Falcon Private Bank Seeks Distance From 1MDB Controversy

March 09 2016 - 8:00PM

Dow Jones News

DUBAI—Falcon Private Bank Ltd. on Wednesday sought to distance

itself from a controversy involving a Malaysian state fund caught

up in allegations of political corruption, saying the transactions

it carried out were based on purely commercial terms.

Several Swiss banks, including Falcon, have come under scrutiny

for transactions involving 1Malaysia Development Bhd. fund, or

1MDB. Among the transactions that are being investigated by

authorities in Switzerland and Malaysia is the transfer of $681

million to the private account of Najib Razak, Malaysia's prime

minister who helped to set up 1MDB.

Malaysia's attorney general said the $681 million was a legal

donation to Mr. Najib by a member of Saudi Arabia's royal family

and most of it was ultimately returned. The attorney general also

concluded that there was nothing improper about the donation.

Investigators, however, believe the money originated with 1MDB and

before much of it was returned moved through a complex web of

transactions in several countries, people familiar with the

investigations previously told The Wall Street Journal.

Mr. Najib has denied wrongdoing or taking money for personal

gain, and 1MDB has denied wrongdoing and has said it is cooperating

with investigators.

Some of the transactions between the Malaysian fund and Falcon's

Abu Dhabi owner, International Petroleum Investment Co., or IPIC,

were routed through Falcon accounts, investigators believe. Falcon

itself hasn't been accused of any wrongdoing. Falcon previously

said the bank is "fully transparent and cooperative with the

current investigations by various authorities and regulators."

On Wednesday, Falcon Private Bank's chief executive, Eduardo

Leemann, said the Zurich-based wealth-management firm operates

independently from its Abu Dhabi owner and that the emirate plays

only a minor role in helping it gain new business or clients.

"The owners, IPIC as well as Aabar, never until today, never

have never had and never will get involved in any operational

issues," Mr. Leemann said. "It opened doors but no more than that,"

he said. He made the comments at the inauguration of the bank's new

office in Dubai's financial center.

Mr. Leemann said the bank suffered no impact from the

association with the Malaysian scandal and that it has internal

compliance mechanisms in place that have been audited internally,

externally and by regulators.

"There's a process about documenting each and every transaction

we execute," Mr. Leemann said. "It's excess documentation, believe

me, we have followed that process on all cases, and I'm not talking

on 1MDB only," he said.

Some banking industry experts have raised questions about why

relatively small private banks like Falcon and other Swiss lenders

are making transactions worth hundreds of millions for government

funds.

Mr. Leemann, a veteran private banker who has worked at Goldman

Sachs and Julius Baer, said such banks dealing with government

entities is unusual but happens. "It's case by case," he said.

"This is an interesting piece of business, we accept it and then

you go through the process and it doesn't matter whether the

counterparty is a government or a high-net-worth individual," said

Mr. Leemann.

IPIC is currently represented on Falcon's board of directors by

its chief financial officer, Murtadha Al Hashmi. IPIC declined to

comment.

Falcon was founded by U.S. insurance giant American

International Group almost half a century ago. After AIG nearly

collapsed during the financial crisis, it was sold to Abu Dhabi

investor Aabar in 2009. Aabar itself is a subsidiary of IPIC, the

emirate's vehicle that over the years has conducted several deals

with 1MDB.

Aside from its domestic market Switzerland, the bank is looking

for more business in Russia, Indonesia and the United Arab

Emirates. Its Middle East offices in Dubai and Abu Dhabi account

for $2.5 billion of the bank's total $18 billion assets under

management, according to Falcon.

Write to Nicolas Parasie at nicolas.parasie@wsj.com

(END) Dow Jones Newswires

March 09, 2016 20:45 ET (01:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

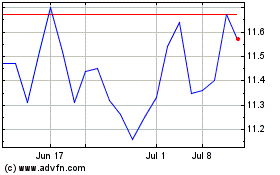

Julius Baer (PK) (USOTC:JBAXY)

Historical Stock Chart

From Dec 2024 to Jan 2025

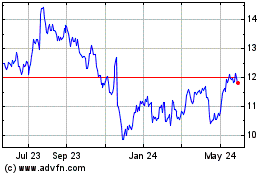

Julius Baer (PK) (USOTC:JBAXY)

Historical Stock Chart

From Jan 2024 to Jan 2025