|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

66,099,349 (2)

|

|

8

|

SHARED

VOTING POWER

0

|

|

9

|

SOLE

DISPOSITIVE POWER

66,099,349 (2)

|

|

10

|

SHARED

DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

66,099,349 (2)

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

51%

|

|

14

|

TYPE

OF REPORTING PERSON (See Instructions)

IV

|

|

(1)

|

TCA Global Credit

Master Fund L.P. (“TCA Fund”) is a Cayman Islands Limited Partnership. As previously disclosed, effective December

7, 2015, the Company closed a Senior Secured Credit Facility Agreement (the “Credit Agreement”) by and among the Company,

as borrower, Grow Solutions, Inc., a Delaware corporation and One Love Garden Supply, a Colorado limited liability company, as

joint and several guarantors (such guarantors, collectively, the “Subsidiaries”) and TCA Fund as lender.

On October 13,

2017, TCA Fund provided notice to the Company and the Subsidiaries of an Event of Default (as defined in the Credit Agreement)

which occurred and remained continuing and uncured for non-payment. Accordingly, on or about November 1, 2017 (the “Effective

Date”), TCA Fund demanded the Escrow Agent (as defined in the Credit Agreement) under the Pledge Agreement to deliver to

TCA Fund the Pledged Securities (as defined in the Pledge Agreement), along with all applicable Transfer Documents (as defined

in the Pledge Agreement), and TCA Fund became the registered owner of the Pledged Securities in accordance with the terms of the

Pledge Agreement.

Additionally,

in connection with the actions taken by TCA Fund under the Pledge Agreement, on the Effective Date, Grow Solutions Holdings, LLC,

a Colorado limited liability company (the “LLC”), and TCA Share Holdings LLC, a Nevada limited liability company controlled

by TCA Fund (“TCA Share Holdings”), entered into an Assignment Agreement whereby the LLC, as assignor, irrevocably

transferred and assigned to TCA Share Holdings, as assignee, all of the LLC’s right, title and interest in and to all of

the 51 shares of Series A Preferred Stock, $0.001 par value per share of the Company (the “Series A Preferred”) held

by the LLC, and TCA Share Holdings assumed all of the LLC’s right, title and interest in and to the Series A Preferred in

accordance with the terms of the Assignment Agreement. TCA Share Holdings is controlled by TCA Fund.

Among other provisions,

each one (1) share of the Series A Preferred shall have voting rights equal to (x) 0.019607

multiplied by

the

total issued and outstanding shares of common stock of the Company eligible to vote at the time of the respective vote (the “Numerator”),

divided by

(y) 0.49,

minus

(z) the Numerator. For purposes of illustration only, if the total issued and outstanding

shares of common stock of the Company eligible to vote at the time of the respective vote is 5,000,000, the voting rights of one

share of the Preferred Voting Stock shall be equal to 102,036 (0.019607 x 5,000,000) / 0.49) – (0.019607 x 5,000,000) = 102,036).

The investment manager of TCA Fund, TCA Fund Management Group (“TCA Management”), through its appointment by the General

Partner of TCA Fund, holds sole voting and dispositive power over the Series A Preferred. Bob Press is the Chief Executive Officer

of TCA Management.

|

|

|

|

|

(2)

|

As of the date hereof, the Company has 129,609,298 total aggregate votes of capital stock outstanding. TCA

Fund controls fifty-one (51) shares of Series A Preferred of the Company whereby each one (1) share has voting power of 1,296,066

votes for total aggregate voting power of 66,099,349 or 51% of the total outstanding voting power of the Company.

|

Item

1 Security and Issuer.

The

statement relates to 51 shares of the Company’s Series A Preferred. The principal executive office of the Company is located

at 12410 SE 282nd Avenue, Unit C, Boring, Oregon 97009.

Item

2 Identity and Background

The

Statement is being filed by TCA Global Credit Master Fund L.P. a Cayman Islands limited partnership (“TCA Fund”).

TCA

Fund’s address is as follows:

3960

Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89169

TCA

Fund is a short duration, absolute return fund specializing in senior secured lending and advisory services to small, publicly

listed companies predominately in the U.S., Canada, Western Europe and Australia.

During

the last five years neither TCA Fund nor any of its representatives has (i) been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors); or (ii) been a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction as a result of which proceeding he was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws.

Item

3 Source and Amount of Funds or Other Consideration.

TCA

Fund acquired the reported shares of Series A Preferred of the Company as follows:

TCA

Global Credit Master Fund L.P. (“TCA Fund”) is a Cayman Islands Limited Partnership. As previously disclosed, effective

December 7, 2015, the Company closed a Senior Secured Credit Facility Agreement (the “Credit Agreement”) by and among

the Company, as borrower, Grow Solutions, Inc., a Delaware corporation and One Love Garden Supply, a Colorado limited liability

company, as joint and several guarantors (such guarantors, collectively, the “Subsidiaries”) and TCA Fund as lender.

