SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act

May 21, 2013

Date of Report (Date of Earliest Event Reported)

RJD Green, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Nevada | | 333-170312 | | 27-1065441 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | |

| 4142 South Harvard, Suite D3 Tulsa, OK | | 74135 |

| (Address of principal executive offices) | | (Zip Code) |

(918) 551-7883

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

This amendment to the Form 8-K as originally filed with the SEC on May 22, 2013, and as amended on October 8, 2014, is being filed solely to incorporate the year-end financial statements of the acquired company. No other changes have been made to the document, and it has not been updated to reflect current events.

1

Item 1.01 - Entry into a Material Definitive Agreement

On May 21, 2013, the Company entered into a stock purchase agreement with the shareholders of Silex Holdings, Inc. (“Silex Holdings”). Under this agreement, the Company will acquire 80% of Silex Holdings and its wholly owned subsidiary, Silex Interiors 2 , LLC (“Silex Interiors”) , a specialty construction materials manufacturer and distributor. Silex Holdings will be an 80% owned subsidiary of the Company.

As consideration for the acquisition, the Company will issue an aggregate 363,500,000 of its common shares to the shareholders of Silex Holdings in return for 4,662,584 common shares of Silex Holdings, representing 80% of the issued and outstanding stock of Silex Holdings. Of the 363,500,000 common shares issued, the shareholders of Silex Holdings have agreed to retire 250,000,000 common shares at Closing.

The Company has agreed not to reverse its common shares for a period of six months from the date of Closing.

Item 2.01 – Completion of Acquisition or Disposition of Assets

On October 1, 2014, the Company completed its acquisition of Silex Holdings. The Company has acquired Silex Holdings and its wholly owned subsidiary, Silex Interiors, LLC, a specialty construction materials manufacturer and distributor. Silex Holdings is now an 80% owned subsidiary of the Company.

As consideration for the acquisition, the Company issued an aggregate 129,090,000 of its common shares to shareholders of Silex Holdings in return for 4,662,584 of Silex Holdings, common shares, representing 80% of the issued and outstanding stock of Silex Holdings. T he shareholders of the Company returned 387,5 00,000 common shares to treasury as part of the agreement. These shares were subsequently cancelled.

FORM 10 INFORMATION FOR SILEX HOLDINGS, INC.

Silex Holdings focused in specialty contracting services for industrial, and construction / retail markets that have a defined market niche.

Silex Holdings first acquisition, Silex Interiors, is a supplier of building products for commercial projects and new home construction, as well as remodel and DIY projects. Silex aims to provide a superior level of quality and client experience to ensure the company exceeds expectations.

Silex Interiors offers “one stop services” when designing a new kitchen or bathroom. Silex offers a full range of all wood cabinets, Granite, Green Marble or Quartz, and other natural stone countertops, sinks, faucets and tile backsplash along with complete bathroom shower tub surround materials. Silex Interiors aims to provide exceptional client care with free project design assistance through our design centers.

2

Silex Holdings intends to pursue additional acquisitions for growth in symmetrical construction services, and specialty niched industrial service providers.

Properties:

Silex Holdings’ administrative offices are located at 4142 South Harvard Ave., Suite D3, Tulsa, OK 74135 at a cost of $700 monthly on a month to month agreement. The Company intends to procure alternative offices after one year of operation.

Silex Holdings currently leases two retail properties. The first property is located at 3701 South Broadway, Edmond, OK 73013. On November 2, 2010, the Company entered into a lease agreement for office and showroom space for a three-year period, which began on December 1, 2010, and expired on November 30, 2013. The Company did not renew the lease and is subsequently paying on a month-to-month basis with a monthly lease payment of $10,131 for 10,000 square feet.

The second retail property is located at 1311 East 35 Street, Tulsa, OK 74105. On March 1, 2012, the Company entered into a lease agreement for office and showroom space for a three-year period that began on March 1, 2012, and expired on April 30, 2015. Subsequent to that date, the Company has been paying on a month-to-month basis with a monthly lease payment of $5,000 for 5,000 square feet.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Silex Holdings’ bylaws provide that the number of directors who shall constitute the whole board shall not be less than one. The shareholders at any annual meeting may determine the number that shall constitute the board of directors and the number so determined shall remain fixed until changed at a subsequent annual meeting. The directors shall be elected at each annual meeting of the shareholders; however, if any such annual meeting is not held or the directors are not elected thereat, the directors may be elected at any special meeting of shareholders held for that purpose. All directors shall hold office until their respective successors are elected.

The officers and directors are as follows:

| | | | | | | |

| NAME | | AGE | | POSITIONS HELD | | TERM OF OFFICE |

| Jerry Niblett | | 51 | | Chief Executive Officer | | June 1, 2012 to present |

|

Mike La Lond | | 66 | |

Chief Financial Officer | | June 1, 2012 to present |

|

Ron Brewer | | 65 | |

Chief Operating Officer June 1, 2012 to present | | |

|

Rex Washburn | | 67 | | Director | | November 1, 2012 to present |

|

Paul Williams | | 66 | | Board Advisor | | June 1, 2012 to present |

3

Officer and Director Information

Jerry Niblett:

Jerry Niblett, our chief executive officer, has held leadership positions in several green energy companies. Since 2007, he has been a regional manager of Sonoco Logistics Pipeline LP, where he monitors, analyzes, and oversees the operational activities for over 2,000 miles of active transmission and gathering pipelines. Since 2009, he has been the president of Green Mountain Resources Corp., a small cap privately held energy company. Since 2010, he has been a managing member of Green Mountain Resources LLC, a subsidiary of Green Mountain Resources Corp, where he is responsible for market strategy, technology development, corporate profitability and accountability to shareholders. Since 2011, he has been a managing member of Rangeland Energy LLC, another small cap privately held energy company. Mr. Niblett received a B.S. in Total Quality Management from Friends University in Wichita, KS in 1996.

Mike La Lond:

Mike La Lond, our chief financial officer, has worked as both CFO and as a consultant. From June 2007 through October 2008, Mr. La Lond was the Vice President and CFO of Lean Gourmet. From January 2009 through June 2010, he worked as a consultant to the Southbridge Advisory Group. From June 2010 through December 2010, he was the CFO of US Highland, a recreational powersports company. Since January 2011, Mr. La Lond has been the president of La Lond Consulting. Mr. La Lond Received a B.S. and a B.A. from Quincy College in 1970, an M.S. from Illinois State University in 1974, and a Ph.D. from Illinois State University in 1976.

Ron Brewer:

Since 2001, Ron Brewer, our chief operating officer, has been the Managing Director of the Southbridge Advisory Group, an Oklahoma based management services firm focused on merger and acquisition advisory, capital procurement, and management consulting services. Mr. Brewer studied at the University of Arkansas and the University of Tulsa between 1969 and 1973.

Rex Washburn, Board Director

Mr. Washburn offers 23 years of senior management experience with 17 of those years as Chief Executive Officer of both publicly held and private companies. Mr. Washburn is recognized as a corporate structural and ‘turnaround’ specialist, and has in-depth experience in international franchising and franchise development. Rex received a BBA in finance from Regis University in 1987 and studied for MS in Economics at the University of Edinburg from 1988 - 1990. Rex served in Special Operations for the US Army in military service from 1968 - 1972.

