SCHEDULE

14A INFORMATION

(Amendment

No. 9)

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

☒

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only

(as permitted by Rule 14A-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-11(c)

or §240.14a-12

|

Sharing

Economy International Inc.

(Name

of Registrant as Specified In Its Charter)

N.A.

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below

per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities

to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or

other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with

preliminary materials.

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

SHARING

ECONOMY INTERNATIONAL INC.

No.

9 Yanyu Middle Road

Qianzhou

Village, Huishan District, Wuxi City

Jiangsu

Province, People’s Republic of China

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

,

2019

NOTICE

IS HEREBY GIVEN that the 2018 annual meeting of stockholders of Sharing Economy International Inc., a Nevada corporation (the

“Company”), will be held at Loeb & Loeb LLP, 21st Floor, CCB Tower, 3 Connaught Road Central, Hong Kong, on ,

2019, at 2:00 P.M. local time. At the meeting, you will be asked to vote on:

(1)

The election of five (5) directors to serve until the next annual meeting of stockholders and until their successors are elected

and qualified;

(2)

To amend the Company’s 2016 Long-Term Incentive Plan (the “Plan”) to increase the number of shares of common

stock, par value $0.001 per share (the “Shares”) authorized for issuance under the Plan from 125,000 to 2,500,000

Shares;

(3)

To amend the Company’s Articles of Incorporation to increase the number of Shares which the Company is authorized to issue

to 250,000,000 Shares, and to increase the number of shares of Preferred Stock which the Company is authorized to issue to 50,000,000

shares of Preferred Stock; and

(4)

The transaction of such other and further business as may properly come before the meeting.

The

Board of Directors has fixed the close of business on , 2019 as the record date for the determination of stockholders entitled

to notice of and to vote at the annual meeting. A list of stockholders of record on the record date will be available for inspection

by stockholders at the office of the Corporation, No. 9 Yanyu Middle Road, Qianzhou Village, Huishan District, Wuxi City, Jiangsu

Province, People’s Republic of China 214181, during the ten (10) days prior to the meeting.

The

enclosed proxy statement contains information pertaining to the matters to be voted on at the annual meeting.

|

|

By order of the Board of Directors,

|

|

|

|

|

|

Jianhua Wu

|

|

|

Chief Executive Officer

|

Wuxi,

China

, 2019

THIS

MEETING IS VERY IMPORTANT TO US AND TO OUR STOCKHOLDERS. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE URGED TO

COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING PRE-ADDRESSED POSTAGE-PAID ENVELOPE AS DESCRIBED ON

THE ENCLOSED PROXY CARD. YOUR PROXY, GIVEN THROUGH THE RETURN OF THE ENCLOSED PROXY CARD, MAY BE REVOKED PRIOR TO ITS EXERCISE

BY FILING WITH OUR CORPORATE SECRETARY PRIOR TO THE MEETING A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A

LATER DATE, OR BY ATTENDING THE MEETING AND VOTING IN PERSON.

SHARING

ECONOMY INTERNATIONAL INC.

No.

9 Yanyu Middle Road

Qianzhou

Village, Huishan District, Wuxi City

Jiangsu

Province, People’s Republic of China 214181

PROXY

STATEMENT

Annual

Meeting of Stockholders

,

2019

The

accompanying proxy and this proxy statement have been prepared by our management for the Board of Directors. Your proxy is being

solicited by the Board of Directors for use at the 2018 annual meeting of stockholders to be held at Loeb & Loeb LLP, 21st

Floor, CCB Tower, 3 Connaught Road Central, Hong Kong, on , 2019 at 2:00 P.M., local time, or at any adjournment thereof. This

proxy statement contains information about the matters to be considered at the meeting or any adjournments or postponements of

the meeting and is first being mailed to stockholders, on or about , 2019. In this proxy statement, we refer to Sharing Economy

International Inc. as “the Company,” “we,” “us,” our” and word of similar import.

ABOUT

THE MEETING

What

is being considered at the meeting?

