Current Report Filing (8-k)

May 01 2020 - 6:06AM

Edgar (US Regulatory)

PUBLIC SERVICE CO OF NEW MEXICO0001108426false00011084262020-05-012020-05-010001108426pnm:PublicServiceCompanyOfNewMexicoMember2020-05-012020-05-010001108426pnm:TexasNewMexicoPowerCompanyMember2020-05-012020-05-01

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

FORM

|

8-K

|

|

|

|

|

CURRENT REPORT

|

|

|

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

May 1, 2020

|

|

|

|

(May 1, 2020)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Registrant, State of Incorporation, Address Of Principal Executive Offices, Telephone Number, Commission File No., IRS Employer Identification No.

|

|

|

|

|

PNM Resources, Inc.

(A New Mexico Corporation)

414 Silver Ave. SW

Albuquerque, New Mexico 87102-3289

Telephone Number - (505) 241-2700

Commission File No. - 001-32462

IRS Employer Identification No. - 85-0468296

Public Service Company of New Mexico

(A New Mexico Corporation)

414 Silver Ave. SW

Albuquerque, New Mexico 87102-3289

Telephone Number - (505) 241-2700

Commission File No. - 001-06986

IRS Employer Identification No. - 85-0019030

Texas-New Mexico Power Company

(A Texas Corporation)

577 N. Garden Ridge Blvd.

Lewisville, Texas 75067

Telephone Number - (972) 420-4189

Commission File No. - 002-97230

IRS Employer Identification No. - 75-0204070

____________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b))

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 40.13e-4(c))

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

PNM Resources, Inc.

|

Common Stock, no par value

|

PNM

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 1, 2020, PNM Resources, Inc., Public Service Company of New Mexico, and Texas-New Mexico Power Company (collectively, the “Company”) issued a press release confirming its previously announced results of operations for the three months ended March 31, 2020. The press release is furnished herewith as Exhibit 99.1 and incorporated by reference herein. The Company previously issued its preliminary unaudited results of operations for the three months ended March 31, 2020 on April 13, 2020.

The Company's press release and other communications from time to time may include certain financial measures that are not determined in accordance with generally accepted accounting principles in the United States of America ("GAAP"). A “non-GAAP financial measure” is defined as a numerical measure of a company's financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in the company's financial statements.

Non-GAAP financial measures utilized by the Company include presentations, on an ongoing basis, of revenues, operating expenses, operating income, other income and deductions, earnings, and earnings per share. The Company uses ongoing earnings and ongoing earnings per diluted share (or ongoing diluted earnings per share) to evaluate the operations of the Company and to establish goals, including those used for certain aspects of incentive compensation, for management and employees. Certain non-GAAP financial measures utilized by the Company exclude the impact of net unrealized mark-to-market gains and losses on economic hedges, the net change in unrealized gains and losses on investment securities, pension expense related to previously disposed of gas distribution business, and certain non-recurring, infrequent, and other items. The Company's management believes that these non-GAAP financial measures provide useful information to investors by removing the effect of variances in GAAP reported results of operations that are not indicative of fundamental changes in the earnings capacity of the Company's operations. Management also believes that the presentation of the non-GAAP financial measures is largely consistent with its past practice, as well as industry practice in general, and will enable investors and analysts to compare current non-GAAP measures with non-GAAP measures with respect to prior periods.

The non-GAAP financial measures used by the Company should not be considered in isolation from or as a substitute for measures of performance prepared in accordance with GAAP.

The Company uses ongoing earnings guidance to provide investors with management's expectations of ongoing financial performance over the period presented. While the Company believes ongoing earnings guidance is an appropriate measure, it is not a measure presented in accordance with GAAP. The Company does not intend for ongoing earnings guidance to represent an expectation of net earnings as defined by GAAP. Since the future differences between GAAP and ongoing earnings are frequently outside the control of the Company, management is generally not able to estimate the impact of the reconciling items between forecasted GAAP earnings and ongoing earnings guidance, nor their probable impact on GAAP earnings without unreasonable effort; therefore, management is generally not able to provide a corresponding GAAP equivalent for forecasted ongoing earnings guidance. Reconciling items may include revenues and expenses resulting from transactions that do not occur in the normal course of the Company's business operations, as well as net unrealized mark-to-market gains and losses on economic hedges, the net change in unrealized gains and losses on investment securities, and pension expense related to previously disposed of gas distribution business as discussed above.

Limitation on Incorporation by Reference

In accordance with general instruction B.2 of Form 8-K, the information in this report, including exhibits, is furnished pursuant to Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section and not deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

Exhibit Number Description

104 Cover page in Inline XBRL format

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

PNM RESOURCES, INC.

|

|

|

PUBLIC SERVICE COMPANY OF NEW MEXICO

|

|

|

TEXAS-NEW MEXICO POWER COMPANY

|

|

|

(Registrants)

|

|

|

|

|

|

|

|

Date: May 1, 2020

|

/s/ Henry E. Monroy

|

|

|

Henry E. Monroy

|

|

|

Vice President and Corporate Controller

|

|

|

(Officer duly authorized to sign this report)

|

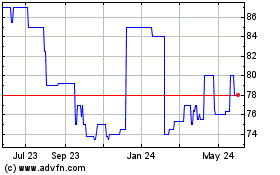

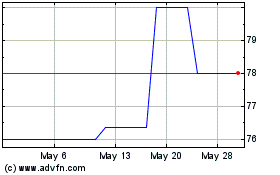

Public Service Company o... (PK) (USOTC:PNMXO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Public Service Company o... (PK) (USOTC:PNMXO)

Historical Stock Chart

From Feb 2024 to Feb 2025