UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): February 11, 2014

_______________________________

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 — REGISTRANT'S

BUSINESS AND OPERATIONS

| Item 1.01 |

Entry into a Material Definitive Agreement. VODWIZ Subscription Model - The Company's newly-launched venture for a "Video-On-Demand" website and IPTV Portal has completed the test-phase of the servicing venture with Nanotech Entertainment. Under the originally structured and announced business model for this new venture, Hannover House titles (along with more than 2,500 titles from other independent distributors, and select major studio suppliers), would be offered to consumers for Video-On-Demand streaming under a "pay-per-transaction" basis. The beta test (involving approximately 50 titles exclusively from the Hannover House library) provided verification of the operational functionality of the venture and PPT model. However, in response to feedback from consumers and from participating studio suppliers, the option of offering consumers a monthly or annualized "subscription" access model (for a pre-determined and modest flat-fee), has been explored for VODWIZ. Principal competitors Hulu Plus, Amazon Prime and Netflix generate a majority of their streaming revenues through this sort of flat-fee subscription model, as compared to the PPT model. After discussing the possibility of offering VODWIZ consumers the option of a monthly or annual subscription with the VODWIZ principal supplier sources, it was determined that a revenue-sharing formula based on the actual monthly transactions for each title (as compared to the total of all transactions for VODWIZ), could serve as a fair mechanism to determine the pro-rata disbursement of subscription revenues across all participating subscription titles. As this subscription model option will be reflected in more than ten separate licensing agreements with participating studio suppliers, and in consideration that the addition of a subscription model could positively impact revenues by many millions of dollars, HHSE Management has elected to disclose the decision to add this option to all VODWIZ supplier agreements. Although the Company has not yet determined the ideal "monthly" subscription rate (or discounted annual rate), management does feel that VODWIZ can operate profitably while still offering a significantly sharper monthly subscription price than is currently available through its principal competitors. |

|

| Item 1.02 |

Termination of a Material Definitive Agreement. Not Applicable. |

|

| Item 1.03 |

Bankruptcy or Receivership. Not Applicable. |

|

SECTION 2 — FINANCIAL INFORMATION

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. Not Applicable. |

|

| Item 2.02 |

Results of Operations and Financial Condition.

Company released its financial results and compliance filings

for the three-month period ending December 31, 2013, which financials, along with additionally required compliance filings and

disclosures, will be posted later this month onto the OTC Markets website under ticker symbol: HHSE. Primary financial reports

are attached hereto as Exhibits. For the Q4 reporting period, Company posted revenues of $1,167,594, with an operating, pre-tax

profit of $331,402. The revenue results represent an increase of approximately two-hundred-ninety-five percent (295%) as compared

to the same reporting quarter last year; the operating, pre-tax profit results represent an increase of two-hundred-twenty-three

percent (223%) as compared against the prior year's income for the same quarter.

General and Administrative Expenses for Q4 were $69,596,

which represents a reduction of $23,165 from the Company's Q4 (2013) G&A period last year. The year-over-year reduction is

attributable primarily to a reduction in staff, including the termination of a sales consulting arrangement for DVD's and Blu-Ray

products. |

|

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. Not Applicable. |

|

| Item 2.04 |

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. Not Applicable. |

|

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. Not Applicable. |

|

| Item 2.06 |

Material Impairments. Not Applicable. |

|

SECTION 3 — SECURITIES AND

TRADING MARKETS

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. Not Applicable. |

|

| Item 3.02 |

Unregistered Sales of Equity Securities. Not Applicable. |

|

| Item 3.03 |

Material Modification to Rights of Security Holders. Not Applicable. |

|

SECTION 4 — MATTERS RELATED

TO ACCOUNTANTS AND FINANCIAL STATEMENTS

| Item 4.01 |

Changes in Registrant’s Certifying Accountant. Not Applicable. |

|

| Item 4.02 |

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. Not Applicable. |

|

SECTION 5 — CORPORATE GOVERNANCE

AND MANAGEMENT

| Item 5.01 |

Changes in Control of Registrant. Not Applicable. |

|

| Item 5.02 |

Not Applicable |

|

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. Not Applicable. |

|

| Item 5.04 |

Temporary Suspension of Trading Under Registrant's Employee Benefit Plans. Not Applicable. |

