UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 10

_____________________

GENERAL

FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_________________

Securities to be registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Name of each exchange on which |

| to be so registered |

|

each class is to be registered |

| |

|

|

| NONE |

|

Not Applicable |

Securities to be registered pursuant

to Section 12(g) of the Act:

| Title of each class |

|

Name of each exchange on which |

| to be so registered |

|

each class is to be registered |

| |

|

|

| Class "A" Common Stock, par value of $.001 per share |

|

OTC Markets |

| Class "B" Preferred Shares, par value of $.001 per share |

|

OTC Markets |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No þ

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer o |

Accelerated filer o |

Non-accelerated filer o |

Smaller reporting company þ |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

EXPLANATORY NOTE

Company is filing this General Form for Registration

of Securities on Form 10 to register the Company’s Common Stock (“Common Stock”) and Preferred Stock (“Preferred

Stock”), par value $0.001 per share pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Once this registration statement is deemed effective, Company will be subject to the requirements of Regulation 13A

under the Exchange Act, which will require Company to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current

reports on Form 8-K, and to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements

pursuant to Section 12(g) of the Exchange Act. Unless otherwise noted, references in this registration statement to the “Registrant,”

the “Company,” “we,” “our” or “us” shall mean Hannover House, Inc., and its related

divisions and entities as described and defined hereunder.

FORWARD-LOOKING

STATEMENTS

This disclosure

statement and filing contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. In some cases you can identify forward-looking statements by terms such as “may”, “intend”,

“will”, “could”, “would”, “expects”, “believe”, “estimate”,

or the negative of these terms, and similar expressions intended to identify forward-looking statements. These forward-looking

statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties.

Also, these forward-looking statements present our estimates and assumptions only as of the date of this disclosure statement.

Except for our ongoing obligation to disclose material information as required by federal securities laws, we do not intend to

update you concerning any future revisions to any forward-looking statements to reflect events or circumstances occurring after

the date of this disclosure statement. Actual results in the future could differ materially and adversely from those described

in the forward-looking statements as a result of various important factors, including the substantial investment of capital required

to produce and market films and television series, increased costs for producing and marketing feature films, budget overruns,

limitations imposed by our credit facilities, unpredictability of the commercial success of our motion pictures and television

programming, the cost of defending our intellectual property, difficulties in integrating acquired businesses, and technological

changes and other trends affecting the entertainment industry.

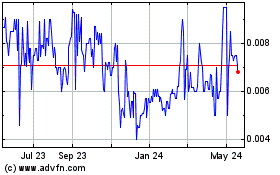

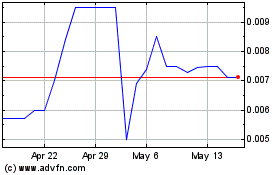

CURRENT STOCK STATUS

The Company’s stock is currently

traded on the OTC “Pinksheets” Markets under the trading symbol: HHSE. The Cusip number for the Company is: 410686

101. The following is true and correct, per our transfer agent, as of and at the period ending on January 1, 2015:

| a. |

Total Common Stock Shares in issue as of January 1, 2015: |

|

663,227,212* |

| b. |

Above Shares Restricted From Sale: |

|

99,560,595 |

| |

TOTAL COMMON STOCK SHARES IN ISSUE: |

|

663,227,212* |

| |

|

|

|

| c. |

Series “A” Preferred Shares: |

|

3,000,000 |

Shareholders of Record: 183 (Standard Registrar count)

Total Beneficial Shareholders: 346 (Broadridge, ICS count)

Total

Authorized Common Stock Shares: 700,000,000 / Total Authorized Series “A” Preferred Shares: 10,000,000

*

Includes 10,000,000 Common Stock Shares (issued to TCA Global Master Fund) subject to return to treasury stock.

Company

is authorized to issue up to 700,000,000 shares of Common Stock; any corporate action to increase thetotal amount of Common

Stock beyond this level requires the approval of a majority of the shareholders.The purpose of this Form 10 12(g) Registration

Statement is for the Company to Register the above CommonStock and Preferred Shares with the Securities and Exchange Commission.

The Transfer

Agent for the Company’s stock is:

Standard Registrar & Transfer Company, Inc.

12528 South 1840 East

Draper,

UT 84020

Tel. 801-571-8844 / Fax 801-571-2551

TABLE OF CONTENTS

| Item 1. |

Business |

2 |

| Item 1A. |

Risk Factors |

9 |

| Item 2. |

Financial Information |

10 |

| Item 3. |

Properties |

14 |

| Item 4. |

Security Ownership of Certain Beneficial Owners and Management |

14 |

| Item 5. |

Directors and Executive Officers |

14 |

| Item 6. |

Executive Compensation |

15 |

| Item 7. |

Certain Relationships and Related Transactions, and Director Independence |

16 |

| Item 8. |

Legal Proceedings |

16 |

| Item 9. |

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters |

16 |

| Item 10. |

Recent Sales of Unregistered Securities |

16 |

| Item 11. |

Description of Registrant’s Securities to be Registered |

16 |

| Item 12. |

Indemnification of Directors and Officers |

17 |

| Item 13. |

Financial Statements and Supplementary Data |

18 |

| Item 14. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

18 |

| Item 15. |

Financial Statements and Exhibits |

20 |

Item 1. Business. (Information as required by

Item 101 of Regulation S-K, §229.101)

This registration statement was voluntarily filed

pursuant to Section 12(g) of the Securities Exchange Act of 1934, in order to comply with the requirements of the OTC Markets,

Over-the-Counter QB, often called "OTCQB". This Registrant's common stock is presently quoted on the OTC Pinksheets under

the ticker symbol “HHSE.” The requirements of the OTCQB are that the financial statements and information about the

Registrant be reported periodically to the Commission and be and become information that the public can access easily. This issuer

wishes to report and provide disclosure voluntarily, and will file periodic reports in the event that its obligation to file such

reports is suspended under the Exchange Act. If and when this 1934 Act Registration is effective and clear of comments by the staff,

this issuer will be eligible for consideration for listing on the OTCQB.

Hannover House, Inc., is a registered corporation in the

State of Wyoming, and is primarily engaged in the distribution of home entertainment products – including pre-recorded movies

onto DVD and BluRay disc formats – as well as book publishing and film rights licensing. A more detailed description of the

Company’s history and business activities are contained hereunder.

The corporate history of the Company chronicles two separate

entities that were functionally merged in a stock-for-stock swap exchange which occurred in December 2009. The first entity is

Truman Press, Inc, d/b/a “Hannover House,” the operating entity that was originally incorporated in the State of California

in 1993 (“Hannover House”). Hannover House was launched in 1993 as a book publisher, and operated continuously in that

industry until 2002, at which time the product line of pre-recorded DVDs was added. Within the first year of operations in the

DVD market, the Company had emerged as one of the top independent supplier studios for Wal-Mart Stores, Inc., and sales of DVDs

had surpassed revenues from the Company’s book publishing activities by a factor of more than ten-to-one. The Company has

since built a film library containing more than 220 feature film and video titles for the DVD marketplace. Over the past 12 years,

since adding DVD products, the Company has also expanded the media outlets for films and television programming, and now distributes

to theatres, television, video-on-demand and to international licensors. The Company continues to remain active in book publishing,

including ebook editions.

The second entity for which a historic overview is merited

is Mindset Interactive Corporation and its successors, including Target Development Group, Inc. (“Mindset / TDGI”).

