UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to

__________________

Commission file number 000-53291

LAKE VICTORIA MINING COMPANY, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

51-0628651 |

| State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization |

Identification No.)

|

Suite 810 – 675 West Hastings Street

Vancouver,

British Columbia, Canada V6B 1N2

(Address of principal executive

offices, including zip code)

604.248.5750

(telephone number, including

area code)

Securities registered pursuant to Section 12(b) of the Act

| Title of Each Class |

Name of each Exchange on which registered

|

| Nil |

N/A |

Securities registered pursuant to Section 12(g) of the Act

Common Stock, par value $0.00001 per share

(Title of

Class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

YES

[ ] NO [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Act:

YES [ ] NO [X]

Indicate by check mark whether the registrant(1) has filed all

reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 day.

YES [X]

NO [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule405 of Regulation S-T (§229.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). YES [X] NO [ ]

2

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulations S-K is not contained herein, and will not be

contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 if the

Exchange Act.

| Large Accelerated Filer [ ] |

Accelerated Filer [ ] |

| Non-accelerated Filer [ ] |

Smaller Reporting Company [X] |

| (Do not check if a smaller reporting

company) |

|

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

YES [ ] NO

[X]

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference to the price at which

the common equity was sold, or the average bid and asked prices of such common

equity, as of the last business day of the registrant’s most recently completed

second fiscal quarter: $1,932,286 based on a price of $0.02 per share, being the

average bid and asking price of the registrant’s common stock as quoted on the

OTC Bulletin Board on September 30, 2014.

Indicate the number of shares outstanding of each of the

registrant's classes of common stock as of the latest practicable date

152,329,067 shares of common stock as of June 29, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by

reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which

the document is incorporated: (1) Any annual report to security holders; (2) Any

proxy or information statement; and (3) Any prospectus filed pursuant to Rule

424(b) or (c) under the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g., annual report to security

holders for fiscal year ended December 24, 1980). Not Applicable

3

TABLE OF CONTENTS

4

PART I

Forward Looking Statements

This annual report contains forward-looking statements.

Forward-looking statements are projections of events, revenues, income, future

economic performance or management’s plans and objectives for our future

operations. In some cases, you can identify forward-looking statements by

terminology such as “may”, “should”, “expects”, “plans”, “anticipates”,

“believes”, “estimates”, “predicts”, “potential” or “continue” or the negative

of these terms or other comparable terminology. These statements are only

predictions and involve known and unknown risks, uncertainties and other

factors, including the risks in the section entitled “Risk Factors” and the

risks set out below, any of which may cause our or our industry’s actual

results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking statements. These

risks include, by way of example and not in limitation:

| |

• |

risks and uncertainties relating to the interpretation of

sampling results, the geology, grade and continuity of mineral deposits;

|

| |

|

|

| |

• |

risks and uncertainties that results of initial sampling

and mapping will not be consistent with our expectations; |

| |

|

|

| |

• |

mining and development risks, including risks related to

accidents, equipment breakdowns, labor disputes or other unanticipated

difficulties with or interruptions in production; |

| |

|

|

| |

• |

the potential for delays in exploration activities;

|

| |

|

|

| |

• |

risks related to the inherent uncertainty of cost

estimates and the potential for unexpected costs and expenses; |

| |

|

|

| |

• |

risks related to commodity price fluctuations; |

| |

|

|

| |

• |

the uncertainty of profitability based upon our limited

history; |

| |

|

|

| |

• |

risks related to failure to obtain adequate financing on

a timely basis and on acceptable terms for our planned exploration

projects; |

| |

|

|

| |

• |

risks related to environmental regulation and liability;

|

| |

|

|

| |

• |

risks that the amounts reserved or allocated for

environmental compliance, reclamation, post-closure control measures,

monitoring and on-going maintenance may not be sufficient to cover such

costs; |

| |

|

|

| |

• |

risks related to tax assessments; |

| |

|

|

| |

• |

political and regulatory risks associated with mining

development and exploration; and |

| |

|

|

| |

• |

other risks and uncertainties related to our mineral

property and business strategy. |

This is not an exhaustive list of the factors that may affect

any of our forward-looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on our

forward-looking statements.

Forward looking statements are made based on management’s

beliefs, estimates and opinions on the date the statements are made and we

undertake no obligation to update forward-looking statements if these beliefs,

estimates and opinions or other circumstances should change. Although we believe

that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Except as required by applicable law, including the securities

laws of the United States and Canada, we do not intend to update any of the

forward-looking statements to have these statements conform to actual results.

5

In this annual report, unless otherwise specified, all dollar

amounts are expressed in United States dollars and all references to “common

stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the

“Company” and “Lake Victoria” mean Lake Victoria Mining Company, Inc., and our

wholly owned subsidiaries Kilimanjaro Mining Company Inc., Lake Victoria

Resources (T) Limited, Chrysos 197 Company Tanzania Ltd and Jin 197 Company

Tanzania Ltd, unless otherwise indicated.

General

We are an exploration stage corporation focused on acquiring,

exploring and developing gold deposits in Tanzania, East Africa. We hold 3

prospective gold projects, consisting of one mining license, 2 Prospecting

Licenses (PLs) and 43 Primary Mining Licenses (PMLs) (Table 1), within our

Tanzania property portfolio, covering approximately 32.71 square kilometers

(8,083 acres).

During the course of the year from 1st April 2014 to 31st March

2015, we have relinquished 3 Gold Prospecting Licenses. Our main area of

interest is acquiring, exploring and evaluating mineral properties through our

ongoing exploration program. Following exploration, we intend to either advance

them to a commercially feasible mining stage, enter joint ventures to further

develop these properties, sell or dispose of them if the properties do not meet

our requirements. Our properties are all early stage exploration properties.

Within our mineral exploration land in Tanzania our focus is primarily on gold.

We have no revenues, we have incurred losses since inception

and we have relied upon the sale of our securities to fund operations. To date,

we have not discovered a NI43-101 compliant commercially viable ore body,

mineral deposit or mineral reserve on any of our properties and we will be

unable to do so until further exploration is done and a comprehensive evaluation

concludes with an economic feasibility study or production is initiated However,

we have received environmental (EIA) approval and a Mining License to commence

gold mining on one of our gold projects mineralized target.

Assuming funding is available, we plan to develop and conduct

small-scale gold mining on selected mineral properties within certain areas that

are currently contained within our primary mining licenses and the Mining

License that we have. The production decision or significant development on

these projects will not be based on mineral reserves supported by an NI43-101

compliant technical report. We plan to secure Mining Licenses for each of these

potential mining areas.

Our property portfolio is large, therefore we may interest

other companies in our properties to either participate by means of option or

joint venture agreements in the exploration of our properties or to finance and

establish production on discovered mineralization.

We maintain our registered agent’s office at The Corporation

Trust Company of Nevada, 6100 Neil Road, Suite 500, Reno, Nevada 89511 and our

business and administrative office is located at Suite 810 – 675 West Hastings

Street, Vancouver, British Columbia, V6B 1N2, Canada. Our telephone number is

604.248.5750.