|

| Item 5.05 |

Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. Not Applicable. |

|

| Item 5.06 |

Change in Shell Company Status. Not Applicable. |

|

SECTION 6 — ASSET-BACKED

SECURITIES

| Item 6.01 |

ABS Informational and Computational Material. Not Applicable. |

|

| Item 6.02 |

Changes in Servicer or Trustee. Not Applicable. |

|

| Item 6.03 |

Change in Credit Enhancement or Other External Support. Not Applicable. |

|

| Item 6.04 |

Failure to Make a Required Distribution. Not Applicable. |

|

| Item 6.05 |

Securities Act Updating Disclosure. Not Applicable. |

|

SECTION 7 — REGULATION FD

| Item 7.01 |

Regulation FD Disclosure. Not Applicable. |

|

SECTION 8 — OTHER EVENTS

| Item 8.01 |

Other Events. Not Applicable. |

|

SECTION 9 — FINANCIAL STATEMENTS

AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

|

| |

(a) Financial statements of businesses acquired. Not Applicable. |

|

| |

(b) Pro forma financial information. Not Applicable. |

|

| |

(c) Shell company transactions. Not Applicable. |

|

| |

(d) Exhibits. |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: February 11, 2014 |

Hannover House, Inc. |

| |

By |

/s/ Eric F. Parkinson |

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

INDEX TO EXHIBITS

| Exhibit No. |

|

Description |

| 1 |

|

Quarterly Financial Results for the three-month period and year ending Dec. 31, 2013 |

| |

|

|

HANNOVER HOUSE, INC.

CONSOLIDATED STATEMENT OF INCOME &

RETAINED EARNINGS

FOR THE THREE-MONTH PERIOD ENDING DEC.

31, 2013 (UNAUDITED)

| |

|

|

|

|

| REVENUES |

|

|

|

|

| Product Sales (including International Licenses) * |

|

$ |

1,153,601 |

|

| Additional VOD Revenue-Share Income |

|

$ |

13,993 |

|

| TOTAL REVENUES |

|

$ |

1,167,594 |

|

| |

|

|

|

|

| COST OF SALES |

|

|

|

|

| Commissions |

|

$ |

0 |

|

| Sales and Marketing |

|

$ |

2,922 |

|

| Video Manufacturing |

|

$ |

10,227 |

|

| Film and Book Royalties |

|

$ |

900 |

|

| Freight |

|

$ |

2,547 |

|

| Other Expense, Accrued third party participations * |

|

$ |

750,000 |

|

| |

|

|

|

|

| TOTAL COST OF SALES |

|

$ |

766,596 |

|

| GROSS PROFIT |

|

$ |

400,998 |

|

| |

|

|

|

|

| GENERAL AND ADMINISTRATIVE EXPENSES |

|

$ |

69,596 |

|

| |

|

|

|

|

| INCOME (LOSS) FROM OPERATIONS |

|

$ |

331,402 |

|

| |

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

$ |

0 |

|

| |

|

|

|

|

| INCOME (LOSS) BEFORE INCOME TAXES |

|

$ |

331,402 |

|

| |

|

|

|

|

| PROVISION FOR INCOME TAXES ** |

|

$ |

0 |

|

| |

|

|

|

|

| NET INCOME (LOSS) |

|

$ |

331,402 |

|

| |

|

|

|

|

| |

|

|

|

|

| RETAINED EARNINGS, BEGINNING OF PERIOD |

|

$ |

4,138,137 |

|

| |

|

|

|

|

| |

|

|

|

|

| RETAINED EARNING, END OF PERIOD |

|

$ |

4,469,539 |

|

* International Sales Contracts have

been allocated based on gross revenue amounts, less accrued third party participations or assignments.

** Corporate tax returns are calculated

on a cash basis, while period reports are calculated on an accrual basis.

Exhibit 1 - Page 1

HANNOVER HOUSE, INC.

CONSOLIDATED AND GENERAL & ADMINISTRATIVE

EXPENSES

FOR THE THREE MONTH PERIOD ENDING DEC.