You

will be voting for:

|

|

●

|

The

election of five (5) directors to serve until the next annual meeting of stockholders and until their successors are elected and

qualified;

|

|

|

●

|

To

amend the Company’s 2016 Long-Term Incentive Plan (the “Plan”) to increase the number of shares of common stock,

par value $0.001 per share (the “Shares”) authorized for issuance under the Plan from 125,000 to 2,500,000 Shares;

|

|

|

●

|

To

amend the Company’s Articles of Incorporation to increase the number of Shares which the Company is authorized to issue

from 12,500,000 Shares to 250,000,000 Shares, and to increase the number of shares of preferred stock, par value $0.001 per share

(the “Preferred Stock”) which the Company is authorized to issue from 10,000,000 shares of Preferred Stock to 50,000,000

shares of Preferred Stock; and

|

|

|

●

|

The

transaction of such other and further business as may properly come before the meeting.

|

Who

is soliciting your proxy?

Your

proxy is being solicited by our Board of Directors.

Who

is entitled to vote at the meeting?

You

may vote if you owned Shares as of the close of business on , 2019, which is the record date for determining who is eligible to

vote at the annual meeting. Each Share is entitled to one (1) vote.

What

is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most

of our stockholders hold their Shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share

certificates in their own name. As summarized below, there are some distinctions between Shares held of record and those owned

beneficially.

Stockholder

of Record

If,

on the record date, your Shares were registered directly in your name with our transfer agent, Empire Stock Transfer, Inc., you

are a “stockholder of record” who may vote at the annual meeting, and we are sending these proxy materials directly

to you. As the stockholder of record, you have the right to direct the voting of your Shares by returning the enclosed proxy card

to us or to vote in person at the annual meeting. Whether or not you plan to attend the annual meeting, please complete, date

and sign the enclosed proxy card to ensure that your vote is counted.

Beneficial

Owner

If,

on the record date, your Shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered

the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your

broker or nominee who is considered the stockholder of record for purposes of voting at the annual meeting. As the beneficial

owner, you have the right to direct your broker on how to vote your Shares and to attend the annual meeting. However, since you

are not the stockholder of record, you may not vote these Shares in person at the annual meeting unless you receive a valid proxy

from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage

firm, bank or other nominee holder. If you do not make this request, you can still vote by using the voting instruction card enclosed

with this proxy statement; however, you will not be able to vote in person at the annual meeting.

How

do I vote?

(1)

You may vote by mail. You may vote by mail by completing, signing and dating your proxy card and returning it in the enclosed,

postage-paid and addressed envelope. If we receive your proxy card prior to the annual meeting and if you mark your voting instructions

on the proxy card, your Shares will be voted:

|

|

●

|

according

to the best judgment of the proxies if a proposal comes up for a vote at the annual meeting that is not on the proxy card.

|

If

you return a signed card, but do not provide voting instructions, your Shares will be voted:

|

|

●

|

for

the election of Messrs. Che Chung Anthony Chan, Jianhua Wu, Cho Fu Li and Shao Yuan Guo, and Ms. Ying Ying Wong, who are the nominees

of the Board of Directors, as directors;

|

|

|

●

|

to approve the amendment

to the Company’s Plan to increase the number of Shares authorized for issuance under the Plan from 125,000 to 2,500,000

Shares;

|

|

|

|

|

|

|

●

|

to approve the amendment

to the Company’s Articles of Incorporation to increase the number of Shares which the Company is authorized to issue

from 12,500,000 Shares to 250,000,000 Shares, and to increase the number of shares of Preferred Stock which the Company is

authorized to issue from 10,000,000 shares of Preferred Stock to 50,000,000 shares of Preferred Stock; and.

|

|

|

●

|

according

to their best judgment if a proposal comes up for a vote at the annual meeting that is not on the proxy card.

|

(2)

You may vote in person at the annual meeting. We will pass out written ballots to anyone who wants to vote at the annual meeting.

However, if you hold your Shares in street name, you must bring to the annual meeting a valid proxy from the broker, bank or other

nominee holding your shares that confirms your beneficial ownership of the Shares and gives you the right to vote your Shares.

Holding Shares in street name means you hold them through a brokerage firm, bank or other nominee, and therefore the shares are

not held in your individual name. We encourage you to examine your proxy card closely to make sure you are voting all of your

Shares in the Company.