Recent Corporate Developments

During the fiscal year ended on March 31st, 2015, we

experienced the following significant corporate developments:

| |

1. |

Effective April 10, 2015, John Surtherland was appointed

as a member of the Board of Directors and as a member and Chairman of the

Company’s Audit Committee. |

| |

|

|

| |

2. |

Effective April 10, 2015, David Webb resigned as a member

of the Board of Directors. Mr. Webb’s resignation was not as a result of

any disagreement with the Company or with its board on any matter relating

to the Company’s operations, policies or

practices. |

6

Competitive Factors

The gold mining industry is fragmented, that is there are many

gold prospectors and producers, small and large. We are a small exploration

stage mining company and we do not have the financial, personnel or equipment

resources that many competitors possess. Because of our lack of resources we may

not be able to adequately withstand the competitive forces that exist in the

mining industry generally and specifically with respect to gold mining.

Regulations

Mineral rights in the United Republic of Tanzania are governed

by the Mining Act of 1998 and The Mining (Mineral Rights) Regulations, 2010 and

control over minerals is vested in the Government of the United Republic of

Tanzania. Prospecting for minerals may only be conducted under authority of a

mineral right granted by the Ministry of Energy and Minerals under this Act.

The three types of mineral rights most often encountered, and

those which are applicable to us include: prospecting licenses; retention

licenses; and mining licenses. A prospecting license grants the holder thereof

the exclusive right to prospect in the area covered by the license for all

minerals, other than building stone and gemstones, for an initial period of four

years. Thereafter, the license is renewable for two further periods of three and

two years consecutively. On each renewal of a prospecting license, 50 percent of

the area covered by the license must be relinquished. The maximum initial area

for a prospecting license is 300 square kilometers. A company applying for a

prospecting license must, inter alia, state the financial and technical

resources available to it. A retention license can also be requested from the

Minister, after the expiry of the 4-3-2-year prospecting license period, for

reasons ranging from funds to technical considerations.

Mining is carried out through either a mining license or a

special mining license or a primary mining license, all three of which confer on

the holder thereof the exclusive right to conduct mining operations in or on the

area covered by the license. A mining license is granted for a period of 10

years and is renewable for a further period of 10 years. A special mining

license is granted for a period of 25 years and is renewable for the estimated

life of the ore body or such period as the applicant may request whichever

period is shorter. If the holder of a prospecting license has identified a

mineral deposit within the prospecting area which is potentially of commercial

significance, but it cannot be developed immediately by reason of technical

constraints, adverse market conditions or other economic factors of a temporary

character, the holder can apply for a retention license which will entitle the

holder thereof to apply for a special mining license when the holder sees fit to

proceed with mining operations.

A retention license is valid for a period of five years and is

thereafter renewable for a single period of five years. A mineral right may be

freely transferred by the holder thereof to another person, except in the case a

mining license, which must have the approval of the Ministry to be assigned.

However, this approval requirement for the assignment of a

mining license will not apply if the mining license is assigned to an affiliate

company of the holder or to a financial institution or bank as security for any

loan or guarantee in respect of mining operations.

The holder of a mineral right may enter into a development

agreement with the Ministry to guarantee the fiscal stability of a long-term

mining project and to make special provision for the payment of royalties,

taxes, fees and other fiscal imposts.

We have complied with all applicable requirements and the

relevant licenses have been issued.

Environmental Law

We are also subject to Tanzania laws dealing with environmental

matters relating to the exploration and development of mining properties. While

in the exploration stage, on any of our project areas, we are conscious of any

environmental impact we may be having. However, our obligations are very

limited, as our activities cause minimal environmental disturbances and are

limited to mapping, sampling, trenching, geophysical surveying and drilling.

Once project areas reach a point of being commercially feasible for mining then

we will be required to conduct proper environmental impact studies based on

feasibility reports and planned mining operations. We do protect the environment

through any regulations affecting:

7

| |

1. |

Health and Safety |

| |

|

|

| |

2. |

Archaeological Sites |

| |

|

|

| |

3. |

Exploration Access |

Subsidiaries

We have four wholly owned subsidiaries. Kilimanjaro Mining

Company Inc., a US corporation, Lake Victoria Resources (T) Limited, Chrysos 197

Company Tanzania Ltd and Jin 179 Company Tanzania Ltd. which are Tanzanian

corporations.

Employees

We have eight full-time employees. On April 26, 2011, we

entered into employment and contract agreements with our officers and directors.

Our president David Kalenuik and secretary Heidi Kalenuik agreed to

handle our administrative duties. See “Item 11. Executive Compensation –

Employment Agreements”, below.

To the extent possible we intend to use the services of

subcontractors for manual labor and exploration work on our properties. Lake

Victoria Resources (T) Limited, our wholly owned Tanzania subsidiary may hire

subcontractors and employees to complete exploration work. A large skilled and

unskilled workforce is readily available within Tanzania to satisfy any labor

requirements we may have. Through contractors and skilled professional employees

we do provide any necessary on the job training to accomplish our exploration

objectives.

Much of the information included in this annual report includes

or is based upon estimates, projections or other “forward looking statements”.

Such forward looking statements include any projections and estimates made by us

and our management in connection with our business operations. While these

forward-looking statements, and any assumptions upon which they are based, are

made in good faith and reflect our current judgment regarding the direction of

our business, actual results will almost always vary, sometimes materially, from

any estimates, predictions, projections, assumptions or other future performance

suggested herein.

Such estimates, projections or other “forward looking

statements” involve various risks and uncertainties as outlined below. We

caution the reader that important factors in some cases have affected and, in

the future, could materially affect actual results and cause actual results to

differ materially from the results expressed in any such estimates, projections

or other “forward looking statements”.

Risks Associated with Mining

All of our properties are in the exploration stage. There is

no assurance that we can establish the existence of any mineral reserve on any

of our properties in commercially exploitable quantities. Until we can do so, we

cannot earn any revenues from operations and if we do not do so we will lose all

of the funds that we expend on exploration. If we do not discover any mineral

reserve in a commercially exploitable quantity, our business could fail.

Despite exploration work on our mineral properties, we have not

established a mineral reserve on any of our properties as defined by NI43-101

regulations and by the Securities and Exchange Commission in its Industry Guide

7, nor can there be any assurance that we will be able to do so. If we do not,

our business could fail.

A mineral reserve is defined by the Securities and Exchange

Commission in its Industry Guide 7 (which can be viewed over the Internet at

http://www.sec.gov/about/forms/industryguides.pdf) as that part of a

mineral deposit which could be economically and legally extracted or produced at

the time of the reserve determination. The probability of an individual prospect

ever having a “reserve” that meets the requirements of the Securities and

Exchange Commission’s Industry Guide 7 is extremely remote; in all probability

our mineral resource property does not contain any ‘reserve’ and any funds that

we spend on exploration will probably be lost.