31, 2013 (UNAUDITED)

| GENERAL AND ADMINISTRATIVE EXPENSES |

|

|

|

|

| Auto |

|

$ |

0 |

|

| Bank Charges |

|

$ |

627 |

|

| Consulting |

|

$ |

0 |

|

| Employees |

|

$ |

38,047 |

|

| Entertainment |

|

$ |

35 |

|

| Equipment |

|

$ |

0 |

|

| Fees |

|

$ |

0 |

|

| Insurance |

|

$ |

0 |

|

| Labor |

|

$ |

0 |

|

| Legal and Accounting |

|

$ |

500 |

|

| Miscellaneous |

|

$ |

3,354 |

|

| Office |

|

$ |

3,101 |

|

| Rent |

|

$ |

9,600 |

|

| Taxes (including Payroll Taxes)* |

|

$ |

8,047 |

|

| Telephone** |

|

$ |

4,867 |

|

| Travel |

|

$ |

0 |

|

| Utilities |

|

$ |

1,418 |

|

| TOTAL GENERAL & ADMINISTRATIVE EXPENSES |

|

$ |

69,596 |

|

* Payroll Taxes include one-time

assessment of $5,585 for unpaid payroll taxes for some of the Screen Actors Guild talent utilized within the "Toys in the

Attic" project.

** Enhanced telephone costs include one-time expense to

upgrade telephone service to accommodate additional phone lines for the VODWIZ operation, as well as to add a fiber-optic service

capable of streaming 4K data to HHSE / VODWIZ offices.

Exhibit 1 - Page 2

HANNOVER HOUSE, INC.

CONSOLIDATED BALANCE SHEET

DECEMBER 31, 2013 (UNAUDITED)

| ASSETS |

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

| Cash & Cash Equivalents |

|

$ |

1,476 |

|

| Accounts Receivable, Net* |

|

$ |

2,739,259 |

|

| Prepaid Wages |

|

$ |

0 |

|

| Merchandise Inventory |

|

$ |

150,099 |

|

| Prepaid Advertising |

|

$ |

0 |

|

| Prepaid Producer Royalties |

|

$ |

1,876,191 |

|

| Producer Marketing Recoupment |

|

$ |

2,204,544 |

|

| Film Distribution Rights |

|

$ |

2,314,914 |

|

| Film Production Investments** |

|

$ |

497,166 |

|

| Notes Receivable and Net Recoupment |

|

$ |

0 |

|

| |

|

|

|

|

| TOTAL CURRENT ASSETS |

|

$ |

9,783,649 |

|

| |

|

|

|

|

| PROPERTY & EQUIPMENT |

|

|

|

|

| Office Furnishings, Fixtures and Equipment |

|

$ |

155,081 |

|

| Less Accumulated Depreciation |

|

$ |

(39,356) |

|

| Vehicles*** |

|

$ |

15,000 |

|

| Less Accumulated Depreciation |

|

$ |

(5,000) |

|

| Real Property |

|

$ |

0 |

|

| TOTAL PROPERTY & EQUIPMENT |

|

$ |

125,725 |

|

| |

|

|

|

|

| OTHER ASSETS |

|

|

|

|

| FILM & TELEVISION LIBRARY |

|

$ |

22,315,337 |

|

| |

|

|

|

|

| TOTAL OTHER ASSETS |

|

$ |

22,315,337 |

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

$ |

32,224,711 |

|

* A.R. includes write-down of $455,000 from Phase 4 Films,

considered to be uncollectible debt; A.R. also includes a total of $1.5-mm in net presales for "Mother Goose" which are

assigned to the special purpose production entity.

** Q3, 2013 Filing erroneously included a Film Production

Investments entry for $750,000 in presales which are assigned to apply towards the production of "Mother Goose: Journey To

Utopia." The contract receivable for the presale was already recognized as part of the A.R. total. Per the terms of the special-purpose

financing for this project, HHSE will recognize the gross sales and fees as received, but will expense out the net amounts as a

"producer payable" until such time that the film has achieved profitability; thereafter, the ownership and asset value

of the film may be capitalized for the benefit of HHSE.

*** Base Value of Company's Grip & Electric Truck (1999

Ford F-80) has been reduced by $10,000 during Q4 to better reflect present market value.

Exhibit 1 - Page 3

HANNOVER HOUSE, INC.

