Current Report Filing (8-k)

November 24 2015 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): Nov. 23, 2015

_______________________________

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| X |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 8 — OTHER EVENTS

FOR REGISTRANT

| Item 8.01 |

Other Events

a). TCA LOAN RETIREMENT - The Company anticipates

a full retirement of the remaining balances due to TCA Global Master Fund (inclusive of principal, interest, penalties, bonus fees

and legal fees) by mid-December. It is Company’s intention to push for a prompt release of the U.C.C. Lien held by TCA into

selected library titles (prior to April, 2013), as well as to compel the return of 10-million shares of common stock that were

issued to TCA in May of 2013 as partial collateral for the business loan transaction.

b). ACTION FOR RECOVERY FROM ERRONEOUSLY ISSUED SHARES

The Board of Directors of Hannover House, Inc. (“Company”) had previously approved the engagement of the law firm of

Hinds & Shankman (Los Angeles) to serve as plaintiff’s counsel in a lawsuit to be filed by Company against Blackbridge

Capital, LLC (“Blackbridge”) and Standard Registrar and Transfer Co., Inc. (“SRTC”). The purpose of the

lawsuit is to compel the return of approximately 9.8-million shares of Company’s stock that were released by SRTC to Blackbridge

without Company’s approval and without a legal basis for such an issuance or release. Company had previously served notice

to both Blackbridge and SRTC demanding the return to treasury of the shares that were issued, but neither party complied. In reviewing

the case, a determination was made that the value of the stock shares at the date of erroneous issue was less than $75,000, and

therefore, the case could be filed in Circuit Court in Arkansas rather than in Federal Court in Los Angeles (which will save the

Company significant legal expenditures). Accordingly, the attorney assigned to pursue this matter has been designated as George

B. Morton, Esq.

c). SHARE STRUCTURE - The

Company refiled the notification and Amended Articles of Incorporation with the Wyoming Secretary of State, as noted on August

11, 2015, to freeze the total A/S of stock at the board approved level of 800-million. The pending return of the TCA Shares,

and the anticipated return of the Blackbridge Capital shares issued in error should collectively create a sufficient reserve

under the 800-million A/S cap. In April of this year, the Company filed Amended Articles of Incorporation to create a mechanism

authorizing the possible increase in total Authorized Shares (A/S) if so required as a reserve for aging notes containing a “conversion

option” in the event of default of payment in cash. The Wyoming Secretary of State’s office misinterpreted the amendment

as a request to immediately increase the A/S to 900-million shares, which was not the intention of the provision. In order to clarify

the proper share structure and cap at 800-million, the Company has refiled with the Wyoming Secretary of State utilizing boiler-plate

format filings that clearly specify the Share Structure.

d). SHARE BUY-BACK – The Board of Directors

approved in principle a plan to begin modest buy-backs of the Company’s Common Stock Shares off the open market, for retirement

into treasury stock. The implementation of such an action will require the prior satisfaction of certain corporate goals, along

with other factors that are not within the Company’s control. The condition precedent to such a use of proceeds would be

the satisfaction of the TCA Global Master Fund senior loan obligation, and the retirement of their U.C.C. Lien. Another condition

would be the agreement and implementation of termed payment plans with other key creditors of the Company. Two other factors will

include the market price of the Company’s Common Stock Shares at the time of purchase consideration, to be compared against

the value of utilizing cash surplus reserves for new release marketing or new ventures.

Page 2 |

|

At this time, the Company forecasts that it could be in receipt

of surplus cash by January, 2016, and if the Company’s price per share of Common Stock is still trading at under $.007 as

of that time, that the purchase of shares (and retirement into treasury stock), may offer the Company’s shareholder’s

the best return on investment and use-of-proceeds. Due to the myriad of factors affecting the viability of a Company share buy-back

plan, the Company makes no representations, warranties or guarantees that such a buy-back will ultimately occur.

e). FORM 10 FILING & AUDITORS - The Company anticipates a re-filing

of the Form 10-12(g) Registration Statement in January, 2016, in order to include the auditor’s report for the year-ending

12-31-2015. The two most recent years of completed audits will include 2014 and 2015, and the auditing firm is PCAOB certified.

The Company considered a possible restatement of the fiscal year closing (in order to facilitate a more expeditious refiling of

the Form 10), but the procedures to restate the prior year periods indicated that there would be no savings in time. The Company

feels that the filing of the Registration Statement in January, 2016, inclusive of the 12-31-2015 year end results, will offer

Shareholder’s the most current and complete analysis of all activities.

f). CIVIL LITIGATION AGAINST STOCK MANIPULATORS – The Company

is continuing to work with attorney George B. Morton in the drafting, review and revisions of the extensively documented civil

case against specific, identified parties that have engaged in covert actions to disparage the Company and its managers in order

to manipulate the Company’s Common Stock price for their own gain. Further disclosures will be released as this legal matter

progresses.

g). NEW BOARD MEMBERS – The Company’s

Board has approved the addition of three new board members, inclusive of two (2) “outside” directors (not otherwise

affiliated or employed by Company). The inside director will be VP of Sales, Tom Sims. The two “outside” directors

will be announced in January, prior to the filing of the Form 10-12(g) Registration Statement. Beginning in January, 2016, the

Company will have “Officers & Director’s Liability Insurance” coverage for the Board of Directors, as a condition

precedent to the acceptance of Board positions for these three, new individuals.

|

|

Page 3

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: November 23, 2015 |

Hannover House, Inc. |

| |

By |

/s/ Eric F. Parkinson |

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

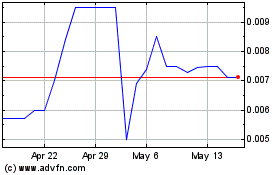

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Nov 2024 to Dec 2024

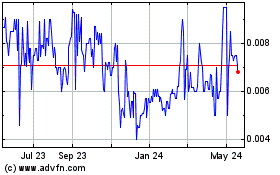

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Dec 2023 to Dec 2024