8

Even if we do eventually discover a mineral reserve on one or

more of our properties, there can be no assurance that we will be able to

develop our properties into producing mines and extract those reserves. Both

mineral exploration and mineral developments involve a high degree of risk and

few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will

depend on a number of factors including, by way of example, the size, grade and

other attributes of the mineral deposit, the proximity of the resource to

infrastructure such as a smelter, roads and a point for shipping, government

regulation and market prices. Most of these factors will be beyond our control,

and any of them could increase costs and make extraction of any identified

mineral reserves unprofitable.

Mineral operations are subject to applicable law and

government regulation. Even if we discover a mineral reserve in a commercially

exploitable quantity, these laws and regulations could restrict or prohibit the

exploitation of that mineral reserve. If we cannot exploit any mineral reserve

that we might discover on our properties, our business may fail.

We believe that we are in compliance with all material laws and

regulations that currently apply to our activities but there can be no assurance

that we can continue to remain in compliance. Current laws and regulations could

be amended and we might not be able to comply with them, as amended. Further,

there can be no assurance that we will be able to obtain or maintain all permits

necessary for our future operations, or that we will be able to obtain them on

reasonable terms. To the extent such approvals are required and are not

obtained, we may be delayed or prohibited from proceeding with planned

exploration or development of our mineral properties.

Our business activities are conducted in Tanzania.

Our mineral exploration activities in Tanzania may be affected

in varying degrees by political stability and government regulations relating to

the mining industry and to foreign investment in that country. The government of

Tanzania may institute regulatory policies that adversely affect the exploration

and development of properties. Any changes in regulations or shifts in political

conditions in this country are beyond our control and may adversely affect our

business. Investors should assess the political and regulatory risks related to

our foreign country investments. Our operations may be affected in varying

degrees by government regulations with respect to restrictions on production,

price controls, export controls, foreign exchange controls, income taxes,

expropriation of property, environmental legislation and mine safety.

We may not have clear title to our properties.

Acquisition of title to mineral properties is a very detailed

and time-consuming process, and titles to our properties may be affected by

prior unregistered agreements or transfers, or undetected defects. Several of

our prospecting licenses are currently subject to renewal by the Ministry of

Energy and Minerals of Tanzania. As a result, there is a risk that we may not

have clear title to all our mineral property interests, or they may be subject

to challenge or impugned in the future.

If we establish the existence of a mineral reserve on any of

our properties in a commercially exploitable quantity, we will require

additional capital in order to develop the property into a producing mine. If we

cannot raise this additional capital, we will not be able to exploit the

resource, and our business could fail.

If we do discover mineral reserves in commercially exploitable

quantities on any of our properties, we will be required to expend substantial

sums of money to establish the extent of the resource, develop processes to

extract it and develop extraction and processing facilities and infrastructure.

Although we may derive substantial benefits from the discovery of a major

deposit, there can be no assurance that such a reserve will be large enough to

justify commercial operations, nor can there be any assurance that we will be

able to raise the funds required for development on a timely basis. If we cannot

raise the necessary capital or complete the necessary facilities and

infrastructure, our business may fail.

Mineral exploration and development is subject to

extraordinary operating risks. We do not currently insure against these risks.

In the event of a cave-in or similar occurrence, our liability may exceed our

resources, which would have an adverse impact on our company.

9

Mineral exploration, development and production involves many

risks, which even a combination of experience, knowledge and careful evaluation

may not be able to overcome. Our operations will be subject to all the hazards

and risks inherent in the exploration for mineral reserves and, if we discover a

mineral reserve in commercially exploitable quantity, our operations could be

subject to all of the hazards and risks inherent in the development and

production of minerals, including liability for pollution, cave-ins or similar

hazards against which we cannot insure or against which we may elect not to

insure. Any such event could result in work stoppages and damage to property,

including damage to the environment. We do not currently maintain any insurance

coverage against these operating hazards nor do we expect to get such insurance

for the foreseeable future. If a hazard were to occur, the costs of rectifying

the hazard may exceed our asset value and cause us to liquidate all of our

assets, resulting in the loss of your entire investment in our company.

Mineral prices are subject to dramatic and unpredictable

fluctuations.

We expect to derive revenues, if any, either from the sale of

our mineral resource properties or from the extraction and sale of precious and

base metals such as gold, silver and copper. The price of those commodities has

fluctuated widely in recent years, and is affected by numerous factors beyond

our control, including international, economic and political trends,

expectations of inflation, currency exchange fluctuations, interest rates,

global or regional consumptive patterns, speculative activities and increased

production due to new extraction developments and improved extraction and

production methods. The effect of these factors on the price of base and

precious metals, and therefore the economic viability of any of our exploration

properties and projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no

assurance that we will continue to be successful in acquiring mineral claims. If

we cannot continue to acquire properties to explore for mineral resources, we

may be required to reduce or cease operations.

The mineral exploration, development, and production industry

is largely un-integrated. We compete with other exploration companies looking

for mineral resource properties. While we compete with other exploration

companies in the effort to locate and acquire mineral resource properties, we

will not compete with them for the removal or sales of mineral products from our

properties if we should eventually discover the presence of them in quantities

sufficient to make production economically feasible. Readily available markets

exist worldwide for the sale of mineral products. Therefore, we will likely be

able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we

compete with many companies possessing greater financial resources and technical

facilities. This competition could adversely affect our ability to acquire

suitable prospects for exploration in the future. Accordingly, there can be no

assurance that we will acquire any interest in additional mineral properties

that might yield reserves or result in commercial mining operations.

If our costs of exploration are greater than anticipated,

then we may not be able to complete the exploration program for our Tanzanian

properties without additional financing, of which there is no assurance that we

would be able to obtain.

We are proceeding with the initial stages of exploration on our

Tanzanian properties. We are carrying out an exploration program that has been

recommended by a consulting geologist. This exploration program outlines a

budget for completion of the recommended exploration program. However, there is

no assurance that our actual costs will not exceed the budgeted costs. Factors

that could cause actual costs to exceed budgeted costs include increased prices

due to competition for personnel and supplies during the exploration season,

unanticipated problems in completing the exploration program and delays

experienced in completing the exploration program. Increases in exploration

costs could result in our not being able to carry out our exploration program

without additional financing. There is no assurance that we would be able to

obtain additional financing in this event.

Because of the speculative nature of exploration of mining

properties, there is substantial risk that no commercially exploitable minerals

will be found and our business will fail.

We are in the initial stage of exploration of our mineral

property, and thus have no way to evaluate the likelihood that we will be

successful in establishing commercially exploitable reserves of gold, silver or

other valuable minerals on our Tanzanian properties.

