Self-Driving Tech Startup Aeva Going Public Through SPAC InterPrivate

November 02 2020 - 9:39AM

Dow Jones News

By Colin Kellaher

Aeva Inc., a self-driving technology startup backed by German

automaker Porsche SE, on Monday unveiled plans to go public by

combining with blank-check company InterPrivate Acquisition

Corp.

The deal, which gives the combined company an estimated

post-transaction equity value of about $2.1 billion, will provide

Aeva with $363 million in gross proceeds, including InterPrivate's

$243 million held in trust and a $120 million from a private

placement that will include investments from Porsche and Adage

Capital.

The companies said Aeva's current investors, which also include

Lux Capital, Canaan Partners and Lockheed Martin Corp., will retain

their equity holdings and own about 80% of the combined

company.

Aeva puts sensor components on small chips in a bid to reduce

the size and cost of roof rack-style lidar sensors, which help cars

drive autonomously by bouncing lasers off objects to create a 3-D

view of the world. Porsche SE, which houses automakers such as

Volkswagen AG, Porsche AG and Audi AG, acquired a minority stake in

the Mountain View, Calif., startup last year.

Aeva, founded in 2017 by a pair of former Apple Inc. engineers,

will remain listed on the New York Stock Exchange under the symbol

AEVA upon completion of the transaction, expected in the first

quarter of 2021.

InterPrivate, a special-purpose acquisition company, completed

its $240 million initial public offering in February.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

November 02, 2020 10:24 ET (15:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

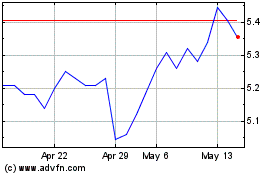

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Nov 2023 to Nov 2024