Regulatory News:

Performance Q1 2020

Group (Million CHF) Q1 2020 Q1 2019 +/-% +/-%LfL

Net sales 5,293 5,959 -11.2 -3.3

Recurring EBIT 262 305 -14.1 -2.6

Jan Jenisch, CEO: "We are confronting an unprecedented health

crisis with COVID-19 that is changing how we live and how we work

in many ways. Keeping our employees healthy and safe is our number

one priority and core value. In early January, when the first signs

of the pandemic emerged, we were quick to respond and take all the

necessary measures to protect the health of our people while

supporting our partners and communities, in full alignment with

local authorities across our markets.

I am very proud of how our people have gone above and beyond to

engage in relief work worldwide. Building on our long tradition of

working closely with our communities, our teams are actively

supporting health efforts around the world - from participating in

the rapid construction of emergency field hospitals to sanitizing

public spaces and disposing of medical waste all the way to

providing critical supplies such as personal protective

equipment.

This crisis highlights how essential construction is to keep

society running. I would like to extend my sincere gratitude to all

our people around the world whose swift response to our new reality

has been exemplary. It has allowed us to maintain vital business

continuity so that we can play our role to address this crisis. I

applaud the determination of all our front-line workers who are

providing critical materials and services in challenging lockdown

circumstances.

Our Q1 results show how resilient we are as a business. With our

significantly strengthened balance sheet, we are in a very strong

position to weather this storm. We are currently successfully

executing our action plan "HEALTH, COST & CASH" in all

countries, setting the company up for the recovery of our markets.

I am confident that LafargeHolcim will emerge from this pandemic as

an important contributor to economic recovery as building activity

gets back to normal."

STRONG PERFORMANCE IN CHANGING MARKET CONDITIONS

The company had a strong start to the year as Q1 performance

remained well ahead of last year's results until Mid-March, when

the impact of COVID-19 spread beyond China into all business

regions. Nevertheless Q1 results remained resilient with net sales

of -3.3% and Recurring EBIT -2.6% compared to the prior-year

period, both on a like-for-like basis.

Europe delivered solid results despite disruptions in key

markets, with good market growth in Eastern Europe and resilient

performances in Switzerland and Germany. Volumes in France, the UK

and Spain were impacted by COVID-19. Recurring EBIT improved on a

like-for-like basis as a result of operational efficiencies.

North America delivered excellent improvement in volume growth

across all business segments. The region showed a continuation of

strong cement demand trends from 2019, further supported by

favorable weather, while aggregate volume improvement of 12% in the

quarter was driven by megaprojects along the Mississippi River. The

US and Canadian operations both delivered solid industrial

performances, with only minor impact from COVID-19 in the

quarter.

Latin America delivered a resilient performance, led by a solid

performance in Mexico. Brazil, Argentina, Ecuador and Colombia were

impacted by COVID-19 lockdown measures since mid-March. The

Recurring EBIT margin was resilient thanks to effective price and

cost management.

Performance of Asia Pacific was impacted by the COVID-19

outbreak, with China significantly impacted in Q1. There was strong

profitability improvement in India despite lockdown measures

towards the end of March. The market slowdown in Australia

continued.

Middle East Africa delivered an over-proportional increase in

Recurring EBIT with turnaround initiatives offsetting COVID-19

impact in the region. Nigeria, Algeria and Iraq were solid

contributors, while South Africa and Lebanon were impacted by

lockdown measures.

CREDIT RATING CONFIRMED, STRONG LIQUIDITY SECURED

LafargeHolcim has a strong balance sheet and liquidity, with a

ratio of Net Financial Debt to Recurring EBITDA of 1.5x as at the

end 2019. As at the end of the quarter the company had secured

strong liquidity of CHF 8 billion in cash and unused committed

credit lines.

These strengths were recently confirmed on March 27, 2020, when

S&P re-affirmed its BBB / outlook stable credit rating of

LafargeHolcim, then again on April 20, 2020, when Moody's

re-affirmed its rating of Baa2 / outlook stable.

The company also executed successful re-financing in April 2020

by issuing a two-year, CHF 250 million 1.05% bond and a five-year,

EUR 500 million 2.375% bond.

ACTION PLAN "HEALTH, COST & CASH"

Since the beginning of the COVID-19 pandemic, LafargeHolcim has

taken all necessary measures to protect its employees and partners.

The company is closely monitoring all markets according to the

evolving situation and to the guidance provided by the authorities

in each country.

