As filed with the Securities and Exchange Commission on October 2, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| PLANET 13 HOLDINGS INC. |

| (Exact name of registrant as specified in its charter) |

|

Nevada

|

|

83-2787199

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

2548 West Desert Inn Road, Suite 100

Las Vegas, Nevada 89109

(702) 815-1313

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

|

Robert Groesbeck & Larry Scheffler

Co-Chief Executive Officers

Planet 13 Holdings Inc.

2548 West Desert Inn Road, Suite 100

Las Vegas, Nevada 89109

(702) 815-1313

|

|

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

Copies to:

|

Kevin Roggow, Esq.

Mehrnaz Jalali, Esq.

Cozen O’Connor P.C.

3 WTC, 175 Greenwich Street 55th Floor

New York, New York 10007

(212) 509-9400

|

|

Leighton Koehler, Esq.

Planet 13 Holdings Inc.

2548 West Desert Inn Road, Suite 100

Las Vegas, Nevada 89109

(702) 815-1313

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

| If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. |

☐ |

| |

|

| If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. |

x |

| |

|

| If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

☐ |

| |

|

| If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

☐ |

| |

|

| If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. |

☐ |

| |

|

| If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. |

☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or emerging growth. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐ |

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

x |

|

Smaller reporting company

|

x

|

| |

|

|

Emerging growth company

|

x

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. |

☐ |

____________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 2, 2023

PROSPECTUS

Planet 13 Holdings Inc.

$100,000,000

Common Stock

Preferred Stock

Warrants

Subscription Rights

Units

We may offer and sell up to $100,000,000 in the aggregate of the securities identified from time to time in one or more offerings. This prospectus provides a general description of the securities we may offer. Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in any securities.

We may offer and sell these securities directly to our stockholders or to purchasers, or through one or more underwriters, dealers or agents, or through a combination of these methods. If any agents, dealers or underwriters are involved in the sale of any of these securities, the applicable prospectus supplement will provide their names and any applicable fees, commissions or discounts. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

Investing in our securities involves risks. Before buying any securities you should carefully read the section entitled “Risk Factors” on page 22 of this prospectus along with the risk factors described in the applicable prospectus supplement and the other information contained in and incorporated by reference in this prospectus and in the applicable prospectus supplement before purchasing the securities offered hereby.

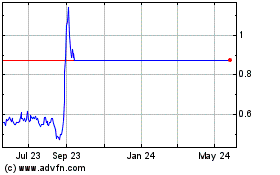

Our common stock is traded on the Canadian Securities Exchange (“CSE”) under the symbol “PLTH” and quoted on the OTCQX operated by OTC Markets Group, Inc. (the “OTCQX”) under the symbol “PLNH.” On September 29, 2023, the closing price of our common stock on the CSE was C$1.17 per share and on the OTCQX was $0.8614 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _______________, 2023

TABLE OF CONTENTS

| ABOUT THIS PROSPECTUS |

1 |

| |

|

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

2 |

| |

|

| MARKET AND INDUSTRY DATA |

3 |

| |

|

| OUR COMPANY |

4 |

| |

|

| RISK FACTORS |

22 |

| |

|

| USE OF PROCEEDS |

32 |

| |

|

| DILUTION |

33 |

| |

|

| PLAN OF DISTRIBUTION |

34 |

| |

|

| DESCRIPTION OF CAPITAL STOCK |

36 |

| |

|

| DESCRIPTION OF WARRANTS |

42 |

| |

|

| DESCRIPTION OF SUBSCRIPTION RIGHTS |

43 |

| |

|

| DESCRIPTION OF UNITS |

44 |

| |

|

| LEGAL MATTERS |

45 |

| |

|

| EXPERTS |

45 |

| |

|

| LIMITATION ON LIABILITY AND DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES |

45 |

| |

|

| WHERE YOU CAN FIND MORE INFORMATION |

45 |

| |

|

| INCORPORATION OF DOCUMENTS BY REFERENCE |

45 |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under this shelf registration process, we may from time to time sell any combination of the securities described in this prospectus in one or more offerings for an aggregate initial offering price of up to $100,000,000.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide one or more prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus and, accordingly, to the extent inconsistent, information in this prospectus is superseded by the information in the prospectus supplement. You should read both this prospectus and the accompanying prospectus supplement together with the additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free writing prospectus filed by us with the SEC. We have not authorized anyone to provide you with different information. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus or such accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

Unless the context otherwise indicates, references in this prospectus to the “Company,” “Planet 13,” “we,” “our” and “us” refer, collectively, to Planet 13 Holdings Inc., a Nevada corporation, and its consolidated subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus includes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws and United States securities laws. All information, other than statements of historical facts, included in this prospectus that addresses activities, events or developments that we expect or anticipate will or may occur in the future is forward-looking information. Forward-looking information is often identified by the words “may,” “would,” “could,” “should,” “will,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “expect” or similar expressions and includes, among others, information regarding: our strategic plans and expansion and expectations regarding the growth of the cannabis market; statements relating to the business and future activities of, and developments related to, us after the date of prospectus, including such things as future business strategy, competitive strengths, goals, expansion and growth of our business, operations and plans, new revenue streams, the completion by us of contemplated acquisitions of additional real estate, cultivation and licensing assets, the roll out of new dispensaries, the application for additional licenses and the grant of licenses or renewals of existing licenses that have been applied for, the expansion of existing cultivation and production facilities, the completion of cultivation and production facilities that are under construction, the construction of additional cultivation and production facilities, the expansion into additional U.S. markets, any potential future legalization of adult-use and/or medical cannabis under U.S. federal law; expectations of market size and growth in the United States and the states in which we operate or contemplate future operations; expectations for other economic, business, regulatory and/or competitive factors related to us or the cannabis industry generally; the ability to complete the proposed acquisition of VidaCann, LLC (“VidaCann”) and successfully integrate the business of VidaCann and to realize the anticipated benefits to the Company of the proposed transaction (the “Transaction”) including the parties’ strategic plans and expansion and expectations regarding the growth of the Florida cannabis market, information concerning the timing and completion of the Transaction, the timing and anticipated receipt of required regulatory approvals for the Transaction and satisfaction of other customary closing conditions.

