Current Report Filing (8-k)

March 07 2018 - 3:34PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 28, 2018

GOLD

TORRENT, INC.

(Exact

name of Registrant as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation or organization)

|

000-53872

|

|

06-1791524

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification No.)

|

960

Broadway Avenue, Suite 530, Boise, Idaho 83706

(Address

of Office)

(208)

343-1413

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Explanatory

Note

On

February 28, 2018, Gold Torrent, Inc. (“Gold Torrent US”) completed a corporate reorganization pursuant to which Gold

Torrent (Canada) Inc., a company organized under the laws of British Columbia, Canada (“Gold Torrent”), became the

parent company of Gold Torrent US (the “Redomicile Transaction”). The Redomicile Transaction was effected pursuant

to a previously announced Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 19, 2017, between

Gold Torrent US, a Nevada corporation, GTOR Merger Co, a Nevada corporation and wholly owned subsidiary of Gold Torrent Canada

(“US Merger Co”), and Gold Torrent Canada. At the effective time of the merger (the “Effective Time”),

(i) US Merger Co was merged with Gold Torrent US, with Gold Torrent US surviving the merger as a wholly owned subsidiary of Gold

Torrent Canada, and (ii) each issued share of common stock, par value US $0.001 per share, of Gold Torrent US (“Gold Torrent

US Common Stock”), other than those shares of Gold Torrent US Common Stock held by Gold Torrent US in treasury, was effectively

transferred to Gold Torrent Canada and converted into one common share, no par value, of Gold Torrent Canada (a “Gold Torrent

Canada Common Share”). An aggregate of approximately 20,110,552 Gold Torrent Canada Common Shares were issued at the Effective

Time as merger consideration in the Redomicile Transaction. Gold Torrent Canada intends to arrange for the Gold Torrent Canada

Common Shares to be quoted on the OTCQB Venture Market subsequent to the Effective Time.

The

issuance of the Gold Torrent Canada Common Shares in the Redomicile Transaction was registered under the Securities Act of 1933,

as amended (the “Securities Act”), pursuant to a registration statement on Form S-4 (File No. 333-221123) (as amended,

the “Registration Statement”) filed by Gold Torrent Canada, which was declared effective by the U.S. Securities and

Exchange Commission (the “SEC”) on January 26, 2018. The information set forth under the heading “Approval

of the Merger Agreement” in the proxy statement/prospectus dated January 26, 2018 included in the Registration Statement

is incorporated herein by reference.

Since

upon the completion of the Redomicile Transaction the total number of holders of Gold Torrent Canada Common Shares was less than

300 persons, pursuant to Rule 12g-3(a)(2) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

Gold Torrent Canada will not be the successor issuer to Gold Torrent US for the purposes of Rule 12g-3(a) under the Exchange Act,

and consequently, the Gold Torrent Canada Common Shares are not deemed to be registered under Section 12(g) of the Exchange Act

as a result of the completion of the Redomicile Transaction. However, Gold Torrent Canada is now subject to the informational

requirements of Section 15(d) of the Exchange Act pursuant to Section 15(d)(1), and consequently will file the reports required

under Section 15(d) of the Exchange Act, while Gold Torrent US expects to file a Form 15 with the SEC to terminate the registration

and suspend its reporting obligations under the Exchange Act with respect to the Gold Torrent US Common Stock.

The

foregoing summary of the Merger Agreement is qualified in its entirety by reference to the full text of the Merger Agreement,

which is filed as Exhibit 2.1 to this Current Report on Form 8-K.

|

Item

3.03

|

Material

Modification to Rights of Security Holders.

|

Description

of Gold Torrent Canada’s Share Capital

Set

forth below is a description of Gold Torrent Canada’s share capital at the Effective Time. Such summary of the notice of

articles and articles does not purport to be complete and is qualified in its entirety by reference to the British Columbia Business

Corporations Act and the complete text of the notice of articles and articles, which are filed as Exhibits 3.1 and 3.2 to this

Current Report on Form 8-K.

Authorized

Share Capital

The

authorized share capital of Gold Torrent Canada consists of an unlimited number of Gold Torrent Canada Common Shares, without

par value. The rights and restrictions to which the Gold Torrent Canada Common Shares are subject is set out in Gold Torrent Canada’s

articles.

Common

Shares

Voting

Rights

Holders

of Gold Torrent Canada Common Shares are entitled to one vote for each share held of record on all matters submitted to a vote

of the shareholders, have the right to vote for the election of directors and will not have cumulative voting rights. Regarding

special resolutions at meetings of shareholders, the majority of votes required for Gold Torrent Canada to pass a special resolution

at a general meeting of shareholders is two-thirds of the votes cast on the resolution.

Dividends

Holders

of Gold Torrent Canada Common Shares will be entitled to receive ratably in proportion to the number of Gold Torrent Canada Common

Shares held by them such dividends (payable in cash, shares or otherwise), if any, as may be declared from time to time by the

Gold Torrent Canada board of directors out of funds available for dividend payments. Dividends will not be declared where there

are reasonable grounds for believing Gold Torrent Canada is insolvent or the payment of dividends would render Gold Torrent insolvent.