4

Paul Williams:

Paul Williams has been a board advisor of Silex Holdings since June 2012. Since January 2005, he has been visiting faculty with the In His Image Family Practice. Since February 2008, he has been the president of the International HealthCare Network. Dr. Williams received a B.S. from Evangel University in 1965 and an M.D. from Washington University School of Medicine in St. Louis Missouri in 1969.

Executive Compensation

The following table set forth certain information as to the compensation paid to our executive officers for the years of 2014 and 2013 .

Summary Compensation Table

| | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Stock Awards | | Option Awards | | Non-Equity Incentive Plan Comp | | Nonqualified Deferred Comp Earnings |

| | | | | | | | | | | | | | | |

| Jerry J Niblett | | 2014 | | $0 | | n/a | | n/a | | n/a | | n/a | | n/a |

| CEO | | 2013 | | $0 | | n/a | | n/a | | n/a | | n/a | | n/a |

| | | | | | | | | | | | | | | |

| Make La Lond | | 2014 | | $0 | | n/a | | n/a | | n/a | | n/a | | n/a |

| CFO | | 2013 | | $0 | | n/a | | n/a | | n/a | | n/a | | n/a |

| | | | | | | | | | | | | | | |

| Ron Brewer | | 2014 | | $0 | | n/a | | n/a | | n/a | | n/a | | n/a |

| COO | | 2013 | | $0 | | n/a | | n/a | | n/a | | n/a | | n/a |

Director Compensation

We do not have any standard arrangements by which directors are compensated for any services provided as a director. No cash has been paid to the directors in their capacity as such.

Outstanding Equity Awards

Our directors and officers do not have any unexercised options, stock that has not vested, or equity incentive plan awards.

Options

We do not currently have a stock option plan. No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to any executive officer or any director since our inception; accordingly, no stock options have been granted or exercised by any of the officers or directors since inception.

5

Long-Term Incentive Plans and Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance at this time. No individual agreements regarding future payouts under non-stock price-based plans have been made to any executive officer or any director or any employee or consultant; accordingly, no future payouts under non-stock price-based plans or agreements have been granted or entered into or exercised by our officer or director or employees or consultants.

Code of Ethics Policy

We have not yet adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions.

Corporate Governance

There have been no changes in any state law or other procedures by which security holders may recommend nominees to our board of directors. In addition to having no nominating committee for this purpose, we currently have no specific audit committee and no audit committee financial expert. Based on the fact that our current business affairs are simple, any such committees are excessive and beyond the scope of our business and needs.

Involvement in Certain Legal Proceedings

None of our directors, executive officers and control persons has been involved in any of the following events during the past ten years:

- Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time,

- Any conviction in a criminal proceeding or being subject to any pending criminal proceeding (excluding traffic violations and other minor offenses);

- Being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities,; or

- Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

Change-In-Control Arrangements

There are currently no employment agreements or other contracts or arrangements with our officers or directors. There are no compensation plans or arrangements, including payments to be made by us, with respect to our officers, directors or consultants that would result from the resignation, retirement or any other termination of any of our directors, officers or consultants. There are no arrangements for our directors, officers, employees or consultants that would result from a change-in-control.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth the number and percentage of our outstanding 5,735,181 common shares owned by:

(i) each person known to us to beneficially own more than 5% of its outstanding common stock,

(ii) each director,

(iii) each named executive officer and significant employee, and

(iv) all officers and directors as a group.

| | | | | | |

| Name and address | | Amount | | Percentage | |

| Jerry Niblett | | | | | |

| 4519 West 95th St North Sperry, OK 74073 | | 100,000 | | 1.74% | |

| | | | | | |

| Mike La Lond | | | | | |

| 928 S Braden Tulsa, OK 74112 | | 100,000 | | 1.74% | |

| | | | | | |

| Ron Brewer | | | | | |

| 4012 W. Utica St. Broken Arrow, OK 74011 | | 100,000 | | 1.74% | |

| | | | | | |

| Paul Williams | | | | | |

| 254 Valley View Vista Dr. Pisgah Forest, NC 28768 | | 13,750 | | 0.24% | |

| | | | | | |

| All Officers and Directors As a Group | | 313,750 | | 5.47% | |

| | | | | | |

| Premiere Resources 4142 S Harvard Ave., Suite D3 Tulsa, OK 74135 | | 1,000,000 | | 17.44% | |

| | | | | | |

| Janice Quist 7463 S 227th East Ave Broken Arrow, OK 74014 | | 350,000 | | 6.10% | |

| | | | | | |

7

| | | | | | |

| Equitas Resources 3012 East Fourmile Road Cheyenne, WY 82009 | | 1,800,000 | | 31.39% | |

| | | | | | |

| All other 5% owners as a group | | 3,150,000 | | 54.92% | |

The following table sets forth the number and percentage of our 125,000 outstanding series A preferred shares owned by:

(i) each person known to us to beneficially own more than 5% of its outstanding series A preferred shares,

(ii) each director,

(iii) each named executive officer and significant employee, and

(iv) all officers and directors as a group.

| | | | | | |

| Name and Address | | Amount | | Percentage | |

| Paul R. Williams 254 Valley View Vista Dr. Pisgah Forest, NC 28768 | | 90,000 | | 72% | |

|

All Officers and Directors as a Group (1 person) | | 90,000 | | 72% | |

The following table sets forth the number and percentage of our 300,000 outstanding series B preferred shares owned by:

(i) each person known to us to beneficially own more than 5% of its outstanding series B preferred shares,

(ii) each director,

(iii) each named executive officer and significant employee, and

(iv) all officers and directors as a group.

| | | | | | |

| Name and Address | | Amount | | Percentage | |

| Eric English 4102 S. 137th W. Ave Sand Springs, OK 74063 | | 175,000 | | 58.33% | |

|

All Officers and Directors as a Group (1 person) | | 175,000 | | 58.33% | |

8

| | | | | | |

|

Rail Pro Services, Inc. 4142 S. Harvard Ave Suite D3 Tulsa, OK 74135 | | 125,000 | | 41.67% | |

|

All other 5% owners as a group (1 member) | | 125,000 | | 41.67% | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During 2011, the Company borrowed $15,000 from Helen English, a related party.

LEGAL PROCEEDINGS

We are not a party to any legal proceedings the outcome of which, in the opinion of our management, would have a material adverse effect on our business, financial condition, or results of operation.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Item 5(a)

a) Market Information. Our common stock is not quoted on a market or securities exchange. We cannot provide any assurance that an active market in our common stock will develop. We intend to quote our common shares on a market or securities exchange.

b) Holders. At January 6 , 2016, there were 46 common shareholders of Silex Holdings.

c) Dividends. Holders of Silex Holdings common stock are entitled to receive such dividends as may be declared by its board of directors. No dividends on Silex Holdings common stock have ever been paid, and Silex Holdings does not anticipate that dividends will be paid on its common stock in the foreseeable future.

d) Securities authorized for issuance under equity compensation plans. No securities are authorized for issuance by the Company under equity compensation plans.

