Report of Foreign Issuer (6-k)

October 23 2019 - 4:21PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2019

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425- 070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

GAFISA S.A.

CNPJ/MF nº 01.545.826/0001-07

NIRE 35.300.147.952

Publicly held Company

NOTICE TO THE MARKET

GAFISA S.A. (B3: GFSA3; OTC: GFASY) (“Gafisa” or “Company”), hereby informs its shareholders and the market that, on this date, the Board of Directors of the Company, resolved:

I. Capital Stock Increase

The approval of the second tranche of the capital increase within the authorized stock capital limit, pursuant the meeting held on August 15, 2019. A total of 48,968,124 shares were subscribed, in the total amount of R$ 272 million with the entrance of new institutional investors in the Company's shareholders base. Together with the first tranche of the capital increase held in June 19, the Company's total capitalization was around R$ 405 million. The funds raised in these transactions will be allocated to project development.

II. Project development

The board members approved the engagement of a financial institution that will organize funding by securities, to the limit of USD 150 million, to be appropriately submitted to the shareholders’ meeting of the Company to deliberate on an eventual issuance of securities. The issuance of securities, once concluded the studies and structuring to be proposed by the contractor, aims at capitalizing the Company to support the growth upswing.

Aiming new projects and diversifying its businesses, the Company materialized the land acquisition for a project in an upmarket area in the City of São Paulo, at Cotovia Street, in the district of Moema, which will set Gafisa’s launch resumption in the first half of 2020. In this regard, the board members approved the execution of two non-binding memoranda of understanding for studies and appraisals targeting relevant projects in the future to be executed in the cities of Rio de Janeiro and Osasco, State of São Paulo.

III. Alphaville Divestment

Finally, was endorsed the agreement entered into referring to the Company’s divestment in Alphaville Urbanismo S.A., in accordance with the Material Fact released on October 21, 2019. The materialization of this transaction will allow the setup of Gafisa Desenvolvimento Urbano S.A, in line with the Company’s strategy of operating in this segment, and its business plan is currently under development. The total transaction amount is equivalent to R$ 100 million, to be

paid by offsetting assets.

GAFISA S.A.

All these resolutions represent a milestone and compose the Company’s turnaround process in order to allow Gafisa to regain its relevance in the Brazilian real estate market.

The Company thanks the confidence of its shareholders and reiterates its commitment to keep shareholders and the market informed of any development of its activities.

Additional information on the Capital Increase and resolutions of the Board of Directors can be obtained with the Company’s Investor Relations Department (http://www.http://ri.gafisa.com.br/), via e-mail ri@gafisa.com.br.

São Paulo, October 23, 2019

André Luis Ackermann

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 23, 2019

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: André Luis Ackermann

Title: Chief Financial Officer

|

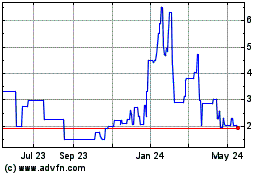

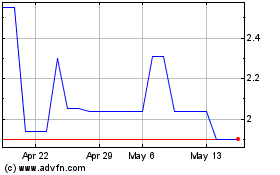

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From May 2024 to Jun 2024

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Jun 2023 to Jun 2024