10

The search for valuable minerals as a business is extremely

risky. We may not find commercially exploitable reserves of gold, silver or

other valuable minerals in our mineral property. Exploration for minerals is a

speculative venture necessarily involving substantial risk. The expenditures to

be made by us on our exploration program may not result in the discovery of

commercial quantities of ore. The likelihood of success must be considered in

light of the problems, expenses, difficulties, complications and delays

encountered in connection with the exploration of the mineral properties that we

plan to undertake. Problems such as unusual or unexpected formations and other

conditions are involved in mineral exploration and often result in unsuccessful

exploration efforts. In such a case, we would be unable to complete our business

plan.

Cost estimates and timing of our Kinyambwiga small scale

mining project and new projects is uncertain, which may adversely affect our

expected production and profitability.

The capital expenditures and time required to develop and

explore our properties are considerable and changes in costs, construction

schedules or both, can adversely affect project economics and expected

production and profitability. There are a number of factors that can affect

costs and construction schedules, including, among others:

| |

• |

changes in input commodity prices and labor

costs; |

| |

• |

availability and terms of financing; |

| |

• |

availability of labor, energy, transportation,

equipment, and infrastructure; |

| |

• |

fluctuations in currency exchange rates; |

| |

• |

changes in anticipated tonnage, grade and

metallurgical characteristics of the ore to be mined and processed; |

| |

• |

recovery rates of gold and other metals from

the ore; |

| |

• |

difficulty of estimating construction costs

over a period of years; |

| |

• |

weather and severe climate impacts; and |

| |

• |

potential delays related to social and

community issues. |

Mineralized targets and other mineralized material

calculations are estimates only, and are subject to uncertainty due to factors

including metal prices, inherent variability of the ore and

recoverability of metal in the mining process. The calculation of mineral

mineralized targets, other mineralized material and grading are estimates and

depend upon geological interpretation and statistical inferences or assumptions

drawn from drilling and sampling analysis, which may prove to be

unpredictable.

There is a degree of uncertainty attributable to the

calculation of mineralized targets and corresponding grades. Until mineralized

targets and other mineralized materials are actually mined and processed, the

quantity of ore and grades must be considered as an estimate only. In addition,

the quantity of mineralized targets and other mineralized materials and ore may

vary depending on metal prices, which largely determine whether mineralized

targets and other mineralized materials are classified as ore (economic to mine)

or waste (uneconomic to mine). A decline in metal prices may result in

previously reported mineralized targets (ore) becoming uneconomic to mine

(waste). Any material change in the quantity of mineralized targets, other

mineralized materials, mineralization, grade or stripping ratio may affect the

economic viability of our properties. In addition, we can provide no assurance

that gold recoveries or other metal recoveries experienced in small- scale

laboratory tests will be duplicated in larger scale tests under on-site

conditions or during production.

We may not achieve our production and/or sales estimates and

our costs may be higher than our estimates, thereby reducing our cash flows and

negatively impacting our results of operations.

We prepare estimates of future production, sales, and costs for

our operations. We develop our estimates based on, among other things, mining

experience, mineralized targets and other mineralized material estimates,

assumptions regarding ground conditions and physical characteristics of ores

(such as hardness and presence or absence of certain metallurgical

characteristics) and estimated rates and costs of mining and processing. All of

our estimates are subject to numerous uncertainties, many of which are beyond

our control. Our actual production and/or sales may be lower than our estimates

and our actual costs may be higher than our estimates, which could negatively

impact our cash flows and results of operations. While we believe that our

estimates are reasonable at the time they are made, actual results will vary and

such variations may be material. These estimates are necessarily speculative in

nature, and it may be the case that one or more of the assumptions underlying

such projections and estimates may not materialize. Investors in our common

stock are cautioned not to place undue reliance on the projections and estimates

set forth in this Form 10-K.

11

Because our executive officers have limited experience in

mineral exploration and do not have formal training specific to the

technicalities of mineral exploration, there is a higher risk that our business

will fail.

Our executive officers have limited experience in mineral

exploration and do not have formal training as geologists or in the technical

aspects of management of a mineral resource exploration company. As a result of

this inexperience, there is a higher risk of our being unable to complete our

business plan for the exploration of our mineral property. With no direct

training or experience in these areas, our management may not be fully aware of

many of the specific requirements related to working within this industry. Our

decisions and choices may not take into account standard engineering or

managerial approaches mineral resource exploration companies commonly use.

Consequently, the lack of training and experience of our management in this

industry could result in management making decisions that could result in a

reduced likelihood of our being able to locate commercially exploitable reserves

on our mineral property with the result that we would not be able to achieve

revenues or raise further financing to continue exploration activities. In

addition, we will have to rely on the technical services of others with

expertise in geological exploration in order for us to carry out our planned

exploration program. If we are unable to contract for the services of such

individuals, it will make it difficult and maybe impossible to pursue our

business plan. There is thus a higher risk that our operations, earnings and

ultimate financial success could suffer irreparable harm and our business will

likely fail.

Risks Relating to Our Common Stock

If we issue additional shares in the future, it will result

in the dilution of our existing shareholders.

Our articles of incorporation authorize the issuance of up to

250,000,000 shares of common stock with a par value of $0.00001 per share. Our

board of directors may choose to issue some or all of such shares to acquire one

or more businesses or to provide additional financing in the future. The

issuance of any such shares will reduce the book value and market price of the

outstanding shares of our common stock. If we issue any such additional shares,

such issuance will reduce the proportionate ownership and voting power of all

current shareholders. Further, such issuance may result in a change of control

of our corporation.

Our common stock is illiquid and shareholders may be unable

to sell their shares.

There is currently a limited market for our common stock and we

can provide no assurance to investors that a market will develop. If a market

for our common stock does not develop, our shareholders may not be able to

re-sell the shares of our common stock that they have purchased and they may

lose all of their investment. Public announcements regarding our company,

changes in government regulations, conditions in our market segment or changes

in earnings estimates by analysts may cause the price of our common shares to

fluctuate substantially. In addition, stock prices for junior mineral

exploration companies fluctuate widely for reasons that may be unrelated to

their operating results. These fluctuations may adversely affect the trading

price of our common shares.

Penny stock rules will limit the ability of our stockholders

to sell their stock.

The Securities and Exchange Commission has adopted regulations

which generally define “penny stock” to be any equity security that has a market

price (as defined) less than $5.00 per share or an exercise price of less than

$5.00 per share, subject to certain exceptions. Our securities are covered by

the penny stock rules, which impose additional sales practice requirements on

broker-dealers who sell to persons other than established customers and

“accredited investors”. The term “accredited investor” refers generally to

institutions with assets in excess of $5,000,000 or individuals with a net worth

in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouse. The penny stock rules require a broker-dealer, prior to a

transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form prepared by the Securities and

Exchange Commission which provides information about penny stocks and the nature

and level of risks in the penny stock market. The broker-dealer also must

provide the customer with current bid and offer quotations for the penny stock,

the compensation of the broker-dealer and its salesperson in the transaction and

monthly account statements showing the market value of each penny stock held in

the customer’s account. The bid and offer quotations, and the broker-dealer and

salesperson compensation information, must be given to the customer orally or in

writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer’s confirmation. In addition, the penny stock

rules require that prior to a transaction in a penny stock not otherwise exempt

from these rules, the broker-dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the

purchaser’s written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in

the secondary market for the stock that is subject to these penny stock rules.