9

| | | | | | | |

| Plan Category | | Number of Securities Issued Upon Exercise of Outstanding Options | | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | | Number of Securities Remaining Available for Future Issuance |

| Equity Compensation Plans Approved by Security Holders | | n/a | | n/a | | n/a |

| Equity Compensation Plans Not Approved by Security Holders | | n/a | | n/a | | n/a |

| Total | | n/a | | n/a | | n/a |

e) Performance graph

Not applicable.

f) Sale of unregistered securities.

None

Item 5(b) Use of Proceeds. None

Item 5(c) Purchases of Equity Securities by the issuer and affiliated purchasers. None.

DESCRIPTION OF CAPITAL STOCK

The following statements constitute brief summaries of Silex Holdings’ articles of incorporation and bylaws.

(a) Authorized Shares. Silex Holdings may issue unlimited shares of common stock, 1,000,000 shares of Series A Preferred Stock and 1,000,000 shares of Series B Preferred Stock. Common stock shall have a par value of $ 0 .001 per share, Series A Preferred Stock shall have a par value of $2 and Series B Preferred Stock shall have a par value of $1. All shares shall be issued for such consideration, expressed in dollars, as the Board of Directors may, from time to time, determine.

(b) Consideration for Shares. All shares of Common Stock and Preferred Stock shall be issued by Silex Holdings for cash, property or services actually performed, for no less than the par value of the respective shares . All shares shall be fully paid and non-assessable.

10

(c) Issuance of Preferred Stock. The Preferred Stock may be issued from time to time in series. The board of directors of Silex Holdings is authorized to establish such series, to fix and determine the variations and the relative rights and preferences as between series, and to thereafter issue such stock from time to time. The board of directors is also authorized to allow for conversion of the Preferred Stock to Common Stock under terms and conditions as determined by the board of directors.

Common Stock

The common stock of Silex Holdings has the following powers, rights, qualifications, limitations and restrictions.

1. The holders of the common stock shall be entitled to one vote for each share of common stock held by them of record at the time for determining the holders thereof entitled to vote

2. After Silex Holdings shall comply with the requirements, if any, with respect to the setting aside of funds as sinking funds or redemption or purchase accounts and subject further to any other conditions which may be affixed in accordance with the provisions hereof, then but not otherwise, the holders of common stock shall be entitled to receive such dividends, if any, as may be declared from time to time by the board of directors; and

3. In the event of a voluntary or involuntary liquidation, distribution or sale of assets, dissolution or winding up of Silex Holdings, the holders of the common stock shall be entitled to receive all of the remaining assets of Silex Holdings, tangible and intangible, of whatever kind available for distribution to stock holders, ratably in proportion to the number of common shares held by each.

Preferred Stock

The preferred stock of Silex Holdings has been divided into two series, and has the following powers, rights, qualifications, limitations and restrictions.

Series A preferred stock

1. The holders of the Series A preferred stock shall be entitled to one vote for each share of preferred stock held by them of record at the time for determining the holders thereof entitled to vote.

2. Each Series A preferred share is convertible into common shares worth an aggregate of $2.00.

11

3. After Silex Holdings shall comply with the requirements, if any, with respect to the setting aside of funds as sinking funds or redemption or purchase accounts and subject further to any other conditions which may be affixed in accordance with the provisions hereof, then but not otherwise, the holders of preferred stock shall be entitled to receive such dividends, if any, as may be declared from time to time by the board of directors; and

4. In the event of a voluntary or involuntary liquidation, distribution or sale of assets, dissolution or winding up of Silex Holdings, the holders of the preferred stock shall be entitled to receive all of the remaining assets of Silex Holdings, tangible and intangible, of whatever kind available for distribution to stock holders, ratably in proportion to the number of preferred shares held by each.

Series B Preferred Stock

1. The holders of the Series B preferred stock shall be entitled to one vote for each share of preferred stock held by them of record at the time for determining the holders thereof entitled to vote.

2. Each Series B preferred share is convertible into common shares worth an aggregate of $1.00.

3. After Silex Holdings shall comply with the requirements, if any, with respect to the setting aside of funds as sinking funds or redemption or purchase accounts and subject further to any other conditions which may be affixed in accordance with the provisions hereof, then but not otherwise, the holders of preferred stock shall be entitled to receive such dividends, if any, as may be declared from time to time by the board of directors; and

4. In the event of a voluntary or involuntary liquidation, distribution or sale of assets, dissolution or winding up of Silex Holdings, the holders of the preferred stock shall be entitled to receive all of the remaining assets of the Silex Holdings, tangible and intangible, of whatever kind available for distribution to stock holders, ratably in proportion to the number of preferred shares held by each.

Transfer Agent

Silex Holdings acts as its own transfer agent.

Indemnification of Directors and Officers

Silex Holdings shall indemnify any officer or director or any former officer or director, to the full extent permitted by law. We shall indemnify any officer or director in connection with any proceedings, including appeals, if he or she acted in good faith and in a manner he or she reasonably believed to be in the best interests of Silex Holdings and they had no reasonable cause to believe that his or her conduct was unlawful. The termination of any proceeding by judgment, order, settlement, or conviction or upon a plea of nolo

12

contendere or its equivalent shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he or she reasonably believed to be in the best interests of Silex Holdings or had reasonable cause to believe that his or her conduct was unlawful.

At present, there is no pending litigation or proceeding involving any of our directors or executive officers as to which indemnification is required or permitted, and we are not aware of any threatened litigation or preceding that may result in a claim for indemnification.

We do not have any insurance policies covering our officers and directors with respect to certain liabilities, including liabilities arising under the Securities Act or otherwise.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

ON ACCOUNTING AND FINANCIAL DISCLOSURE

There have not been any changes in or disagreements with accountants on accounting and financial disclosure or any other matter.

Item 3.02 – Unregistered Sales of Equity Securities

On October 1, 2014, the Company issued 129,090 ,000 common shares to the shareholders of Silex Holdings under the securities purchase agreement, as described above. These common shares were issued in return for 4,662,584 Silex Holdings common shares. These common shares were issued under an exemption from registration under Section 4(a) (2) of the Securities Act. The shareholders of Silex Holdings are knowledgeable enough to be considered “sophisticated investors”, they had access to the type of information normally provided in a prospectus for a registered securities offering, and have agreed not to resell or distribute the securities to the public.

13

Item 9.01 - Financial Statements and Exhibits.

(a)

Financial statements of businesses acquired.

Silex Holdings, Inc.

Years August 31, 2014 and 2013

| | |

| | Index |

| Report of Independent Registered Public Accounting Firm | 15 |

|

Consolidated Balance Sheets | 16 |

|

Consolidated Statements of Operations and Comprehensive Loss | 17 |

|

Consolidated Statements of Cash Flows | 18 |

|

Consolidated Statements of Stockholders' Deficiency | 19 |

|

Notes to the Consolidated Financial Statements | 20 |

14

![[rjdgreen8k101201302901v12002.gif]](rjdgreen8k101201302901v12002.gif)

Report of Independent Registered Public Accounting Firm

To the Directors and Stockholders

Silex Holdings, Inc.

