Extract Resources Starts Funding Talks For US$1.66 Billion Uranium Mine

September 13 2011 - 10:01PM

Dow Jones News

Extract Resources Ltd. (EXT.AU) said Wednesday it has begun

talks with potential lenders to its US$1.66 billion Husab uranium

project in Namibia, in a major test of financiers' appetites to

support new mines in the wake of Japan's nuclear crisis.

Perth-based Extract has approached several financing agencies

and banks to support its plans to process 15 million tons of ore

annually at Husab, which would make it one of the world's largest

uranium mines.

"Extract intends to finance the development of Husab with a

combination of debt and equity," Chief Executive Jonathan Leslie

said in the company's annual report.

Spot uranium prices continue to trade near lows reached soon

after radiation leaks and explosions at the Fukushima Daiichi

nuclear power plant in Japan raised fresh concerns about nuclear

safety. Long-term contract prices are also down nearly 12% since

just before the earthquake and tsunami struck Japan on March

11.

Although analysts predict the spot uranium price could fall as

low as US$45.95 a pound over the next 3-6 months from US$52.75/lb

currently, reflecting market concerns about weak demand for the

nuclear fuel in Japan and Germany, the long-term contract price is

expected to stay in a US$60-US$75/lb trading band.

"This level should support development decisions at a number of

advanced uranium development projects, particularly in Namibia,

such as the large-scale Husab project of Extract Resources,"

Sydney-based Resource Capital Research wrote in a report this

month.

In February, Extract said it was talking with Rio Tinto PLC

(RIO) about the potential to develop Husab jointly with Rio's

neighboring Rossing uranium mine, which is already in

production.

However, Leslie reiterated Wednesday that Extract is "confident

that the fundamentals underlying the project will support

standalone financing".

These fundamentals include a mine life of over 20 years,

competitive cost structure, and a robust long-term uranium market

as China, India and South Korea build new nuclear reactors, he

said.

Extract remains in talks with potential buyers over long-term

offtake and partnership deals supportive of equity and debt

financing, he said.

Japanese trading house Itochu Corp. (8001.TO) last year built a

10.3% stake in Extract, while Leslie said Extract remains in talks

with Namibia's state mining company Epangelo about its potential

involvement in Husab.

In August, Extract said uranium reserves within Husab's zones 1

and 2 are now estimated at 280 million metric tons, 37% larger than

previously thought, and the ore grade was also better than

expected.

-By David Winning, Dow Jones Newswires; +61-2-82724688;

david.winning@dowjones.com

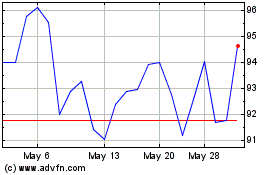

Itochu (PK) (USOTC:ITOCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

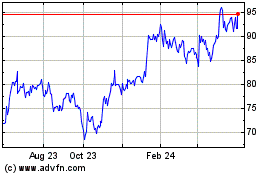

Itochu (PK) (USOTC:ITOCY)

Historical Stock Chart

From Jan 2024 to Jan 2025