The development of the COVID-19 pandemic and its implications

for the business remains volatile and very different from country

to country. With a sharp focus on business resilience, the action

plan "HEALTH, COST & CASH" is in full execution to meet the

following targets:

-- Reduction of CAPEX by at least CHF 400 million compared to 2019

-- Reduction in fixed costs by CHF 300 million in 2020

-- Realization of the reduction in energy prices and review of all third

party products and services

-- Reduction of Net Working Capital at least in line with the level of

activity

SUPPORTING PREVENTION AND MITIGATION OF COVID-19

To promote the health and well-being of the communities where it

operates, LafargeHolcim has been implementing an extraordinary

range of measures at country level from the very start of the

pandemic, to support health efforts around the world. Services

include:

-- Supplying concrete and other building materials for emergency field

hospitals and other public health infrastructure

-- Driving public hygiene, from disposing of medical waste to sanitizing

public spaces

-- Leading awareness campaigns with employees, partners and communities

-- Providing critical products such as masks, gloves and sanitizer gels

-- Delivering basic goods such as prepared meals and water

In Wuhan and surrounding cities, for example, thousands of tons

of cement have been donated for the rapid construction of makeshift

hospitals. Reaching out to local authorities proactively to offer

their support, local teams managed to execute on tight delivery

schedules despite severe limitations on the movement of people and

equipment, thus enabling the facilities' ultra-fast construction.

Local teams further supported public authorities with the disposal

of COVID-19 related medical waste, while leading prevention

awareness campaigns and donating personal protective equipment and

basic goods.

For more information on our response to COVID-19, please visit

the dedicated section on our website, www.lafargeholcim.com.

OUTLOOK

LafargeHolcim is well-positioned to weather the crisis. The

company is supported by a strong balance sheet, with a ratio of Net

Financial Debt to Recurring EBITDA at 1.5x as at the end of 2019.

The company has secured strong liquidity of CHF 8 billion and both

credit ratings were recently confirmed.

Early implementation and execution of the action plan "HEALTH,

COST & CASH" will further strengthen business resilience.

The biggest impact from COVID-19 is expected in Q2. The full

impact of the crisis on the company's 2020 results cannot be

assessed at this point. Given the encouraging April data on the

rebound of activity in China, the company looks forward with

confidence. More fundamentally, the building industry is resilient

and expected to benefit from future recovery plans from governments

and central banks.