At the time of the stock-for-stock swap and merger of Hannover House and Mindset / TDGI in December, 2009, TDGI had been operating

and trading as an unregistered security on the OTC Markets Pinksheets Exchange under the ticker symbol “TDGI.” Previously,

Mindset /TDGI had been a fully registered security with the Securities and Exchange Commission as of March 15, 2000. After operating

as a fully reporting and registered security for more than five years, on August 15, 2005, Mindset / TDGI filed a Form 15 with

the Securities and Exchange Commission (“Notice of Termination of Registration”). Mindset / TDGI continued to

operate as an unregistered, non-reporting entity for the next four years, participating in the development and licensing of computer

software and in the real estate marketplace, holding title to real properties in Connecticut.

In December, 2009, Mindset / TDGI and Truman Press, Inc.,

d/b/a “Hannover House” agreed to a stock-for-stock swap, at which time, the directors and managers of Truman Press,

Inc., d/b/a “Hannover House” were elected to become the directors, officers and principal managers of the combined

entity, and the prior officers, directors and managers of Mindset / TDGI resigned. Since December, 2009, Mindset / TDGI has been

managed by the Hannover House principals, namely Eric F. Parkinson as Chairman and Chief Executive Officer, and D. Frederick Shefte

as President. From December 2009 until the date of this filing, the Company has continued to file voluntary reports with the OTC

Markets in order to comply with the requirements for “current reporting status” under the OTC Pinksheets regulations.

Voluntarily filed reports by the Company have included all required quarterly and annual financial disclosures, along with compliance

and disclosure filings required by the OTC Markets.

In April, 2012, in order to reduce confusion in the marketplace

about the brand identity of Company’s product lines, and to streamline investor identification of the Company’s securities,

the Company applied to FINRA for a name change and ticker symbol change. Effective April 3, 2012, FINRA approved and formally acknowledged

the Company’s requested name change from the prior registration of “Target Development Group, Inc.” (“TDGI”)

to Hannover House, Inc., (“HHSE”). Due to a typographical error in FINRA’s announcement of the official name

change, some trading sites have misspelled Hannover House with only one “n” in Hannover, e.g., “Hanover House,

Inc.” However, all filings by the Company at all times have listed the proper spelling of the Company name, and for the purpose

of this Registration Statement, all mentions of the Company hereunder as “Hannover House, Inc.” shall refer to the

entity which is listed in some financial websites as “Hanover House, Inc.”

(a). In the past five years, Hannover House has expanded

its release activities in the domestic (North American marketplace) with movies and television programs onto prerecorded DVDs and

BluRay units. In 2009, the Company had a library of approximately 150 movie titles, and was adding and releasing about 12 titles

each year. The Company’s Library of Film and Television properties has since grown to more than 220 titles licensed under

exclusive agreements, with over 100 additional titles under non-exclusive distribution agreements. During 2012, the Company released

11 titles to DVD and / or BluRay. During 2013, the Company released 6 titles to DVD and / or BluRay. During 2014, the Company released

6 titles to DVD and / or BluRay. During 2015, the Company expects to significantly increase its output of DVD and BluRay releases,

under a new, multi-studio sales venture, Medallion Releasing, which is described in greater detail hereunder. The Company believes

that its significant expansion of new release titles and catalog / library promotions will result in a significant improvement

in gross revenues and profits for 2015 and 2016.

Over the past five years, the Company has launched activities

to expand the media outlets carrying or exhibiting Company’s programs. In 2010, the Company released the feature film “Twelve”

to 210 theatres across the U.S.A., and has since released ten additional films to theatres. The Company also launched video-on-demand

agreements with Netflix in 2010, and has since licensed twelve titles for digital streaming via Netflix under a subscription video-on-demand

contract. In 2014, the Company launched sales activities to obtain international licenses for current and upcoming productions,

and in 2015, the Company will activate a new video-on-demand streaming service, VODwiz, that will make thousands of feature films

from a wide variety of suppliers – including many hard-to-find titles – available for consumers to stream via the internet

or via O.T.T. devices (including ROKU) or APPs.

| (1) | Corporate & Principal Filing History of Entities. |

| a. | Sept. 1993 – Truman Press, Inc., d/b/a “Hannover House” was incorporated in California in 1993; |

| b. | Mar. 2000 – Ecklan Corporation (Texas) files Form 10 SB Registration (predecessor entity to Mindset Interactive and Target

Development Group, Inc); |

| c. | Aug. 2005 – Mindset Interactive files Form 15, Termination of Registration; |

| d. | June 2008 – Truman Press, Inc. reregisters in the State of Arkansas |

| e. | Dec. 2009 – Shareholders of Mindset / Target Development Group, Inc., and Truman Press, Inc. agree to a stock-for-stock

swap, effectively merging the entities and leaving Truman Press, Inc. (“Hannover House”) as the managing entity. Company

maintains current reporting status with OTC Pinksheets requirements by filing period financial reports and disclosures. |

| f. | Apr. 2012 – FINRA approves Company’s proposal for official name and ticker symbol change to: “Hannover House,

Inc.” HHSE. |

| g. | Feb. 2015 – Hannover House, Inc. files Form 10-12g Registration Statement with the S.E.C. |

The name of the entity filing this Form 10-12g

Registration Statement is Hannover House, Inc., a Wyoming registered corporation. References to the name Hannover House, Inc. hereunder

shall mean the combined entities and operations inclusive of those additional corporations that are wholly owned or effectively

controlled by Hannover House, Inc., including but not limited to: Bookworks, Inc. (Arkansas), Truman Press, Inc. (Arkansas), Medallion

Releasing, Inc. (Arkansas) and VODWIZ, Inc. (Wyoming). The Registrant, Hannover House, Inc., has been operating continuously since

1993 and has been operating as an unregistered security on the OTC Pinksheets exchange since December, 2009. The Registrant desires

to obtain approval by the Securities and Exchange Commission of this Registration filing in order that the Company’s shares

can be listed on the OTC Markets QB exchange, as well as to generally comply with the disclosure requirements of the Securities

Act of 1934.

| (A) | Plan of Operation. The Company’s ongoing Plan of Operation is to maintain its existing activities in the home

entertainment markets, and to expand such activities by increasing both the number of titles being released each year as well as

reaching additional media platforms and markets for entertainment products. Further detail of the Company’s Plan of Operation

is included within this Form 10 filing, including on the Exhibits. |

| (B) | Current Fiscal Year. During calendar year 2015, the Company plans to release a record number of titles to the DVD and

BluRay markets; this enhanced release activity has already commenced, with seven new release titles shipping in December (2014)

and January (2015) for sale via major USA Retailers during the month of February, 2015. The Company plans to release approximately

fifty-five (55) new release titles onto DVD or BluRay during the current year, along with approximately forty (40) titles being

reissued, repackaged or repriced as catalog or budget promotions. Additionally, during the current fiscal year, the Company will

be launching a consumer-oriented “Video-On-Demand” streaming service entitled “VODWIZ.” Other activities

for the Company during the current fiscal year include production activities on several high-profile feature films, including “Mother

Goose: Journey to Utopia”, “ShadowVision”, and “The Legend of Belle Starr” and the subsequent theatrical

release activities supporting such higher profile titles. |

| (1) | Cash Requirements. The cash required for the Company to satisfy its core DVD and BluRay releasing activities as described

above shall be primarily self-generated from cash flow resources. The cash required for the Company to pursue and otherwise complete

the productions of the high-profile feature films listed above shall be generated through a variety of third-party methodologies

not directly impacting the Company’s cash flow (including the monetization of international presale contracts, State and