Consequently, these penny stock rules may affect the ability of broker-dealers

to trade our securities. We believe that the penny stock rules discourage

investor interest in and limit the marketability of our common stock.

12

The Financial Industry Regulatory Authority, or FINRA, has

adopted sales practice requirements which may also limit a shareholder’s ability

to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA

has adopted rules that require that in recommending an investment to a customer,

a broker-dealer must have reasonable grounds for believing that the investment

is suitable for that customer. Prior to recommending speculative low priced

securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status,

tax status, investment objectives and other information. Under interpretations

of these rules, FINRA believes that there is a high probability that speculative

low priced securities will not be suitable for at least some customers. FINRA

requirements make it more difficult for broker-dealers to recommend that their

customers buy our common stock, which may limit your ability to buy and sell our

stock and have an adverse effect on the market for its shares.

Because of the early stage of development and the nature of

our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally

because of the nature of our business and the early stage of our development. We

are engaged in the business of identifying, acquiring, exploring and developing

commercial reserves of primarily gold. Our properties are in the exploration

stage only although we have achieved environmental (EIA) approval and a Mining

License to commence gold mining on the mineralized target in one of our gold

projects. This project does not contain a compliant gold reserve as defined by

Canadian NI43-101 regulations nor the Securities and Exchange Commission in its

Industry Guide 7. We have not generated any revenues nor have we realized a

profit from our operations to date. Any profitability in the future from our

business will be dependent upon locating and developing economic reserves of

gold, which itself is subject to numerous risk factors as set forth herein.

Since we have not generated any revenues, we will have to raise additional

monies through the sale of our equity securities or debt in order to continue

our business operations.

We do not intend to pay dividends on any investment in the

shares of stock of our company.

We have never paid any cash dividends and currently do not

intend to pay any dividends for the foreseeable future. To the extent that we

require additional funding currently not provided for in our financing plan, our

funding sources may prohibit the payment of a dividend. Because we do not intend

to declare dividends, any gain on an investment in our company will need to come

through an increase in the stock’s price. This may never happen and investors

may lose all of their investment in our company.

Risks Related to Our Company

Our by-laws contain provisions indemnifying our officers and

directors.

Our by-laws provide the indemnification of our directors and

officers to the fullest extent legally permissible under the Nevada corporate

law against all expenses, liability and loss reasonably incurred or suffered by

them in connection with any action, suit or proceeding. Furthermore, our by-laws

provide that our board of directors may cause our company to purchase and

maintain insurance for our directors and officers, and we have implemented

director and officer insurance coverage.

Because most of our directors and officers are residents of

other countries other than the United States, investors may find it difficult to

enforce, within the United States, any judgments obtained against our directors

and officers.

Most of our directors and officers are nationals and/or

residents of countries other than the United States, and all or a substantial

portion of such persons’ assets are located outside the United States. As a

result, it may be difficult for investors to enforce within the United States

any judgments obtained against our officers or directors, including judgments

predicated upon the civil liability provisions of the securities laws of the

United States or any state thereof.

13

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS.

|

Not applicable.

Executive Offices

As of the date of this report, our executive offices are

located at Suite 810, 675 West Hastings Street, Vancouver, British Columbia V6B

1N2, Canada.

Mineral Properties

Mineral Properties

Licenses

The following table is a complete list of gold mining and

prospecting licenses that we own by project name, license number, the area of

location, district of its location and the size in square kilometers. We own no

prospecting property other than the following licenses listed on the chart.

There are no known reserves on these properties and any proposed programs by us

are exploratory in nature.

Table 1: Gold Projects and License List

| Project |

License No |

Area |

District |

Size

(SqKm) |

Ownership |

MUSOMA

BUNDA |

PL 4653/2007

ML520/2014 |

Kinyambwi ga

Kinyambwi ga

|

Musoma

Musoma |

9.12

5.12 |

Owned

Owned |

| |

|

|

|

14.24 |

|

| SINGIDA |

23 PMLs

20 PMLs |

Singida - Londoni

Singida -

Londoni |

Singida

Singida |

1.62

1.94 |

Owned

Optioned |

| |

|

|

|

3.53 |

|

| BUHEMBA |

PL7142/2011 |

Buhemba |

Kiabakari |

14.94 |

Owned |

| |

|

|

|

14.94 |

|

| HANDENI |

PL7148/2011 |

Manga |

Handeni |

12.03 |

Relinquished

in April 2015 |

| |

|

|

|

12.03 |

|

| 1 Mining License (ML) –

Total SqKm |

|

|

5.12 |

|

| 3 Prospecting Licenses(PLs)-Total SqKm |

|

|

36.09 |

|

| 43 Primary Mining Licenses

(PMLs)- Total SqKm |

|

3.53 |

|

14

Prospective Projects and Properties

The following map is a gold project location map (Map

1). For a detailed listing see Licenses – Gold Projects and License List

(Table 1).

Map 1: Gold Project Location Map, March 2014

Prospective Gold Projects

The following is a brief overview of our portfolio of

prospective mineral properties, the exploration developments on them where

applicable and some of the details of the historical option agreements for them.

During the fiscal year ended March 31, 2015, no exploration was undertaken on

any of the gold projects..

Musoma Bunda Murangi Gold Project

The Musoma

Bunda Murangi Project is comprised of 1 Prospecting and 1 Mining License,

covering 9.12 and 5.12 square kilometers respectively. In 2013, the original 39

PMLs, totaling 3.44 square kilometres located on the Kinyambwiga PL4653/2007

were amalgamated and incorporated back within the PL (5 July 2013). This was

undertaken in order to facilitate the application for a Mining License (Map

2).

On August 2, 2013, The Company completed and filed an

Environmental and Social Impact Assessment report for the Kinyambwiga mining

project covering the amalgamated 39 PMLs with the National Environmental Management Council (NEMC) on August 2, 2013. The Environmental

Certificate was approved by January 7th 2014. This was shortly

followed by the submission of the Mining application to the Ministry of

Mines.

15

No field exploration was undertaken during this reporting

period on the Kinyambwiga (PL4653/2007). A trial test pit was dug by excavator

at the proposed Kanunga Mine site on the Kinyambwiga Project in February 2013 to

evaluate the upper saprolite horizon for geotechnical studies.

Exploration Strategy

The Kinyambwiga License has

been reduced from the original 30.90 square kilometers to 13.47 square

kilometers as part of the required Government relinquishment of 50 percent of

the ground holdings on License renewal. Part of the License area comprised of 39

PML’s which have subsequently been amalgamated into a Mining License. The

Prospecting License area now includes a Mining License, and covers a total area

14.24 square kilometres. The southern part of the License area, was largely

covered by dark gray to black, clay rich soil and is underlain by granitic rocks

with no known artisanal workings, was relinquished. The Company maintained the

northern part of the License which is host to the Kanunga 1, 2 and 3 artisanal

or small scale mine sites. The relinquished area is currently under application

on account of a soil anomaly in the NE corner of the License.