We have audited the accompanying consolidated balance sheets of Silex Holdings, Inc. as of August 31, 2014 and 2013 and the related consolidated statements of operations and comprehensive loss, cash flows and stockholders' deficiency for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Silex Holdings, Inc. as of August 31, 2014 and 2013, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has a working capital deficiency and has accumulated losses since inception. The Company will need additional financing to sustain operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/S/ Manning Elliott LLP

CHARTERED PROFESSIONAL ACCOUNTANTS

Vancouver, Canada

August 21, 2015

15

Silex Holdings, Inc.

Consolidated Balance Sheets

(Expressed in US dollars)

| | | |

|

| August 31, 2014 $ | August 31, 2013 $ |

| | | |

| ASSETS |

|

|

| |

|

|

| Current Assets |

|

|

| |

|

|

| Cash | 16,906 | 12,971 |

| Accounts receivable | 247,192 | 138,111 |

| Inventory | 131,853 | 88,399 |

| Due from related party (Note 6(a)) | 36,250 | 36,250 |

| |

|

|

| Total Current Assets | 432,201 | 275,731 |

|

|

|

|

| Deposits | 28,879 | 29,131 |

| Property and Equipment (Note 3) | 619 | 16,134 |

| Total Assets | 461,699 | 320,996 |

| |

|

|

| |

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIENCY |

|

|

| |

|

|

| Current Liabilities |

|

|

| | | |

| Accounts payable (Note 6) | 797,118 | 713,834 |

| Accrued liabilities | 304,287 | 116,089 |

| Due to related party (Note 6(b)) | 30,000 | - |

| Contingently convertible debt (Note 4) | 143,589 | 74,000 |

| Current portion of long-term debt (Note 5) | 61,111 | 57,859 |

| | | |

| Total Current Liabilities | 1,336,105 | 961,782 |

| | | |

| Long-term Debt (Note 5) | 174,797 | 228,722 |

| |

|

|

| Total Liabilities | 1,510,902 | 1,190,504 |

| |

|

|

| |

|

|

| Going concern (Note 1) Commitments (Note 8) |

|

|

| |

|

|

| |

|

|

| Stockholders’ Deficiency |

|

|

| |

|

|

| Series A Preferred Stock, 1,000,000 shares authorized, with a par value of $2; 125,000 shares issued and outstanding (2013 – 125,000) (Note 7) None issued and outstanding (Note 12(b)) | 250,000 | 250,000 |

| |

|

|

| Series B Preferred Stock, 1,000,000 shares authorized, with a par value of $1; 300,000 shares issued and outstanding (2013 – 300,000) (Note 7) | 300,000 | 300,000 |

| |

|

|

| Common Stock, unlimited shares authorized, with a par value of $0.001; 5,735,181 shares issued and outstanding (2013 – 5,735,181) (Note 7) | 5,735 | 5,735 |

| Additional Paid-in Capital | 312,246 | 312,246 |

| |

|

|

| Deficit | (1,917,184) | (1,737,489) |

| |

|

|

| Total Stockholders’ Deficiency | (1,049,203) | (869,508) |

| |

|

|

| Total Liabilities and Stockholders’ Deficiency | 461,699 | 320,996 |

The accompanying notes are an integral part of the consolidated financial statements

16

Silex Holdings, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Expressed in US dollars)

| | | | |

| | | For the Year Ended | For the Year Ended |

| | | August 31, | August 31, |

| | | 2014 | 2013 |

| | | $ | $ |

| | | | |

| Revenues |

| 2,950,505 | 2,288,957 |

| |

| | |

| Cost of Sales |

| 2,173,434 | 1,593,147 |

| |

| | |

| Gross Profit |

| 777,071 | 695,810 |

| |

|

|

|

| Expenses |

|

|

|

| |

|

|

|

| Advertising and promotion |

| 7,911 | 33,891 |

| Amortization |

| 12,822 | 32,145 |

| Bad debts |

| 12,549 | - |

| Bank charges and interest |

| 97,476 | 79,210 |

| Consulting fees (Note 6(c)) |

| 68,927 | 180,413 |

| General and administrative |

| 31,429 | 23,913 |

| Insurance |

| 42,417 | 43,209 |

| Interest on long-term debt |

| 27,144 | 18,804 |

| Maintenance and repairs |

| 11,901 | 6,493 |

| Management fees |

| 72,000 | 94,400 |

| Meals and entertainment |

| - | 709 |

| Other expenses |

| - | 4,269 |

| Payroll |

| 368,672 | 439,790 |

| Professional fees |

| 5,287 | 27,077 |

| Property taxes |

| 15,384 | 14,381 |

| Rent |

| 133,474 | 128,745 |

| Travel |

| 342 | 11,841 |

| Utilities |

| 42,301 | 38,096 |

| Vehicle |

| 12,449 | 25,401 |

| |

|

|

|

| Total Expenses |

| 962,485 | 1,202,787 |

| |

| | |

| Loss Before Other Income (Expense) |

| (185,414) | (506,977) |

| |

| | |

| Other Income (Expense) |

| | |

| |

| | |

| Other income (expense) |

| 5,719 | (3,299) |

| |

| | |

| Net Loss and Comprehensive Loss |

| (179,695) | (510,276) |

| |

| | |

| |

| | |

| Net Loss Per Share – Basic and Diluted | | (0.03) | (0.10) |

| |

| | |

| |

| | |

| Weighted Average Shares Outstanding |

| 5,735,181 | 5,079,761 |

The accompanying notes are an integral part of the consolidated financial statements

17

Silex Holdings, Inc.

Consolidated Statements of Cash Flows

(Expressed in US dollars)

| | | | |

| | | For the Year Ended August 31, 2014 $ | For the Year Ended August 31, 2013 $ |

| Operating Activities | | | |

| | | | |

| Net loss for the year |

| (179,695) | (510,276) |

| |

| | |

| Adjustments to reconcile net loss to net cash used in operating activities: |

| | |

| Amortization |

| 12,822 | 32,145 |

| Interest accrual |

| – | 4,000 |

| Write-down of investment |

| – | 759 |

| Issuance of common stock for services |

| – | 25,400 |

| |

| |

|

| Changes in operating assets and liabilities: |

| |

|

| Accounts receivable |

| (109,081) | (84,380) |

| Inventory |

| (43,454) | 38,708 |

| Deposits |

| 252 | (151) |

| Accounts payable and accrued liabilities |

| 376,071 | 433,130 |

| Due from related party |

| – | 40,000 |

| |

| | |

| Net Cash Provided By (Used In) Operating Activities |

| 56,915 | (20,665) |

| |

| | |

| Investing Activities |

| | |

| |

| | |

| Purchases of property and equipment |

| (3,161) | (12,120) |

| Proceeds from disposal property and equipment |

| 5,854 | 13,265 |

| |

| | |

| Net Cash Provided By Investing Activities |

| 2,693 | 1,145 |

| |

| | |

| Financing Activities |

| | |

| |

| | |

| Proceeds from issuance of contingently convertible debt |

| – | 30,000 |

| Repayment of contingently convertible debt |

| (5,000) | – |

| Repayment of long-term debt |

| (50,673) | (52,950) |

| |

| | |

| Net Cash Flows Used In Financing Activities |

| (55,673) | (22,950) |

| |

| | |

| Increase (Decrease) in Cash |

| 3,935 | (42,470) |

| |

| | |

| Cash - Beginning of Year |

| 12,971 | 55,441 |

| |

| | |

| Cash - End of Year |

| 16,906 | 12,971 |

| |

| | |

|

Non-Cash Investing and Financing Activities: |

| |

|

| Common stock issued for services |

| – | 25,400 |

| Due to related party for contingently convertible debt |

| 30,000 | – |

| | – | | |

Supplemental Disclosures:

| | | | |

| Interest paid |

| 18,134 | 13,643 |

| Income taxes paid |

| – | – |

The accompanying notes are an integral part of the consolidated financial statements

18

Silex Holdings, Inc.