Readers are cautioned that forward-looking information and statements are not based on historical facts but instead are based on reasonable assumptions and estimates of our management at the time they were provided or made and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information and statements. Such factors include, among others, our actual financial position and results of operations differing from management’s expectations; our business model; a lack of business diversification; increasing competition in the industry; public opinion and perception of the cannabis industry; expected significant costs and obligations; current reliance on limited jurisdictions; development of our business; access to capital; risks relating to the management of growth; risks inherent in an agricultural business; risks relating to energy costs; risks related to research and market development; risks related to breaches of security at our facilities; reliance on suppliers; risks relating to the concentrated voting control of the Company; risks related to our being a holding company; risks related to service providers withdrawing or suspending services under threat of prosecution; risks related to proprietary intellectual property and potential infringement by third parties; risks of litigation relating to intellectual property; negative clinical trial results; insurance related risks; risk of litigation generally; risks associated with cannabis products manufactured for human consumption, including potential product recalls; risks relating to being unable to attract and retain key personnel; risks relating to obtaining and retaining relevant licenses; risks relating to integration of acquired businesses; risks related to quantifying our target market; risks related to industry growth and consolidation; fraudulent activity by employees, contractors and consultants; cyber-security risks; conflicts of interest; risks related to reputational damage in certain circumstances; leased premises risks; U.S. regulatory landscape and enforcement related to cannabis, including political risks; heightened scrutiny by Canadian regulatory authorities; risks related to capital raising due to heightened regulatory scrutiny; risks related to tax liabilities; risks related to U.S. state and local law and regulations; risks related to access to banks and credit card payment processors; risks related to potential violation of laws by banks and other financial institutions; ability and constraints on marketing products; risks related to lack of U.S. federal trademark and patent protection; risks related to the enforceability of contracts; the limited market for our securities; difficulty for U.S. holders of shares of our common stock to resell over the Canadian Securities Exchange; price volatility of our common stock; uncertainty regarding legal and regulatory status and changes; risks related to legislation and cannabis regulation in the states in which we operate or contemplate future operations; future sales by shareholders; no guarantee regarding use of available funds; currency fluctuations; the potential that regulatory approval of the Transaction may not be received or may be delayed or that other conditions to the closing of the Transaction may not be satisfied, the potential impact on the Company’s business or stock price due to the announcement of the Transaction, the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction; and other factors beyond our control, as more particularly described under the heading “Risk Factors” in this prospectus.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Although we have attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information and statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such information and statements. Accordingly, readers should not place undue reliance on forward-looking information and statements. The forward-looking information and statements contained herein are presented for the purposes of assisting readers in understanding our expected financial and operating performance and our plans and objectives and may not be appropriate for other purposes.

The forward-looking information and statements contained in this prospectus represent our views and expectations as of the date of this prospectus. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update such forward-looking information and statements at a future time, we have no current intention of doing so except to the extent required by applicable law.

MARKET AND INDUSTRY DATA

This prospectus and the documents incorporated by reference herein contain statistical data and estimates regarding market and industry data. Unless otherwise indicated, information concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity and market size, are based on our management’s knowledge and experience in the markets in which we operate, together with currently available information obtained from various sources, including publicly available information, industry reports and publications, surveys, our customers, trade and business organizations and other contacts in the markets in which we operate. Certain information is based on management estimates, which have been derived from third-party sources, as well as data from our internal research, and are based on certain assumptions that we believe to be reasonable. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. We have not independently verified any of the information from third-party sources nor have we ascertained the validity or accuracy of the underlying economic assumptions relied upon therein. Actual outcomes may vary materially from those forecast in the reports or publications referred to herein, and the prospect for material variation can be expected to increase as the length of the forecast period increases. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to these estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors” in this prospectus and in our Annual Report on Form 10-K.

OUR COMPANY

Overview

We are a multi-state cannabis operator with licenses to operate in Nevada, California, and Florida, and a conditional dispensing license in Illinois. We are headquartered in Las Vegas, Nevada, at our superstore dispensary located adjacent to the Las Vegas Strip. A detailed description of our corporate history and our business can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with SEC on March 23, 2023.

We remain focused on providing our customers with the best products, best services, and an experiential shopping experience at our superstore-themed dispensaries, while expanding our products and sales through neighborhood stores. Each of our state operations is held in state-focused subsidiaries: (a) Newtonian Principles, Inc. (“Newtonian”) for California licensed cannabis dispensing and distribution activities, (b) Next Green Wave, LLC (“NGW”) for California licensed cannabis cultivation, production and distribution activities, (c) MM Development Company, Inc. (“MMDC”) for all licensed Nevada cannabis cultivation, production, distribution, and dispensing activities, (d) Planet 13 Florida, Inc. (“Planet 13 Florida”) which holds our Florida Medical Marijuana Treatment Center (“MMTC”) license, and (e) Planet 13 Illinois, LLC (“Planet 13 Illinois”) which holds a conditional Illinois social-equity justice impaired dispensing license. We have focused on our large-store dispensing stores as superstores which offer an experiential approach to our customers, including drones, robotics, 3-D mapping projection, cannabis-culture inspired social-media backdrops for customer interaction, customer facing production, one-on-one sales staffing and customer education, and other interactive marketing elements to differentiate from more traditional dispensing locations, which we refer to herein as “neighborhood stores”.

We were originally incorporated under the Canada Business Corporations Act (“CBCA”) on April 26, 2002 under the name “High Income Preferred Shares Corporation.” On June 26, 2019, we continued out of the jurisdiction of Canada under the CBCA into the jurisdiction of the Province of British Columbia under the Business Corporations Act (British Columbia). A special resolution to approve our change in jurisdiction from the Province of British Columbia, Canada, to the State of Nevada (the “Domestication”) was submitted to a shareholder vote at our 2023 annual general and special meeting on July 27, 2023, and approved by our shareholders. On September 15, 2023, the Domestication was completed pursuant to a court-approved plan of arrangement.

Overview of the Company’s Cannabis Business

Introduction

On November 1, 2018, we opened the Planet 13 Las Vegas Superstore, less than 500 feet from the Trump Tower and less than 2,500 feet from the Wynn hotel. MMDC entered into an arm’s length agreement to lease a 100,000 square foot building to house its Planet 13 Las Vegas Superstore dispensary and corporate office space in a Phase I build-out of the location (the “Planet 13 Las Vegas Superstore”). In October 2019, we opened a 4,500-square-foot coffee shop and pizzeria in the Planet 13 Las Vegas Superstore. In 2020, the coffee shop and pizzeria were renamed as the Trece Eatery + Spirits restaurant, owned and operated by us through our subsidiaries. Future plans include the opening of a consumption lounge and a sub-tenant operated cannabis museum. The Planet 13 Las Vegas Superstore lease has a seven-year term with two seven-year renewal options and we have a right-of-first-refusal on any sale of the building. Prior to opening the Planet 13 Las Vegas Superstore, we sold both medical and adult-use products from our then existing facilities. On April 1, 2019, we entered into a lease and sub-license agreement for an additional 4.17 acres of land directly adjacent to the Planet 13 Las Vegas Superstore for additional parking. The term of the April 1, 2019 lease and sub-license runs concurrent with the Planet 13 Las Vegas Superstore lease.

We may in the future build a 100,000 square foot greenhouse for cultivation and an approximately 43,000 square foot processing/production facility located in Beatty, Nevada, approximately 120 miles north-west of Las Vegas. The Beatty location is licensed and zoned for up to three million square feet of greenhouse space for the cultivation of cannabis. The site, which is owned by us, has been permitted and is ready for construction to begin. We are evaluating the timing of construction based on a current excess of supply of wholesale cannabis product in the State of Nevada and in the event of future federal legalization. We expect to revisit our expansion plans for the Beatty facility once the wholesale market in Nevada stabilizes.