On

October 13, 2017, TCA Fund provided notice to the Company and the Subsidiaries of an Event of Default (as defined in the Credit

Agreement) which occurred and remained continuing and uncured for non-payment. Accordingly, on or about November 1, 2017 (the

“Effective Date”), TCA Fund demanded the Escrow Agent (as defined in the Credit Agreement) under the Pledge Agreement

to deliver to TCA Fund the Pledged Securities (as defined in the Pledge Agreement), along with all applicable Transfer Documents

(as defined in the Pledge Agreement), and TCA Fund became the registered owner of the Pledged Securities in accordance with the

terms of the Pledge Agreement.

Additionally,

in connection with the actions taken by TCA Fund under the Pledge Agreement, on the Effective Date, Grow Solutions Holdings, LLC,

a Colorado limited liability company (the “LLC”), and TCA Share Holdings LLC, a Nevada limited liability company controlled

by TCA Fund (“TCA Share Holdings”), entered into an Assignment Agreement whereby the LLC, as assignor, irrevocably

transferred and assigned to TCA Share Holdings, as assignee, all of the LLC’s right, title and interest in and to all of

the 51 shares of Series A Preferred Stock, $0.001 par value per share of the Company (the “Series A Preferred”) held

by the LLC, and TCA Share Holdings assumed all of the LLC’s right, title and interest in and to the Series A Preferred in

accordance with the terms of the Assignment Agreement. TCA Share Holdings is controlled by TCA Fund.

Item

4 Purpose of Transaction.

The

purpose of the acquisition of the securities of the Company by TCA Fund is the repayment of certain loans made by TCA Fund to

the Company under the terms and conditions of the Credit Agreement and related Transaction Documents (as defined in the Credit

Agreement).

As

of the date hereof, TCA Fund does not have any current plans or proposals which relate to or would result in: (a) the acquisition

of additional securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction,

such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a

material amount of assets of the Issuer or any of its subsidiaries; (d) any change in the present board of directors or management

of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on

the board; (e) any material change in the present capitalization or dividend policy of the Issuer; (f) any other material change

in the Issuer’s business or corporate structure; (g) any change in the Issuer’s charter, bylaws or instruments corresponding

thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities

of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer

quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming eligible

for termination of registration pursuant to section 12(g)(4) of the Exchange Act; or (j) any action similar to any of those enumerated

above.

Item

5 Interest in Securities of the Issuer.

(a)

As of the date hereof, TCA Fund controls 51 shares of Series A Preferred of the Company and such amount represents 100% of the

total issued and outstanding shares of the Company’s Series A Preferred. As of the date hereof, the Series A Preferred represents

a majority of the voting equity of the Company.

(b)

The Investment Manager of TCA Fund, TCA Management, holds sole voting and dispositive power over the Shares. Bob Press is the

Chief Executive Officer of TCA Management.

(c)

Other than disclosed below, there were no transactions by TCA Fund in the Company’s capital stock during the last 60 days:

(d)

No other person is known to have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds

from the sale of, the securities of the Company owned by TCA Fund.

(e)

Not applicable.

Item

6 Contracts, Agreements, Understandings or Relationships With Respect to Securities of the Issuer.

To

the knowledge of TCA Fund, there are no contracts, arrangements, understandings or relationships (legal or otherwise), including

but not limited to transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements,

puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies between Mr. Press

and/or any other person, with respect to any securities of the Company.

Item

7 Material to be Filed as Exhibits.

None.

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

TCA

GLOBAL CREDIT MASTER FUND LP

|

Date:

March 23, 2018

|

|

|

|

|

|

/s/

Bob Press

|

|

|

Name:

Bob Press

|

|

|

Title:

Chief Executive Officer

|

|

5

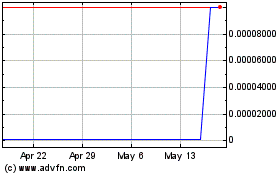

Grow Solutions (CE) (USOTC:GRSO)

Historical Stock Chart

From Feb 2025 to Mar 2025

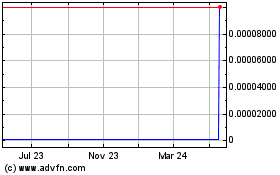

Grow Solutions (CE) (USOTC:GRSO)

Historical Stock Chart

From Mar 2024 to Mar 2025