Federal Tax Rebates and other incentives, private equity investments, and supplier / vendor deferrals). The cash requirements for

the Company to launch the VODWIZ consumer Video-On-Demand streaming service are detailed in this Form 10 filing, and are expected

to be self-funded through cash flow resources. |

| (2) | Research & Development. Not applicable to Registrant. |

| (3) | Acquisition of a Plant or Equipment Capacity. During the current fiscal year, Company plans to expand its ability to

manufacture DVD’s in-house at its principal location of business. The costs for such expansion of manufacturing capabilities

are expected to be self-funded from cash flow resources; the benefits of expanding the Company’s in-house product manufacturing

capabilities are to result in an overall reduction of unit costs and a reduction in inventory (as the Company will be capable of

manufacturing more closely to short-term needs). |

| (4) | Anticipated Changes in Number of Employees. During the current fiscal year, Company anticipates adding approximately

six (6) employees to the current roster of eight employees. As of the date of this filing, the Company had six (6) full-time employees

and two (2) part-time employees. Full-time positions include C.E.O., President, V.P. of Sales, Director of Marketing, Bookkeeper

and Office Manger. Part-time positions (30-hours or less per week) include Production Supervisor and Warehouse Manager. Areas of

new staff support anticipated to be added during 2015 include VODWIZ operations, Theatrical Bookings, Sales and Marketing support

and accounting. |

| (5) | Other Material Areas. Not Applicable to Registrant. |

(b) Financial Information about segments. Detailed

and audited financial statements for the Company covering the full fiscal years ending 12/31/2012 and 12/31/2013 are included in

this Form 10 filing. Applicable notes, discussions and analysis of the Company’s financial reports

are included in this filing and subsequent discussion.

(c) Narrative description of business.

(1) The following discussion

should be read in conjunction with the audited consolidated financial statements and related notes to the audited financial statements

included elsewhere in this report. This discussion contains forward-looking statements that relate to future events or the Company’s

future financial performance. These statements involve known and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance or achievements to be materially different from any future results, levels

of activity, performance or achievements expressed or implied by these forward-looking statements. These forward-looking statements

are based largely on Company’s current expectations and are subject to a number of uncertainties and risks including the

Risk Factors identified in prior Quarterly Form 10-Q filings and other disclosures posted to the OTC Markets website. Actual results

could differ materially from these forward-looking statements. Hannover House, Inc. is sometimes referred to herein as "we,"

"us," "our" and the "Company."

The nature of the issuer’s

business is driven by the operating entity, Hannover House, which is a full-service producer and distributor of entertainment

products (i.e., feature films for theatrical, video, television and international distribution, and a publisher of books).

Hannover House, Inc., is a Wyoming Corporation.

Truman Press, Inc., d/b/a “Hannover House” is an Arkansas Corporation.

Hannover House, Inc., f/k/a Target Development

Group, Inc. (which was also formerly known as "Mindset Interactive Corp.") was registered as a corporation in Wyoming

on January 29, 2009. Truman Press, Inc., d/b/a “Hannover House” was registered as a corporation in California on September

15, 1993, and re-registered in Arkansas effective June 2008. The Ecklan Corporation, registered on March 25, 1998, in the State

of Texas, was the predecessor entity to Target Development Group, Inc.

The Company, Hannover House, Inc., as

well as Truman Press, Inc., d/b/a “Hannover House” each have an effective fiscal year-end date of December 31.

Neither the Company, Hannover House,

Inc., nor the operating entity, Truman Press, Inc., d/b/a “Hannover House” have ever been in bankruptcy. To the best

of management’s knowledge, no predecessor entity has ever been in bankruptcy.

In December, 2009, and effective as

of January 1, 2010, Target Development Group, Inc., acquired all of the shares of Truman Press, Inc., d/b/a “Hannover House”

in a stock-swap agreement. The details of this acquisition venture are described in detail within the information statement posted

on the OTC Markets Disclosure Statement of December 14, 2009.

Business of Issuer -- The SIC

Codes most closely conforming to the Company’s business activities are: 7822 (Services – Motion Picture & Video

Tape Distribution) and 2731 (Books: Publishing). The Company is currently operating. At no time has the Company ever

been a “shell company” as defined in the guidelines.

Through the operating entity of “Hannover

House,” the Company is actively involved with the production, acquisition and distribution of entertainment products into

the USA and Canadian markets, including theatrical films, home video releases, rights licenses of films and videos to Video-On-Demand

platforms and television, as well as book publishing (including printed editions and electronic “E-Book” formats).

FILMS & VIDEOS – Most

of the film and video titles that are distributed by the Company are “acquired” or otherwise licensed from third-party

suppliers, often production companies or media companies seeking to expand their income and market reach through a relationship

with Hannover House. Some of the properties distributed by the Company are “sales agency” ventures, in which

the Company performs certain sales & marketing functions on behalf of the owners of the properties, as opposed to having the

Company actually purchase or otherwise license rights into the property. Historically, most of the titles sold by the Company were

under such “sales agency” ventures. However, beginning in 2010 with the merger of Hannover House and Target

Development Group, Inc., the Company has been moving away from “sales agency” ventures and pursuing actual rights-licensing

/ acquisition structures for new titles. Examples of “sales agency” titles would include “Grand Champion”

from American Family Movies; examples of rights-licensed titles would include “Twelve” from Gaumont and “Turtle:

The Incredible Journey” from Sola-Media. The Company benefits from rights-licensed titles over sales-agency titles in

a variety of ways: a). the fees to the Company are usually higher under rights licenses, b). the duration of the terms of representation

rights are usually longer for rights licenses, and c). titles falling under rights-licenses provide the Company with additional

balance sheet and collateral benefits.

BOOKS / E-BOOKS –

The Company remains active in the acquisition and licensing of publishing rights to printed books and e-Books. The gross margins

earned by the Company in the release of Books are generally much higher than the margins derived from the release of Film and

Video properties; however, the upside revenue potential for books is usually not as high as the potential for Films. So the Company

seeks to maintain a balance in its release slate of high-margin book properties, with high-revenue Film and Video properties.

The use of the term "Company"

refers to the combined entities, as reported on a consolidated basis, of Hannover House, Inc., Truman Press, Inc., d/b/a “Hannover

House” and Bookworks, Inc. (a special purpose entity utilized for Screen Actors Guild activities and productions), as well

as the newly formed entities VODWIZ, Inc. and Medallion Releasing, Inc. Each of the corporate entities files separate income tax

returns with the federal government and respective states of registration; however, financial statements and reports, as of January

1, 2010, refer to the combined and consolidated results of all entities. Hannover House, Inc. is the publicly-traded entity for

all operating divisions. Truman Press, Inc., d/b/a “Hannover House” is the operating and releasing division entity

for all consumer products. Bookworks, Inc., is a special purpose entity established for the servicing of book and publishing ventures,

and more recently, used for Screen Actors Guild productions.

