UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ___)

|

|

|

|

|

Filed by the Registrant

ý

|

|

Filed by a Party other than the Registrant

o

|

|

Check the appropriate box:

|

|

o

|

|

Preliminary Proxy Statement

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

|

Definitive Proxy Statement

|

|

ý

|

|

Definitive Additional Materials

|

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

LIVE CURRENT MEDIA INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

ý

|

|

No fee required.

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

The following letter was sent to stockholders beginning on September 24, 2010.

780 Beatty Street, Suite 307

Vancouver, BC, V6B 2M1, Canada

(604) 453-4870

Dear Fellow Stockholders:

ELECT THE DIRECTOR NOMINEES NAMED

ON THE ENCLOSED

GOLD

PROXY CARD TODAY

At the Annual Meeting of Stockholders of Live Current Media Inc. (“Live Current” or the “Company”) on Tuesday, October 12, 2010, you will be asked to vote on nominees for election to your Board of Directors. David Jeffs, a dissident stockholder, is proposing seven director nominees for election at the Annual Meeting in opposition to the Board’s five recommended nominees for the purpose of seeking control of the Board of Directors and control of Live Current. Mr. Jeffs has decided to pursue a costly and disruptive proxy contest at the Annual Meeting, which is distracting our employees, our management and our Board during the launch of our new strategy for the Company that is intended to drive future revenue growth and profitability.

The Live Current Board of Directors strongly urges you to vote in favor of the Board’s five nominees for election at the 2010 Annual Meeting of Stockholders of Live Current Media Inc. by voting the GOLD proxy card and to discard any proxy card representing the opposing slate nominated by Mr. Jeffs

.

LIVE CURRENT HAS A STRONG BOARD OF

DIRECTORS WITH HIGHLY RELEVANT EXPERIENCE IN PLACE

Live Current’s Board is open-minded and experienced.

Our Board is comprised of highly qualified, proven business executives with relevant experience with start-up and technology-based companies. The Board’s nominees have the necessary depth and breadth of expertise in public and private company leadership, finance, accounting, operations and strategic management, all of which are critical to Live Current’s success. In addition, our executive officers, Geoff Hampson and Paul Morrison have an in-depth knowledge of our business, strategy and team.

Your Board is asking stockholders to elect the following five directors at the Annual Meeting:

|

|

·

|

C. Geoffrey Hampson

, Live Current’s Chairman, Chief Executive Officer and Chief Financial Officer, who has led the Company since June 2007 and whose experience with start-up and operating companies spans 25 years. Prior to joining Live Current, Mr. Hampson had successfully grown Peer 1 Network Enterprises, Inc., a public company, from $25,000 to $6,000,000 a month in revenue from 2000 through 2006.

|

|

|

·

|

James P. Taylor

, former Chief Financial Officer of Corelink Data Centers, LLC, Lakewood Engineering and Manufacturing, and Peer 1 Network Enterprises, Inc. Mr. Taylor has over 20 years of experience in corporate management, finance and planning, as well as in-depth experience with corporate financial and administrative operations.

|

|

|

·

|

Mark Benham

, partner at Celerity Partners, a California-based private equity fund. Mr. Benham has over 15 years of experience in private equity and investment banking, with a particular focus on technology-based companies.

|

|

|

·

|

Boris Wertz

, Chief Executive Officer of W Media Ventures, a Vancouver-based angel fund focusing on consumer Internet investments. Formerly, Dr. Wertz was the Chief Executive Officer of Nexopia, a popular social networking utility for Canadian youth, and Chief Operating Officer of AbeBooks.com, an online marketplace for books that was sold to Amazon.com in 2008. Dr. Wertz has extensive strategic management and operations experience in the area of consumer Internet use.

|

|

|

·

|

Paul W. Morrison

, Live Current’s President and Chief Operating Officer since July 2010. Previously, Mr. Morrison was a founder and the Chief Executive Officer and a director of OmniReliant Holdings, which builds successful brands by leveraging television and multi-channel digital marketing, media assets and e-commerce properties. Mr. Morrison has significant operational and brand-building experience.

|

Please refer to our Proxy Statement for complete biographies of each of our director nominees.