Cultivation

We operate our Nevada cultivation licenses at three separate facilities, each location operating jointly under a medical and adult-use cultivation license. Two of our cultivation licenses operate out of Las Vegas in Clark County, Nevada and include indoor cultivation and perpetual harvest cycles. One is located in an approximately 16,100 square foot facility, and the other operates out of a 45,000 square foot facility. The third cultivation license is located near the town of Beatty in Nye County, Nevada. The Beatty cultivation facility currently houses approximately 500 square feet of research and development and genetics testing with the potential to expand to over 2,300,000 square feet of greenhouse production capacity on 80 acres of owned land that includes municipal water and abundant electrical power already at the edge of the property.

Through our wholly-owned subsidiary NGW, which is licensed by the State of California to produce, distribute and sell products throughout the state, we cultivate and process our cannabis products at our 35,875 square foot facility on one of the four properties utilized by us and zoned for cannabis cultivation in the City of Coalinga, California (“Facility A”). Facility A enables us to cultivate medicinal and adult-use cannabis and distribute cannabis products in accordance with the requirements under the Medicinal and Adult Use Cannabis Regulation and Safety Act, throughout the State of California.

As part of our Florida expansion, on July 1, 2022, we closed on a $3,300,000 purchase of a 23-acre parcel of real property, inclusive of a 10,500 square foot building, near Ocala, Florida. We are in the beginning stages of establishing our cultivation operations at this property as we continue to strategically select dispensary locations across the State of Florida.

Production

Our six Nevada production licenses operate at three licensed production facilities, each location operating jointly under a medical and adult-use cultivation license. One production facility is a 18,500 square foot customer facing production facility that opened inside the Planet 13 Las Vegas Superstore, our cannabis entertainment complex adjacent to the Las Vegas Strip. In operation since October 2019, this facility incorporates butane hash oil (“BHO”) extraction, distillation equipment and microwave assisted extraction equipment as well as a state-of-the-art bottling and infused beverage line and an edibles line able to produce infused chocolates, infused gummies and other edible products. Prior to opening this facility, we produced our cannabis products at a separate 4,750 square foot facility leased in Las Vegas (Clark County). The second production facility is co-located at the Beatty facility, and the third facility is co-located in the 45,000 square foot cultivation facility located in Las Vegas. Manufactured products and Trendi-branded third-party flower are distributed through Nevada under our Nevada distribution license.

In California, through our wholly-owned subsidiary, NGW, which is licensed by the State of California to produce, distribute and sell products throughout the State, we process and package our cannabis products at our 4,000 square foot facility on one of the four properties utilized by us and zoned for cannabis cultivation in the City of Coalinga, California (“Facility C”). Facility C enables us to process and package medicinal and adult-use cannabis and distribute cannabis products in accordance with the requirements under the Medicinal and Adult Use Cannabis Regulation and Safety Act, throughout the State of California.

Distribution

We currently operate Nevada distribution activities, primarily for the transport of our products between our cultivation, production, and dispensing operations, out of our 16,100 square foot cultivation facility located in Las Vegas (Clark County). In addition to self-distribution services, the distribution license is used for the delivery of our wholesale products to licensed Nevada-state cannabis retailers. All distribution licenses held by us in the State of Nevada have been issued to MMDC.

We currently operate California distribution activities at our licensed facility in Santa Ana, California to receive cannabis products purchased from our vendors prior to placement in the Planet 13 OC Superstore.

Through our wholly-owned subsidiary, NGW, which is licensed by the State of California to produce, distribute and sell products throughout the State, we distribute our cannabis products from Facilities A and C to California-licensed wholesale customers.

Dispensing

We have three Nevada dispensary licenses, one for medical and two for the sale of adult-use product. Since 2018, the Planet 13 Las Vegas Superstore, approximately 23,000 square feet of retail space located adjacent to the Las Vegas Strip, has housed one medical and one adult-use license. The Planet 13 Las Vegas Superstore has the capacity to serve between 3,000 and 5,000 customers per day through its new, enhanced dispensary. We intend to build out the balance of the Planet 13 Las Vegas Superstore location with ancillary services such as a potential cannabis lounge in a segregated area of the facility where patrons will be able to consume products that have been purchased at the dispensary. The Planet 13 Las Vegas Superstore also houses our corporate offices. Prior to relocating to the Planet 13 Las Vegas Superstore, the licenses operated out of the Medizin Facility, a 2,300 square foot facility located approximately six miles off the Las Vegas Strip. In September 2020, we received an unincorporated Clark County adult-use license for the Medizin Facility dispensary which had closed when its dispensary licenses were transferred to the Planet 13 Las Vegas Superstore and re-opened the Medizin Facility on November 30, 2020.

The regulatory framework for consumption lounge applications and operations was finalized in July 2022. In December 2022, we were approved for a retail attached cannabis consumption lounge prospective license and continue to develop our buildout and operational plans.

We operate one dispensary in California, the Planet 13 OC Superstore, which occupies approximately 25,600 square feet of retail space on Warner Avenue in the City of Santa Ana located in Orange County. On March 3, 2023, we submitted a request to the California Department of Cannabis Control to add a medical designation to our dispensary license which will allow for the sale of medical cannabis products from the Planet 13 OC Superstore.

On August 5, 2021, our subsidiary, Planet 13 Illinois, which was then owned 49% by us and 51% by Frank Cowan, a resident of Illinois, was a lottery winner for a Social-Equity Justice Involved Conditional Adult Use Dispensing Organization License in the Chicago-Naperville-Elgin region from the Department of Financial and Professional Regulation in the State of Illinois. On February 7, 2023, we exercised and closed our option to purchase Mr. Cowan's 51% interest in Planet 13 Illinois. On October 5, 2021, we formed Planet 13 Chicago, LLC as a 100% owned leasing entity to support future operations in Illinois. On February 3, 2023, we closed on the purchase of a dispensary location in the town of Waukegan, a suburb of the greater Chicago area, and anticipate that it will be operational in the quarter ended December 31, 2023.

Our Florida MMTC license authorizes us to dispense medical marijuana to qualified patients and caregivers. We have entered into four leases for dispensing locations in Florida which remain subject to completion of tenant improvements and regulatory inspection prior to sales to customers.

Licenses

Please see Table 1 below for a list of the cannabis licenses issued to us in each state.

