Nacel Energy Pays Down $1.34 Millon in Debt and Provides Shareholder Update

May 23 2011 - 6:15AM

Marketwired

NACEL Energy Corporation (OTCQB: NCEN) (FRANKFURT: 4FC) ("NACEL" or

the "Company") today confirmed significant improvement in the

Company's financial statements was achieved during the first nine

months of the fiscal year ended March 31, 2011. Total debt

reduction during the period amounted to $1,335,499. Accounts

Payable was reduced by $245,837 to $61,464. Remaining debt

outstanding amounted to $1,195,226 of which a member of NACEL's

Board of Directors has advanced $460,753 on terms favourable to the

Company. NACEL anticipates further improvement will be reported

upon the release of its annual financial statements for fiscal

2010-11 to be filed at the end of June.

Shareholder Update

Following the appointment of Mark Schaftlein to the combined

role of Chief Executive Officer/Chief Financial Officer in April

2010, NACEL embarked upon a restructuring of its operations with a

focus on debt reduction. The restructuring included termination of

various consultants and management, other cost reductions and the

negotiation of a series of Notes with JMJ Financial of San Diego to

provide a new source of operating capital for the Company.

As a result of the restructuring efforts and the level of debt

reduction achieved during the first nine months of Fiscal 2010-11,

in January 2011, the Board of Directors of NACEL authorized the

acquisition of two blocks of the common stock of Crownbutte Wind

Power, Inc. (OTCQB: CBWP) of Mandan, North Dakota ("Crownbutte").

With this stock acquisition, NACEL became the largest shareholder

of Crownbutte.

Crownbutte developed and built the first utility scale wind park

in the Dakotas and most recently, built the two-phase 30 MW Diamond

Willow wind power facility near Baker, Montana. Twenty GE 1.5 MW

wind turbines are operating today at Baker, which is presently

owned by Montana-Dakota Utilities.

Subsequent to the Crownbutte stock acquisition, in February

2011, NACEL appointed Crownbutte's Executive Vice President, Terry

Pilling, Ph.D., to the position of Chief Operating Officer of

NACEL, thereby tasking Dr. Pilling with responsibility for the

combined wind project portfolio of NACEL and Crownbutte -- a total

of 13 wind projects in four States -- including three now ready to

be constructed in 2011 pending the execution of definitive turbine

financing. The Company cautions that while discussions with various

parties regarding this wind turbine financing are ongoing there is

no certainty these discussions will result in any financing

arrangements being concluded.

In May 2011, following the completion of the review of the

combined project portfolio by Dr. Pilling, NACEL determined it

would participate directly with Crownbutte in the development of

the 200 MW Gascoyne II wind power generation project. Gascoyne is

located on 1733 acres between the towns of Bowman and Hettinger in

North Dakota and is considered to possess among the best wind

characteristics in the nation for a wind power generation project.

NACEL then advanced funds directly to the Midwest Independent

Transmission System Operator, Inc. (Midwest ISO) to complete the

Feasibility Study for the interconnection of the Gascoyne II

project to the electric grid.

NACEL anticipates it will continue to invest further capital in

Crownbutte and will participate directly in other Crownbutte wind

projects in the future. NACEL will update shareholders and other

interested parties regarding the extent of NACEL's capital

investment in Crownbutte subsequent to the Company becoming the

largest shareholder of Crownbutte, following the filing of

Crownbutte's next quarterly report on Form 10-Q.

For further information concerning today's news release please

refer to NACEL's News Archive at

http://www.nacelenergy.com/news/archive.html.

About NACEL Energy Corporation (OTCQB:

NCEN)

NACEL is one of the first publicly traded companies in America

exclusively developing clean, renewable, utility scale wind energy.

The Company currently anticipates generating an aggregate 300

megawatts of new wind power upon the commissioning of the Gascoyne

II project in North Dakota, together with the Company's Leila Lake,

Hedley Pointe, Swisher, Channing Flats and Blue Creek, all located

in the Texas Panhandle. NACEL was founded in 2006 and successfully

completed its IPO in December of 2007. NACEL is also the largest

shareholder of Crownbutte Wind Power Inc. (OTCQB: CBWP) of Mandan,

ND.

NACEL Energy The WIND POWER COMPANY™

Notice regarding Forward-Looking Statements

Statements in this press release relating to NACEL Energy's

plans, strategies, economic performance and trends, projections of

results of specific activities, and other statements that are not

descriptions or historical facts may be forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934. Forward-looking information

is subject to risks and uncertainties, and actual results could

differ materially from those currently anticipated due to a number

of factors, which include, but are not limited to, risk factors

inherent in NACEL Energy's business. Forward-looking statements may

be identified by words such as "should," "may," "will,"

"anticipate," "expect," "estimate," "intend" or "continue," or

comparable words or phrases. Interested persons are encouraged to

read NACEL Energy's Securities and Exchange Commission filings,

particularly its Annual Report on Form 10-K for the fiscal year

ended March 31, 2010 and its Quarterly Report on Form 10-Q for the

quarter ended December 31, 2010, for meaningful cautionary language

disclosing why actual results may vary materially from those

anticipated by management.

Contact: NACEL Energy Investor Relations 1-888-242-5848

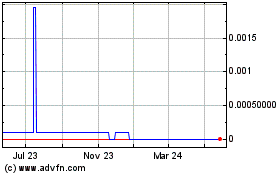

Nacel Energy (CE) (USOTC:NCEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

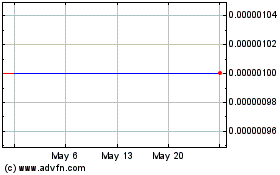

Nacel Energy (CE) (USOTC:NCEN)

Historical Stock Chart

From Dec 2023 to Dec 2024