Voting the GOLD proxy will still allow the dissident stockholder to add two members to the Board.

There are currently seven seats on the Board of Directors, and the seven nominees receiving the highest number of votes will be elected. Since there are only five nominees included in the GOLD proxy, it is likely that two of the dissident stockholder’s nominees will be elected even if all of the nominees on the GOLD proxy are elected. Our decision to include only five nominees on the GOLD card is consistent with our repeated offers to the dissident stockholder of Board representation. Management and the current Board believe that voting the GOLD proxy will result in an inclusive Board that will represent the interests of all of the stockholders.

YOUR CURRENT BOARD OF DIRECTORS HAS WORKED TO BUILD A STRONG MANAGEMENT TEAM AND CREATE STOCKHOLDER VALUE

Mr. Hampson has devoted substantial time and effort to growing Live Current’s business.

When Mr. Hampson joined the Company, he agreed to put in a “full time” effort at Live Current, even as he continued his involvement in several other business ventures, which were detailed in Mr. Hampson’s biography as provided to David Jeffs and as disclosed in the Company’s Securities and Exchange Commission (“SEC”) filings at that time. At no time did Mr. Hampson indicate that he would cease to be involved with these other businesses. Later in 2007, Mr. Hampson invested in, and became Chief Executive Officer and a director of Corelink Data Centers, LLC, a start-up company involved in a business unrelated to Live Current’s business. The day-to-day business operations of Corelink were managed at that time by a full-time President and Chief Operating Officer. Mr. Hampson’s investment in Corelink at that time represented approximately 6.25% of the committed capital in that company and now represents only 4.7% of the committed capital. During the later part of 2007, Mr. Hampson devoted in excess of 200 hours per month to his duties as Live Current’s Chief Executive Officer.

Mr. Hampson has worked to strengthen the Board and the management team.

Mr.

Hampson concluded after joining Live Current that there were no established long-term plans or goals, and management had little in the way of tools or reports with which to analyze business activity. In July 2007, Mr. Hampson concluded that David Jeffs, as President of Live Current, would be unable to build the Company’s business without the assistance of a strengthened management team and an expanded Board. Prior to Mr. Hampson joining the Board in June 2007, David Jeffs had been serving as the sole director. Mr. Hampson felt it would be appropriate to expand the Board to include outside directors who could offer their experience and advice, while holding management accountable for its actions. As a result, James Taylor and Mark Benham were appointed to the Board in July and September 2007, respectively. In October 2007, Mr. Hampson was able to persuade Jonathan Ehrlich to leave a senior position at one of Canada’s largest e-tailers to join Live Current as President, at which time David Jeffs stepped down as President and resigned as a director. In November 2007, Mark Melville joined Live Current as Chief Business Development Officer. As a result, Live Current’s senior management team was comprised of three experienced individuals all of whom had successful track records as entrepreneurs and executive officers.

This strengthening of the team was in response to input from several large stockholders, including David Jeffs’s father, Richard Jeffs, for a strategy of rapid and aggressive growth. New investors also endorsed the plan, as Mr. Hampson was able to complete a $5,000,000 financing at $2.00 a share in September 2007. These funds were needed to provide management with the time and capital to pursue alternative business opportunities for the Company.

Mr. Hampson and our current Board of Directors have worked hard to implement strategies to grow Live Current’s business.

