Amended Statement of Beneficial Ownership (sc 13d/a)

December 07 2017 - 5:06AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)

GOLD

TORRENT, INC.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

38075A107

(CUSIP

Number)

Mr.

Daniel Kunz

Chief

Executive Officer

Gold

Torrent, Inc.

960

Broadway Avenue, Suite 530

Boise,

Idaho 83706

(208)

343-1413

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

April

11, 2017

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f), or 240.13d-1(g), check the following box.

[ ]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of Act but

shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No.

38075A107

|

1

|

NAMES

OF REPORTING PERSONS

Daniel

Kunz

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

[ ]

(b)

[ ]

|

|

3

|

SEC

USE ONLY

|

|

4

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

(Not

applicable)

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING PERSON

WITH

|

7

|

SOLE

VOTING POWER:

|

3,827,851

|

|

|

|

|

|

8

|

SHARED

VOTING POWER:

|

0

|

|

|

|

|

|

9

|

SOLE

DISPOSITIVE POWER:

|

3,827,851

|

|

|

|

|

|

10

|

SHARED

DISPOSITIVE POWER:

|

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,827,851 (1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS) [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

18.8% (2)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

(1)

|

Includes

3,536,184 shares of common stock of Gold Torrent, Inc. (the “Company”), of which 1,350,000 are restricted shares,

plus 133,333 presently exercisable options to acquire shares of common stock at an exercise price of $0.50 per share and 25,000

presently exercisable options to acquire shares of common stock at $1.38 per share. Does not include 266,667 unvested options

or 15,000 performance shares subject to vesting upon the closing of corporate finance transactions by the Company that exceed

$5 million in the aggregate and the commencement of construction of a mine and a mill on the Company’s Lucky Shot Project

in Willow, Alaska. With limited exceptions, the restricted shares held by Mr. Kunz cannot be sold or otherwise transferred

for the longer of: i) a one year period from the grant date; and, ii) the date when Company’s Lucky Shot Project is

in receipt of all required permits authorizations, licenses, certificates, and other necessary approvals required for and

achieves commercial production.

|

|

|

|

|

|

|

(2)

|

The

calculations set forth in Row (13) for Mr. Kunz is based on 20,110,552 shares of common stock outstanding as of December 1,

2017, as reported by the Company’s transfer agent, plus 158,333 shares of common stock issuable pursuant to the exercise

of options by Mr. Kunz within 60 days of the date of this report.

|

Amendment

No. 1 to Schedule 13D

This

Amendment No. 1 (“Amendment”) amends and supplements the Schedule 13D filed with the U.S. Securities and Exchange

Commission on September 10, 2013 (the “Schedule 13D”).

Except

as set forth in this Amendment, the Schedule 13D remains unchanged. Unless otherwise indicated, all capitalized terms used herein

but not defined herein shall have the same meaning as set forth in the Schedule 13D.

|

ITEM

1.

|

SECURITY

AND ISSUER

|

Item 1

of the Schedule 13D is hereby amended and restated by the following:

The

title and class of equity securities to which this Schedule 13D relates is Common Stock, par value $0.001 per share (“Common

Stock”), of Gold Torrent, Inc., a Nevada corporation (the “Company”). The address of the principal executive

offices of the Company is 960 Broadway Avenue, Suite 530, Boise, Idaho 83706.

|

ITEM

2.

|

IDENTITY

AND BACKGROUND

|

Item 2

of the Schedule 13D is hereby amended and restated by the following:

|

|

(a)

|

This

statement is being filed by Mr. Daniel Kunz (the “Reporting Person”).

|

|

|

|

|

|

|

(b)

|

The

Reporting Person’s business address is 960 Broadway Avenue, Suite 530, Boise, Idaho 83706.

|

|

|

|

|

|

|

(c)

|

The

Reporting Person is the Chief Executive Officer of the Company.

|

|

|

|

|

|

|

(d)

|

During

the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors).

|

|

|

|

|

|

|

(e)

|

During

the last five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining

future violations of, or prohibiting or mandating activities subject to, United States Federal or State securities laws or

finding any violations with respect to such laws.

|

|

|

|

|

|

|

(f)

|

The

Reporting Person is a citizen of the United States.

|

|

ITEM

3.

|

SOURCE

AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

Item 3

of the Schedule 13D is hereby amended and supplemented by the following:

On

April 11, 2017, the Reporting Person was granted by the Company 1,350,000 restricted shares of Common Stock as consideration for

the Reporting Person’s service as the Company’s Chief Executive Officer and Chairman of the Company’s Board

of Directors. These restricted shares of Common Stock were issued to the Reporting Person pursuant to the terms of the Company’s

2016 Stock Option and Stock Bonus Plan. With limited exceptions, the restricted shares held by the Reporting Person cannot be

sold or otherwise transferred for the longer of: i) a one year period from the grant date; and, ii) the date when Company’s

Lucky Shot Project is in receipt of all required permits authorizations, licenses, certificates, and other necessary approvals

required for and achieves commercial production. No consideration was paid by the Reporting Person in connection with the issuance

of these restricted shares of Common Stock.