GROUP AND REGIONAL FIGURES

Group Q1 2020 Q1 2019 +/-% +/-%LfL

Sales of cement (mt) 44.9 50.1 -10.4 -5.2

Sales of aggregates (mt) 49.1 49.6 -1.1 0.5

Sales of ready-mix concrete (m m(3) ) 9.8 11.4 -13.8 -8.5

Net sales (CHFm) 5,293 5,959 -11.2 -3.3

Recurring EBIT (CHFm) 262 305 -14.1 -2.6

Asia Pacific Q1 2020 Q1 2019 +/-% +/-%LfL

Sales of cement (mt) 15.8 20.9 -24.3 -12.3

Sales of aggregates (mt) 5.6 6.6 -14.7 -4.3

Sales of ready-mix concrete (m m(3) ) 2.1 2.9 -27.7 -3.8

Net sales to external customers (CHFm) 1,327 1,745 -23.9 -9.2

Recurring EBIT (CHFm) 169 243 -30.3 -20.7

Europe Q1 2020 Q1 2019 +/-% +/-%LfL

Sales of cement (mt) 9.3 9.5 -2.3 -2.3

Sales of aggregates (mt) 25.5 26.2 -3.0 -2.8

Sales of ready-mix concrete (m m(3) ) 4.1 4.6 -10.5 -11.0

Net sales to external customers (CHFm) 1,569 1,703 -7.9 -3.9

Recurring EBIT (CHFm) 27 22 23.3 9.3

Latin America Q1 2020 Q1 2019 +/-% +/-%LfL

Sales of cement (mt) 5.6 5.9 -5.9 -5.9

Sales of aggregates (mt) 1.2 0.9 34.9 34.9

Sales of ready-mix concrete (m m(3) ) 1.0 1.2 -16.5 -16.5

Net sales to external customers (CHFm) 565 636 -11.2 -0.5

Recurring EBIT (CHFm) 159 176 -9.6 -2.7

Middle East Africa Q1 2020 Q1 2019 +/-% +/-%LfL

Sales of cement (mt) 8.4 8.8 -4.8 -4.8

Sales of aggregates (mt) 1.0 1.7 -43.6 -43.6

Sales of ready-mix concrete (m m(3) ) 0.7 1.0 -23.2 -23.2

Net sales to external customers (CHFm) 650 736 -11.6 -7.2

Recurring EBIT (CHFm) 74 75 -2.1 3.3

North America Q1 2020 Q1 2019 +/-% +/-%LfL

Sales of cement (mt) 3.6 3.4 8.0 8.0

Sales of aggregates (mt) 15.9 14.2 11.5 11.9

Sales of ready-mix concrete (m m(3) ) 1.9 1.8 7.6 5.5

Net sales to external customers (CHFm) 1,019 951 7.2 10.0

Recurring EBIT (CHFm) -76 -114 33.9 31.5

RECONCILIATION TO GROUP ACCOUNTS

Reconciling measures of profit and loss to the consolidated

statement of income of LafargeHolcim

Million CHF Q1 2020 Q1 2019

Recurring EBITDA 838 920

Depreciation of right-of-use assets -97 -107

Recurring EBITDA after leases 741 813

Depreciation and amortization -479 -508

Recurring EBIT 262 305

Restructuring, litigation, implementation and other

non-recurring costs -13 -18

Impairment of operating assets -4 1

Operating profit 244 288

ADDITIONAL INFORMATION

Non-GAAP definitions

Some non-GAAP measures are used in this release to help describe

the performance of LafargeHolcim. A full set of these non-GAAP

definitions can be found on our website.

Analyst presentation

The analyst presentation of the first quarter trading update is

available on our website at www.lafargeholcim.com.

Media conference: 09:00 CEST Analyst conference: 10:00 CEST

Switzerland: +41 58 310 5000

France: +33 1 7091 8706

UK: +44 207 107 0613

US: +1 631 570 5613

ABOUT LAFARGEHOLCIM

LafargeHolcim is the global leader in building materials and

solutions and active in four business segments: Cement, Aggregates,

Ready-Mix Concrete and Solutions & Products. Its ambition is to

lead the industry in reducing carbon emissions and shifting towards

low-carbon construction. With the strongest R&D organization in

the industry, the company seeks to constantly introduce and promote

high-quality and sustainable building materials and solutions to

its customers worldwide - whether individual homebuilders or

developers of major infrastructure projects. LafargeHolcim employs

over 70,000 employees in over 70 countries and has a portfolio that

is equally balanced between developing and mature markets.

More information is available on www.lafargeholcim.com

Important disclaimer -- forward-looking statements:

This document contains forward-looking statements. Such

forward-looking statements do not constitute forecasts regarding

results or any other performance indicator, but rather trends or

targets, as the case may be, including with respect to plans,

initiatives, events, products, solutions and services, their

development and potential. Although LafargeHolcim believes that the

expectations reflected in such forward-looking statements are based

on reasonable assumptions as at the time of publishing this

document, investors are cautioned that these statements are not

guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are difficult to

predict and generally beyond the control of LafargeHolcim,

including but not limited to the risks described in the

LafargeHolcim's annual report available on its website

(www.lafargeholcim.com) and uncertainties related to the market

conditions and the implementation of our plans. Accordingly, we

caution you against relying on forward-looking statements.

LafargeHolcim does not undertake to provide updates of these

forward-looking statements.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200429005915/en/

CONTACT: Media Relations: media@lafargeholcim.com

+41 (0) 58 858 87 10

Investor Relations: investor.relations@lafargeholcim.com

+41 (0) 58 858 87 87

SOURCE: LafargeHolcim

Copyright Business Wire 2020

(END) Dow Jones Newswires

April 30, 2020 00:45 ET (04:45 GMT)

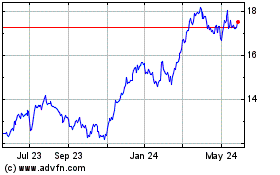

Holcim (PK) (USOTC:HCMLY)

Historical Stock Chart

From Feb 2025 to Mar 2025

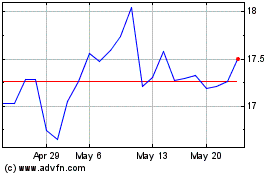

Holcim (PK) (USOTC:HCMLY)

Historical Stock Chart

From Mar 2024 to Mar 2025