Table 1: Licenses

|

Holding Entity

|

Permit/License

|

Jurisdiction

|

Expiration/Renewal Date

|

Description

|

|

MMDC

|

Medical/Adult-Use

|

Clark County, NV

|

June 30, 2024

|

Dispensary

|

|

MMDC

|

Adult-Use

|

Clark County, NV

|

November 30, 2023

|

Dispensary

|

|

MMDC

|

Medical/Adult-Use

|

Clark County, NV

|

June 30, 2024

|

Cultivation

|

|

MMDC

|

Medical/Adult-Use

|

Clark County, NV

|

June 30, 2024

|

Production

|

|

MMDC

|

Medical/Adult-Use

|

Nye County, NV

|

June 30, 2024

|

Cultivation

|

|

MMDC

|

Medical/Adult-Use

|

Clark County, NV

|

June 30, 2024

|

Cultivation

|

|

MMDC

|

Medical/Adult-Use

|

Clark County, NV

|

June 30, 2024

|

Production

|

|

MMDC

|

Medical

|

Nye County, NV

|

June 30, 2024

|

Production

|

|

MMDC

|

Adult-Use

|

Nye County, NV

|

December 31, 2023

|

Production

|

|

MMDC

|

Distribution

|

Clark County, NV

|

March 31, 2024

|

Distribution

|

|

Newtonian

|

Medical / Adult-Use Retailer

|

Santa Ana, CA

|

April 17, 2024

|

Dispensary(1)

|

|

Newtonian

|

Medical / Adult-Use Distribution

|

Santa Ana, CA

|

June 11, 2024

|

Distribution

|

|

NGW

|

Medical/Adult-Use

|

Coalinga, CA

|

June 20, 2024

|

Distribution

|

|

NGW

|

Medical/Adult-Use

|

Coalinga, CA

|

October 26, 2023

|

Manufacturer Type 6

|

|

NGW

|

Adult-Use

|

Coalinga, CA

|

November 17, 2023

|

Cultivation, Medium Indoor

|

|

Planet 13 Florida

|

MMTC

|

Florida

|

October 25, 2024

|

MMTC

|

|

Planet 13 Illinois

|

Adult-Use Dispensing

|

Chicago-Naperville-Elgin, IL

|

July 11, 2024

|

Dispensary

|

_________________________

| |

(1)

|

On March 16, 2023, DCC enhanced this dispensary license to add a medical designation, allowing for the sale of medical cannabis products.

|

Legal and Regulatory Matters

United States Federal Law Overview

At the federal level, cannabis currently remains a Schedule I controlled substance under the U.S. Controlled Substance Act of 1970 (the “CSA”). Under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of accepted safety for the use of the drug under medical supervision. As such, the manufacture, importation, possession, use or distribution of cannabis remains illegal under U.S. federal law. This has created a dichotomy between state and federal law, whereby many states have elected to regulate and remove state-level penalties regarding a substance that is still illegal at the federal level. As of September 25, 2023, and despite the conflict with U.S. federal law, the medical use of cannabis is permitted in 38 states, the District of Columbia, the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, and the U.S. Virgin Islands, and of those, the adult use of cannabis for recreational purposes is authorized in 23 states and the District of Columbia, the Commonwealth of the Northern Mariana Islands, and Guam.

While technically illegal, the U.S. federal government’s approach to enforcement of such laws has, at least until recently, trended toward non-enforcement. On August 29, 2013, the U.S. Department of Justice (“DOJ”) issued a memorandum known as the “Cole Memorandum” to all U.S. Attorneys’ offices (federal prosecutors). The Cole Memorandum generally directed U.S. Attorneys not to prioritize the enforcement of federal marijuana laws against individuals and businesses that rigorously comply with state regulatory provisions in states with strictly-regulated medical or adult-use cannabis programs. The Cole Memorandum, while not legally binding, assisted in managing the tension between state and federal laws concerning state-regulated cannabis businesses.

However, on January 4, 2018, the Cole Memorandum was revoked by then Attorney General Jeff Sessions. While this did not create a change in federal law - as the Cole Memorandum was not itself law - the revocation added to the uncertainty of U.S. federal enforcement of the CSA in states where cannabis use is regulated. Sessions also issued a one-page memorandum known as the “Sessions Memorandum”. This confirmed the rescission of the Cole Memorandum and explained that the Cole Memorandum was “unnecessary” due to existing general enforcement guidance as set forth in the U.S. Attorney’s Manual (the “USAM”). The USAM enforcement priorities, like those of the Cole Memorandum, are also based on the federal government’s limited resources, and include “law enforcement priorities set by the Attorney General,” the “seriousness” of the alleged crimes, the “deterrent effect of criminal prosecution,” and “the cumulative impact of particular crimes on the community.”

While the Sessions Memorandum does emphasize that marijuana is a Schedule I controlled substance and states the statutory view that it is a “dangerous drug and that marijuana activity is a serious crime,” it does not otherwise guide U.S. Attorneys that the prosecution of marijuana-related offenses is now a DOJ priority. Furthermore, the Sessions Memorandum explicitly describes itself as a guide to prosecutorial discretion. Such discretion is firmly in the hands of U.S. Attorneys in deciding whether to prosecute marijuana-related offenses. U.S. Attorneys could individually continue to exercise their discretion in a manner similar to that displayed under the Cole Memorandum’s guidance. Dozens of U.S. Attorneys across the country have affirmed their commitment to proceeding in this manner, or otherwise affirming that their view of federal enforcement priorities has not changed, although a few have displayed greater ambivalence.

On January 21, 2021, Joseph Biden, Jr. was sworn in as President of the United States. President Biden’s Attorney General, Merrick Garland, was confirmed by the United States Senate on March 10, 2021. It is not yet known whether the Department of Justice under President Biden and Attorney General Garland will re-adopt the Cole Memorandum or announce a substantive marijuana enforcement policy. Mr. Garland indicated at a confirmation hearing before the United States Senate that it did not seem to him to be a good use of limited resources to pursue prosecutions in states that have legalized and that are regulating the use of marijuana, either medically or otherwise. In a White House Statement dated October 6, 2022, President Biden announced “First, I am announcing a pardon of all prior Federal offenses of simple possession of marijuana ... Second, I am urging all Governors to do the same with regard to state offenses ... Third, I am asking the Secretary of Health and Human Services and the Attorney General to initiate the administrative process to review expeditiously how marijuana is scheduled under federal law.” On August 30, 2023, Bloomberg reported on a non-public letter from the United States Department of Health and Human Services (“HHS”) to the United States Drug Enforcement Administration announced that HHS would recommend moving marijuana from Schedule I to Schedule III under the CSA. Rescheduling, if it occurs, could result in significant, material changes in the federal legal and regulatory framework and enforcement, up to and including an environment under which the current state-based licenses are no longer feasible for operation. Rescheduling from Schedule I to Schedule III is generally anticipated to result in allowance of income tax deductions for federal income tax purposes, as the underlying activity will no longer be viewed as federally illegal.

Despite these statements which appear positive for the nascent cannabis industry, there is no guarantee that cannabis will be rescheduled federally, that current state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. Unless and until the United States Congress amends the CSA with respect to cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that federal authorities may enforce current U.S. federal law. Currently, in the absence of uniform federal guidance, as had been established by the Cole Memorandum, enforcement priorities are determined by respective United States Attorneys.

In addition to federal illegality and uncertainty of state-driven legalization frameworks for cannabis operators within the U.S., it may potentially be a violation of federal anti-money laundering statutes for financial institutions to take any proceeds from the sale of cannabis or any other Schedule I controlled substance. Canadian banks are likewise hesitant to deal with cannabis companies, due to the uncertain legal and regulatory framework of the industry. Banks and other financial institutions, particularly those that are federally chartered in the U.S., could be prosecuted and possibly convicted of money laundering for providing services to cannabis businesses.

