Imperial Brands Sees Higher Operating Profit Growth in Year Ahead -- Update

November 14 2023 - 3:07AM

Dow Jones News

By Elena Vardon

Imperial Brands said it expects its adjusted operating profit

for fiscal 2024 to be close to the middle of its mid-single digit

range and its revenue to grow in the low-single digits.

The FTSE 100 tobacco group--which houses Davidoff, Gauloises and

JPS among its brands--said Tuesday it sees its performance in the

year ahead to be weighted to the second half on the phasing out of

its pricing and investments in its next-generation products. It

expects its first-half operating profit to grow at low-single

digits at constant currency.

"Looking ahead, we expect the continuing benefits of our

transformation to enable a further acceleration in our adjusted

operating profit growth in the final two years of our five-year

strategy," Chief Executive Stefan Bomhard said.

For fiscal 2023, the cigarette maker reported an adjusted

operating profit--one of its preferred metrics--of GBP3.89 billion

for the year ended Sept. 30--behind analyst expectations of GBP3.91

billion--which represents 3.8% on-year growth at constant currency.

It had guided for growth at the lower end the of mid-single-digit

range while consensus had seen 3.5% organic growth against the

GBP3.69 billion reported for the year-prior period.

It said net revenue from tobacco and its next-generation

products--which include vape, heated tobacco and oral nicotine

products--was GBP8.01 billion, or 0.7% on-year growth at constant

currency. The group had guided for low-single-digit organic growth

while analysts polled in a company-compiled consensus had expected

the figure to improve 1%, and to report GBP8.04 billion, from the

previous year's GBP7.79 billion result.

Imperial Brands' tobacco volumes fell 10.4% due to its exit from

Russia and weakness in the mass market for cigars in the U.S.,

which was offset by stronger pricing, it said. Next-generation

products' net revenue rose 26.4%, it added.

The board declared a dividend 146.82 pence a share, compared

with the previous year's 141.17 pence payout, while analysts had

expected 145.1 pence a share return.

At 0833 GMT, shares were down 3.5 pence, or 0.2%, at 1,784.5

pence after opening slightly higher, while the wider FTSE 100 index

edged down 0.1%.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

November 14, 2023 03:52 ET (08:52 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

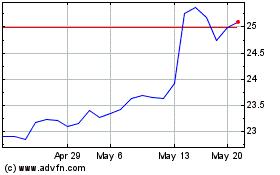

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Dec 2023 to Dec 2024