Consolidated Statements of Stockholders’ Deficiency

(Expressed in US dollars)

| | | | | | | | | | |

| | Common Stock | Amount | Series A Preferred Shares | Series A Preferred Shares | Series B Preferred Shares | Series B Preferred Shares | Additional Paid-in Capital | Deficit | Total |

| | # | $ | # | $ | # | $ | $ | $ | $ |

| | | | | | | | | | |

| Balance – August 31, 2012 | 2,581,180 | 2,581 | 125,000 | 250,000 | 300,000 | 300,000 | – | (1,227,213) | (674,632) |

| | | | | | | | | | |

| Shares issued for services at $0.10 per share | 3,154,001 | 3,154 | – | – | – | – | 312,246 | – | 315,400 |

| | | | | | | | | | |

| Net loss for the year | – | – | – | – | – | – | – | (510,276) | (510,276) |

| | | | | | | | | | |

| Balance – August 31, 2013 | 5,735,181 | 5,735 | 125,000 | 250,000 | 300,000 | 300,000 | 312,246 | (1,737,489) | (869,508) |

| | | | | | | | | | |

| Net loss for the year | – | – | – | – | – | – | – | (179,695) | (179,695) |

| Balance – August 31, 2014 | 5,735,181 | 5,735 | 125,000 | 250,000 | 300,000 | 300,000 | 312,246 | (1,917,184) | (1,049,203) |

| | | | |

|

|

|

| | |

The accompanying notes are an integral part of the consolidated financial statements

19

Silex Holdings, Inc.

Notes to the Consolidated Financial Statements

Years Ended August 31, 2014 and 2013

1. NATURE OF OPERATIONS AND GOING CONCERN

Silex Holdings, Inc. (the “Company”) was incorporated as Silex Interiors, Inc. in the State of Oklahoma, USA on February 15, 2006. The name was subsequently amended on June 27, 2012 to Silex Holdings, Inc. The Company has locations in Edmond, Oklahoma and Tulsa, Oklahoma and is engaged in the retail and wholesale distribution and installation of kitchen builder products including granite, quartz and other countertops, cabinets, and other related products.

These consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. While the Company has generated revenue since inception, it has never paid any dividends and is unlikely to pay dividends or generate significant earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. As at August 31, 2014, the Company has a working capital deficiency of $903,904 and has accumulated losses of $1,917,184 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

On May 21, 2013, the Company entered into a definitive agreement with RJD Green, Inc. (“RJD Green”). Pursuant to the agreement, and subsequent amendment on November 1, 2013, RJD Green will purchase all of the outstanding securities of the Company in exchange for 129,090,000 common shares of RJD Green and the retirement of 387,500,000 shares of RJD Green. The shares were issued to the stockholders of the Company and retired respectively during the year ended August 31, 2014 in anticipation of the completion of the agreement. On October 1, 2014, the Company and RJD Green agreed to waive certain conditions precedent and the agreement closed accordingly.

Management plans to obtain funding from its shareholders and other qualified investors to pursue its business plan upon the successful completion of an anticipated S-1 filing following the completion of the agreement with RJD Green. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of the Company’s shares. No assurance can be given that additional financing will be available, or that it can be obtained on terms acceptable to the Company and its stockholders.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

These consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in US dollars. These consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Silex Interiors 2 LLC. All intercompany transactions and balances have been eliminated. The Company’s fiscal year-end is August 31.

Subsequent events have been evaluated through August 21, 2015, the date the financial statements were available to be issued.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to long-lived assets, stock-based compensation, allowances for doubtful accounts, inventory reserves, and deferred income tax asset valuations. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. Actual results could differ from those estimates.

20

Cash Equivalents

Cash equivalents are represented by operating accounts or money market accounts maintained with insured financial institutions. The Company also considers all highly liquid short-term debt instruments with a maturity of three months or less when purchased to be cash-flow.

Accounts Receivable

Accounts receivable consist of the unpaid balances due to the Company from its customers. At August 31, 2014 and 2013, the Company has estimated that all amounts recorded are collectible and, thus has not provided an allowance for uncollectible amounts.

Investments

The Company determines the appropriate classification of its investments in equity securities at the time of purchase and reevaluates such determinations at each reporting date. Investments in entities in which the Company’s ownership is greater than 20% and less than 50%, or which the Company does not control through majority ownership or means other than voting rights, are accounted for by the equity method and are included in long-term assets. The Company accounts for its marketable security investments as available for sale securities in accordance with Accounting Standards Codification (“ASC”) guidance on accounting for certain investments in debt and equity securities. The Company periodically evaluates whether declines in fair values of its investments below the Company’s carrying value are other-than-temporary in accordance with ASC guidance. The Company’s policy is to generally treat a decline in the investment’s quoted market value that has lasted continuously for more than six months as an other-than-temporary decline in value. The Company also monitors its investments for events or changes in circumstances that have occurred that may have a significant adverse effect on the fair value of the investment and evaluates qualitative and quantitative factors regarding the severity and duration of the unrealized loss and the Company’s ability to hold the investment until a forecasted recovery occurs to determine if the decline in value of an investment is other-than-temporary. Declines in fair value below the Company’s carrying value deemed to be other-than-temporary are charged to earnings.

Inventory

Inventory is determined on an average cost basis and is stated at the lower of cost or market. Market is determined based on the net realizable value, with appropriate consideration given to obsolescence, excessive levels, deterioration and other factors. As at August 31, 2014 and 2013, inventory consisted of granite, quartz and other countertops, cabinets, and other related products.

Property and Equipment

Property and equipment is recorded at cost when acquired. Amortization is provided principally on the straight-line method over the estimated useful lives of the related assets, which is 3-7 years for equipment, furniture and fixtures, and vehicles. Leasehold improvements are being amortized over a five-year estimated useful life. Expenditures for maintenance and repairs are charged to expense as incurred, whereas expenditures for major renewals and betterments that extend the useful lives of property and equipment are capitalized.

Long-Lived Assets

In accordance with ASC 360, Property Plant and Equipment the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value. No impairment charges were incurred during the years ended August 31, 2014 and 2013.

21

Revenue Recognition

Revenue from the sales of products without an installation package is recognized when persuasive evidence of an arrangement exists, the product is delivered to the customer, the price is fixed or determinable, and collectability is reasonably assured. Revenue is recognized under these arrangements either at the time the customer picks up the products or the products are delivered to and accepted by the customer.

