Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

November 15 2023 - 1:36PM

Edgar (US Regulatory)

| |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (Check

one): |

|

☐

Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR |

| |

|

|

| |

|

For

Period Ended: |

September

30, 2023 |

| |

|

|

| |

|

☐

Transition Report on Form 10-K |

| |

|

|

| |

|

☐

Transition Report on Form 20-F |

| |

|

|

| |

|

☐

Transition Report on Form 11-K |

| |

|

|

| |

|

☐

Transition Report on Form 10-Q |

| |

|

|

| |

|

☐

Transition Report on Form N-SAR |

| |

|

|

| |

|

For

the Transition Period Ended: |

|

Read

Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein. |

|

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

LEGACY

EDUCATION ALLIANCE, INC.

Full

Name of Registrant

Former

Name if Applicable

1490

N.E. Pine Island Road, Suite 5D

Address

of Principal Executive Office (Street and Number)

Cape

Coral, Florida 33909

City,

State and Zip Code

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed. (Check box if appropriate)

☒

|

(a) |

The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

|

| (b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof will be filed on or before the

fifth calendar day following the prescribed due date; and |

| |

|

| (c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III — NARRATIVE

State

below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report portion thereof, could not

be filed within the prescribed time period.

The Registrant has been unable, without unreasonable effort or expense, to timely compile all information for the disclosures required

to be included in its Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023 (the “Quarterly Report”).

The Registrant expects to file the Quarterly Report no later than the fifth calendar day following the prescribed filing date; however

such Quarterly Report will not be reviewed by an independent registered public accounting firm as the Registrant has not found a replacement

for its former accounting firm.

| SEC

1344 (04-09) |

|

Persons

who are to respond to the collection of information contained in this form are not required to respond unless the form displays a

currently valid OMB control number. |

(Attach

extra Sheets if Needed)

PART

IV — OTHER INFORMATION

| (1) |

|

Name

and telephone number of person to contact in regard to this notification |

| Barry

Kostiner |

|

(239) |

|

542-0643 |

| (Name) |

|

(Area Code) |

|

(Telephone Number) |

| (2) |

|

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment

Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s)

been filed? If answer is no, identify report(s). |

| |

|

Yes

☐ No ☒ |

| |

|

|

|

|

On

August 21, 2023, the Registrant filed its Quarterly Report on Form 10-Q for the fiscal quarter

ended June 30, 2023 (the “Q2 Quarterly Report”). However, as previously disclosed,

the interim financial statements and notes, included in the Q2 Quarterly Report were not

reviewed by an independent public accounting firm using professional standards and procedures

for conducting such reviews, as established by generally accepted auditing standards, as

required by Rule 10-01(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange

Act”). Therefore, the Registrant may not be considered current in its filings under

the Exchange Act until it files an amendment to the Q2 Quarterly Report that contains financial

statements that have been reviewed in accordance with the requirements of Rule 10-01(d).

The

Registrant has further identified one or more Current Reports on Form 8-K not filed to disclose the entering into of material definitive

agreements and the creation of direct financial obligations. |

| |

|

|

| (3) |

|

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be

reflected by the earnings statements to be included in the subject report or portion thereof? |

| |

|

Yes

☒ No ☐ |

| |

|

|

| |

|

If

so, attach an explanation of the anticipated change, both narratively and quantitatively,

and, if appropriate, state the reasons why a reasonable estimate of the results cannot be

made.

|

Revenue

Revenue

was $(0.02) million for the three months ended September 30, 2023 compared to $0.07 million for the three months ended September 30,

2022. Revenue decreased $0.08 million or 131% during the three months ended September 30, 2023 compared to the same period in 2022 as

a result of a decrease in recognition of deferred revenue.

Operating

Expenses

Total

operating costs and expenses were $0.8 million for the three months ended September 30, 2023 compared to $0.67 million for the three

months ended September 30, 2022, an increase of $0.13 million or 20%. The increase was primarily due to the additional costs incurred

by the Legacy Live subsidiary.

General

and administrative expenses

General

and administrative expenses primarily consist of compensation, benefits, insurance, professional fees, facilities expenses and travel

expenses for the corporate staff, as well as depreciation and amortization expenses. General and administrative expenses were $0.76 million

for the three months ended September 30, 2023 compared to $0.58 million for the three months ended September 30, 2022, an increase of

$0.18 million, or 31%. The increase was due to the additional costs incurred by the Legacy Live subsidiary.

Net

income (loss) from continuing operations

Net

income (loss) from continuing operations was $(0.8) million or $(0.03) per basic and diluted common share for the three months ended

September 30, 2023 compared to net income (loss) from continuing operations of $(0.6) million or $(0.02) per basic and diluted common

share for the three months ended September 30, 2022, a decrease in net income from continuing operations of $0.2 million or $0.01 per

basic and diluted common share.

LEGACY

EDUCATION ALLIANCE, INC.

(Name

of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: |

November

15, 2023 |

|

By: |

/s/

Barry Kostiner |

| |

|

|

|

Barry

Kostiner

Chairman

and CEO |

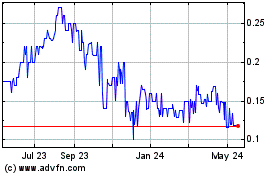

Legacy Education Alliance (CE) (USOTC:LEAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

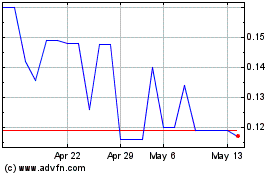

Legacy Education Alliance (CE) (USOTC:LEAI)

Historical Stock Chart

From Dec 2023 to Dec 2024