Following the successful financing in 2007, the Board and management worked to implement a strategy to grow the Company’s business. For example, in April 2008, Live Current announced the acquisition of the exclusive online and mobile digital rights for the Indian Premier League (“IPL”), a professional cricket league based in India, for 10 years for $2,000,000 per year. These efforts showed results, as the price of Live Current’s shares increased from a range of $1.06 to $1.14 per share in May 2007 immediately prior to Mr. Hampson joining the Company to a range of $1.95 to $3.04 per share in June through August 2008. The Company’s other acquisition efforts included negotiating an agreement with and conducting due diligence on an e-commerce skin care company that management and the Board believed would be highly compatible with and complementary to Live Current’s perfume e-commerce business. The planned closing of this transaction in August 2008 was not completed as a result of a lack of financing, which the Company believes was due at least in part to the global financial crisis that was then unfolding.

Mr. Hampson and our current Board of Directors have continued to adjust Live Current’s management team to meet the Company’s evolving business needs.

Management and the Board believed, following discussion with several prominent financial institutions, that the Company could leverage the relationship with IPL and the planned skincare acquisition to raise the necessary capital to implement Live Current’s growth strategy. Unfortunately, the Company’s fundraising efforts in August and September 2008 coincided with the onset of the worldwide credit and liquidity crisis, which effectively shut off access to the capital markets for most micro cap companies, including Live Current. As a result, the Company renegotiated and ultimately sold the IPL contracts for $1,750,000, generating a profit for the Company.

By January 2009, the economic climate and Live Current’s financial position made it apparent that the Company could not sustain three senior level executives, and Mr. Ehrlich resigned. Also in January 2009, while continuing to devote substantial time and attention, typically 120 to 150 hours per month, to managing Live Current’s business, Mr. Hampson agreed to defer the payment of his salary. In October 2009, the Company and Mr. Hampson agreed to amend his employment agreement to reduce his salary retroactively by 60%, effective February 1, 2009, and to provide that the Company would pay Mr. Hampson’s deferred salary at the end of 2009.

In a further effort to tailor the management team to the economic conditions facing Live Current, the Board promoted Mr. Melville to President in February 2009. The Board’s goal was to implement a plan pursuant to which Mr. Melville would be promoted to become Live Current’s Chief Executive Officer in mid-2010. The expectation was that Mr. Hampson would remain Chairman of the Board, but would no longer be an officer or employee of the Company. Mr. Hampson, believing that Live Current would be in good hands with Mr. Melville at the helm and that his responsibilities at Live Current would be significantly diminished, made a commitment to assume a greater role at Corelink and in June 2010 relocated to Chicago.

In June 2010, Mr. Melville announced that he had accepted a position with the group that had acquired the IPL business from the Company. A search began immediately to replace Mr. Melville and resulted in the hiring of Paul Morrison as President in July 2010. Mr. Morrison’s extensive business experience includes working on the launch of the Calvin Klein, CK1 perfume brand. The Board has asked Mr. Hampson to remain as Chief Executive Officer until early 2011 to ensure continuity, particularly during the key holiday buying season. On July 29, 2010, the Company and Mr. Hampson entered into an amendment to his employment agreement to reduce his salary to CDN$1.00 per year effective July 23, 2010.

YOUR BOARD IS COMMITTED TO ENHANCING STOCKHOLDER

VALUE THROUGH EXECUTION OF MANAGEMENT’S STRATEGY

Management is implementing a new strategy for growth.

After undertaking a thorough analysis, management has developed a new, luxury-oriented business plan for the Company’s main business unit, perfume.com, that it believes will uniquely position the Company in a competitive marketplace. This strategy, which is strongly supported by our current Board of Directors, focuses on working with the major brands that dominate the perfume business, allowing perfume.com’s customers access to the newest fragrances and related products. The new strategy is intended to differentiate perfume.com in a market that is currently dominated by several large groups and has over 1,000 competitors. Under the new strategy, management is targeting gross margins of approximately 40 to 50%, compared to approximately 15 to 20% under the prior strategy.

