MOL Raises Full-Year Profitability Guidance on Third-Quarter Result

November 03 2016 - 7:57PM

Dow Jones News

By Margit Feher

BUDAPEST--Hungarian integrated oil-and-gas company MOL Nyrt.

(MGYOY, MOL.BU) raised Friday its full-year profitability guidance

on the back of its third-quarter earnings, which beat analysts'

forecasts despite a sharp decline on the year.

Clean earnings before interest, tax, depreciation and

amortization, a major indicator of profitability in the oil

industry that investors watch closely, was 165 billion forints

(about $592.7 million) for the period, down by a sharp 19% from a

year earlier. MOL's earnings took a hit from a decline in refining

and petrochemicals margins, and planned maintenance, which strong

retail Ebitda could only partly offset, the company said.

Still, clean Ebitda beat analysts' expectations of HUF156.8

billion for the July-September quarter, according to a poll of nine

independent analysts conducted by the company. Clean earnings don't

include the revaluation of inventories and one-off items.

As a result of its third-quarter performance, MOL, Hungary's

largest firm by revenue, raised its full-year clean Ebitda guidance

to around $2.2 billion from over $2 billion earlier. Clean Ebitda

already totaled $1.68 billion in the first nine months of the

year.

Downstream--or refining and marketing--clean Ebitda was HUF114.9

billion, down 25% from a record-high quarterly result a year

earlier. The decline was partly the result of scheduled maintenance

both at a refinery and a petrochemicals plant, the company said.

Clean Ebitda was higher than analysts' forecast for HUF111.0

billion.

As for the outlook, motor fuel demand remains high in central

Europe and robust economic growth in the region is expected to keep

boosting the downstream segment, MOL said.

The clean Ebitda of the upstream--or exploration and

production--segment was HUF48.3 billion, up 12% from a year

earlier, delivering its first Ebitda growth since 2011. It was also

higher than analysts' expectation for HUF46.4 billion. Oil and gas

production was 107,000 barrels of oil equivalent a day in the third

quarter, up 6% on the year.

In the third quarter, the company generated a net profit of

HUF68.8 billion, down by a sharp 24% from HUF90.7 billion a year

earlier. Still, that was also higher than analysts' expectation for

HUF60.3 billion. It translated into earnings of HUF759.2 a share,

down from HUF966 a share a year before.

Write to Margit Feher at margit.feher@wsj.com

(END) Dow Jones Newswires

November 03, 2016 20:42 ET (00:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

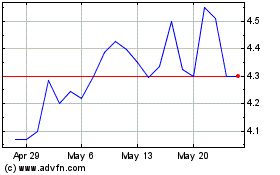

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jan 2025 to Feb 2025

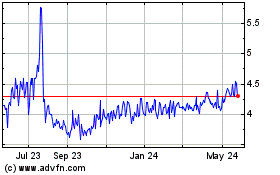

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Feb 2024 to Feb 2025