All outstanding Gold Torrent Canada Common Shares are fully paid and non-assessable. There is not be a fixed rate of dividends.

Conversion,

Sinking fund, Redemption, Liquidation and Preemption Rights

The

holders of Gold Torrent Canada Common Shares have no preferences or rights of conversion, exchange, pre-emption or other subscription

rights. There are no redemption or sinking fund provisions applicable to the Gold Torrent Common Shares. In the event of any voluntary

or involuntary liquidation, dissolution or winding-up of Gold Torrent Canada’s affairs, holders of Gold Torrent Canada Common

Shares will be entitled to share ratably in Gold Torrent Canada’s assets in proportion to the Gold Torrent Canada Common

Shares held by them that are remaining after payment or provision for payment of all of Gold Torrent Canada’s debts and

obligations.

Notice

of Articles and Articles

Provisions

of Gold Torrent Canada’s notice of articles and articles may delay or discourage transactions involving an actual or potential

change in control or change in Gold Torrent Canada management, including transactions in which shareholders might otherwise receive

a premium for their shares, or transactions that Gold Torrent Canada’s shareholders might otherwise deem to be in their

best interests. Therefore, these provisions could adversely affect the price of the Gold Torrent Canada Common Shares.

These

provisions are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed

to encourage persons seeking to acquire control of Gold Torrent Canada to first negotiate with Gold Torrent Canada’s management.

Gold Torrent Canada’s management believes that the benefits of increased protection and the potential ability to negotiate

with the proponent of an unfriendly or unsolicited proposal to acquire or restructure Gold Torrent Canada outweigh the disadvantages

of discouraging these proposals because, among other things, negotiation of these proposals could result in an improvement of

their terms.

Among

other things, the notice of articles and articles:

|

|

●

|

provide

that Gold Torrent Canada’s directors may only be removed by shareholders passing a special resolution with the requisite

special majority of two-third of the votes cast at a meeting of shareholders entitled to vote in the election of directors,

voting together as a single class;

|

|

|

|

|

|

|

●

|

provide

that the authorized number of directors may only be set by the board of directors;

|

|

|

|

|

|

|

●

|

provide

that all vacancies, including newly created directorships, may, except as otherwise required by law, be filled by the affirmative

vote of a majority of directors then in office; and

|

|

|

|

|

|

|

●

|

provide

that Gold Torrent Canada’s notice of articles and articles can be amended or repealed at any regular or special meeting

of shareholders or amended by the board of directors in certain circumstances, including the requirement that most amendments

by the shareholders at a meeting be upon the affirmative vote of at least 66 2/3% of the voting power of the issued and outstanding

shares generally entitled to vote on such matters.

|

When

interpreting a director’s duties under British Columbia law, Canadian courts have generally interpreted a director’s

duty to act in “the best interest of the company” to comprehend a duty to treat all stakeholders affected by corporate

actions equitably and fairly, including in the context of a change of control transaction. Accordingly, in determining what is

in “the best interests of the company”, it may be legitimate for Gold Torrent Canada’s directors to consider

the interests of not only Gold Torrent Canada’s shareholders, but other stakeholders, such as employees and creditors, as

well.

Limitation

of Liability and Indemnification Matters

British

Columbia law provides that directors of a company will not be personally liable for monetary damages for breach of their fiduciary

duty as directors, except for liabilities:

|

|

●

|

if

the indemnity or payment is made under an earlier agreement to indemnify or pay expenses and, at the time that the agreement

to indemnify or pay expenses was made, the company was prohibited from giving the indemnity or paying the expenses by its

articles;

|

|

|

|

|

|

|

●

|

if

the indemnity or payment is made otherwise than under an earlier agreement to indemnify or pay expenses and, at the time that

the indemnity or payment is made, the company is prohibited from giving the indemnity or paying the expenses by its articles;

|

|

|

|

|

|

|

●

|

if,

in relation to the subject matter of the relevant proceeding, the director did not act honestly and in good faith with a view

to the best interests of the company or the associated corporation, as the case may be, with such associated corporation being

an affiliate of the company or a partnership, trust, joint venture or other unincorporated entity in which the director served

in the capacity as a director or a position equivalent to that thereof, at the request of the company; or

|

|

|

|

|

|

|

●

|

in

the case of the relevant proceeding other than a civil proceeding, if the director did not have reasonable grounds for believing

that the director’s conduct in respect of which the proceeding was brought was lawful.

|

Any

amendment, repeal or modification of these provisions would be prospective only and would not affect any limitation on liability

of a director for acts or omissions that occurred prior to any such amendment, repeal or modification.