The key elements of management’s new “luxury strategy” include:

|

|

·

|

Refocusing the website to appeal to women and to attract the major perfume brands. To lead that effort, the Company hired Teresa Findlay, Mr. Hampson’s common law wife, who has over 20 years experience in the fashion industry working with the major fashion brands, a number of which have fragrance lines. Ms. Findlay’s initial role was part-time Creative Director. Her mandate was to make the perfume.com website more appealing to women and to help position it as a luxury site, while continuing to sell perfume at a discount. In that role, she sought feedback from major brands, which was instrumental in getting undertakings from several prominent perfume houses to work with perfume.com in connection with the new “luxury site” we plan to launch in October 2010. Ms. Findlay was promoted to General Manager of the perfume.com website, reporting to Mark Melville, in June 2009.

|

|

|

·

|

Changing the pricing strategy on perfume.com in April 2010 by increasing prices to full MSRP, or manufacturer’s suggested retail prices, in an effort to have major brands take perfume.com seriously. While this change resulted in an initial decrease in sales transactions and revenues, it has been accompanied by a significant increase in gross margin from approximately 20% on the discount model to approximately 40 to 45% on the full-price model. Following the initial decline in revenue that accompanied the change in pricing strategy, we have experienced a growth in total revenue and total site traffic, as the desired consumers discover the site. Furthermore, in September 2010, the total weekly gross margin for the website surpassed that of the same period in 2007.

|

|

|

·

|

Implementing a fulfillment facility in New Jersey where, along with new proprietary perfume.com packaging, the Company has the ability to provide “gifts with purchase” and samples. We expect the operation of this facility to increase margins and to allow us to eliminate the prior practice of relying on suppliers who are also perfume.com competitors to fulfill customer orders. The prior practice, originally implemented when David Jeffs was President, gave the suppliers access to our customer contact information and allowed them to include discount coupons for their own e-commerce sites in the boxes of perfume they shipped to perfume.com customers.

|

|

|

·

|

Working with the major brands to allow perfume.com to purchase either directly from them or through their normal wholesale channels, so that perfume.com can sell the latest fragrance releases before those fragrances trickle down to the discount market. To date, perfume.com has successfully negotiated such deals with three of the major perfume businesses representing hundreds of brands. This will allow us to include the latest brands on perfume.com’s new site at launch.

|

|

|

·

|

Developing marketing strategies with the brands to have perfume.com develop and host mini-boutiques for the major brands on perfume.com. The brands would pay for the right to have a boutique. Several brands have expressed their intention to enter into agreements with perfume.com after the new site is launched.

|

Your Board believes that the continued execution of Live Current’s focused luxury brand strategy is in the best interests of the Company and all of its stockholders and that it provides the greatest opportunity to create long-term stockholder value.

Perfume is an approximately $30 billion a year industry in which Internet sales currently represent a relatively small portion of overall sales. We believe there are significant opportunities to grow both margins and revenues with our new, luxury-oriented strategy, particularly as compared to the discount model that had been implemented by David Jeffs. We also believe our current strategy of building a luxury, full-priced site differentiates perfume.com from the more than 1,000 discount perfume e-commerce sites on the Internet. In addition, we feel that the “full priced, luxury private sale” model has a proven track record with other luxury goods, as is evidenced by the success of sites such as Gilt.com, Netaporter.com and onekingslane.com. We believe that no other focused perfume website has implemented this strategy.

Live Current is at a critical point in implementing our new strategic plan. Considerable investment has been made, and we feel that we have gained important momentum with the perfume brands for launch in time for the key holiday gift giving season. We believe that a return to the discount model strategy developed under Mr. Jeffs’s leadership would deny stockholders the opportunity to realize the economic benefits of the investment we have made in our new strategy. Furthermore, we believe that the election of the full slate of nominees supported by David Jeffs could jeopardize the Company’s commitment to fully implementing our new strategy.

MANAGEMENT AND THE CURRENT BOARD OF DIRECTORS ARE

COMMITTED TO AND INVESTED IN LIVE CURRENT

Management continues to invest in Live Current.