Despite these laws, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) issued a memorandum on February 14, 2014 (the “FinCEN Memorandum”) outlining the pathways for financial institutions to bank state-sanctioned cannabis businesses in compliance with federal enforcement priorities. The FinCEN Memorandum echoed the enforcement priorities of the Cole Memorandum. Under these guidelines, financial institutions must submit a Suspicious Activity Report (“SAR”) in connection with all marijuana-related banking activities by any client of such financial institution, in accordance with federal money laundering laws. These marijuana-related SARs are divided into three categories - marijuana limited, marijuana priority, and marijuana terminated - based on the financial institution’s belief that the business in question follows state law, is operating outside of compliance with state law, or where the banking relationship has been terminated, respectively. On the same day as the FinCEN Memorandum was published, the DOJ issued a memorandum (the “2014 DOJ Memorandum”) directing prosecutors to apply the enforcement priorities of the Cole Memorandum in determining whether to charge individuals or institutions with crimes related to financial transactions involving the proceeds of cannabis-related conduct. The 2014 DOJ Memorandum has been rescinded as of January 4, 2018, along with the Cole Memorandum, removing guidance that enforcement of applicable financial crimes against state-compliant actors was not a DOJ priority.

However, former Attorney General Sessions’ revocation of the Cole Memorandum and the 2014 DOJ Memorandum has not affected the status of the FinCEN Memorandum, nor has the Department of the Treasury given any indication that it intends to rescind the FinCEN Memorandum itself. Though it was originally intended for the 2014 DOJ Memorandum and the FinCEN Memorandum to work in tandem, the FinCEN Memorandum appears to be a standalone document which explicitly lists the eight enforcement priorities originally cited in the Cole Memorandum. As such, the FinCEN Memorandum remains intact, indicating that the Department of the Treasury and FinCEN intend to continue abiding by its guidance. However, in the United States, it is difficult for cannabis-based businesses to open and maintain a bank account with any bank or other financial institution.

In the U.S., the SAFE Banking Act of 2019, H.R. 1595 (“SAFE Banking Act”), was first introduced on March 7, 2019 and passed a vote on September 25, 2019 by the Committee of the Whole Congress, but failed to receive the support needed to pass the U.S. Senate. Generally, the act would let banks offer services to cannabis-related businesses. They could also offer services to those businesses’ employees. In both Canada and the U.S., transactions involving banks and other financial institutions are both difficult and unpredictable under the current legal and regulatory landscape. Legislative changes could help to reduce or eliminate these challenges for companies in the cannabis space and would improve the efficiency of both significant and minor financial transactions. On September 27, 2023, the Committee on Banking, Housing, and Urban Affairs of the United States Senate passed a legislative markup of the Act, now titled the “SAFER Banking Act,” out of the committee and headed to the Senate floor for a vote. While there is strong support in the public and within Congress for the SAFER Banking Act and similar legislation, there can be no assurance that it will be passed as presently proposed or at all.

Although the Cole Memorandum and 2014 DOJ Memorandum have been rescinded, Congress has used the Joyce Amendment, previously known as the Rohrabacher-Farr and the Rohrabacher-Leahy Amendment, as a rider provision in the FY 2015, 2016, 2017, 2018, 2019, 2020, and 2021 Consolidated Appropriations Acts and accompanying stopgap spending measures to prevent the federal government from using congressionally appropriated funds to enforce federal marijuana laws against regulated medical cannabis actors operating in compliance with state and local law. President Joe Biden became the first president to propose a budget with the Joyce Amendment included. On December 29, 2022, the Joyce Amendment was renewed through the signing of the “Consolidated Appropriations Act, 2023” which extended the protections for the medical cannabis industry until September 30, 2023. On September 30, 2023, the U.S. House of Representatives passed a stopgap funding bill titled as the “Continuing Appropriations Act, 2024 and Other Extensions Act,” which continued the enforcement restrictions regarding medical marijuana through November 17, 2023.

Despite the legal, regulatory, and political obstacles the cannabis industry currently faces, the industry has continued to grow. It was anticipated that the federal government would eventually repeal the federal prohibition on cannabis and thereby leave the states to decide for themselves whether to permit regulated cannabis cultivation, production and sale, just as states are free today to decide policies governing the distribution of alcohol or tobacco.

Given current political trends, however, these developments are considered unlikely to materialize in the near-term. As an industry best practice, despite the recent rescission of the Cole Memorandum, we intend to abide by the following to ensure compliance with the guidance provided by the Cole Memorandum:

| |

●

|

ensure that our cannabis related activities adhere to the scope of the licensing obtained (for example, in states where cannabis is permitted only for adult-use, the products are only sold to individuals who meet the requisite age requirements);

|

| |

|

|

| |

●

|

implement policies and procedures in place to ensure that funds are not distributed to criminal enterprises, gangs or cartels;

|

| |

|

|

| |

●

|

implement an inventory tracking system and necessary procedures to ensure that such compliance system is effective in tracking inventory and preventing diversion of cannabis or cannabis products into those states where cannabis is not permitted by state law, or cross any state lines in general;

|

| |

|

|

| |

●

|

ensure that our state-authorized cannabis business activity is not used as a cover or pretense for trafficking of other illegal drugs, is engaged in any other illegal activity or any activities that are contrary to any applicable anti-money laundering statutes; and

|

| |

|

|

| |

●

|

ensure that our products comply with applicable regulations and contain necessary disclaimers about the contents of the products to prevent adverse public health consequences from cannabis use and prevent impaired driving.

|

In addition, we may (and frequently do) conduct background checks to ensure that the principals and management of our operating subsidiaries are of good character and have not been involved with other illegal drugs, engaged in illegal activity or activities involving violence, or use of firearms in cultivation, manufacturing or distribution of cannabis. We also conduct ongoing reviews of the activities of our cannabis businesses, the premises on which they operate and the policies and procedures that are related to possession of cannabis or cannabis products outside of the licensed premises, including the cases where such possession is permitted by regulation.

Nevada State Law Overview

In 2000, Nevada voters passed a medical marijuana initiative allowing physicians to recommend cannabis for an inclusive set of qualifying conditions including chronic pain and created a limited non-commercial medical marijuana patient/caregiver system. Senate Bill 374, which passed the legislature and was signed by the Nevada Governor in 2013, expanded this program and established a for-profit regulated medical marijuana industry.

In 2014, Nevada accepted medical marijuana business applications and a few months later the Nevada Division of Public and Behavioral Health (the “Division”) approved 182 cultivation licenses, 118 licenses for the production of edibles and infused products, 17 independent testing laboratories, and 55 medical marijuana dispensary licenses. The number of dispensary licenses was then increased to 66 by legislative action in 2015. The application process was merit-based, competitive, and is currently closed.