The relatively recent artisanal small scale mining site,

located 1 kilometer along strike to the east of Kanunga 2, was abandoned by the

artisanal miners. Furthermore, the artisanal miners that were mining the surface

quartz rubble at Kanunga 3 in the northern part of the license have ceased

operations and have also left the site.

Map 2: Plan showing the outline of the 39 amalgamated PMLs

(purple outline) which have subsequently been included within the Mining License

(ML 520/2014 in red) that lie within the Kinyambwiga License

PL4653/2007.

The Kanunga 1 Prospect has been earmarked for commercial small

scale mining operations that are expected to proceed once necessary funding has

been obtained. The ESIA report, completed by TANSHEQ a local Tanzanian

consulting firm specializing in Environmental Management, was approved by the

National Environmental Management Council (NEMC) on the 23rd December 2013

and the Environmental Certificate was issued to Lake Victoria Resources (T) Ltd

on the 7 January 2014. An application for the Mining License, covering the

amalgamated 39 PMLs, together with the required Environmental Certificate, was

submitted to the Ministry of Energy and Minerals early in 2014. A slight

revision of the proposed Mining License was requested by the Ministry of Mines

in order to reduce the amount of corner beacons presented by the current PML

layout and which has subsequently increased the surface area to 5.12 square

kilometres (Map 2). The Mining License ML520/2014 was offered by the

Ministry of Energy and Minerals of Tanzania (MEM) on April 1, 2014 and

officially received on June 2, 2014.

16

A scoping study covering metallurgical test work, mine

planning, mine scheduling (details of which were included in the 1st Quarter

Report 2013) and preliminary financial evaluations has been prepared. A capital

investment of US$3M is an estimated requirement for building the project.

Mine Planning

The Kanunga 1 Prospect consists of a small, conceptual gold

target that is based on 40 meter spaced reverse circulation drill sections and

trenches and may contain gold bearing mineralized material of between 600,000

and 1,000,000 tonnes. The estimated gold grades are between 1.50 and 2.00 g/t.

The mineralized area which lies in three vein structures at Kanunga 1, is within

the first 150 and 200 meters of surface. Continuity of the narrow quartz veins

appears to extend along a strike length for about 500 meters.

The potential quantity and grade of these targets are

conceptual in nature. There has been insufficient exploration to define a

mineral resource and that it is uncertain if further exploration will result in

the target being delineated as a mineral resource. The conceptual target has

been determined on the results of trenching, mapping, geophysics and both RC and

RAB drilling.

It is currently proposed to mine the mineralization by open pit

mining methods using an excavator and trucks to transport the ore to an onsite

processing plant. A vertical test pit to a depth of 8 meters was excavated in

granitic saprolite (host rock) at site using a Caterpillar 320 excavator in a

relatively short time of 3 hours. The results of the test pit proved good

retaining rock wall strength, ease of excavation and the lack of ground

water.

The proposed site plan showing location of pit, waste dumps and

processing plant is shown in Map 3.

Map 3: Site plan map showing the proposed position of the

rock waste dump, tailings dam and the mine open pit. Also shown is a 100 meter

and a 200 meter buffer zone around the mine open pit which represents an area of

non-inhabitation and limited farming activities, which are required by the

Mining Act of Tanzania.

17

Based on the results of the test pit, a pit slope of 55-60

degrees was re-modeled for the open pit, using 10 meter and 7 meter benches

(Map 4 & Map 5). At this time, the deepest bench in the 40m deep pit

would be steeper depending upon the reach of the equipment and rock strength of

the pit walls.

The rock dump and tailings dam have been re-designed (Map 6

& 7) to accommodate approximately 1.5M tons and 260,000 tons

respectively; this is the estimated amount of rock to be mined to a depth of 40

meters.

Map 4: Plan view of the open pit on the Kanunga 1 showing the

access ramp and benches

Map 5: Longitudinal and cross sections of the Kanunga 1 Pit

18

Map 6: Plan and profile section of the rock waste dump

Map 7: Plan and profile section of the tailings dam

The Mining and Mill plan is designed for processing 300 tonnes

per day (Chart 1).

19

Chart 1: Flow sheet diagram showing the conceptual

processing plant

Mining License

The Environmental Impact Assessment (ESIA) report, completed by

TANSHEQ, a local Tanzanian consulting firm specializing in Environmental

Management, was submitted to the Tanzanian Government’s National Environmental

Management Council (NEMC) on the 2nd August 2013 and was approved on

the 23rd December 2013. The company received the approved report on

January 7th, 2014 (see news release dated January 9th,

2014). The Company has been awarded the Environmental Certificate of approval,

registration number EC/EIS/1106, issued under the Environmental Management Act

No.20 of 2004 and signed by the Tanzanian Minister of Environment. The EIA

Certificate is valid during the entire life cycle of the project based on the

Company’s compliance with the General and Specific Conditions of its issuance.

The Company has already completed the Mining and Processing

License Application to cover not only the Kanunga Prospect but also the 39

amalgamated Primary Mining Licenses (PMLs) previously held by the Company’s

Tanzanian subsidiary. The area, totalling 5.12 square kilometers also includes

the 2 other known gold occurrences at Kanunga 2 and 3. The Mining application

was submitted to the Ministry of Energy and Minerals in January 2014 and a

Mining License was granted in April 2014, and is valid for an initial period of

10 years.

Future work

With the Mining and Processing application approval and a

Mining License being awarded by the Ministry Energy and Minerals, the Company

will be in a position to proceed with the proposed mine plan once the necessary

funding has been obtained. Future exploration on the mining license will be

primarily focused at Kunanga 1, 2 and 3 with the focus on defining additional

gold resources to feed the gold processing plant (Map 8).

20

Map 8: Exploration strategy proposed on the Mining

License

A prospective exploration area lies to the east of the Kanunga

1 Prospect and is referred to as the Kanunga School Anomaly. With the Mining

License approval, the Company will be in the position to make application for

the area in order to do follow-up investigations at this gold anomaly.

An anomalous stone layer, as encountered from previous RAB

(rotary air blast) drilling during 2009 as well as the soil anomaly over the

school zone, requires further investigation. A number of auger drill traverses

are planned to test the strike towards the SW where a number of anomalous soil

samples are present (Map 9). Since this area was previously relinquished

as part of the government’s requirement to reduce the PL area by 50 percent, an

application to renew the area of “shed-off” was filed with the Ministry of

Mines.

21

Map 9: Kanunga 1 East and School soil anomalies

The influx of +500 artisanal miners at the Kanunga 3 Prospect, situated approximately 1 kilometer to the north of Kanunga 1 (Map 10), was short lived. After processing some of the surface quartz gravels, the miners migrated elsewhere and off the license. The prospect consists of abundant quartz float covering an area of 200 meters x 200 meters which has been the site for periodic artisanal activity over the years. Trenching and reverse circulation drilling intersected a number of narrow discontinuous quartz veins (Map 11).

