Current Report Filing (8-k)

September 28 2015 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): Sept. 25, 2015

_______________________________

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| X |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 8 — OTHER EVENTS

FOR REGISTRANT

| Item 8.01 |

Other Events

a). The Board of Directors of Hannover House, Inc. (“Company”)

have approved the engagement of the law firm of Hinds & Shankman (Los Angeles) to serve as plaintiff’s counsel in a lawsuit

to be filed by Company against Blackbridge Capital, LLC (“Blackbridge”) and Standard Registrar and Transfer Co., Inc.

(“SRTC”). The purpose of the lawsuit is to compel the return of approximately 9.8-million shares of Company’s

stock that was released by SRTC to Blackbridge without Company’s approval and without a legal basis for such an issuance

or release. Company has served notice to both Blackbridge and SRTC demanding the return to treasury of the shares that were issued,

but neither has complied.

b). The Board of Directors of Hannover House, Inc. (“Company”)

have approved the engagement of the law firm of George B. Morton & Associates (Fayetteville, AR), to file a civil action in

Federal District Court against defendants Joseph A. Chaskin, John Zehr, Mickey Britt, Thomas Evertts and other alias defendants,

co-conspirators and alter-egos utilized by these defendants in a criminal scheme to manipulate the market for the Company’s

stock. The lawsuit will seek damages of $15-million dollars, or such additional amounts as the court may deem appropriate, to be

distributed to Shareholders under a damages formula. The Company will continue to work with the FBI and the US Attorney’s

office to assist with their separate investigations into the criminal violations of the defendants. The Company will reserve the

option of naming additional defendants to this action.

c). The Company’s Board of Directors has approved the

second cash installment payment to TCA Global Master Fund (for “October” 2015). The final issuance of debt-conversion

shares to TCA through Magna Investments, which was initiated on July 2, 2015 and allowed to survive under the cash-retirement agreement

with TCA has been completed through three conversion actions, each consisting of approximately 5.8-mm shares. Company does not

anticipate any additional share conversion issuances for the benefit of TCA and the balance still due to TCA from Company as ongoing

monthly installments from the Company’s cash flow are expected to fully retire the balance of this obligation.

d). The Company’s Board of Directors has approved a

payment plan to retire the P&A Loan balances due to JoLynn Anderson and Dennis Anderson in cash and through quarterly installments

funded through the Company’s cash flow. Company does not anticipate the need for any share conversion activities to deal

with this obligation, or any other obligation as currently situated within the scope of operations and relationship management. |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: September 28, 2015 |

Hannover House, Inc. |

| |

By |

/s/ Eric F. Parkinson |

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

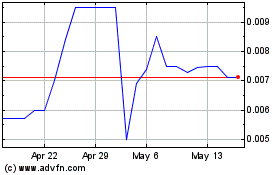

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Feb 2025 to Mar 2025

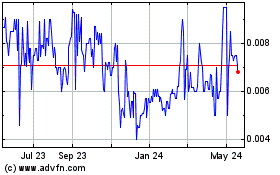

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Hannover House Inc (PK) (OTCMarkets): 0 recent articles

More Hannover House, Inc. News Articles