How

does the board of directors recommend that I vote?

The

Board of Directors unanimously recommends that you vote in favor of the Board of Directors’ nominees for director and in

favor of the other proposals being brought before the meeting as set forth in this proxy statement.

Can

I change my mind after I vote?

Yes,

you may change your mind at any time before the polls close at the meeting. You can change your vote by signing another proxy

with a later date and returning it to us prior to the meeting or by voting again at the meeting. If your Shares are held in a

brokerage account, you must provide your broker with instructions as to any changes in the voting instructions which you previously

provided to your broker.

What

if I sign and return my proxy card but I do not include voting instructions?

If

you sign your proxy card and return it to us but you do not include voting instructions as to any proposal, your proxy will be

voted FOR the election of the board of directors’ nominees for directors and FOR all proposals put before our stockholders

at the annual meeting.

What

does it mean if I receive more than one proxy card?

It

means that you have multiple accounts with brokers and/or our transfer agent. Please vote all of these Shares. We recommend that

you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address.

Our transfer agent is Empire Stock Transfer, Empire Stock Transfer Inc., 1859 Whitney Mesa Dr., Henderson, NV 89014.

Will

my Shares be voted if I do not provide my proxy?

If

your Shares are held in a brokerage account, they may be voted if you provide your broker with instructions as to how you want

your Shares voted. Your broker will send you instructions as to how you can vote shares that are held in your brokerage account.

If you do not give your broker instructions as to how you want your shares to be voted, then your Shares will not be voted either

for the election of directors or any of the proposals being voted on at the meeting.

If

you hold your Shares directly in your own name, they will only be voted if you either sign and deliver a proxy or attend and vote

at the meeting.

How

many votes must be present to hold the meeting?

In

order for us to conduct our meeting, we must have a quorum. We will have a quorum, and be able to conduct the meeting, if one-third

of our outstanding Shares as of , 2019, are present at the meeting. Your Shares will be counted as being present at the meeting

if you attend the meeting or if you properly return a proxy by mail or if you give your broker voting instructions and the broker

votes your Shares.

On

the record date, , 2019,

we had Shares outstanding.

We will have a quorum if

Shares are present and voting at the annual meeting.

What

vote is required to elect directors?

Directors

are elected by a plurality of the votes cast, which means that, as long as a quorum is present, the five (5) nominees for director

who receive the most votes will be elected. Abstentions will have no effect on the voting outcome with respect to the election

of directors.

How

many votes are required for approval of amendment to the Company’s Plan?

The

proposal to approve the amendment to the Company’s Plan to increase the number of Shares authorized for issuance under the

Plan from 125,000 to 2,500,000 Shares requires the affirmative vote of a majority of the votes cast at the annual meeting. Abstentions

and broker non-votes will not be counted as “for” or “against” the approval of the amendment to the Plan

and thus will have no effect on the proposal.

How

many votes are required to approve the amendment to the Company’s Articles of Incorporation?

The

proposal to approve the amendment to the Company’s Articles of Incorporation to increase the number of Shares which the

Company is authorized to issue to 250,000,000 Shares and 50,000,000 shares of Preferred Stock requires the affirmative vote of

a majority of the issued and outstanding Shares on the record date. Abstentions and broker non-votes will count as votes against

this proposal.

How

many votes are required to approve other matters that may come before the stockholders at the annual meeting?

An

affirmative vote of a majority of the votes cast at the annual meeting is required for approval of all other items being submitted

to the stockholders for their consideration.

Who

is paying the cost of the meeting?

We

will pay for preparing, printing and mailing this proxy statement. Proxies may be solicited on our behalf by our directors, officers

or employees in person or by telephone, electronic transmission and facsimile transmission. We will reimburse banks, brokers and

other custodians, nominees and fiduciaries for their out-of-pocket costs of sending the proxy materials to our beneficial owners.

We estimate our costs at approximately $25,000.

Is

my vote kept confidential?

Proxies,

ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary

to meet legal requirements.

Where

do I find the voting results of the annual meeting?

We

will announce voting results at the annual meeting and file a current report on Form 8-K announcing the voting results of the

annual meeting.