Nevada has a medical marijuana program and passed adult-use legalization through the ballot box in November 2016. Under Nevada’s adult-use marijuana law, the state licensed marijuana cultivation facilities, product manufacturing facilities, distributors, retail stores and testing facilities. For the first 18 months after legalization, applications to the Nevada State Department of Taxation (the “DOT”) for adult- use establishment licenses were only accepted from existing medical marijuana establishments and from existing liquor distributors for the adult-use distribution license. The Division licensed and regulated medical marijuana establishments up until July 1, 2017, when the state’s medical marijuana program merged with adult-use marijuana enforcement under the DOT. After merging medical and adult-use marijuana regulation and enforcement, the single regulatory agency was known as the “Marijuana Enforcement Division of the Department of Taxation.” The DOT oversaw regulation of cannabis operations until the State of Nevada’s Cannabis Compliance Board (the “CCB”) took over on July 1, 2020. As of October 5, 2020, all five members of the CCB were appointed by the Nevada Governor.

In February 2017, the state announced plans to issue “early start” recreational marijuana establishment licenses in the summer of 2017. These licenses expired at the end of the year and, beginning on July 1, 2017, allowed marijuana establishments holding both a retail marijuana store and dispensary license to sell their existing medical marijuana inventory as either medical or adult-use marijuana. All cannabis cultivated and infused products produced under the adult-use program that were not existing inventory at a medical marijuana dispensary were transported to retail marijuana stores utilizing a licensed retail marijuana distributor. Starting on July 1, 2017, medical and adult-use marijuana became subject to a 15% excise tax on the first wholesale sale (calculated on the fair market value) and adult-use cannabis is subject to an additional 10% special retail marijuana sales tax in addition to any general state and local sales and use taxes.

The regular retail marijuana program began in early 2018. The Regulation and Taxation of Marijuana Act specifies that, for the first 18 months of the program, only existing medical marijuana establishment certificate holders could apply for a retail marijuana establishment license. As that restriction expired in November 2018, on December 5, 2018, the DOT expanded the application process and awarded an additional 61 licenses for retail marijuana dispensaries in Nevada. The regular program was governed by permanent regulations found in Nevada Administrative Code Sections 453A and 453D through June 30, 2020.

In early 2019, Nevada legislature passed Nevada Assembly Bill 533 (“AB533”), which authorized the formation of the CCB to be vested with the authority to license and regulate persons and establishments engaged in cannabis activities within Nevada and promulgated statutes which will replace Nevada Revised Statute (“NRS”) 453A and 453D effective on July 1, 2020. Those statutes are currently codified at NRS 678A, B, C and D. On July 21, 2020, the CCB adopted final Nevada Cannabis Compliance Regulations 1 through 14 (“NCCR”) which are substantially similar to the former Nevada Administrative Code Sections 453A and 453D. CCB continuously reviews, updates, and adds to the NCCRs, the most material update being the June 28, 2022 addition of Regulation 15 relating to cannabis consumption lounges.

In response to industry feedback, on October 20, 2020, the CCB amended NCCR 5 to give clarity regarding public company ownership of Nevada cannabis companies. Generally, those amendments include such companies being required to provide to the CCB notice of annual general meetings of shareholders and a non-objecting beneficial owners (“NOBO”) list as of the record date of each such meeting, and disclosure of any stockholders having 5% or greater ownership interest or that are able to exert control over a Nevada cannabis establishment. Additionally, the CCB requires an updated list of all beneficial owners, regardless of amount or type of ownership, but if a list of all beneficial owners cannot be obtained through reasonable cost and/or effort, the publicly traded company must provide an updated NOBO list as of the annual meeting record date, and explain why it cannot provide a list of all beneficial owners through reasonable cost and effort.

Nevada does not have any U.S. residency requirements with respect to license ownership, but does require background checks of all individuals having an ownership interest. Background checks are waivable at the discretion of the CCB for individuals having less than 5% ownership interest. The last background check waiver approval received from the CCB was on August 23, 2022, in relation to our acquisition of Next Green Wave Holdings Inc. and extended to all shareholders holding less than 5% ownership interest. Although the CCB has not chosen to exercise their authority to require a background check on ownership interests in public cannabis companies that remain under 5% and do not otherwise exercise control over a Nevada cannabis licensee, the CCB does have authority to require a licensee to investigate and submit any ownership interest, beneficial or direct, for CCB approval. For example, under Nevada cannabis laws, any beneficial holder of any of our securities, regardless of the number of shares, may be required to file an application, be investigated, and have his or her suitability as a beneficial holder of the voting securities determined if the CCB has reason to believe that such ownership would otherwise be inconsistent with the declared policies of the State of Nevada.

In addition, vertical integration is neither required nor prohibited. All medical cannabis sales are made subject to the recipient holding a registry identification card issued by the State of Nevada as defined at NRS 678C.080. We are permitted to sell medical cannabis products to non-Nevada patients as non-Nevada patients are permitted reciprocity under NRS 678C.470.

Nevada Reporting Requirements

Nevada has selected Franwell Inc.’s METRC solution (“METRC”) as the state’s track-and-trace system used to track commercial cannabis activity and movement through the supply chain. Individual licensees whether directly or through third-party integration systems are required to push data to the state to meet all reporting requirements. For all licensed facilities, we have designated an in-house computerized seed to sale software that integrates with METRC via an application programming interface, and captures the required data points for cultivation, production and retail as required by Nevada statutes and regulations.

Nevada Licenses and Regulatory Compliance

We are licensed for the cultivation, production, distribution, and retail sale of cannabis and cannabis products. These licenses were formerly issued by the DOT under the provisions of NRS section 453A through June 30, 2020 and reissued by the CCB under NRS 678A, B and D starting July 1, 2020. All licenses are independently issued for each approved activity for use at our facilities and retail locations in Nevada.

Cannabis consumption lounges were authorized in Nevada pursuant to AB 341 in the 2021 81st Session of the Nevada Legislature. On July 9, 2021, our subsidiary MMDC received a notification letter of eligibility to hold a retail attached cannabis consumption lounge license from the CCB. On June 28, 2022, the CCB adopted regulations for the cannabis consumption lounge application and requirements to operate. On June 20, 2023, we were approved for a retail attached cannabis consumption lounge conditional license, and on September 19, 2023, we were approved for a zoning permit to place the lounge inside the Planet 13 Las Vegas SuperStore. We have targeted opening the consumption lounge in or around the quarter ended March 31, 2024.

Our licenses are in good standing and we, through MMDC, are in compliance with Nevada’s cannabis regulatory program. MMDC has responded to all CCB inspections and received approval on all corrective actions.

We comply with applicable Nevada state licensing requirements as follows: (i) MMDC is licensed pursuant to applicable Nevada state law to cultivate, possess and/or distribute THC-bearing cannabis in Nevada; (ii) renewal dates for such licenses are docketed by legal counsel and/or other advisors; (iii) random audits of our business activities are conducted by the applicable Nevada state regulator and by us to ensure compliance with applicable Nevada state law; (iv) each of our employees is provided with an employee handbook that outlines internal standard operating procedures in connection the cultivation, possession and distribution of cannabis to ensure that all cannabis inventory and proceeds from the sale of such cannabis are properly accounted for and tracked, including through the use of scanners to confirm each customer’s legal age and the validity of each customer’s photo identification; (v) each room that cannabis inventory and/or proceeds from the sale of such inventory enter is monitored by video surveillance; and (vi) software is used to track cannabis inventory from seed to sale. We are contractually obligated to comply with applicable Nevada state law in connection with the cultivation, possession and/or distribution of cannabis in Nevada.

