false000127799800012779982023-08-112023-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 11, 2023 |

MANUFACTURED HOUSING PROPERTIES INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

000-51229 |

51-0482104 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

136 MAIN STREET |

|

PINEVILLE, North Carolina |

|

28134 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 980 273-1702 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 11, 2023, Manufactured Housing Properties Inc. (the “Company”) issued a press release reporting its financial results for the quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

The Company is making reference to certain non-GAAP financial information in the press release. A reconciliation of GAAP to non-GAAP results is provided in the press release.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Date: August 11, 2023 |

MANUFACTURED HOUSING PROPERTIES INC. |

|

|

|

/s/ Raymond M. Gee |

|

Name: |

Raymond M. Gee |

|

Title: |

Chief Executive Officer |

|

(Principal Executive Officer and Principal Financial and Accounting Officer) |

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.1

Manufactured Housing Properties Inc. Announces Results For the Three and Six Months Ended June 30, 2023

Revenues increased by 35%, net loss increased by 107%, and Adjusted EBITDA increased by 18% over Prior Period For the Six Months Ended June 30, 2023.

CHARLOTTE, N.C., August 11, 2023 - Manufactured Housing Properties Inc. (OTC: MHPC), whose principal activities are to acquire, own, and operate manufactured housing communities, today announced operating results for the quarter ended June 30, 2023.

Total revenues, net loss and adjusted EBITDA for the quarter ended June 30, 2023, were $4,423,514, $2,307,002, and $1,163,956, respectively, compared to $3,371,371, $1,343,976, and $725,798, respectively, for the quarter ended June 30, 2022. Total revenues, net loss and adjusted EBITDA for the six months ended June 30, 2023, were $8,681,003, $4,424,044, and $2,123,384, respectively, compared to $6,426,393, $2,133,666, and $1,797,505, respectively for the six months ended June 30, 2022.

As of June 30, 2023, the total portfolio consisted of 58 manufactured housing communities containing approximately 3,125 developed sites and 1,410 company-owned, manufactured homes. MHPC acquired one community during the second quarter of 2023, consisting of 402 lots. Our communities are in Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Jay Wardlaw, President of Manufactured Housing Properties Inc. added “We are happy to report another strong quarter of revenue increase of 35% through both new acquisitions and growth in our existing portfolio, representing an increase of 21% and 14%, respectively. This quarter we continued to focus on building our infrastructure to promote our long-term value-add strategies.”

Raymond M. Gee, Chairman and CEO of Manufactured Housing Properties Inc. commented, “We are pleased to announce another strong quarter of revenue growth, stemming from both new acquisitions and the existing portfolio, resulting in an 18% increase in EBIDTA. We closed on a significant acquisition during the quarter and have continued to improve our existing communities. The increase in our corporate payroll and overhead expenses are attributable to onboarding new team members. These results are in line with the company’s strategy for responsible growth year over year.”

Reconciliation of Non-GAAP Financial Measures

Manufactured Housing Properties Inc. presents Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) in addition to its Net Income (Loss) reported in accordance with accounting principles generally accepted in the United States (GAAP). EBITDA is a non-GAAP financial measure that differs from Net Income. Non-GAAP EBITDA excludes income tax expense, interest expense and depreciation and amortization, as well as refinancing cost. The table presented below includes a list of items excluded from Net Income (Loss) to reconcile to non-GAAP EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net (Loss) |

|

$ |

(2,307,002 |

) |

|

$ |

(1,343,976 |

) |

|

$ |

(4,424,044 |

) |

|

$ |

(2,133,666 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation & Amortization Expense |

|

|

1,178,089 |

|

|

|

818,975 |

|

|

|

2,201,104 |

|

|

|

1,578,679 |

|

Interest Expense |

|

|

1,822,853 |

|

|

|

1,039,271 |

|

|

|

3,471,457 |

|

|

|

2,005,819 |

|

Pref C Dividends Included in Interest Expense on P&L |

|

|

470,016 |

|

|

|

195,777 |

|

|

|

874,867 |

|

|

|

330,922 |

|

Refinancing Cost |

|

|

— |

|

|

|

15,751 |

|

|

|

— |

|

|

|

15,751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

1,163,956 |

|

|

$ |

725,798 |

|

|

$ |

2,123,384 |

|

|

$ |

1,797,505 |

|

Management believes non-GAAP Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating operating performance because it provides them with an additional tool to compare business performance across companies and across periods. Management also believes that non-GAAP Adjusted EBITDA is widely used by investors to measure operating performance without regard to items such as income tax expense, interest expense and depreciation and amortization, which can vary substantially from company to company depending upon, among other things, the book value of assets, capital structure and whether assets were constructed or acquired. Non-GAAP Adjusted EBITDA also allows investors and other users to assess the underlying financial performance of our income-producing properties before management’s decision to deploy capital. The presentation of non-GAAP Adjusted EBITDA is intended to complement, and should not be considered an alternative to, the presentation of Net Income (Loss), which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Adjusted EBITDA as presented in this release may not be comparable to similarly titled measures used by other companies.

About Manufactured Housing Properties Inc.

Manufactured Housing Properties Inc., together with its affiliates, acquires, owns, and operates manufactured housing communities. The company focuses on acquiring and operating manufactured housing communities in high growth markets and is actively seeking to expand its portfolio.

Forward-Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will”, “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on our current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” of the reports that we file with the Securities and Exchange Commission (SEC). Forward-looking statements contained in this announcement are made as of this date, and we undertake no duty to update such information except as required under applicable law.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

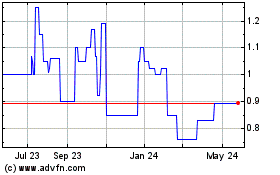

Manufactured Housing Pro... (CE) (USOTC:MHPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Manufactured Housing Pro... (CE) (USOTC:MHPC)

Historical Stock Chart

From Jan 2024 to Jan 2025