Who

can help answer my questions?

You

can contact Mr. Parkson Yip by email at parkson.yip@seii.com, with any questions about proposals described in this Proxy Statement

or how to execute your vote.

ELECTION

OF DIRECTORS

Directors

are elected annually by the stockholders to serve until the next annual meeting of stockholders and until their respective successors

are duly elected. Our Bylaws provide that the number of directors comprising the whole board shall be determined from time to

time by the Board. The size of the Board for the ensuing year is five (5) directors. Our nominating committee recommended, and

our Board of Directors accepted the committee’s recommendation, that the directors named below be elected. If any nominee

becomes unavailable for any reason, a situation which is not anticipated, a substitute nominee may be proposed by the board, and

any Shares represented by proxy will be voted for the substitute nominee, unless the Board reduces the number of directors.

Our

current Board consists of Ping Kee Lau, Jianhua Wu, Cho Fu Li, Xue Leng and Ying Ying Wong. Messrs. Lau and Leng will not stand

for election at the annual meeting. Messrs. Che Chung Anthony Chan, Wu, Li and Shao Yuan Guo and Ms. Wong were recommended by

our nominating committee for election to the Board of Directors at the annual meeting. If Mr. Chan is elected as a director to

serve until our next annual meeting of shareholders, he will replace Mr. Wu as Chairman of the Board. The following table sets

forth certain information concerning the Board of Directors’ nominees for directors:

|

Name

|

|

Age

|

|

|

Position

|

|

Director

Since

|

|

Jianhua Wu

|

|

|

63

|

|

|

Chairman

of the Board and Chief Executive Officer

|

|

November 2007

|

|

Che Chung Anthony Chan

|

|

|

47

|

|

|

Director

|

|

Director Nominee

|

|

Cho

Fu Li1,2,3

|

|

|

42

|

|

|

Director

|

|

December

2017

|

|

Shao Yuan Guo1,2,3

|

|

|

61

|

|

|

Merchant

|

|

Director Nominee

|

|

Ying Ying Wong1,2,3

|

|

|

38

|

|

|

Director

|

|

December 2017

|

|

|

1

|

Member

of the audit committee.

|

|

|

2

|

Member

of the compensation committee.

|

|

|

3

|

Member

of the corporate governance/nominating committee.

|

Jianhua

Wu has been our chief executive officer, chairman and a director since the completion of the reverse acquisition in November

2007. Mr. Wu founded our predecessor companies, Wuxi Huayang Dyeing Machinery Co., Ltd. and Wuxi Huayang Electrical

Power Equipment Co., Ltd., in 1995 and 2004, respectively, and was executive director and general manager of these companies prior

to becoming our chief executive officer. Mr. Wu was nominated as a director because of his position as our chief executive officer.

Mr. Wu is a certified mechanical engineer.

Che

Chung Anthony Chan has over 20 year experience in sales and general management. Previously, he was the managing director

of Nibou Transmission Machinery Co., Ltd (Hong King & China). He has a Master Business Administration degree from the University

of Wales. We believe Anthony Chan has relevant sales and management experience which is useful for the development of our business

in Hong Kong.

Cho

Fu Li has over ten years of experience in auditing, accounting and banking, and is a member of the Hong Kong Institute

of Certified Public Accountants and a fellow member of the Association of Chartered Certified Accountants. We nominated Mr. Li

as a director because we believe that his accounting and finance experience is important to improve our financial accounting controls.

Shao

Yuan Guo has over 10 years of experience in banking and financial services with Industrial and Commercial Bank of China

and The People's Bank of China in China. He has over 20 years of management experience in the weaving and garment manufacturing

industries. We nominated Mr. Guo as a director because we believe his investment and management experience in China is important

for the future development of the Company in the market.

Ying

Ying Wong is a director of World Sharing Economy Coalition which promotes global sharing economic development. Ms. Wong

has over ten years of experience in banking and financial services with China Construction Bank (Asia) Corporation Limited and

Standard Chartered Bank in Hong Kong. We nominated Ms. Wong as a director because we believe that her banking and finance experience

is important for the future development of the Company.