All Nevada cannabis establishments must be licensed by the CCB. If applications contain all required information and after vetting of officers, establishments are issued a cannabis establishment registration certificate. In a local governmental jurisdiction that issues business licenses, the issuance by the CCB of a cannabis establishment license is considered conditional until the local government has issued a business license for operation and the establishment is in compliance with all applicable local governmental ordinances. Final licenses are valid for a period of one year and are subject to annual renewals after required fees are paid and the business remains in good standing. It is important to note that conditional licenses do not permit the operation of any commercial or medical cannabis businesses. Only after a conditional licensee has gone through necessary state and local inspections, if applicable, and has received a final license from the CCB may an entity engage in cannabis business operation. The CCB limits applications for all licenses.

Our executive team’s duties include monitoring the day-to-day activities of regulatory compliance staff, including ensuring that the established standard operating procedures are being adhered to at each stage of the cultivation, processing and distribution cycle, to identify any non-compliance matters and to put in place the necessary modifications to ensure compliance. The regulatory compliance staff conducts regular unannounced audits against our established standard operating procedures and State of Nevada regulations. Each employee is provided with an employee handbook outlining the standard operating procedures and state regulations upon hiring and is then provided with one-on-one quality and regulatory training through programs overseen by Company management.

California State Law Overview

In 1996, California was the first state to legalize medical marijuana through Proposition 215, the Compassionate Use Act of 1996. This legalized the use, possession and cultivation of medical marijuana by patients with a physician recommendation for treatment of cancer, anorexia, AIDS, chronic pain, spasticity, glaucoma, arthritis, migraine, or any other illness for which marijuana provides relief.

In 2003, Senate Bill 420 was signed into law establishing an optional identification card system for medical marijuana patients. In September 2015, the California legislature passed three bills collectively known as the Medical Cannabis Regulation and Safety Act (“MCRSA”). The MCRSA established a licensing and regulatory framework for medical marijuana businesses in California. The system created multiple license types for dispensaries, infused products manufacturers, cultivation facilities, testing laboratories, transportation companies, and distributors. Edible infused product manufacturers would require either volatile solvent or non-volatile solvent manufacturing licenses depending on their specific extraction methodology. Multiple agencies would oversee different aspects of the program and businesses would require a state license and local approval to operate. However in November 2016, voters in California overwhelmingly passed Proposition 64, the Adult-Use of Marijuana Act (“AUMA”) creating an adult-use marijuana program for adults 21 years of age or older.

AUMA included certain conflicting provisions with MCRSA, so in June 2017, the California State Legislature passed Senate Bill No. 94, known as Medicinal and Adult-Use Cannabis Regulation and Safety Act (“MAUCRSA”), which amalgamates MCRSA and AUMA to provide a set of regulations to govern a medical and adult-use licensing regime for cannabis businesses in the State of California. At that time the four agencies that regulated marijuana at the state level were the Bureau of Cannabis Control (“BCC”), California Department of Food and Agriculture, California Department of Public Health, and California Department of Tax and Fee Administration. MAUCRSA came into effect on January 1, 2018. One of the central features of MAUCRSA is known as “local control.” In order to legally operate a medical or adult-use marijuana business in California, an operator must have both a local and state license. This requires license holders to operate in cities or counties with marijuana licensing programs. Cities and counties in California are allowed to determine the number of licenses they will issue to marijuana operators, or can choose to outright ban marijuana.

State cannabis licenses in California must be renewed annually. Depending on the jurisdiction, our local authorizations must generally be renewed annually as well. Each year, licensees are required to submit a renewal application per State cannabis regulatory guidelines. Provided renewal applications are submitted in a timely manner, we can expect the renewals to be granted in the ordinary course of business.

On January 10, 2020, the three commercial cannabis licensing agencies in California, the BCC, the Department of Food and Agriculture, and the Department of Public Health (collectively, “California Licensing Agencies”) announced that California Governor Gavin Newsom’s budget proposal for cannabis industry regulation and taxation included plans to consolidate the three licensing entities that are currently housed at the California Licensing Agencies into a single Department of Cannabis Control by July 2021. With the passage of AB 141 on July 12, 2021, the California Licensing Agencies were consolidated into the Department of Cannabis Control (“DCC”). On September 8, 2021, the DCC announced proposed emergency regulations to move all cannabis regulations into Title 4 of the California Code of Regulations, with a stated goal of consolidating and improving the regulations. Effective November 7, 2022, the DCC made permanent the emergency regulations adopted on September 27, 2021, and March 28, 2022. The DCC adopted a consolidated regulatory package that streamlines and simplifies cannabis regulations, eases burdens for licensees, and enhances consumer and youth protections. DCC proposed changes to the current regulations are available to track online at: https://cannabis.ca.gov/cannabis-laws/rulemaking/.

MAUCRSA allows local municipalities and jurisdictions to authorize the on-site consumption of cannabis by state-licensed retailers and/or microbusinesses. If a city or county permits it, retailers and microbusinesses can have on-site consumption if: (i) access to the area where cannabis consumption is allowed is restricted to persons 21 years of age and older, (ii) cannabis consumption is not visible from any public place or non-age-restricted area, and (iii) the sale or consumption of alcohol or tobacco is not allowed on the premises.

California Reporting Requirements

California has selected METRC as the state’s track-and-trace system used to track commercial cannabis activity and movement across the supply chain. Individual licensees whether directly or through third-party integration systems are required to push data to the state to meet all reporting requirements. For all licensed facilities, we have designated an in- house computerized seed to sale software that integrates with METRC via an application programming interface, and captures the required data points for cultivation, manufacturing and retail as required by California statutes and regulations.

California License and Regulatory Compliance

We, through our subsidiaries Newtonian and NGW, are licensed for the cultivation, manufacturing, distribution, and retail sale of cannabis and cannabis products. We are in compliance with applicable licensing requirements and the regulatory framework enacted by the State of California. In order to qualify for these licenses, we submitted applications and license renewals with detailed plans and procedures evidencing to the applicable regulators that we comply with all statutory and regulatory requirements in California for the operation of the licenses. We have retained a California regulatory consultant with experience operating regulatory-compliant California license operations to advise us on regulatory requirements and updates in that state. Additionally, our executive team works regularly with our California regulatory consultant and oversees all aspects of services provided to ensure compliance and continuity of these licenses.