Management strongly believes that the new strategy can create real value and has demonstrated that belief by continuing to invest their own capital in the Company.

As a result of the investment required to implement our new business strategy, as well as the costs incurred by the Company as a result of legal actions taken by David Jeffs, the Board determined that the Company needed to obtain additional funding. Mr. Hampson and a group of investors, including Amir Vahabzadeh, who is one of the dissident stockholder’s nominees, agreed to participate in a private placement of units that included shares and share purchase warrants. The Board believes that private offerings of this type by micro cap companies are often priced at a discount to the public trading price of the issuer’s securities. Nonetheless, being aware that the issuance of additional securities by the Company would be dilutive, the Board based the offering price of the units on the current market price of the Company’s common stock, without any discount.

Management is incented to create value for all stockholders.

All of your Board’s nominees have invested cash in Live Current, and a number of them have purchased shares in the market. Mr. Hampson has personally invested approximately $1,500,000 in company securities, at an average cost of approximately $0.40 per share. In addition to his participation in the Company’s July 2010 financing, Mr. Hampson has made open market purchases in May, August and September 2010. Mr. Hampson has never sold any of his Company stock. Further details on the stock ownership of our directors and executive officers can be found in the Company’s definitive proxy statement.

In contrast to the investment of the current Board, Mr. Jeffs has disclosed in his proxy statement that one of his director nominees, Cameron Pan, sold 500,000 shares of Company stock during the period from September 10 to November 19, 2008.

WE BELIEVE THE DISSIDENT STOCKHOLDER HAS A PERSONAL AGENDA

AND HIS SLATE OF NOMINEES SHOULD BE REJECTED

Your Board strongly opposes the efforts of Mr. Jeffs to elect his hand-picked nominees to your Board.

We believe that Mr. Jeffs’s nominees do not have the necessary skills to assist Live Current in achieving growth. If elected, we believe Mr. Jeffs’s nominees would cause significant disruption and undermine Live Current’s ability to continue executing its strategic plan. David Jeff’s nominees include his mother, Susan Jeffs, and John Da Costa, who is a long-time associate of Susan Jeffs and Richard Jeffs. Therefore, we believe that the election of the dissident stockholder’s nominees would not bring the diversity of viewpoints that we believe the Company’s Board needs at this time.

We believe Mr. Jeffs has targeted your company for his own personal agenda.

In May 2010, Richard and David Jeffs brought a stockholder derivative suit against Mr. Hampson and the other current directors of the Company. Management and the Board of Directors believe that the suit was initiated by Richard and David Jeffs to bring pressure on Mr. Hampson and the Board of Directors to resign. Mr. Hampson has made several attempts to find a compromise with Richard and David Jeffs, including offers of Board representation and changes in our management team. We believe that it is in the interests of all stockholders not to waste the Company’s limited resources on a battle for control of the Company and that a compromise would be in everyone’s interest. These efforts have been rebuffed by Richard and David Jeffs.

We believe Mr. Jeffs’s initiation of a disruptive and costly proxy contest at a time when Live Current is implementing a number of important actions to enhance the Company’s prospects and profitability in the current e-commerce environment only serves to interfere with the important progress we are making.

THE FUTURE OF YOUR INVESTMENT IS AT STAKE

Vote TODAY to protect your investment — by telephone, by Internet or by signing, dating and returning the enclosed

GOLD

proxy card.

Thank you for your support.

Sincerely,

C. Geoffrey Hampson

Chairman of the Board and Chief Executive Officer

YOUR VOTE IS IMPORTANT – NO MATTER HOW MANY SHARES YOU OWN –

ELECT THE DIRECTOR NOMINEES NAMED ON THE

ENCLOSED

GOLD

PROXY CARD TODAY

If you have questions about how to vote your shares on the

GOLD

proxy card,

or need additional assistance, please contact the firm

assisting us in the solicitation of proxies:

GEORGESON INC.