Our

directors are elected for a term of one (1) year and until their successors are elected and qualified.

We

are incorporated in Nevada and are subject to the provisions of the Nevada corporate law. Our Articles of Incorporation and Bylaws

provide that we will indemnify and hold harmless our officers and directors to the fullest extent permitted by law. Our Articles

of Incorporation also provide that, except as otherwise provided by law, no director or officer is individually liable to us or

our stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or

officer unless it is proven that (a) the director’s or officer’s act or failure to act constituted a breach of his

or her fiduciary duties as a director or officer and (b) the breach of those duties involved intentional misconduct, fraud or

a knowing violation of law.

Nevada

Revised Statutes Section 78.7502 gives us broad authority to indemnify our officers and directors. under certain prescribed circumstances

and subject to certain limitations against certain costs and expenses, including attorney’s fees actually and reasonably

incurred in connection with any action, suit or proceeding, whether civil, criminal, administrative or investigative, to which

a person is a party by reason of being a director or officer it is determined that such person acted in accordance with the applicable

standard of conduct set forth in such statutory provisions.

Director

Independence

We

believe that three (3) of our nominees for director, Mr. Li, Ms. Wong and Mr. Guo, are independent directors. Our Board has determined

that Ms. Wong is an audit committee financial expert. Mr. Wu and Mr. Chan are not independent directors.

Committees

Our

business, property and affairs are managed by or under the direction of the Board of Directors. Members of the Board are kept

informed of our business through discussion with the Chief Executive and Financial Officers and other officers, by reviewing materials

provided to them and by participating at meetings of the Board and its committees.

Our

Board of Directors has three (3) committees - the audit committee, the compensation committee and the corporate governance/nominating

committee. The audit committee shall be comprised of Ms. Wong and Mr. Guo, with Ms. Wong serving as Chairwoman. The compensation

committee shall be comprised of Mr. Li, Ms. Wong and Mr. Guo, with Mr. Guo serving as Chairman. The corporate governance/nominating

committee shall be comprised of Ms. Wong, Mr. Li and Mr. Guo, with Mr. Li serving as Chairman. Our Plan is administered by the

compensation committee.

Our

audit committee is involved in discussions with our independent auditor with respect to the scope and results of our year-end

audit, our quarterly results of operations, our internal accounting controls and the professional services furnished by the independent

auditor. Our Board of Directors has adopted a written charter for the audit committee which the audit committee reviews and reassesses

for adequacy on an annual basis. A copy of the audit committee’s current charter is available on our website at: https://www.seii.com/uploads/04-Asl-cleantech-audit-committee-charter-00172533.doc

The

compensation committee oversees the compensation of our Chairman, Chief Executive Officer and our other executive officers and

reviews our overall compensation policies for employees generally. If so authorized by the Board of Directors, the committee may

also serve as the granting and administrative committee under any option or other equity-based compensation plans which we may

adopt. The compensation committee does not delegate its authority to fix compensation; however, as to officers who report to the

Chairman or the Chief Executive Officer, the compensation committee consults with the Chairman or the Chief Executive Officer

(as the case may be), who may make recommendations to the compensation committee. Any recommendations by the Chairman or the Chief

Executive Officer are accompanied by an analysis of the basis for the recommendations. The committee will also discuss compensation

policies for employees who are not officers with the Chairman nor the Chief Executive Officer and other responsible officers.

The compensation committee has the responsibilities and authority relating to the retention, compensation, oversight and funding

of compensation consultants, legal counsel and other compensation advisers, as well as the requirement to consider six independence

factors before selecting, or receiving advice from, such advisers. A copy of the compensation committee’s current charter

is available on our website at: https://www.seii.com/uploads/03-cleantech-compensation-amended-committee-charter-00254120.pdf.