22

Map 10: Map showing positions of Kunanga 1, 2 and 3 prospects as well as the Kunanga School gold-in-soil anomaly in the eastern part of the Kinyambwiga licenses.

Map 11: Kanunga 3 prospect showing results of trenching and

drilling undertaken across the area.

23

Singida Gold Project

No exploration work has been undertaken since 31st

March 2013.

Future exploration

An evaluation of the Reverse Circulation drill results for both

Phase 1 and 2 programs undertaken during 2010 and 2011 has shown that gold

mineralization at the Singida-Londoni project consists of narrow, medium to low

grade and often discontinuous lenses. The shear structures hosting the gold-rich

zones typically “pinch and swell” along strike, which in places, has resulted in

larger pods of limited size as at Sambaru 3 and Sambaru 4 which indicates that

the gold deposits have limited potential to be developed into a major ore

resource contrary to the Company’s vision of discovering substantially larger

and economically viable gold deposits in the short term. In this regard, the

Company believes that the nature and extent of the mineralization revealed thus

far may lend itself towards a small-scale commercial mining operation. The

Company intends to explore the possibilities of undertaking a small scale mining

operation on a number of PMLs once a scoping study has been completed.

Although the Company completed a Technical report in compliance

with Canadian National Instrument 43-101 prior to the September 2010 revised

43-101 code, the report was not submitted. Plans call for the report to be

prepared under the revised 43-101 guidelines.

Buhemba Gold Projects

The Buhemba Gold projects initially comprised of the Kiabakari

East (PL7142/2007) and the recently acquired Maji Moto (HQ-P23869) licenses.

However, The Maji Moto license was revoked by theTanzanian Ministry of Mines

during the year due to Company’s financial constraiints in fulfilling license

payments.

No exploration work has been undertaken on the Kiabakari

License since 31st March 2013,

Kiabakari East (PL7142/2011)

The Kiabakari East Project is located approximately 55

kilometers southeast of Musoma town, in the Mara Region. The License PL7142/2011

covers 14.94 square kilometers and lies within the central part of the

Musoma-Mara Greenstone Belt. The license was granted to Lake Victoria Resources

by the Ministry of Mines in April 2011.

Future exploration

Metallurgical test work is to be undertaken on the oxide rock

material taken from artisanal workings and from surface trenches as part of the

scoping study. This tese work will help determine the viability of commencing an

open pit/underground small scale mining operation at BIF Hill (Map 12).

Due to the moderate to steep easterly plunge of the gold zone, a follow-up

reverse circulation drill program has limited potential other than to evaluate a

near surface resource and will be unable to test east plunging down-dip

extensions of the gold ore shoot. A substantial diamond drill program will be

required to evaluate the easterly down plunging gold mineralization.

In order

to obtain short term revenue for the project, a small scale open pit mining

operation could be possible once an RC drill program has defined a near surface

gold resource. Alternatively, in order to get a better understanding of the

geology and gold mineralization, the Company could consider developing a north

trending underground adit from the southern side at the base of the hill.

24

Figure 12: Location map of the Kibabakri East License

showing the position of BIF Hill (insert) and the current status of exploration.

Uyowa Gold Project

The Uyowa Gold project, located 120 kilometers northwest of

Tabora town, previously consisted of seven (7) Prospecting Licenses (PLs) that

initially covered a total area of 729.73 square kilometers in the west-central

area of Tanzania. Due to increased Ministerial costs of annual renewals coupled

with the Company’s objective to focus its exploration efforts on potentially

more viable ground holding, the number of licenses was reduced to one PL

amounting to 29.17 square kilometers which was relingusihed during the last

fiscal year(Map 13).

Four PMLs on PL5153/2008 were optioned to the Company but have

subsequently been returned to their respective owners. No exploration work was

undertaken on the License during the year. All licenses under Uyowa gold project

were relinquished.

25

Map 13: Current license holding of the Uyowa Poject

Handeni Gold Project

The Handeni Project, comprising of the Mkulima East Prospect

PL7148/2011 and covering a total area of 12.03 square kilometers, is located

approximately 240 kilometers by road north-west of Dar es Salaam and some 30

kilometers south of Handeni town within the Handeni District (Map

14).

The license PL7148/2011 was relinquished in April 2015.

26

Map 14: Location map of the Handeni Project showing

PL7148/2011 in Red.

Exploration

No exploration has been undertaken on the Handeni Project since

2013.

Previous exploration involving stream sediment sampling and

soil sampling programs outlined four, northwest trending low threshold

gold-in-soil anomalies. These gold anomalies have an overall strike length of

1.5 kilometers, and lie on both sides of the NNW trending Mkulima Hill (Map

15).

Map 15: Soil sampling across Mukulima Hill outlining

potential soil anomalies

27

| ITEM 3. |

LEGAL PROCEEDINGS. |

On May 8, 2015, we served with notice of legal claim of a civil case in Tanzania by the Board of Trustees of National Social Security Fund in the amount of $18,463 (34,835,560 Tanzanian Schillings) plus 5% interest for statutory contributions. We are currently in negotiations regarding settlement of the claim. The amount claimed is included in the amounts accrued for contributions payable.

| ITEM 4. |

MINE SAFETY DISCLOSURES.

|

Not Applicable.

PART II

| ITEM 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY

SECURITIES. |

Market for Securities

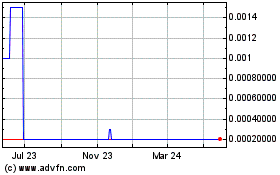

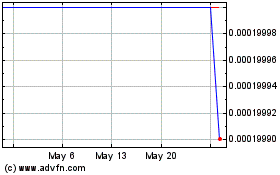

Our Company’s common stock is traded on the FINRA OTC Pink

Sheets under the symbol “LVCA”. Set forth below are the range of high and low

bid quotations for the periods indicated as reported by the FINRA. The market

quotations reflect inter-dealer prices, without retail mark-up, mark-down or

commissions and may not necessarily represent actual transactions.

| Quarter

Ending |

High |

Low |

| March 31, 2015 |

$0.05 |

$0.05 |

| December 31, 2014 |

$0.01 |

$0.01 |

| September 30, 2014 |

$0.03 |

$0.02 |

| June 30, 2014 |

$0.03 |

$0.03 |

| March 31, 2014 |

$0.03 |

$0.03 |

| December 31, 2013 |

$0.02 |

$0.01 |

| September 30, 2013 |

$0.02 |

$0.02 |

| June 30, 2013 |

$0.02 |

$0.02 |

Our transfer agent is Pacific Stock Transfer Company, of 4045

South Spencer Street, Suite 403, Las Vegas, NV 89119; telephone number:

702.361.3033; facsimile: 702.433.1979.

Holders of our Common Stock

As of June 29, 2015, there are approximately 213 registered stockholders

holding 152,329,067 shares of our issued and outstanding common stock.

