Gafisa”, including all its affiliates or

“Company”) hereby discloses to its

shareholders and the market that its Board of Directors has

authorized the Company’s management to initiate studies for a

potential separation (“Separation”) of the Gafisa and Tenda

business units (“Companies”) into two independent publicly traded

companies.

The Separation would be the next step in a comprehensive plan

initiated by management to enhance value creation for the Company

and its shareholders. The Companies have distinct strategic,

operational and optimal financing profiles. Gafisa is a

well-established operation, focused on the medium to high income

classes, with a proven business model and a leadership position in

its target markets (São Paulo and Rio de Janeiro). Tenda recently

reinitiated launches under a new business model and is one of the

few companies operating within the Level 2 segment of the Federal

Government sponsored “Minha Casa Minha Vida” program, a segment

with high growth potential. Additionally, the current synergies

between the companies are minimal.

The main objectives of the Separation would be to:

i) Allow shareholders to allocate resources

between the two Companies based on their own interests and

investment strategies;

ii) Enable each of the Companies to respond

faster to opportunities in their respective target markets;

iii) Establish sustainable capital structures

for each of the Companies based on each unique risk profile, and

allocate resources according to their strategic priorities;

iv) Provide more visibility to the market

regarding the individual performance of each of the Companies,

enabling better evaluation of inherent value;

v) Increase their ability to attract and

retain talent by developing their respective appropriate culture

and compensation plans which should be consistent with their

different stages and lines of business and better aligned with the

results of each business.

As an initial step to facilitate and accelerate the development

of more appropriate operating structures for each of Gafisa and

Tenda, the Company’s Board of Directors approved the division of

their administrative structures, creating two operationally

independent companies. The initial phase of this transition process

will be led by Gafisa´s current Chief Executive Officer, Alceu

Duilio Calciolari. It should last approximately 90 days after which

period Duilio has decided to leave the presidency. Duilio joined

the Company in 2000 as Chief Financial Officer. He became CEO in

2011 and has spearheaded and concluded the Company’s turnaround

strategy, which resulted in its strategic repositioning, the

rebalancing of its capital structure through the successful sale of

70% of Alphaville and the redefinition of Gafisa’s operating and

corporate model.

Duilio said: “I believe the new corporate structure will enable

each business unit to reach its full potential and generate

additional shareholder value. Having completed the turnaround

process, I feel this is the appropriate juncture to complete a

successful leadership cycle in Gafisa. We have one of the best

teams in the market to further develop both Gafisa and Tenda in a

profitable and sustainable manner.”

Sandro Gamba, the current head of the Gafisa business unit, will

become Gafisa’s CEO and Rodrigo Osmo, the current head of the Tenda

business unit, will become Tenda’s CEO. Sandro joined Gafisa as an

intern in 1995 and worked in the Operations department, as New

Business Director and as Regional SP Business Director, before

assuming his current role. Rodrigo joined Gafisa in 2006 and acted

as Business Development Director, head of the Alphaville business

unit and Chief Financial Officer, before assuming his current role

of head of the Tenda business unit. André Bergstein will remain as

Gafisa’s Chief Financial Officer.

The Board of Directors intends to evaluate the Separation

studies in the following months, analyzing possible alternatives

for structuring and execution that take into consideration a number

of factors, including legal and fiscal, that are in the best

interest of shareholders. If approved by the Board of Directors,

the Separation plan will be submitted to a vote by shareholders at

a Shareholders Meeting. If the plan is approved, the Separation

process should be concluded within 2015 resulting in the request

for conversion of Tenda registration at Comissão de Valores

Mobiliarios (CVM) to Category A (i.e., authorized to negotiate its

shares in the market) and listing in the Novo Mercado at

BMF&Bovespa.

Gafisa has engaged Rothschild as its financial advisor in the

process.

The Company will keep its shareholders and the Market informed

about the process and any developments pertaining to the

Separation.

About Gafisa

Gafisa is one of Brazil´s leading diversified national

homebuilders serving all demographic segments of the Brazilian

market. Established over 59 years ago, the Company has completed

and sold more than 1,000 developments and built more than 12

million square meters of housing only under Gafisa’s brand, more

than any other residential development company in Brazil.

Recognized as one of the foremost professionally managed

homebuilders, "Gafisa" is also one of the most respected and

best-known brands in the real estate market, recognized among

potential homebuyers, borrowers, lenders, landowners, competitors,

and investors for its quality, consistency, and professionalism.

Our pre-eminent brands include Tenda, serving the affordable/entry

level housing segment, and Gafisa and Alphaville, which offer a

variety of residential options to the mid to higher-income

segments. Gafisa S.A. is traded on the Novo Mercado of the

BM&FBOVESPA (BOVESPA:GFSA3) and on the New York Stock Exchange

(NYSE:GFA).

MBS BrazilDenise CarvalhoPhone: +55 11 5051-

5849OrFabiane

GoldsteinFabiane.gold@mbsvalue.com

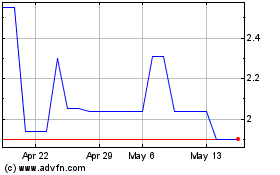

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Jan 2025 to Feb 2025

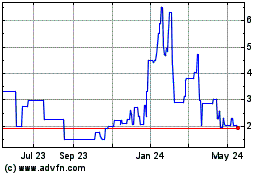

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Feb 2024 to Feb 2025