The nature of products and services

offered:

| A. | The principal products of the Company, and their respective markets are: |

| i. | Theatrical films – released to theatres in the United States |

| ii. | Home Video Products (DVDs, Blu-Rays, Digital Copies) – released to video specialty retailers,

mass-merchandisers, bookstores, schools, libraries and rental outlets (including kiosks) in the United States and Canada; |

| iii. | Video-On-Demand releases – films and videos offered for direct ‘in-home viewing’

by consumers via a variety of service providers. |

| iv. | Books and E-Books – sold through bookstores, schools, libraries, internet retailers and streamed

through a variety of e-Book platforms. |

| B. | The primary distribution methods used by the Company for all consumer product goods can be categorized

as: “two-step wholesale” distribution (wherein the Company sells its products to an authorized wholesale distributor,

which in turn, resells the products to retailers or consumers) and “direct distribution” wherein the Company sells

its products directly to consumers or directly to the end-user retailer. |

| C. | The Company has announced, and included in this disclosure below, a listing of upcoming theatrical

films that will also be released onto home video formats. |

| D. | Competitive Position – The Company competes for theatrical screens and retail (home video)

shelf space against seven (7) Major Studio suppliers and approximately eight (8) independent studio suppliers. While all of the

Major Studio competitors operate their own (in-house) home video distribution divisions, only three of the independent studio suppliers

operate both theatrically and in the home video markets. Operating a home video releasing label “in-house” provides

the Company with an advantage in the solicitation of titles for acquisition, as well as provides greater control over the Company’s

cash-flow and corporate goals. |

| E. | Materials and Suppliers – The principal service providers to the Company are listed in detail

in this disclosure, below. The principal suppliers of new release film and video products include the following production companies

and programming sources (listed alphabetically): Allegheny Image Factory; American Family Movies; Associated Television;

Atlas Films; BerVon Entertainment; Cinetic Media; Daybreak Pictures; Empire Film Group, Inc.; Eurocine International; FreeStyle

Releasing; Gaumont, SA; Green Apple Entertainment; Little Film Company; Northbank Entertainment; Origin Motion Pictures; Paseo-Miramar

Studios; Plaza Entertainment, Inc.; Phoenix Entertainment; Phoenix Releasing Group; SND Films; Sola-Media, GmbH; Shoreline Entertainment;

Studio 3 Entertainment and PWI-Veracruz Entertainment. The principal suppliers of books for the Company to publish include (listed

alphabetically): James Danielson, Brenda Hancock, Vivian Kaplan, Barr McClellan, and Vivian Schilling. The Company sees no shortage

of properties available for acquisition in any of the applicable media. |

| F. | Dependence on Major Customers – The only current customer for the Company that constitutes

a greater-than fifteen percent (15%) contribution to gross revenues is Wal-Mart Stores, Inc. (inclusive of sales to their SAM’S

Clubs division). The Company does not see the Wal-Mart market share as an unhealthy dependence on a key customer, as Wal-Mart constitutes

a much smaller share of the Company’s overall revenues than for many Major Studios, and the Company does not anticipate that

the growth in sales to Wal-Mart Stores, Inc., will grow disproportionately with the Company’s other customers. |

| G. | The Company does not own or control any patents, franchise or concessions. The licenses and royalty

agreements fall under the category of being part of the ordinary course of business. |

| H. | The company does not need any government approvals of principal products or services. |

| I. | Key Suppliers providing essential services to the Company include: CD Video Labs / Encore Media

Services / Gentek Media (DVD and Blu-Ray Replication); Modern VideoFilm / Cloud 19 Media (video manufacturing & replication);

Mike DVD (video authoring); Oleum Rain Studios (art design); Just-Us Printers (Printing); George B. Morton,

Esq. (Corporate Legal Advisor); Jonathan Leinwand, Esq. (Securities Legal Advisor); Terry L. Johnson, CPA (Auditor);

Lisa L. Higgins, CPA (Tax Preparer); Elder Properties (Landlord). |

The

nature and extent of the issuer’s facilities include a primary office and warehouse combo unit (under lease from Elder

Properties, Springdale, AR), comprising approximately 6,000 square feet. The Company has operated from this location since February

of 2008, and this is the location of the Company’s principal operations, records and staff.

(d) Financial Information

about geographic areas. At present, over ninety percent (90%) of the Company’s annual revenues are derived from sales

of products or contracts to licensors within the United States of America and Canada. Principal customers include Walmart Stores,

Inc., Redbox, Netflix, Ingram Entertainment and a variety of other retail chains and wholesalers servicing such outlets. During

2015 and moving into the future with international presale agreements, the source of revenues for the Company will become more

diverse geographically, as these international sales are delivered and collected. Company forecasts that the feature film, “Mother

Goose: Journey To Utopia” could generate approximately five-million dollars (USD $5,000,000) in revenues for Company

from territories and media outside of the United States and Canada. Based upon the Company’s forecasts of existing (core)

DVD and BluRay releases of approximately ten-million dollars (USD $10,000,000) from sales in the United States and Canada during

2015 – inclusive of sales to be derived from the Medallion Releasing supplier studios (but excluding any forecasted revenues

for the launch of the VODWIZ video-on-demand portal), the addition of international revenues from “Mother Goose”

and other titles owned or controlled for international sales by Company could result in a shift of geographic dependence of revenues.

At present, the only foreign country generating revenues for the Company is Canada, and the Company does not see any reasonable

threats to jeopardize this ongoing sales or collection activities. During 2015, the Company expects to begin making delivery of

new productions to international rights licensors, with principal revenues deriving from recognized and financially solvent licensors

in the territories of Germany, France, United Kingdom, Spain, Japan and Scandinavia (in descending order of anticipated total

sales). The Company does not foresee any material risks associated with the solicitation of international presale contracts

for new and upcoming productions, as full payment for said rights licenses is paid in full, contemporaneously with the delivery

of the films.

(e) Long-Lived Assets.

The Company’s financial reports include an asset listing for the Film and Television Library and rights otherwise owned or

controlled by Company. Under film industry practices, entertainment companies will forecast the long-term value of each of their

properties based on previous sales histories or current activities, inclusive of all applicable media for the rights controlled

in each property. The value of a Film Library is usually realized over multiple years as the titles generate revenues for the studio;

the addition of new media formats can have a positive impact to the value of a Film Library by creating new outlets and revenue

opportunities for titles that had otherwise grown exhausted. Conversely, the rights to distribute some titles will eventually expire

and result in the elimination of the revenue forecasts for such titles. The Film and Television Library report for Hannover House

was conducted in 2011 and will be conducted again in 2015 by a reputable, third-party firm specializing in entertainment property

valuation reports. The Company has added over seventy (70) properties under exclusive license since the Film & Television Library

report was completed in 2011, yet none of these recently added titles have been added yet into this report. Management does not

believe that the updated Library Valuation Report to be conducted during 2015 will result in a material change in the valuation

of the Library as listed in the Company’s financial statements and balance sheets.

(f) S.E.C. / Edgar Reporting.

Although not yet listed as a fully-reporting and registered security, in the interests of shareholder disclosure, beginning in

2013, the Company began making periodic and voluntary filings with the Securities and Exchange Commission through access to the

Edgar Department. Filings provided included 10q and Form 8 statements, and were reflective or otherwise identical to the periodic

filings made by the Company to the OTC Markets. The Company acknowledges that the public may read and copy any materials that the

Company files with the S.E.C. through the direct means and methodologies prescribed by the S.E.C., or electronically through the

S.E.C. and the Edgar file access system. Disclosures, filings and financial reports made by the Company are available to the public

free-of-charge through the OTC Markets website.

(g) Reports to Shareholders.