Dividend Policy

There are no restrictions in our articles of incorporation or

bylaws that prevent us from declaring dividends. The Nevada Revised Statutes,

however, do prohibit us from declaring dividends where, after giving effect to

the distribution of the dividend:

| |

1. |

We would not be able to pay our debts as they become due

in the usual course of business; or |

| |

|

|

| |

2. |

Our total assets would be less than the sum of our total

liabilities plus the amount that would be needed to satisfy the rights of

shareholders who have preferential rights superior to those receiving the

distribution. |

We have not declared any dividends and we do not plan to

declare any dividends in the foreseeable future.

28

Recent Sales of Unregistered Securities

On March 20, 2015, we completed a private placement of

2,375,000 units at $0.04 per unit for total consideration of $95,000. We issued

these shares to five subscribers who represented that the subscriber was an

accredited investor pursuant to Rule 506 of Regulation D and/or Section 4(a)(2)

of the Securities Act of 1933.

On February 23, 2015, we completed a private placement of

10,000,000 units at $0.015 per unit for total consideration of $150,000. We

issued an aggregate of 3,000,000 units to one subscriber who represented that

the subscriber was not a US person (as that term is defined in Regulation S of

the Securities Act of 1933) in an offshore transaction pursuant to Regulation S

and/or Section 4(a)(2) of the Securities Act of 1933 and an additional 9,000,000

units to one accredited investors, who represented that they were each a "US

Person" as defined in Regulation S, pursuant to Rule 506 of Regulation D and/or

Section 4(a)(2) of the Securities Act of 1933.

On February 23, 2015, we signed debt settlement and

subscription agreement with a consultant to settle a consulting fee of $55,000

for business consulting services provided. On February 23, 2015, the Company

issued 1,000,000 restricted shares of common stock at a fair value of $0.055 per

share to settle the outstanding balance. The shares were valued at $55,000

representing their fair value on the date of the agreement. We issued these

shares to the subscriber who represented that the subscriber was an accredited

investor pursuant to Rule 506 of Regulation D and/or Section 4(a)(2) of the

Securities Act of 1933.

On December 19, 2014, we completed a private placement of

24,400,000 units at $0.025 per unit for gross consideration of $610,000. The

shares are accompanied by a gold bonus distribution of a total of 244 ounces of

0.999 percent gold during the first 480 days of commercial gold production. The

gold bonus distribution plan contains a feature where the Company retains the

option to convert the gold bonus into common shares of the Company at a rate of

$0.025 per share based on the spot price per ounce of gold on the payment date.

We issued an aggregate of 9,000,000 units to 3 subscribers that each represented

that he, she or it was not a US person (as that term is defined in Regulation S

of the Securities Act of 1933) in an offshore transaction pursuant to Regulation

S and/or Section 4(a)(2) of the Securities Act of 1933 and an additional

15,400,000 units to 10 accredited investors, who represented that they

were each a "US Person" as defined in Regulation S, pursuant to Rule 506 of

Regulation D and/or Section 4(a)(2) of the Securities Act of 1933.

Purchases of Equity Securities by the Issuer and Affiliated

Purchasers

We did not purchase any of our shares of common stock or other

securities during our fiscal year ended March 31, 2015.

| ITEM 6. |

SELECTED FINANCIAL DATA.

|

Not Applicable.

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

The following discussion should be read in conjunction with our

audited financial statements and the related notes that appear elsewhere in this

annual report. The following discussion contains forward-looking statements that

reflect our plans, estimates and beliefs. Our actual results could differ

materially from those discussed in the forward looking statements. Factors that

could cause or contribute to such differences include those discussed below and

elsewhere in this annual report.

Our audited consolidated financial statements are stated in

United States dollars and are prepared in accordance with United States

generally accepted accounting principles.

Plan of Operation

As of March 31, 2015, we had working deficit of approximately

$1,683,000. We plan to spend approximately $400,000 for our property

acquisitions and $2,000,000 for development and production of small scale mining

in Kinyambwiga project and exploration activities on other projects. We will

need to raise additional funds to finance the activities on our projects. There

is no assurance that such financing will be available at this time.

In September 2012, the Company offered a total of up to 120

royalty units to raise a gross amount of $3,000,000 for a small scale mining

operation on the Kinyambwiga property. Each unit will entitle investors to

receive ½ of 1 percent (1%) of the net proceeds of production from the small

scale mining operation at Kinyambwiga. Up to 60% of the net proceeds of gold

production are offered to investors. As of March 31, 2015 the Company received

subscription payments of $1,125,000 for 45 units.

During the years ended March 31, 2015 and 2014, the Company

entered into forward gold sales agreements to sell a total of 112.37 oz of gold

from the future gold production from the Kinyambwiga project. Under these

agreements, the Company committed to deliver the specified quantities of gold

with delivery dates ranging from December 2014 through November 2015.

29

The forward gold sales agreements for 31.94 oz of gold with

delivery dates ranging from December 2014 through April 2015 have a clause in

the agreements whereby the Company’s failure to meet the minimum monthly

production and monthly gold distribution schedules specified in the agreements

results in a penalty premium equal to the US Bond Interest Rate per annum of the

remaining balance of the distributable gold. As at March 31, 2015, the Company

accrued $Nil in penalty premium payable under these agreements as the amount of

penalties payable was minimal. The remaining forward gold sales agreements

entered into subsequent to March 31, 2014 and accounting for 80.43 oz do not

have the clauses of the interest penalty and the mandatory conversion into

common shares of the Company.

In addition, if the minimum production and gold distribution

schedules are not met for 6 months out of 9 consecutive months, the Company is

required to convert the remaining gold deliverable to common shares based on the

30-day weighted average market price of the Company’s stock. As at June 29,

2015, the Company was not yet required to convert any gold deliverables into

common shares.

Our estimated expenses over the next twelve months are as

follows:

Cash Requirements during the Next Twelve Months

| Expense |

|

($) |

| Property acquisition and holding costs |

|

400,000 |

| Mine development and production costs |

|

3,00,000 |

| Professional fees |

|

100,000 |

| General and administration fee |

|

500,000 |

| Total |

|

4,000,000 |

There is no historical financial information about us upon

which to base an evaluation of our performance. We are an exploration stage

corporation and have not generated any revenues from operations. We cannot

guarantee we will be successful in our business operations. Our business is

subject to risks inherent in the establishment of a new business enterprise,

including limited capital resources, possible delays in the exploration of our

properties, possible cost overruns due to price and cost increases for services

and economic conditions. Because we do not currently derive any production

revenue from operations, our ability to conduct exploration and development on

properties is largely based upon our ability to raise capital by equity

funding.

Our exploration objective is to find an economic mineral body

containing gold. Our success depends upon finding mineralized material. This

includes a determination by our contracted consultants and professional staff

whether the property contains resources and/or reserves. Mineralized material is

a mineralized body, which has been delineated by appropriately spaced drilling