On

April 7, 2017, the Reporting Person was granted 400,000 stock options to purchase shares of Common Stock at an exercise price

of $0.50 per share pursuant to the terms of the Company’s 2016 Stock Option and Stock Bonus Plan. These options, which were

granted to the Reporting Person in connection with their role as the Company’s Chief Executive Officer, vest incrementally

over a three year period with the initial 133,333 stock options vesting as of the grant date and the remaining two-thirds vesting

in equal amounts on April 7, 2018 and April 7, 2019, respectively. No consideration was paid by the Reporting Person in connection

with the issuance of these stock options.

On

June 23, 2015, the Reporting Person purchased from the Company 800,000 shares of Common Stock at a price of $0.25 per share. The

Reporting Person used his personal funds to pay the $200,000 purchase price for these shares, which were issued by the Company

pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended.

On

July 30, 2014, the Reporting Person was granted 25,000 stock options to purchase shares of Common Stock at an exercise price of

$1.38 per share pursuant to the terms of the Gold Torrent, Inc. 2013 Equity Incentive Plan. These options, which were granted

to the Reporting Person in connection with their role as the Company’s Chief Executive Officer, vest incrementally over

a three year period with the initial 16,667 stock options vesting as of the grant date while the remaining two-thirds vested in

equal amounts on July 30, 2016 and July 30, 2017, respectively. No consideration was paid by the Reporting Person in connection

with the issuance of these stock options.

On

February 26, 2014, the Reporting Person purchased from the Company 20,000 shares of Common Stock at a price of $1.25 per share.

The Reporting Person used his personal funds to pay the $25,000 purchase price for these shares, which were issued by the Company

pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended.

|

ITEM

5.

|

INTEREST

IN SECURITIES OF THE ISSUER

|

Item 5

of the Schedule 13D is hereby amended and restated by the following:

|

(a)

|

As

of the date this Amendment, the Reporting Person beneficially owns 3,827,851 shares of the Company’s Common Stock,

which includes 3,536,184 shares of Common Stock, of which 1,350,000 are restricted shares, plus 133,333 presently exercisable

options to acquire shares of Common Stock at an exercise price of $0.50 per share and 25,000 presently exercisable options

to acquire shares of Common Stock at an exercise price of $1.38 per share. Does not include 266,667 unvested options or

15,000 performance shares subject to vesting upon the closing of corporate finance transactions by the Company that exceed

$5 million in the aggregate and the commencement of construction of a mine and a mill on the Company’s Lucky Shot

Project in Willow, Alaska. With limited exceptions, the restricted shares held by the Reporting Person cannot be sold

or otherwise transferred for the longer of: i) a one year period from the grant date; and, ii) the date when Company’s

Lucky Shot Project is in receipt of all required permits authorizations, licenses, certificates, and other necessary approvals

required for and achieves commercial production.

The

number of shares of Common Stock beneficially owned by the Reporting Person represents approximately 18.8% of the partially

diluted outstanding Common Stock, based on 20,110,552 shares of Common Stock outstanding as of December 1, 2017, as reported

by the Company’s transfer agent, plus 158,333 shares of Common Stock issuable pursuant to the exercise of options

by the Reporting Person within 60 days of the date of this Amendment.

|

|

|

|

|

(b)

|

The

Reporting Person may be deemed to hold sole voting and dispositive power over 3,827,851 shares of Common Stock of the Company.

The Reporting Person does not have shared voting or dispositive power over any shares of Common Stock.

|

|

|

|

|

(c)

|

Other

than the acquisition of the shares of Common Stock as reported herein, the Reporting Person has not affected any transactions

in the shares of the Company’s Common Stock during the past 60 days or since the most recent filing of Schedule 13D,

whichever is less.

|

|

|

|

|

(d)

|

To

the best knowledge of the Reporting Person, no person other than the Reporting Person has the right to receive, or the power

to direct the receipt of, dividends from, or the proceeds from the sale of the 3,827,851 shares of Common Stock reported in

Item 5(a).

|

|

|

|

|

(e)

|

Not

applicable.

|

|

ITEM

6.

|

Contracts,

Arrangements, Understandings or Relationships

|

Item 6

of the Schedule 13D is hereby amended and supplemented by the following:

The

1,350,000 restricted shares of Common Stock held by the Reporting Person are subject to transfer restrictions that were outlined

by the Company to the Reporting Person at the time of issuance. With limited exceptions, the restricted shares of Common Stock

held by the Reporting Person cannot be sold or otherwise transferred for the longer of: i) a one year period from the grant date;

and, ii) the date when Company’s Lucky Shot Project is in receipt of all required permits authorizations, licenses, certificates,

and other necessary approvals required for and achieves commercial production.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

Date:

December 7, 2017

|

|

/s/

Daniel Kunz

|

|

|

Name:

|

Daniel Kunz

|

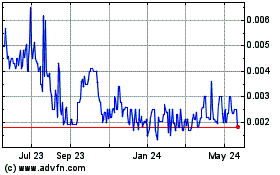

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

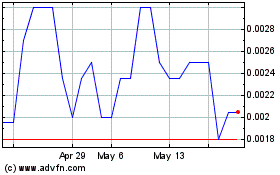

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Feb 2024 to Feb 2025