Company currently conducts an annual meeting of shareholders, once each year, which occurs prior to March 1st, and contains

a recap report on the prior year’s activities and a forecast of new activities for the coming year. The bylaws of the Company

do not require that an annual meeting of shareholders be held. However, in lieu of an annual meeting of shareholders, Company may

elect to issue an annual report, which shall be sent free-of-charge to all identified shareholders of record as of the qualifying

period. The Company believes that its periodic filing of Management Statements, Board of Directors Minutes and General Updates

– both as filings on the OTC Markets website, as well as through the Company’s publicly accessible blog site –

creates a clear line of transparency and current communication to shareholders on all activities of a material or substantive nature.

(h) Principal Properties

/ Titles. Attached to this Registration Form are Exhibits which list some of the primary titles and properties owned, controlled

or distributed by the Company. The following list summaries some of the titles which have previously proven to be significant contributors

to the Company’s revenues, or which are anticipated to become top selling titles for the Company over the coming year.

| HISTORIC – BEST SELLING BOOKS |

|

UPCOMING – ANTICIPATED BOOKS |

| Blood, Money & Power: How LBJ Killed JFK |

|

The Verdict: Justice for John F. Kennedy |

| Quietus |

|

Genergraphics |

| Sacred Prey |

|

Book of Rhymes |

| |

|

|

| HISTORIC – BEST THEATRICAL TITLES |

|

UPCOMING – ANTICIPATED THEATRICAL HITS |

| Twelve |

|

Dark Awakening |

| On Any Sunday: The Next Chapter |

|

The Algerian |

| Toys in the Attic |

|

Bonobos: Back to the Wild |

| |

|

|

| HISTORIC – TOP SELLING VIDEO TITLES |

|

UPCOMING – ANTICIPATED HIT VIDEO TITLES |

| Twelve |

|

American Justice |

| Grand Champion |

|

Gabrielle |

| Boggy Creek: The Legend Is True |

|

Dinosaurs of the Jurassic |

| Turtle: The Incredible Journey |

|

Doonby |

| Martial Arts Marathon |

|

Salvation |

| SWAT: The Real Story |

|

Silent No More |

| Future Shock |

|

Alcatraz Prison Escape |

| Savage Land |

|

Brutal Colors |

Periodic Reporting and Audited Financial

Statements; Disclosure of Business Combination

Upon the effective date

of this Registration Statement, the Company’s class of Common Stock will be registered under the Exchange Act and it will

have reporting obligations, including the requirement that it files annual, quarterly and current reports with the SEC. In accordance

with the requirements of the Exchange Act, the Company’s annual reports will contain financial statements audited and reported

on by its independent registered public accountants.

The Company does not

intend to enter into a business combination with a business if audited financial statements based on United States generally accepted

accounting principles (U.S. GAAP) cannot be obtained for such business. The Company cannot assure you that any particular business

identified by the Company as a potential acquisition candidate will have financial statements prepared in accordance with U.S.

GAAP or that the potential target business will be able to prepare its financial statements in accordance with U.S. GAAP. To the

extent that this requirement cannot be met, the Company may not be able to acquire the proposed target business. While this may

limit the pool of potential acquisition candidates, the Company does not believe that this limitation will be material.

If applicable, upon the

consummation of a business combination, the Company will file with the SEC a current report on Form 8-K to disclose the business

combination, the terms of the transaction and a description of the business and management of the target business, among other

things, and will include audited consolidated financial statements of the Company giving effect to the business combination. Holders

of the Company’s securities will be able to access the Form 8-K and other filings made by the Company on the EDGAR Company

Search page of the SEC’s Web site, the address for which is www.sec.gov. The public may read and copy any materials the Company

files with the SEC at the SEC’s Public Reference Room at Room 1518, 100 F. Street, N.E., Washington, D.C. 20549. The public

may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Item 1A. Risk Factors.

An investment in the Company is highly

speculative in nature and involves a high degree of risk.

Risks Related to our Business

There may be conflicts of interest between

our management and the non-management stockholders of the Company. Conflicts of interest create the risk that management may

have an incentive to act adversely to the interests of the stockholders of the Company. A conflict of interest may arise between

our management’s personal pecuniary interest and its fiduciary duty to our stockholders. The Company is unaware of any such

conflicts of interest with any of the three principal managers of the Company (Eric F. Parkinson, Don Frederick Shefte, Tom Sims).

Other than as set forth in this FORM

10 filing, there are no specific risk factors relating to the Company's securities that are not universally applicable to other

equities trading on the OTC Markets.

Key Man / Principals - The Company

is reliant upon the continued employment and work performance of the three, principal managers, Eric Parkinson (CEO), D. Frederick

Shefte (President) and Tom Sims (VP of Sales). As an accommodation to benefit the Company's cash flow, both Parkinson and Shefte

have been deferring a majority of their salaries. Additionally, as has been required by many third-party program suppliers, Parkinson

has often been listed as a "key man" to the rights licenses or sales venture agreements for specific acquisitions, due

to his successful home video sales track record. The cessation of employment by either Parkinson or Shefte could have a material

and negative impact on the Company, as current cash flows would not facilitate the hiring of comparably qualified executives,

and the loss of Parkinson as "key man" could result in multiple title agreement cancellations. The loss of Tom Sims

as VP of Sales could be claimed as a material breach or cause of termination for some of the supplier agreements entered into

under the Medallion Releasing multi-studio distribution and sales venture, which is being managed by Sims on behalf of Company.

Prior to joining Hannover House and launching the Medallion Releasing multi-studio venture, Tom Sims had worked for 13 years as

the Wal-Mart Video Buyer for Anderson Merchandisers, the primary VMI Supplier for Wal-Mart’s D5 Entertainment categories.

In part due to his unique knowledge and connections with Wal-Mart, Sims was hired by Vivendi / Universal Music Group to establish

a multi-studio distribution venture which rapidly grew to more than $180-million in annual revenues. The structure and releasing

strategy that Sims has designed (and is implementing) for the Medallion Releasing multi-studio sales venture is similar to the

strategy for the ventures established by Sims for Vivendi / Universal Music Group and Allegro Media Group.

Credit Facilities & Key

Suppliers – At present, the Company is operating without the benefit of an unencumbered, general-use a credit

facility to finance new release activities or operations. An agreement for a loan of $250,000 was entered into in December

with European Group, Ltd., which ultimately was terminated by mutual agreement prior to funding. Two additional agreements

with lenders have been obtained and relate to title-specific financing and will be disclosed in a Form 8 Information

Statement as funding for each occurs.

A credit line for the manufacture

of DVDs and BluRays with CD Video Labs is being pursued, which is anticipated to be collateralized by a lien against accounts

receivable. However, at present, Company is operating without the benefit of a credit line or substantial vendor credit facilities

for the manufacture and release of DVDs and BluRays. Current sales volume – while growing exponentially with the increase

in new release activities – still has not created an unmanageable burden on the Company’s cash flow or abilities to

properly service new release demand in a timely manner. The greatest risk factor at present regarding the timely fulfillment of

orders is the upside of titles which might generate reorders at a demand that outpaces the maturation of the accounts receivable.

If such a scenario occurs, Company is confident that manufacturer (lab-supplier) credit to fill such orders can be obtained, or

that cash flow from purchasers can be accelerated in order to alleviate any shortfalls required to meet a growing sales demand.

The in-house DVD manufacturing capabilities possessed by Company do not economically conform to be competitive with the pricing

of large orders in excess of 10,000 units per title when compared to the costs from larger replications labs.