Florida State Law Overview

In 2014, the Florida Legislature passed the Compassionate Use Act, which was the first legal medical cannabis program in the state’s history. The original Compassionate Use Act only allowed for low-THC cannabis to be dispensed and purchased by patients suffering from cancer and epilepsy. In 2016, the Legislature passed the Right To Try Act which allowed for full potency cannabis to be dispensed to patients suffering from a diagnosed terminal condition. Also in 2016, the Florida Medical Marijuana Legalization Initiative was introduced by citizen referendum and passed on November 8. This language, known as “Amendment 2,” amended the state constitution and mandated an expansion of the state’s medical cannabis program.

Amendment 2, and the resulting expansion of qualifying medical conditions, became effective on January 3, 2017. The Florida Department of Health, physicians, dispensing organizations and patients are bound by Article X Section 29 of the Florida Constitution and Florida Statutes Section 381.986. On June 9, 2017, the Florida House of Representatives and Florida Senate passed respective legislation to implement the expanded program by replacing large portions of the existing Compassionate Use Act, which officially became law on June 23, 2017.

The Florida Statutes Section 381.986(8) provides a regulatory framework that requires licensed producers, which are statutorily defined as “Medical Marijuana Treatment Centers”, to cultivate, process and dispense medical cannabis in a vertically-integrated marketplace.

Licenses are issued by the Office of Medical Marijuana Use (“OMMU”) and must be renewed biennially. License holders can only own one license. Currently, the dispensaries can be in any geographic location within the state, provided that the local jurisdiction’s zoning regulations authorize such a use, the proposed site is zoned for a pharmacy and the site is not within 500 feet of a school.

The MMTC license permits us to sell medical cannabis to qualified patients to treat certain medical conditions in Florida, which are delineated in Florida Statutes Section 381.986. As we expect our operations in Florida to be vertically-integrated, we will be able to cultivate, harvest, process and sell/dispense/deliver our own medical cannabis products. Under the terms of our Florida license, we are permitted to sell medical cannabis only to qualified medical patients that are registered with the State. Only qualified physicians who have successfully completed a medical cannabis educational program can register patients on the Florida Office of Medical Marijuana Use Registry.

An Adult Personal Use of Marijuana ballot initiative gathered over 1 million signatures in 2023. The state attorney general filed an opposition brief following a request for advisory opinion filed with the Supreme Court of Florida on July 19, 2023. If the ballot initiative survives legal challenge, Florida voters will be permitted to vote on the adult personal use of marijuana on the November 5, 2024 ballot.

In 2023, OMMU issued two new MMTC licenses pursuant to a statutory provision requiring the issuance of MMTC licenses to certain individuals and entities who were members of a class that sued the United States Department of Agriculture alleging racial discrimination by the agency in the allocation of financial assistance to farmers. OMMU is currently reviewing applications for additional licenses under the this provision and can potentially issue up to 10 more MMTC licenses.

In April 2023, OMMU accepted applications for the issuance of 22 new MMTC licenses. OMMU is currently evaluating and scoring the applications. Once OMMU announces its selection of the winning applicants, it is anticipated that there will be litigation which delays the issuance of the licenses. At this time, it is unclear when OMMU will announce the winners and when the licenses will ultimately be issued.

Florida Reporting Requirements

Florida law calls for the OMMU to establish, maintain, and control a computer software tracking system that traces cannabis from seed to sale and allows real-time, 24-hour access by the OMMU to such data. The tracking system must allow for integration of other seed-to-sale systems and, at a minimum, include notification of certain events, including when marijuana seeds are planted, when marijuana plants are harvested and destroyed and when cannabis is transported, sold, stolen, diverted, or lost. Each medical marijuana treatment center shall use the seed-to-sale tracking system established by the OMMU or integrate its own seed-to-sale tracking system with the seed-to-sale tracking system established by the OMMU. At this time the OMMU has not implemented a statewide seed-to-sale tracking system. Additionally, the OMMU also maintains a patient and physician registry and the licensee must comply with all requirements and regulations relative to the provision of required data or proof of key events to said system in order to retain its license. Florida requires all MMTCs to abide by representations made in their original application to the State of Florida or any subsequent variances to same. Any changes or expansions of previous representations and disclosures to the OMMU must be approved by the OMMU via a variance process.

Security and Storage Requirements

Adequate outdoor lighting is required from dusk to dawn for all MMTC facilities. 24-hour per day video surveillance is required and all MMTCs must maintain at least a rolling 45-day period that is made available to law enforcement and the OMMU upon demand. Alarm systems must be active at all times for all entry points and windows. Interior spaces must also have motion detectors and all cameras must have an unobstructed view of key areas. Panic alarms must also be available for employees to be able to signal authorities when needed.

In dispensaries, the MMTC must provide a waiting area with a sufficient seating area. There must also be a minimum of one private consultation/education room for the privacy of the patient(s) and their caregiver (if applicable). The MMTC may only dispense products between 7:00 am and 9:00 pm. All active products must be kept in a secure location within the dispensary and only empty packaging may be kept in the general area of the dispensary which is readily accessible to customers and visitors. No product or delivery devices may be on display in, or visible from, the waiting area.

An MMTC must at all times provide secure and logged access for all cannabis materials. This includes approved vaults or locked rooms. There must be at least two employees of the MMTC or an approved security provider on site at all times where cultivation, processing, or storing of cannabis occurs. All employees must wear proper identification badges and visitors must be logged in and wear a visitor badge while on the premises. The MMTC must report any suspected activity of loss, diversion or theft of cannabis materials within 24 hours of becoming aware of such an occurrence.

Florida Transportation Requirements

When transporting cannabis to dispensaries or to patients, a manifest must be prepared and transportation must be done using an approved vehicle. The cannabis must be stored in a separate, locked area of the vehicle and at all times while in transit there must be two people in a delivery vehicle. During deliveries, one person must remain with the vehicle. The delivery employees must at all times have identification badges. The manifest must include the following information: (i) departure date and time; (ii) name, address and license number of the originating MMTC; (iii) name and address of the receiving entity; (iv) the quantity, form and delivery device of the cannabis; (v) arrival date and time; (vi) the make, model and license plate of the delivery vehicle; and (vii) the name and signatures of the MMTC delivery employees. These manifests must be kept by the MMTC for inspection for up to three years. During the delivery, a copy of the manifest is also provided to the recipient.

OMMU Inspections in Florida

The OMMU may conduct announced or unannounced inspections of MMTC’s to determine compliance with applicable laws and regulations. The OMMU is to inspect an MMTC upon receiving a complaint or notice that the MMTC has dispensed cannabis containing mold, bacteria, or other contaminants that may cause an adverse effect to humans or the environment. The OMMU is to conduct at least a biennial inspection of each MMTC to evaluate the MMTC’s records, personnel, equipment, security, sanitation practices, and quality assurance practices.

Florida License and Regulatory Compliance

We, through our subsidiary, Planet 13 Florida, hold the MMTC license and are in compliance with applicable licensing requirements and the regulatory framework enacted by the State of Florida. We have retained Florida regulatory consultants with experience to advise us on regulatory requirement and updates in that state. Our executive team works regularly with our Florida regulatory consultant and oversees all aspects of statutory and regulatory compliance for our MMTC license.

Illinois State Law Overview