CONSOLIDATED BALANCE SHEET

DECEMBER 31, 2013 (UNAUDITED)

| LIABILITIES AND STOCKHOLDER'S EQUITY |

|

|

| |

|

|

| CURRENT LIABILITIES |

|

|

|

|

| Accounts Payable |

|

$ |

148,522 |

|

| Accrued Royalties |

|

$ |

303,829 |

|

| Producer Acquisition Advances Due |

|

$ |

157,260 |

|

| Accrued Wages |

|

$ |

0 |

|

| Payroll Taxes Payable |

|

$ |

5,585 |

|

| NB Cal AFIL P&A Loan |

|

$ |

334,188 |

|

| Hounddog P&A Note (Weinreb) |

|

$ |

826,624 |

|

| Other Bank Note |

|

$ |

23,843 |

|

| |

|

|

|

|

| TOTAL CURRENT LIABILITIES |

|

$ |

1,799,851 |

|

| |

|

|

|

|

| LONG-TERM LIABILILTIES |

|

|

|

|

| Long-Term Payables (including Interstar & Bedrock) |

|

$ |

2,753,427 |

|

| Assignment of Intl. Sales Net to Production |

|

$ |

1,500,000 |

|

| Executive Salary Deferrals |

|

$ |

1,063,996 |

|

| Officer Notes Payable |

|

$ |

169,840 |

|

| |

|

|

|

|

| TOTAL LONG-TERM LIABILITIES |

|

$ |

5,487,263 |

|

| |

|

|

|

|

| TOTAL OF ALL LIABILITIES |

|

|

7,287,114 |

|

| |

|

|

|

|

| |

|

|

|

|

| SHAREHOLDER'S EQUITY |

|

|

|

|

| Common Stock (583,732,365 shares |

|

|

|

|

| issued and outstanding)* |

|

$ |

20,468,058 |

|

| Retained Earnings |

|

$ |

4,469,539 |

|

| |

|

|

|

|

| TOTAL SHAREHOLDER'S EQUITY |

|

$ |

24,937,597 |

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

$ |

32,224,711 |

|

* Share number does not include 6,500,000 shares

which have since been retired / returned to treasury as unissued.

Exhibit 1 - Page 4

HANNOVER HOUSE, INC.

CHANGE IN SHARE STRUCTURE DURING REPORTING

PERIOD

DECEMBER 31, 2013

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Change |

| |

|

|

|

|

|

During |

| Share Structure Description |

|

12/31/2013 |

|

9/30/2013 |

|

Quarter |

| Unrestricted Common Stock* |

|

|

453,080,622 |

|

|

|

424,437,771 |

|

|

|

28,642,850 |

|

| Restricted Common Stock |

|

|

130,651,743 |

|

|

|

138,651,743 |

|

|

|

(8,000,000) |

|

| COMMON STOCK ISSUED* |

|

|

583,732,365 |

|

|

|

563,089,514 |

|

|

|

20,642,850 |

|

| COMMON STOCK AUTHORIZED |

|

|

600,000,000 |

|

|

|

600,000,000 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred Shares Issued |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

0 |

|

| Preferred Shares Authorized |

|

|

10,000,000 |

|

|

|

10,000,000 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Beneficial Owners |

|

|

342 |

|

|

|

343 |

|

|

|

(1) |

|

| (per Broadridge) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Shareholders of Record |

|

|

183 |

|

|

|

185 |

|

|

|

(2) |

|

| (per Standard Registrar) |

|

|

|

|

|

|

|

|

|

|

|

|

* Total count of Unrestricted Common Stock does not include

the reduction of 6.5-mm shares from a cancelled transaction with Greenwood Finance Group, LLC, which was terminated during Q4,

2013, but not reflected in the share count totals until Jan. 8, 2014.

Exhibit 1 - Page 5

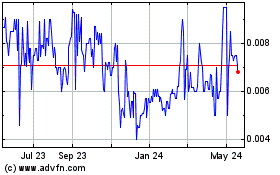

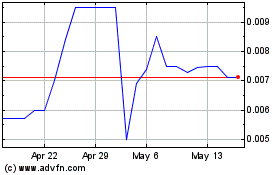

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Dec 2023 to Dec 2024