Judgment Creditors – Over

the past six years, the Company has effected payments to creditors, suppliers and judgment lien holders in a manner which has preserved

the Company’s ability to operate and grow. Total debt balances due to Judgment Creditors have been reduced in the past four

years by approximately $2,814,330, leaving a total due to Judgment Creditors of approximately $2,319,667. Management feels that

the Company’s ability to reduce these key debts by more than 54% in the past four years, while still growing the core business

activities, indicates both managerial and operational capabilities to handle the ongoing reduction and retirement of debts. Although

there is no indication to suggest otherwise, Company makes no representation, warranty or guarantee that the judgment creditors

will continue to work with management in a cooperative manner regarding the retirement of the remaining balances.

Officer Deferrals and Loans –

As of 12/31/2013, the total amount of the balances due to key managers Parkinson and Shefte for deferred salaries and officer loans

was $843,561. This amount is considered to be “long-term / deferred debt” (as it is presently structured as being

payable under a basis subordinate to other creditors and Company needs).

Item 2. Financial Information – Balance Sheets

and Income Statements for the Full Fiscal Years, ending 12/31/2012 and 12/31/2013 along with Auditor’s letter and footnotes

are contained within this Registration filing. Company has also provided as Exhibits additional financial data, including a pro-forma

income statement and balance sheet for the full fiscal year ending 12/31/2014 (unaudited), and a side-by-side comparison of the

Income Statements and Balance Sheets for the years 2012 and 2013 (audited) and the proforma (unaudited) results for the year ending

12/31/2014.

Management’s Discussion and Analysis of Financial

Condition and Results of Operation.

The Hannover House operating division

of the Company has been operating continuously since 1993, and in 2002 added DVD products to its original product line of print-edition

books. During the past three years (2012, 2013 and 2014), the number of new release products released by the Company as DVD or

BluRay titles was a total of 23 releases, with an approximately annualized average of eight (8) new releases each year. The Company

does not feel that this level of release activity will generate sufficient cash flow for the Company to meet its goals of expanding

revenues and profits. Accordingly, the Company has modified its releasing plan to allow for up to ninety (90) titles to be released

during 2015, inclusive of fifty-five (55) new release titles and approximately thirty-five (35) pricing or packaging promotions

from existing titles in the Company’s extensive Film and Television Library catalog. The exact quantity of new releases and

catalog promotions is subject to change, and is impacted by a variety of factors, most notably, the space availability at any particular

time with key retail customers. However, despite the possibility of modest adjustments in title release quantities or specific

on-sale street dates, the activities for enhanced releasing during 2015 will represent a substantial increase for the Company,

potentially representing a ten-fold increase and output and a substantial increase in both gross revenues and bottom line profits.

The Company believes that there is an

identifiable and maximum ceiling of revenues that are likely to be obtained for each of the direct-to-video releases representing

the majority of 2015 product release activities for the Company. “Action-Adventure” titles such as the Company’s

February 24 (2015) release of “AMERICAN JUSTICE” are attractive titles for both Walmart and Redbox, and this

particular title has been placed for sale with both of these key accounts. However, the total, gross wholesale revenues for the

packaged-goods (DVD and BluRay) revenue segments of such a title (inclusive of all other retailers and wholesalers),

tops out at approximately $300,000. Similar sales results and limitations apply to Sci-Fi Horror titles (including “Gabrielle,”

and “Salvation”), with Family and Christian appeal titles carrying a slightly higher revenue upside and Urban and

Spanish titles carrying a slightly lower upside. With the existence of these market realities and limitations, the Company feels

that the direct-to-video level business has a likely maximum annual revenue potential of about $10-million from the domestic (USA

& Canada) home video market.

In order to elevate the stature of the

Company’s profile, as well as to increase its overall revenues and bottom line, the Company is pursuing new activities in

the markets of Theatrical level films and high-profile productions. Films that have bigger budgets, star-powered casts and wide

release theatrical exposure generate substantially higher revenues from all media platforms, including the Company’s core

business with packaged-goods DVD and BluRay products. The challenge for the Company in pursuing such goals is to find (or produce)

films with such enhanced market values, and to create (or license) such properties in a manner which assures profitability. During

2015, the Company plans to pursue activities both in the arenas of wider USA Theatrical release programs, as well as activities

involved with the production or facilitation of production of higher profile films that the Company can release to a variety of

media platforms.

Management feels that the current cash

requirements for the Company’s “core” business of releasing packaged-goods titles to the DVD and BluRay markets

can be self-generated from regular cash flow. However, Management does not feel that the Company is financially able to fund wider

theatrical releases or higher-profile film productions. In this regard, the Company will be seeking various forms of funding to

facilitate these two ventures. There can be no assurance that the Company will successfully obtain the financing needed to release

films on a wider basis to theatres, or that the Company will be able to obtain production financing for the original productions

that are referenced in this Form 10 registration filing. Failure to obtain funding to enable films to be released on a wider basis

to theatres, or failure to obtain production funding will not jeopardize the Company’s ability to operate or to continue

with its core, packaged goods business activities.

The feature film thriller, “The

Summoning” is an example of a financing strategy that the Company is pursuing to help with both the film’s production

costs as well as the film’s theatrical releasing costs in a manner that does not drain resources from the Company’s

cash flow. In partnership with FreeStyle Releasing and Netflix, Company has negotiated for a significant pre-sale of the Video-on-Demand

rights (including the right for Netflix to offer this film via its popular “subscription” based streaming service).

The producers of the film, Renegade Motion Pictures (Canada) have arranged bank financing (further secured by private investors),

that will cash-flow the distribution presale obtained by Company to fully fund the film’s theatrical release through

Hannover House. Under this structure, Hannover House receives the benefit of having a film open nationwide on more than 600-theatres,

without incurring any out-of-pocket or accrued financial liability. The Producers of the film benefit by having a guarantee of

a wide USA Theatrical Release which enhances the film’s value to international buyers and becomes a key tool towards assuring

the film’s profitability. “The Summoning” is scheduled for production in May, 2015 in Louisiana, with

a Jan. 8, 2016 theatrical date planned by Hannover House, DVD and V.O.D. planned for April 12, 2016.

With respect to original feature film

productions being planned by the Company, the chart below shows some of the financing needs and strategies being pursued by the

Company during 2015 to fund both the physical “production” costs of the properties as well as the subsequent theatrical

releasing costs for the USA & Canada (referred to as “P&A”).

Under the above structure, the financial commitments required

of the Company would be insignificant and not of a material nature. However, there can be no assurance that the anticipated pre-sales,

private investors or required banking facilities (to monetize presales) will be obtained for these production and releasing

ventures.

HANNOVER HOUSE, INC.

Item 2 – continued – Results of Operations.

The following discussion should

be read in conjunction with our financial statements and the related notes that appear elsewhere in this Report.