Revenue from the sales of products that include an installation package is recognized when persuasive evidence of an arrangement exists, the product is delivered and services have been rendered to the customer, the price is fixed or determinable, and collectability is reasonably assured. Revenue is recognized under these arrangements upon the completion and customer acceptance of the installation.

Advertising

The Company expenses advertising costs as incurred. Such costs totaled approximately $2,196 and $821 for the years ended August 31, 2013 and 2014, respectively.

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with ASC 718, Compensation-Stock Compensation. ASC 718 requires companies to measure the cost of employee services received in exchange for an award of equity instruments, including stock options, based on the grant-date fair value of the award and to recognize it as compensation expense over the period the employee is required to provide service in exchange for the award, usually the vesting period.

Income Taxes

The Company accounts for income taxes utilizing ASC 740, Income Taxes which requires the measurement of deferred tax assets for deductible temporary differences and operating loss carry-forwards and measurement of deferred tax liabilities for taxable temporary differences. Measurement of current and deferred tax liabilities and assets is based on provisions of enacted tax law. The effects of future changes in tax laws or rates are not included in the measurement. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized.

Basic and Diluted Net Income (Loss) Per Share

The Company computes net income (loss) per share in accordance with ASC 260, Earnings per Share, which requires presentation of both basic and diluted earnings per share (EPS) on the face of the statement of operations and comprehensive loss. Basic EPS is computed by dividing net income (loss) available to common stockholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. As of August 31, 2014, the Company had no potentially dilutive securities outstanding, other than those potentially issued in conversions of contingently convertible debt (refer to Note 4). However, at August 31, 2014, the number of potentially dilutive shares relating to these financial instruments was indeterminable.

Financial Instruments

ASC 825, Financial Instruments, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 825 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 825 prioritizes the inputs into three levels that may be used to measure fair value:

22

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of cash, accounts receivable, due from related party, accounts payable, contingently convertible debt and long-term debt.

Pursuant to ASC 825, the fair value of cash is determined based on Level 1 inputs, which consist of quoted prices in active markets for identical assets.

The carrying amount of cash is equal to its fair value. The carrying amounts of accounts receivable, due from related party and accounts payable approximates fair values due to the short-term maturity of these instruments. The carrying values of the Company’s contingently convertible debt and long-term debt approximates their fair values based on market rates available for similar debt.

Assets and liabilities measured at fair value on a recurring basis were presented on the Company’s consolidated balance sheet as of August 31, 2014 as follows:

| | | | | |

| | Fair Value Measurements Using |

| | Quoted Prices in | Significant | | |

| | Active Markets | Other | Significant | |

| | For Identical | Observable | Unobservable | Balance |

| | Instruments | Inputs | Inputs | August 31, |

| | (Level 1) $ | (Level 2) $ | (Level 3) $ | 2014 $ |

| Assets: | | | | |

|

Cash | 16,906 | – | – |

16,906 |

| | | | | |

Recently Adopted Accounting Standards

In June 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation. This ASU does the following among other things: a) eliminates the requirement to present inception-to-date information on the statements of income, cash flows, and stockholders’ equity, b) eliminates the need to label the financial statements as those of a development stage entity, c) eliminates the need to disclose a description of the development stage activities in which the entity is engaged, and d) amends FASB ASC 275, Risks and Uncertainties, to clarify that information on risks and uncertainties for entities that have not commenced planned principal operations is required. The amendments in ASU No. 2014-10 related to the elimination of Topic 915 disclosures and the additional disclosure for Topic 275 are effective for public companies for annual and interim reporting periods beginning after December 15, 2014. Early adoption is permitted. The Company early adopted this ASU effective for the year ended August 31, 2014.

23

Recently Issued Accounting Standards

In July 2013, ASC guidance was issued related to the presentation of an unrecognized tax benefit when a net operating loss carryforward, a similar tax loss or a tax credit carryforward exists. The updated guidance requires an entity to net its unrecognized tax benefits against the deferred tax assets for all same jurisdiction net operating loss carryforward, a similar tax loss, or tax credit carryforwards. A gross presentation will be required only if such carryforwards are not available or would not be used by the entity to settle any additional income taxes resulting from disallowance of the uncertain tax position. The update is effective prospectively for the Company’s fiscal year beginning September 1, 2014. The adoption of the pronouncement is not expected to have a material effect on the Company’s consolidated financial statements.

In March 2013, the FASB issued ASU No. 2013-05, Foreign Currency Matters (Topic 830), to clarify the treatment of cumulative translation adjustments when a parent sells a part or all of its investment in a foreign entity or no longer holds a controlling financial interest in a subsidiary or group of assets that is a business within a foreign entity. The updated guidance also resolves the diversity in practice for the treatment of business combinations achieved in stages in a foreign entity. The update is effective prospectively for the Company’s fiscal year beginning September 1, 2014. The adoption of the pronouncement is not expected to have a material effect on the Company’s consolidated financial statements.

In April 2014, the FASB issued ASU No. 2014-08, Discontinued Operations (Topic 205 and 360), which changed the criteria for determining which disposals can be presented as discontinued operations and modified related disclosure requirements. The updated guidance requires an entity to only classify discontinued operations due to a major strategic shift or a major effect on an entity’s operations in the financial statements. The updated guidance will also require additional disclosures relating to discontinued operations. The update is effective prospectively for the Company’s fiscal year beginning September 1, 2014. The adoption of the pronouncement is not expected to have a material effect on the Company’s consolidated financial statements.

In June 2014, ASU guidance was issued to resolve the diversity of practice relating to the accounting for stock-based performance awards for which the performance target could be achieved after the employee completes the required service period. The update is effective prospectively or retrospectively for annual reporting periods beginning December 15, 2015. The adoption of the pronouncement is not expected to have a material effect on the Company’s consolidated financial statements.

In May 2014, ASU guidance was issued related to revenue from contracts with customers. The new standard provides a five-step approach to be applied to all contracts with customers and also requires expanded disclosures about revenue recognition. The ASU is effective for annual reporting periods beginning after December 15, 2016, including interim periods and is to be retrospectively applied. Early adoption is not permitted. The Company has not yet determined whether the adoption of this ASU will have any impact on the Company’s consolidated financial statements.

In August 2014, the FASB issued ASU No. 2014-15, “Presentation of Financial Statements - Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” (“ASU 2014-15”). ASU 2014-15 is intended to define management’s responsibility to evaluate whether there is substantial doubt about an organization’s ability to continue as a going concern and to provide related footnote disclosure. This ASU provides guidance to an organization’s management, with principles and definitions that are intended to reduce diversity in the timing and content of disclosures that are commonly provided by organizations today in the financial statement footnotes. The amendments are effective for annual periods ending after December 15, 2016, and interim periods within annual periods beginning after December 15, 2016. Early adoption is permitted for annual or interim reporting periods for which the financial statements have not previously been issued. The Company is evaluating the impact the revised guidance will have on its consolidated financial statements.

