UPDATE:Impala Platinum's Rustenburg Mine At 85% Of Full Output

May 30 2012 - 3:55AM

Dow Jones News

Impala Platinum Holdings Ltd. (IMP.JO), the world's

second-largest producer of the metal, said Tuesday that Rustenburg,

its largest platinum operation, had reached about 85% of full

production and is due to reach full production in June, a company

spokesman confirmed Wednesday.

The Johannesburg-based miner had initially targeted 900,000

ounces of platinum production from Rustenburg for the fiscal year

ending June 30, 2012 but a protracted illegal strike at Rustenburg

in February significantly curtailed production there. The company

has refrained from giving a new official production target as it

continues to ramp up the mining complex to full production.

The company's executive director of South African operations,

Paul Dunne, told analysts on a conference call Tuesday that

Rustenburg produced 64,000 troy ounces of platinum in May compared

to previous expectations that Rustenburg would produce about 75,000

ounces a month for each of the 12 months in the current fiscal

year.

"Shafts 12, six, eight and five shaft, although small, have all

reached 100% of their expected production and we are confident that

the rest will follow into June," he said.

Rustenburg suffered about 120,000 ounces of lost platinum output

due to a six-week illegal strike in its third fiscal quarter ending

March 31. The lost output contributed to a 46% drop in the

company's total platinum output to 230,000 troy ounces in the third

quarter compared with the same quarter a year before.

A company spokesman said Impala Platinum intends to reach 100%

platinum output per month in June. The company confirmed an

analyst's calculation on the call that the company was likely to

achieve 750,000 oz of platinum output from the reef area around

Rustenburg for the full fiscal year ending June 30, although David

Brown said the company wasn't yet prepared to confirm a final

output guidance for the year.

The company confirmed another calculation from the same analyst

that the company was likely to produce 65,000 to 70,000 ounces of

platinum in June from the Rustenburg complex.

Separately, Bob Gilmour, the head of corporate relations, said

the outlook for platinum and palladium remains robust in the medium

to long term, driven by tighter restrictions on vehicular

emissions, but said demand in the short term remains mixed.

He said the platinum market is "currently dominated by the

global macroeconomic environment and particularly the euro zone

crisis. This will impact European vehicle sales and obviously

platinum given that an excess of 50% sales are diesel which is the

platinum base [for] autocatalysts."

Counterbalancing weak demand in Europe is a rebound in North

American vehicle sales, a rebound in Japanese vehicle sales

following last year's earthquake and growth in emerging markets

such as China where the government is looking to fund vehicle sales

in rural areas and also a "cash for clunkers" program, Gilmour

said, referring to the financial incentive scheme to replace old

cars with new models. He also noted that Chinese jewlery demand

remains firm, aided by weaker platinum prices.

Impala Platinum expects the global platinum market to be close

to balanced this year following a surplus last year due to lower

output from South Africa and flatish output elsewhere. South Africa

accounts for about three-quarters of global platinum supply.

He added that he expects both the platinum and palladium markets

to remain in deficit over the next five years.

-By Alex MacDonald, Dow Jones Newswires; +44 (0)20 7842 9328;

alex.macdonald@dowjones.com

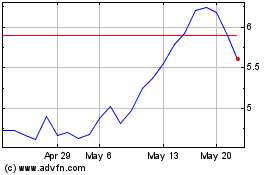

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Oct 2024 to Nov 2024

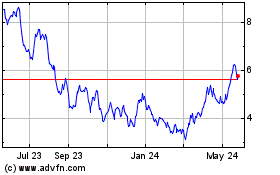

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Nov 2023 to Nov 2024