Operating Expenses – Operating expenses

during the prior four years have been generated principally through four sources:

| 1) | Accounts Receivable / Collected Revenues from the Sales or Licensing of products; |

| 2) | Revenues from loans, credit lines and vendor (supplier) provided credit terms; |

| 3) | Benefits to Company from conversion of eligible (aged) debts under Rule 144 debt exemptions; |

| 4) | Cash loans to Company from Officers / Managers |

The Company believes that the current value and the collection

timeline of the existing (as well as the recently generated) Accounts Receivable will be sufficient to meet all of the Company’s

releasing goals and announced plans, without the requirement of a significant credit line or additional debt considerations. However,

despite the Company’s predicted ability to self-fund current and upcoming activities at this time, Company is still pursuing

a variety of credit arrangements to have available on an as-needed basis. Additionally, as described above, the Company will continue

to pursue financing opportunities to assist with or fully finance the production and distribution of the five key titles described

above. Company believes that the successful production and release of these higher profile titles will contribute to significant

growth in revenues and profits for 2016, but that the majority of revenues and profits for the current fiscal year (2015) will

be generated from the core business of packaged goods distribution through Hannover House and Medallion Releasing supplier studio

releases. The Company does not have a financial forecast at this time for the revenue potential to be derived from the forthcoming

consumer launch of the VODWIZ streaming service.

Net Income – Accrued Income – As is consistent

with other entertainment media firms, Company reports sales and profits under an accrual accounting methodology, which takes into

account that some contracts (e.g., Netflix subscription payments) can be paid over a two-or-three year timeframe. Accordingly,

the Company’s accrued profit position at any given moment in time is unlikely to conform to the Company’s cash position

at that same moment. The Company has been generating a positive profit for each of the past four years utilizing the Industry standard

accrual accounting methodology. During the past four years, the Company has generated sufficient revenues and funding to reduce

its long-term debts by over $2.7-million dollars while still preserving sufficient working capital to expand the Company’s

release activities and product library.

International Presales – During 2013, the Company

entered into some multi-title (and title-specific) sales agreements for the licensing of existing and upcoming productions to the

International Markets. Under industry practice, the Company may elect to recognize these presale agreements as executed, or as

delivered. During 2013 and the first half of 2014, the Company has previously recognized $2-million in presale agreements for the

international market, which become enforceable upon delivery of the covered properties. The Company has recognized its applicable

sales fees for these presales. As of Q3 of 2014, the Company has voluntarily elected to defer recognition of additional international

presale agreements, and to book such revenues in the future as each property is delivered to the licensors.

Liquidity and Capital Resources

As of the date of this Form 10 filing,

the Company had approximately $30,282 in cash. It is the Company’s standard procedure and policy to minimize the amount of

cash on hand in order to utilize these resources for immediate reinvestment into new releases, operating needs and debt reductions.

The Company collects payments from customers (Accounts Receivable) on a daily / weekly basis, and management believes that sufficient

collections are scheduled to meet the operating needs for liquidity and capital resources.

Short Term

Not Applicable.

Inflation

Company’s business is not expected to be materially

affected by inflation.

Off-Balance Sheet Arrangements

Company has not entered into any off-balance sheet arrangements

that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that would be considered

material to investors.

Item 3. Properties. The Company does not currently

own any Real Estate, but instead rents a combination warehouse and office facility in Springdale, Arkansas from Elder Properties.

The Company previously held an option to purchase a warehouse and 4.5-acres of land in Washington, County (Arkansas), which

agreement was eventually abandoned due to a probate title-clearance issue with the previous property owner. Company has been offered

land on a functionally “gratis” basis in the Fayetteville (Arkansas) Industrial Park, contingent upon Company’s

commitment to build and operate its offices, production and manufacturing facilities at that location. This opportunity will be

evaluated and considered during 2015; an Architectural Survey of the Property site and a proposed sketch of a facility entitled

the “Hannover Media Center” has been completed by Amirmoez, Foster, Haley Architects. The estimated cost for such a

facility would be approximately $1.1-million; upon completion, with the value of the 10-acres of land included, the property is

forecasted to have a market value of $1.8-million. If the Company were to obtain bank financing for such an investment (at $1.1-million),

under a 20-year mortgage at a 5% interest rate, the monthly payments would run approximately $7,250. At present, the Company is

paying $3,200 per month in rent (and has paid approximately $262,400 in rent to Elder Properties since March, 2008). The

Company will present the opportunity for the development of the Hannover Media Center for shareholder review and discussion at

the next Annual Meeting of Shareholders.

While the Company does not currently own any Real Estate,

the Company does own significant assets, including motion picture production and post production gear, a film truck, significant

inventories of DVDs and Books, and the distribution rights to a large Film and Television Library. An Exhibit of principal titles

owned, controlled or otherwise distributed by Company is included with this Form 10 Registration filing.

Item 4. Security Ownership of Certain Beneficial Owners

and Management. Chairman and C.E.O. Eric F. Parkinson currently owns 43,151,649 shares of Common Stock. Parkinson has the option

to call on the issuance of 6,451,613 shares of Common Stock, as well as the right to call for the reissue of 37,400,000 shares

of Common Stock that were returned to Treasury or issued or assigned to creditors of the Company as partial collateral for agreements.

Parkinson also owns 1,800,000 shares of Preferred Stock in the Company. President Don Frederick Shefte currently owns 31,487,546

shares of Common Stock. Shefte has the option to call on the issuance of 6,451,613 shares of Common Stock, as well as the right

to call for the reissue of 5,000,000 shares of Common Stock that were returned to Treasury pending achievement of specific performance

thresholds. Shefte also owns 1,200,000 shares of Preferred Stock in the Company. The Preferred Stock shares held by Parkinson and

Shefte each represent the voting power of 1,000 shares each of Common Stock; the Preferred Stock shares can be converted into Common

Stock by Parkinson or Shefte upon his departure from the Company for any reason.

COMMON STOCK – Officers, Directors

& Owners of 5% or More Shares

| Eric F. Parkinson (Beneficial Owner) |

|

Don. F. Shefte (Beneficial Owner) |

| Chairman & C.E.O. |

|

President |

| 1722 N. College Ave. |

|

3741 N. Old Wire Road |

| Fayetteville, AR 72703 |

|

Fayetteville, AR 72701 |

| |

|

|

| a). 43,141,649 Common Stock Shares |

|

a). 31,487,546 Shares |

| b). 1,800,000 Preferred Shares |

|

b). 1,200,000 Preferred Shares |

| c). Option to call for 6,451,613 Common Stock Shares |

|

c). Option to call for 6,451,613 Common Stock Shares |

| d). Option to call for 37,400,000 Common Stock Shares |

|

d). Option to call for 5,000,000 Common Stock Shares |

| |

|

|

| Current Ownership of Common Stock: 6.5% |

|

Current Ownership of Common Stock: 4.7% |

| Potential Common Stock Percentage: 12.31% |

|

Potential Common Stock Percentage: 6.36% |

Item 5. Directors and Executive Officers.

| (a) | Eric F. Parkinson (56) – Chairman and Chief Executive Officer. Parkinson is a entertainment industry veteran with

more than 30-years of experience in the film production and distribution arenas. Prior to purchasing Truman Press, Inc., d/b/a

“Hannover House” in 2002, Parkinson had served as the Chairman and C.E.O. of Hemdale Communications, Inc., a NASDAQ

traded entertainment company, as well as senior executive level positions with Plaza Entertainment, Inc. and A.I.P. Studios. Parkinson

has released more than 900 titles to the North American home video marketplace, with a dozen #1 national best-sellers, including

“Terminator”, “Little Nemo” and the “1984 Summer Olympic Highlights.” Parkinson studied film

production and communications at the University of Kansas and the University of Arkansas, where he has also served as a guest lecturer

on film production and distribution. On the production side, Parkinson has served as producer (or executive producer) on more than

sixty feature films or television programs. |

| (b) | Don Frederick Shefte, Esq. (67) – President. Shefte joined Hannover House in 2007 after serving

as a Trust Officer for the Bank of Fayetteville. As a licensed attorney in California, Shefte worked his way up to a partnership

position at one of the top law firms in San Diego (Seltzer Caplan) before moving into private-practice as an entrepreneur and Wal-mart

vendor. Shefte obtained his law degree from Vanderbilt University, and undergraduate degree at Trinity University. Due to his specialized

knowledge of financial services and estate planning, Shefte also worked as an adjunct professor

for the Sam Walton School of Business at the University of Arkansas while also working as a Bank Trust Officer. Since joining Hannover

House, Shefte has negotiated over 100 rights license agreements and has assisted in the release of more than 65 titles. |

The term of office of each director expires at the earlier of when

the director’s successor is elected and qualified, his resignation, his removal from office by the stockholders or his death.