24

3. PROPERTY AND EQUIPMENT

Property and equipment consists of the following:

| | | | | | | | | | | | | | | |

| | | As at August 31, 2014 | As at August 31, 2013 |

| | | Cost $ | Accumulated Amortization $ | Net Book Value $ | Cost $ | Accumulated Amortization $ | Net Book Value $ |

| Vehicles | 6,501 | 6,501 | - | 54,402 | 48,276 | 6,126 |

| Equipment | 54,753 | 54,134 | 619 | 51,591 | 42,518 | 9,073 |

| Leasehold improvements | 1,748 | 1,748 | - | 1,748 | 1,748 | - |

| Furniture and fixtures | 27,287 | 27,287 | - | 27,287 | 26,352 | 935 |

| | 90,289 | 89,670 | 619 | 135,028 | 118,894 | 16,134 |

4. CONTINGENTLY CONVERTIBLE DEBT

| | | |

| | August 31, 2014 | August 31, 2013 |

| | | |

| Promissory note bearing interest at 10% per annum, unsecured, maturing in September 2014; convertible into shares of the Company’s common stock at a conversion price equal to 85% of the 28-day mean trading price prior to the date of the conversion notice, contingent upon the Company becoming publicly traded. |

$ - |

$ 30,000 |

| | | |

| Amount due to Equitas Group LLC, bearing interest at 18% per annum, secured by 30,000,000 shares of the Company’s common stock, matures in July 2016; convertible into shares of the Company’s common stock at a conversion price equal to 50% of the lowest trading price during the 10 trading days prior to the date of the conversion notice, contingent upon the Company becoming publicly traded. | 100,189 | - |

| | | |

| Promissory note bearing interest at 10% per annum, unsecured, maturing in August 2016; convertible into shares of the Company’s common stock at a conversion price equal to 85% of the 28-day mean trading price prior to the date of the conversion notice, contingent upon the Company becoming publicly traded. | 43,400 | 44,000 |

| | | |

| | $ 143,589 | $ 74,000 |

| | | |

| | August 31, 2014 | August 31, 2013 |

| | | |

| Loan payable to Borrego Springs Bank, National Association, bearing interest at prime plus 4.5% per annum, blended monthly payments of principal and interest of $755, unsecured, matures in October 2017. |

$ 26,794 |

$ 33,169 |

| Note payable to The First National Bank and Trust Company of Broken Arrow, bearing interest at prime plus 2% per annum, monthly principal payments of $527, secured by two fork lifts and a grinder, matures in November 2016. | 13,851 |

18,958 |

| Note payable to Central Bank of Oklahoma (formerly ONB Bank), bearing interest at the higher of prime plus 2% and 6% per annum, blended monthly payments of principal and interest of $4,814, matures in May 2018, secured by certain property and equipment and accounts receivable. | 195,263 | 234,454 |

| | | |

| Total | 235,908 | 286,581 |

| | | |

| Less estimated current portion of long-term debt | 61,111 | 57,859 |

| | | |

| Non-current portion of long-term debt | $ 174,797 | $ 228,722 |

The estimated principal repayments of long-term debt over the next five years as of August 31, 2014 are:

| | |

| | |

| 2015 | 61,111 |

| 2016 | 64,546 |

| 2017 | 63,506 |

| 2018 | 46,745 |

| 2019 | - |

| | |

| Total | 235,908 |

6. RELATED PARTY TRANSACTIONS AND BALANCES

(a)

As at August 31, 2014, the Company was owed $36,250 (2013 - $36,250) from a company controlled by a director in common which has been included in due from related party. The amount is unsecured, non-interest bearing and is due on demand.

(b)

As at August 31, 2014, the Company owed $30,000 (2013 - $Nil) to a company controlled by directors in common. The amount is non-interest bearing and has no fixed terms of repayment.

(c)

During the year ended August 31, 2014, the Company incurred consulting fees to a director of the Company in the amount of $72,000 (2013 - $72,000). As at August 31, 2014, consulting fees payable to the director of $156,000 (2013 - $84,000) have been included in accounts payable.

(d)

During the year ended August 31, 2014, the Company incurred consulting fees to a company controlled by a director in common with the Company in the amount of $Nil (2013 - $39,600). As at August 31, 2014, consulting fees payable to the director of $39,600 (2013 - $39,600) have been included in accounts payable.

(e)

During the year ended August 31, 2014, the Company incurred consulting fees to a company controlled by a director in common with the Company in the amount of $Nil (2013 - $27,000) and rent expense in the amount of $Nil (2013 – $6,300). As at August 31, 2014, consulting fees payable to the company controlled by the director of $9,410 (2013 - $Nil) have been included in accounts payable.

26

(f)

During the year ended August 31, 2014, the Company incurred professional fees to a company controlled by a director in common with the Company in the amount of $Nil (2013 - $43,800). As at August 31, 2014, professional fees payable to the director of $43,800 (2013 - $43,800) have been included in accounts payable.

The transactions were recorded at their exchange amounts, being the amounts agreed upon by the related parties.

7. CAPITAL STOCK

Series A Preferred Stock

The Company is authorized to issue 1,000,000 shares of series A preferred stock with a par value of $2. Each share of series A preferred stock is convertible at the option of the holder into $2 of common stock based on 60% of the 28 day trading average as of the date of the conversion notice and is entitled to one vote per series A preferred share. Series A preferred shares are not entitled to cash dividends. As of August 31, 2014 and 2013, the Company has issued 125,000 series A preferred stock.

Series B Preferred Stock

The Company is authorized to issue 1,000,000 shares of series B preferred stock with a par value of $1. Each share of series B preferred stock is convertible at the option of the holder into $1 of common stock based on 60% of the 28 day trading average as of the date of the conversion notice and is entitled to one vote per series B preferred share. Series B preferred shares are not entitled to cash dividends. As of August 31, 2014 and 2013, the Company has issued 300,000 series B preferred stock.

Common Stock

The Company is authorized to issue unlimited shares of common stock. All shares have equal voting rights, are non-assessable and have one vote per share. Voting rights are not cumulative and, therefore, the holders of more than 50% of the common stock could, if they choose to do so, elect all of the directors of the Company.

During the year ended August 31, 2013, the Company issued 3,154,001 shares of common stock for services with an estimated fair value of $315,400. 2,900,000 of these shares were issued for services incurred during the year ended August 31, 2012. No shares of common stock were issued during the year ended August 31, 2014.

8. COMMITMENTS

On November 2, 2010, the Company entered into a lease agreement for office and showroom space in Edmond, Oklahoma. The initial lease was for a three-year period, which began on December 1, 2010, and expired on November 30, 2013. The Company did not renew the lease and is subsequently paying on a month-to-month basis.

On March 1, 2012, the Company entered into a lease agreement for office and showroom space in Tulsa, Oklahoma. The lease is began on March 1, 2012, and expires on April 30, 2015. Subsequent to that date, the Company has been paying on a month-to-month basis. Minimum lease payments up until April 30, 2015 are $15,264.

