Jade Art Group Inc. (OTCBB: JADA) (“Jade Art" or the "Company"),

a seller and distributor of raw jade in China, announced today its

financial results for the third quarter and nine months ended

September 30, 2010.

2010 Third Quarter Financial Highlights

- Revenue was $2.3 million in the third

quarter, down from $10.7 million of revenue recorded in the third

quarter of 2009.

- Gross profit was $1.4 million, compared

to $9.2 million in the third quarter of 2009.

- Net income in the third quarter of 2010

was $235,576, a decrease of 96% compared to net income of $6.3

million in the third quarter of 2009.

Third Quarter 2010 Financial Results

Jade Art Group's third quarter 2010 revenue was $2.3 million,

representing a 78% decrease from the $10.7 million of revenue

recorded in the comparable period in 2009. This decrease in revenue

resulted from a reduced level of orders received from the Company’s

major customers.

Gross profit for the third quarter was $1.4 million compared to

$9.2 million for the same period last year, a direct result of the

decrease in revenue.

Selling, general, and administrative expenses for the third

quarter of 2010 were $130,832 as compared to $531,484 for the same

period in 2009 due to a reduction in promotional costs.

Bad debt expense for the third quarter was $767,691. This bad

debt expense results from delayed payments from our five major

customers. As a result of these delayed payments, the Company has

suspended shipments of raw jade to two of our customers. The

Company will continue to monitor this situation and periodically

reevaluate the adequacy of the bad debt reserve.

As a result, net income was $235,576 for the third quarter of

2010 as compared to $6.3 million of the third quarter of 2009.

Basic and diluted earnings per share in the third quarter of 2010

were $0.00 as compared to $0.08 per basic and diluted share in the

third quarter of 2009.

2010 First Nine Months Financial Results

Jade Art Group’s revenue for the first nine months of 2010 was

$11.0 million, a decrease of $6.6 million or 37% from last year’s

comparable period’s results. Gross profit for the first nine months

of 2010 was $8.1 million, a decrease from the $14.2 million

recorded in the first nine months of 2009.

Selling, general and administrative expenses for the nine months

ended September 30, 2010 were $353,157 compared to last year’s

level of $1,174,353. This 70% decrease reflects a reduction in

promotional costs.

Bad debt expense for the first nine months of 2010 was

$1,019,064 and there was no bad debt expense for the prior year’s

comparable period.

Income before taxes for the first nine months of 2010 and 2009

was $6.7 million and $13.0 million, respectively, representing a

decrease of $6.3 million or 48% for the 2010 period.

Net income for the first nine months of 2010 was $4.5 million, a

decrease of approximately 50% from $9.1 million for the nine months

ended September 30, 2009. Basic and fully diluted earnings per

share for the first nine months of 2010 was $0.06, while the basic

and fully diluted earnings per share for the first nine months of

2009 were $0.11.

Financial Condition

As of September 30, 2010, Jade Art Group had cash and cash

equivalents of $16.3 million, up from $147,392 as of December 31,

2009. Current assets and current liabilities as of September 30,

2010, were $22.4 million and $1.9 million, respectively, yielding

working capital of $20.5 million.

About Jade Art Group Inc.

Jade Art Group Inc. is a seller and distributor in China of raw

jade, which has uses ranging from decorative construction material

for both the commercial and residential markets to high-end

jewelry. For more information, please

visit: http://www.jadeartgroupinc.com/.

FORWARD-LOOKING STATEMENTS

This press release contains certain statements that may include

"forward-looking statements." All statements other than statements

of historical fact included herein are "forward-looking

statements." These forward-looking statements are often identified

by the use of forward-looking terminology such as 'believes,'

'expects' or similar expressions, involve known and unknown risks

and uncertainties. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company's

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including those discussed in the Company's periodic

reports that are filed with the Securities and Exchange Commission

and available on its website http://www.sec.gov. All

forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these factors. Other than as required under the securities laws,

the Company does not assume a duty to update these forward-looking

statements.

Jade Art Group Inc.

Condensed Consolidated Statements of Operations

(Unaudited) Three Months Ended

September 30, Nine Months Ended September 30,

2010 2009 2010 2009 Revenues $

2,330,773 $ 10,667,585 $ 11,024,888 $ 17,592,611 Cost of Sales

886,093 1,486,437 2,947,631 3,436,507

Gross Profit 1,444,680

9,181,148 8,077,257 14,156,104 Selling, General and Administrative

Expenses 130,832 531,484 353,157 1,174,353 Bad Debt Expense 767,691

- 1,019,064 -

Income before Taxes 557,780 8,653,242

6,726,286 12,980,498 Provision for Income Taxes 322,204 2,359,012

2,176,331 3,876,945 Net Income $ 235,576 $ 6,294,230 $

4,549,955 $ 9,103,553 Basic weighted average shares 79,980,000

79,980,000 79,980,000 79,980,000 Diluted weighted average shares

79,980,000 79,980,000 79,980,000 80,300,755

Total Basic Earnings

Per Share $ 0.00 $ 0.08 $ 0.06 $ 0.11

Total Diluted Earnings

Per Share $ 0.00 $ 0.08 $ 0.06 $ 0.11

Jade Art Group Inc.

Condensed Consolidated Balance Sheets (Unaudited)

Assets September 30, 2010 December 31,

2009 Current Assets Cash and cash equivalents $

16,270,724 $ 147,392 Accounts receivable, net 5,913,817 7,502,004

Deferred tax assets 254,766 - Total Current Assets 22,439,307

7,649,396 Acquisition deposit - 8,787,089 Exclusive jade

distribution rights, net 65,115,169 63,108,842

Total Assets

$

87,558,325 $

79,550,028 Liabilities and

Stockholders’ Equity Current Liabilities Account payable

and accrued liabilities $ 584,679 $ 270,960 Due to related party

785,826 723,090 Taxes payable 566,436 2,050,385 Total Current

Liabilities 1,936,431 3,044,435

Total Liabilities

1,936,431 3,044,035 Total Stockholders' Equity

85,621,384 76,505,593

Total Liabilities and Stockholders'

Equity $ 87,558,325 $ 79,550,028

Jade Art Group Inc.

Condensed Consolidated Statements of Cash Flow

(Unaudited) Nine Months Ended September 30,

2010 2009 Net cash provided by operating

activities $ 6,751,225 $ 6,496,350 Net cash provided by investing

activities 8,787,089 - Net cash used in financing activities -

(2,264,851) Effect of exchange rate changes on cash 585,018 - Net

change in cash and cash equivalents $ 16,123,332 $ 4,340,016

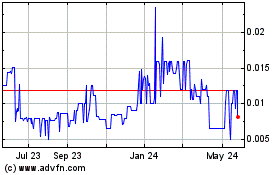

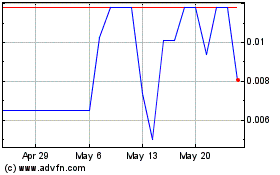

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Nov 2023 to Nov 2024