Directors are not compensated for serving as such, but the Board of Directors may provide for compensation of Directors by resolution.

Officers serve at the discretion of the Board of Directors.

| (c) | Significant Employees. |

In addition to Eric F. Parkinson and D. Frederick

Shefte, Company considers its Vice President of Sales, Tom Sims, to be a significant employee. Sims joined the Company in June,

2014, with a mandate to recreate a multi-studio distribution model similar to those that he successfully formed and operated for

Vivendi / Universal Music Group and Allegro Media Group. The release model being operated by Tom Sims, Medallion Releasing, Inc.,

is a consortium of five (at present) video labels, each representing a specialty in non-competitive arenas and categories of videos

(e.g., Spanish, Urban, Christian, Family, Horror, Anime). The continued employment of Tom Sims is believed to be a material requirement

of the supplier studios participating with Medallion Releasing, Inc. For calendar year 2015, Company is forecasting gross sales

of over $5-million from the Medallion supplier labels, which revenues will nicely supplement income being generated by Hannover

House activities.

(d) Family Relationships.

None.

(e) Involvement in Certain Legal Proceedings.

No officer, director, or persons nominated for such positions, promoter,

control person or significant employee has been involved in the last ten years in any of the following:

| · | Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either

at the time of the bankruptcy or within two years prior to the time of such filing, or any corporation or business association

of which such person was an executive officer either at the time of the bankruptcy or within two years prior to the time of such

filing; |

| · | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and

other minor offenses); |

| · | Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent

jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business,

securities or banking activities; and |

| · | Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission

to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Item 6. Executive Compensation.

Both Parkinson and Shefte are currently accruing an annualized

salary of one-hundred-eighty-thousand dollars (USD $180,000) each; however, these managers has been deferring receipt of most or

all of this accrued salary on a monthly basis, in order to assist with the Company’s cash flow management and growth. In

addition to this accrued salary, each of Parkinson and Shefte have had their health insurance premiums and cellular phone bills

covered by the Company. Based on industry comparisons for salary and compensation packages for key executives in the entertainment

industry, both Parkinson and Shefte are accruing less than half of the base compensation of $400,000 being paid to key executives

by other independent studios. By agreement with Parkinson and Shefte, payment of the deferred / accrued salaries shall be considered

subordinate to key creditors and corporate operational needs, excepting for termination or cessation of employment for any reason,

at which time the deferred salaries become due and payable.

Item 7. Certain Relationships and Related Transactions,

and Director Independence.

Not Applicable.

Item 8. Legal Proceedings.

As of the date of this Form 10 Registration Filing, the Company

was not involved in any legal proceedings. Over the past five years, the Company has been involved in a variety of lawsuits and

disputes, all of which have been fully adjudicated and are now subject to performing settlement agreements, full resolution or

pending negotiations.

As Plaintiff, the Company has engaged the services of attorney

George B. Morton, Esq., to file a lawsuit for damages against a known individual and his accomplices who have been aggressively

attacking the Company’s stock, reputation and management with knowingly false and malicious statements and acts of interference

(including a sabotage of the Company’s relationship with a previously designated auditing firm and direct interference

with several programming supplier partners). Details of this lawsuit, which is expected to be filed during February, 2015 –

and which is expected to seek damages of $10-million or more on behalf of the Company, officers and shareholders – will be

disclosed in a separate Form 8 information statement filing.

Item 9. Market Price of and Dividends on the Registrant’s

Common Equity and Related Stockholder Matters.

The Common Stock is currently trading on the OTC Markets

Pinksheets under ticker symbol: HHSE. The current market price of the Common Stock shares is approximately one-cent ($.01) per

share, with an average daily volume of approximately 1,672,000 shares (value of dollar volume of average daily trading is $16,720).

According to the Company’s Transfer Agent, Standard

Registrar & Transfer Co., Inc., there are currently 183 Shareholders of Record, inclusive of account holders with multiple

shareholders (such as E-Trade, Scottrade, TD Ameritrade, etc…). To the best of Management’s knowledge, and as confirmed

by the Transfer Agent, there are only two shareholders known to own or control more than five percent (5%) of the Company’s

stock, namely officers Eric F. Parkinson and D. Frederick Shefte (Shefte’s ownership of 5% or more is predicated upon

his exercise of the two options to receive shares as described herein).

The Registrant has not paid any cash dividends to date and

does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize

all available funds for the development of the Registrant’s business.

| (d) | Securities Authorized for Issuance under Equity Compensation Plans. |

None.

Item 10. Recent Sales of Unregistered Securities.

As described hereunder, there is an existing market for the

Company’s unregistered securities via the OTC Markets Pinksheets Exchange, under ticker symbol: HHSE. At all times since

the merger between Hannover House and Mindset / TDGI in December, 2009, the Company has relied upon the advice of competent, outside

securities counsel as well as the Company’s transfer agent, regarding the legality of any issuances of unregistered securities,

including shares that have been issued over the past four years under a Rule 144 exemption for qualified debt conversions.

Item 11. Description of Registrant’s Securities

to be Registered.

| (a) | Capital Stock and Preferred Stock. |

The Company is authorized by its Articles

of Incorporation to issue an aggregate of 700,000,000 shares of capital stock, par value $0.001 per share, all of which are shares

of Common Stock. The Company is also authorized by its Articles of Incorporation to issue an aggregate of 10,000,000 shares of

Preferred Stock, par value $.001 per share, all of which are shares of Preferred Stock. As of January 1, 2015, Company had issued

a total of 663,227,212 shares of Common Stock and 3,000,000 shares of Preferred Stock.

Common Stock - All outstanding shares of Common Stock

are of the same class and have equal rights and attributes. The holders of Common Stock are entitled to one vote per share on all

matters submitted to a vote of stockholders of the Company. All stockholders are entitled to share equally in dividends, if any,

as may be declared from time to time by the Board of Directors out of funds legally available. In the event of liquidation, the

holders of Common Stock are entitled to share ratably in all assets remaining after payment of all liabilities. The stockholders

do not have cumulative or preemptive rights.

Preferred Stock – As per the Company’s

Articles of Incorporation, all outstanding shares of Preferred Stock are considered as “Voting Shares” to be held by

the Company’s principal managers. The Preferred Stock shares carry a value of 1,000-to-1 as compared to the voting power

of the Common Stock shares. The Preferred Stock may be converted to Common Stock by the Preferred Stockholders upon cessation of

their managerial or directorship duties for the Company, said conversion to be performed at a ratio of 30 Common Stock shares per

share of Preferred Stock.

Principal managers for the Company, Eric F. Parkinson and

D. Frederick Shefte, each retain the option of converting their unpaid and / or deferred salaries and / or the balances otherwise