Stockholders Call Toll-Free: (888) 206-5896

Banks and Brokers Call Collect: (212) 440-9800

IMPORTANT

We urge you NOT to sign any white proxy card sent to you by the dissident stockholder.

IMPORTANT INFORMATION

Additional Information

On September 24, 2010, Live Current filed a definitive proxy statement with the SEC in connection with the Company’s 2010 Annual Meeting of Stockholders. Live Current stockholders are strongly advised to read carefully the Company’s definitive proxy statement before making any voting or investment decision because the definitive proxy statement contains important information. Live Current’s definitive proxy statement and any other reports filed by the Company with the SEC can be obtained free of charge at the SEC’s web site at www.sec.gov or from Live Current at www.livecurrent.com. A copy of the Company’s definitive proxy statement is available for free by writing to our Corporate Secretary at Live Current Media Inc., 780 Beatty Street, Suite 307, Vancouver, British Columbia V6B 2M1. In addition, copies of the proxy materials may be requested from our proxy solicitor, Georgeson Inc., by phone at (888) 206-5896 or by email at livecurrent.info@georgeson.com.

About Live Current Media Inc.

Live Current owns one of the most powerful and engaging content and commerce destinations on the Internet in www.perfume.com. This site and others in the Company’s portfolio can be built into subject-specific DestinationHubs™, that can connect people to each other and to the information, brands, and products they are passionate about. Live Current has headquarters in Vancouver, Canada with an office in Washington, WA and New York City, NY and is publicly traded on the OTCBB (LIVC). For more information, visit www.livecurrent.com.

Cautionary Statement Regarding Forward-Looking Information

All statements in these soliciting materials that are not statements of historical fact are forward-looking statements, including particularly statements of the plans, strategies, objectives and goals of management for future operations, any statements regarding future economic conditions or performance, statements of belief and any statements of assumptions underlying any of the foregoing. These statements are based on expectations and assumptions as of the date of these soliciting materials and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to, general economic conditions particularly as they relate to demand for our products and services; competitive factors; pricing pressures; changes in operating expenses; our ability to raise capital as and when we need it and other factors. The Company assumes no obligation to update these forward-looking statements to reflect future events or actual outcomes and does not intend to do so.

|

YOUR VOTE IS EXTREMELY IMPORTANT THIS YEAR IN LIGHT OF THE PROXY CONTEST BEING CONDUCTED BY THE DISSIDENT STOCKHOLDER.

Your vote is very important to Live Current. Whether or not you plan to attend the meeting and regardless of the number of shares of common stock that you own, Live Current urges you to vote in favor of the nominees of your Board of Directors by promptly marking, signing, dating and returning the enclosed

GOLD

proxy card in the accompanying postage-paid envelope or by voting by Internet or telephone as described under “Voting and Proxy” in our Proxy Statement.

Live Current urges you not to sign any proxy card that may be sent to you by David Jeffs, a dissident stockholder. If you have previously returned a white proxy card to the dissident stockholder, you may change your vote by marking, signing, dating and returning the enclosed

GOLD

proxy card in the accompanying postage-paid envelope or by voting by Internet or telephone as described under “Solicitation” in our Proxy Statement. Only the latest dated proxy you submit will be counted.

|

|

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor.

199 Water Street, 26

th

Floor

New York, NY 10038

Stockholders Call Toll Free: (888) 206-5896

Banks and Brokers Call Collect: (212) 440-9800

Email: livecurrent.info@georgeson.com

|

9

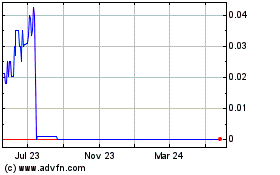

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Oct 2024 to Nov 2024

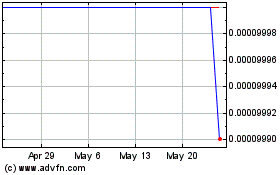

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Nov 2023 to Nov 2024