Gold

Torrent Canada’s articles also provide that Gold Torrent Canada will indemnify its directors and officers to the fullest

extent permitted by British Columbia law. Gold Torrent Canada’s articles also permit us to purchase insurance on behalf

of any officer, director, employee or other agent of Gold Torrent Canada or, at Gold Torrent Canada’s request, of another

entity, for any liability arising out of that person’s actions in such capacity, regardless of whether British Columbia

law would permit indemnification.

|

Item

5.01

|

Changes

in Control of the Registrant.

|

The

information included under the heading “Explanatory Note” above is incorporated herein by reference.

|

Item

5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

|

At

the Effective Time, pursuant to the terms of the Merger

Agreement, Daniel Kunz and Ryan Hart, the directors of US Merger Co. immediately prior to the Effective Time became the directors

of Gold Torrent US, while the executive officers of Gold Torrent US immediately prior to the Effective Time continued to serve

as executive officers of Gold Torrent US in the same respective position(s) as each such executive officer held prior to the Redomicile

Transaction.

All

executive officers and directors of Gold Torrent US will hold such positions until their death, resignation or removal or until

their respective successors are duly elected or appointed.

Biographical

i

nformation concerning each of the directors and executive

officers of Gold Torrent US is included in Gold Torrent US’s proxy statement on Schedule 14A filed on January 26, 2018.

Executive

Compensation Arrangements

Following

the Effective Time, Gold Torrent US continued to assume the obligations under the consulting agreements with Ryan Hart and Daniel

Kunz & Associates LLC (“Kunz LLC”). The Redomicile Transaction is not considered a “change of control”

for purposes of any of the consulting agreements between Gold Torrent US, Ryan Hart and Kunz LLC, and no payments, accelerated

vesting or benefit enhancements were triggered by the Redomicile Transaction under such agreements.

Assumed

Equity Plans

At

the Effective Time and pursuant to the Merger Agreement, Gold Torrent Canada assumed the following Gold Torrent US equity compensation

plans, including all options and awards issued or granted under such plans: (i) the Gold Torrent, Inc. 2013 Equity Incentive Plan,

and (ii) the Gold Torrent, Inc. 2016 Stock Option and Stock Bonus Plan (collectively, the “Assumed Plans”).

In

connection with the assumption of the Assumed Plans, each Assumed Plan was deemed amended pursuant to the Merger Agreement to

provide that, as of the Effective Time, Gold Torrent Canada Common Shares will be issued to satisfy awards issued or granted under

such Assumed Plans. The outstanding options or other awards or benefits available under the terms of the Assumed Plans shall,

to the extent permitted by law and otherwise reasonably practicable, otherwise be exercisable, payable, issuable or available

upon the same terms and conditions as under such Assumed Plans and the agreements relating thereto immediately prior to the Effective

Time (including, for greater certainty, having the same option exercise or measurement price).

The

information included under the heading “Explanatory Note” above is incorporated herein by reference.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

2.1

|

|

Agreement

and Plan of Merger dated October 19, 2017, by and among Gold Torrent, Inc., Gold Torrent (Canada) Inc., and GTOR US Merger

Co. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K (file no. 000-53872) filed on October 20,

2017).

|

|

|

|

|

|

3.1

|

|

Notice

of Articles of Gold Torrent (Canada) Inc. (incorporated by reference to Annex B of Gold Torrent, Inc.’s proxy statement

on Schedule 14A (file no. 000-53872) filed on January 26, 2018).

|

|

|

|

|

|

3.2

|

|

Articles

of Gold Torrent (Canada) Inc. (incorporated by reference to Annex B of Gold Torrent, Inc.’s proxy statement on Schedule

14A (file no. 000-53872) filed on January 26, 2018).

|

|

|

|

|

|

4.1

|

|

Form

of Common Share Certificate.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

GOLD

TORRENT, INC.

|

|

|

|

|

|

/s/

Alexander Kunz

|

|

|

Alexander

Kunz

|

|

|

Chief

Financial Officer

|

|

|

|

|

Date:

March 6, 2018

|

|

EXHIBIT

INDEX

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

2.1

|

|

Agreement

and Plan of Merger dated October 19, 2017, by and among Gold Torrent, Inc., Gold Torrent (Canada) Inc., and GTOR US Merger

Co. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K (file no. 000-53872) filed on October 20,

2017).

|

|

|

|

|

|

3.1

|

|

Notice

of Articles of Gold Torrent (Canada) Inc. (incorporated by reference to Annex B of Gold Torrent, Inc.’s proxy statement

on Schedule 14A (file no. 000-53872) filed on January 26, 2018).

|

|

|

|

|

|

3.2

|

|

Articles

of Gold Torrent (Canada) Inc. (incorporated by reference to Annex B of Gold Torrent, Inc.’s proxy statement on Schedule

14A (file no. 000-53872) filed on January 26, 2018).

|

|

|

|

|

|

4.1

|

|

Form

of Common Share Certificate.

|

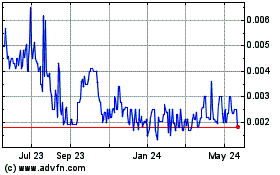

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

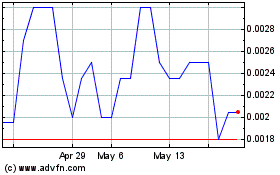

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Jan 2024 to Jan 2025