27

9. INCOME TAXES

The components of the net deferred tax asset at August 31, 2014 and 2013, the statutory tax rate, the effective tax rate, and the amount of the valuation allowance are indicated below:

| | | | | |

| | | August 31, 2014 $ | | August 31, 2013 $ |

| | | | | |

| Net loss before taxes | | (179,695) | | (510,276) |

| Statutory rate | | 38.9% | | 38.9% |

| | | | | |

| Computed expected tax (recovery) | | (69,901) | | (198,497) |

| Other | | (21,463) | | 50,280 |

| Change in valuation allowance | | 91,364 | | 148,217 |

| | | | | |

| Income tax expense (recovery) | | – | | – |

| | | | | | | | | | | |

| | | | August 31, 2014 $ | | August 31, 2013 $ |

| | | | | | |

| Net operating loss carryforwards | | 268,925 | | 177,561 |

| Valuation allowance | | (268,925) | | (177,561) |

| Net deferred tax assets | | – | | – |

The Company has estimated net operating tax losses of approximately $691,325 which, if unutilized, will expire beginning in 2032 through to 2034. Deferred tax benefits, which may arise as a result of these losses, have not been recognized in these consolidated financial statements, and have been offset by a valuation allowance. The following table lists the fiscal years in which loss carryforwards expire:

| | | | |

| | | Expiration |

| | Loss | Date |

| | | $ | |

| | | | |

| | | 226,307 | 2032 |

| | | 345,222 | 2033 |

| | | 119,796 | 2034 |

| | | 691,325 | |

28

(a)

Pro forma financial information.

| | | | | | | | | | |

| | RJD Green Inc. |

| | Unaudited Condensed Pro Forma Consolidated Balance Sheet |

| | As at August 31, 2014 |

| | | Silex Holdings, Inc. | RJD Green, Inc. | | Pro Forma | | |

| | | | August 31, 2014 | | August 31, 2014 | | Adjustments | | Pro Forma Total |

| | | | | | | | | | |

| | | | | | | | (a) | | |

| | Assets | | | | | | | | |

| | Current Assets: | | | | | | | | |

| | Cash | $ | 16,906 | $ | 10,141 | $ | - | $ | 27,047 |

| | Accounts receivable | | 247,192 | | - | | - | | 247,192 |

| | Inventory | | 131,853 | | - | | - | | 131,853 |

| | Other current assets | | 36,250 | | - | | - | | 36,250 |

| | Total Current Assets | | 432,201 | | 10,141 | | - | | 442,342 |

| | Long-term Assets | | 29,498 | | 231,773 | | (231,773) | | 29,498 |

| | | | | | | | | | - |

| | | | | | | | | | |

| | Total Assets | $ | 461,699 | $ | 241,914 | $ | (231,773) | $ | 471,840 |

| | | | | | | | | | |

| | Liabilities and Shareholders' Deficiency | | | | | | | | |

| | Current Liabilities: | | | | | | | | - |

| | Accounts payable | $ | 797,118 | $ | 5,619 | $ | - | $ | 802,737 |

| | Accrued liabilities | | 304,287 | | - | | - | | 304,287 |

| | Due to related party | | 30,000 | | - | | - | | 30,000 |

| | Contingently convertible debt | | 143,589 | | - | | - | | 143,589 |

| | Current portion of long-term debt | | 61,111 | | - | | - | | 61,111 |

| | Total Current Liabilities | | 1,336,105 | | - | | - | | 1,336,105 |

| | Long-term Debt | | 174,797 | | - | | - | | 174,797 |

| | | | | | | | | | - |

| | Total Liabilities | | 1,510,902 | | 5,619 | | - | | 1,516,521 |

| | | | | | | | | | - |

| | | | | | | | | | |

| | Shareholders' Deficit: | | | | | | | | |

| | | | | | | | | | |

| | Common Stock, 750,000,000 shares authorized, with a par value $0.001 and 167,090,000 shares issued and outstanding as of August 31, 2014 | | - | | 167,090 | | | | 167,090 |

| | Common Stock, unlimited shares authorized, with a par value of $0.001;

5,735,181 shares issued and outstanding | | 5,735 | | - | | (5,735) | | - |

| | Series A Preferred Stock, 1,000,000 shares authorized, with a par value of $2; 125,000 shares issued and outstanding | | 250,000 | | - | | (250,000) | | - |

| | Series B Preferred Stock, 1,000,000 shares authorized, with a par value of $1; 300,000 shares issued and outstanding | | 300,000 | | - | | (300,000) | | - |

| | Additional paid in capital | | 312,246 | | 490,183 | | (97,016) | | 705,413 |

| | Donated Capital | | - | | 45,845 | | (45,845) | | - |

| | Discount on Common Stock | | - | | (27,500) | | 27,500 | | - |

| | Accumulated Deficit | | (1,917,184) | | (439,323) | | 439,323 | | (1,917,184) |

| | | | | | | | | | - |

| | | | (1,049,203) | | 236,295 | | (231,773) | | (1,044,681) |

| | Total Liabilities and Stockholders' Deficiency | $ | 461,699 | $ | 241,914 | $ | (231,773) | $ | 471,840 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| (a) | To reflect elimination entries upon the recapitalization transaction. | | | | | | | | |

| | | | | | | | | |

| RJD Green Inc. | | | | |

| Unaudited Condensed Pro Forma Consolidated Statement of Operations | | | | |

| Year Ended August 31, 2014 | | | | |

| | | | | | | | | |

| | | Silex Holdings, Inc. for the Year Ended August 31, 2014 | | RJD Green, Inc. for the Year Ended August 31, 2014 | | Pro Forma Adjustments | | Pro Forma Total |

| | | | | | | | | |

| Revenue | $ | 2,950,505 | $ | - | $ | - | $ | 2,950,505 |

| Cost of Sales | | 2,173,434 | | - | | - | | 2,173,434 |

| Gross Profit | | 777,071 | | - | | - | | 777,071 |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| General and administrative | | 922,519 | | 35,630 | | - | | 958,149 |

| Depreciation | | 12,822 | | - | | - | | 12,822 |

| Interest expense | | 27,144 | | - | | - | | 27,144 |

| Other income | | (5,719) | | (11,101) | | - | | (16,820) |

| Total Expenses | | 956,766 | # | 24,529 | | - | | 981,295 |

| Net Loss and Comprehensive Loss | $ | (179,695) | $ | (24,529) | $ | - | $ | (204,224) |

| | | | | | | | | |

| | | | | | | | | |

| Net loss per share (basic and diluted) | | | | | | | $ | (0.00) |

| Weighted average common shares (basic and diluted) | | | | | | | 129,090,000 |

(c) Shell company transactions.

Not applicable

(d) Exhibits

(10) Stock Purchase Agreement dated May 21, 2013 by and between the Company, Ronald Brewer, as agent and attorney-in-fact for Sellers and RJD Green , as filed in the Form 8-K/A filed October 8, 2014,

30

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

RJD Green, Inc.

January 6 , 2016

By: /s/ Rex Washburn

Rex Washburn

Chief Executive Officer

31

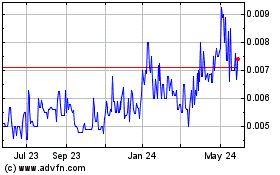

RJD Green (PK) (USOTC:RJDG)

Historical Stock Chart

From Dec 2024 to Jan 2025

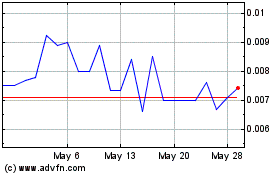

RJD Green (PK) (USOTC:RJDG)

Historical Stock Chart

From Jan 2024 to Jan 2025