The

corporate governance/nominating committee is involved evaluating the desirability of and recommending to the Board any changes

in the size and composition of the Board, evaluation of and successor planning for the Chief Executive Officer and other executive

officers. The qualifications of any candidate for director will be subject to the same extensive general and specific criteria

applicable to director candidates generally. A copy of the corporate governance/ nominating committee charter is available on

our website at: https://www.seii.com/uploads/05-Asl-cleantech-nominating-governance-committee-charter-00172535.doc

The

board and its committees held the following number of meetings during 2018:

|

Board of directors

|

|

|

4

|

|

|

Audit committee

|

|

|

4

|

|

|

Compensation committee

|

|

|

1

|

|

|

Nomination committee

|

|

|

1

|

|

The

meetings include meetings that were held by means of a conference telephone call, but do not include actions taken by unanimous

written consent.

Each

director attended at least 75% of the total number of meetings of the board and those committees on which he served during the

year.

Our

non-management directors had no meetings during 2018.

Compensation

Committee Interlocks and Insider Participation

Aside

from the service as a director, no member of our compensation committee had any relationship with us as of December 31, 2018,

and none of our executive officers served as a director or compensation committee member of another entity.

Code

of Ethics

We

have adopted a code of ethics that applies to our officers, directors and employees. We have filed copies of our code of ethics

and our board committee charters as exhibits to our filings with the Securities and Exchange Commission (the “SEC”).

Audit

Committee Report*

The

audit committee of the Board is currently composed of two directors: Ying Ying Wong, who is the chairwoman and Xue Leng, who is

independent. The board has adopted a written Audit Committee Charter.

Management

is responsible for our financial statements, financial reporting process and systems of internal accounting and financial reporting

control. Our independent auditor is responsible for performing an independent audit of our financial statements in accordance

with auditing standards generally accepted in the United States and for issuing a report thereon. The audit committee’s

responsibility is to oversee all aspects of the financial reporting process on behalf of the board. The responsibilities of the

audit committee also include engaging and evaluating the performance of the accounting firm that serves as the Company’s

independent auditor.

The

audit committee discussed with our independent auditor, with and without management present, such auditor’s judgments as

to the quality, not just acceptability, of our accounting principles, along with such additional matters required to be discussed

under the Statement on Auditing Standards No. 61, “Communication with Audit Committees.” The audit committee has discussed

with the independent auditor, the auditor’s independence from us and our management, including the written disclosures and

the letter submitted to the audit committee by the independent auditor as required by the Independent Standards Board Standard

No. 1, “Independence Discussions with Audit Committees.”

In

reliance on such discussions with management and the independent auditor, review of the representations of management and review

of the report of the independent auditor to the audit committee, the audit committee recommended (and the board approved) that

our audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2018.

Submitted

by:

Audit

Committee of the Board of Directors

|

/s/ Ying Ying Wong

|

|

|

/s/ Xue Leng

|

|

|

|

*

|

The

information contained in this Audit Committee Report shall not be deemed to be “soliciting material” or “filed”

or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of Securities Exchange

Act of 1934, as amended (the “Exchange Act”), except to the extent that the Company specifically requests that the

information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities

Act of 1933, as amended or the Exchange Act.

|

Section

16(a) Compliance

Section

16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of our Shares to file with

the SEC initial reports of ownership and reports of changes in ownership of Shares and other of our equity securities. During

the year ended December 31, 2018, we believe that all of our Section 16 reports were timely filed with the SEC.

Executive

Compensation

The

following summary compensation table indicates the cash and non-cash compensation earned during the years ended December 31, 2018

and 2017 by each person who served as chief executive officer and chief financial officer during the year ended December 31, 2018

and 2017. No other executive officer received compensation equal or exceeding $100,000.

Summary

Annual Compensation Table

|

Name and Principal Position

|

|

Fiscal Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

All Other Compensation ($)

|

|

|

Total

($)

|

|

|

Jianhua Wu,

|

|

2018

|

|

|

36,261

|

|

|

|

0

|

|

|

|

34,500

|

|

|

|

0

|

|

|

|

70,761

|

|

|

chief executive officer (1)

|

|

2017

|

|

|

36,999

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

36,999

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wanfen Xu,

|

|

2018

|

|

|

12,957

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

12,957

|

|

|

chief financial officer (2)

|

|

2017

|

|

|

8,584

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

8,584

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parkson Yip,

|

|

2018

|

|

|

42,637

|

|

|

|

0

|

|

|

|

0

|

|

|

|

1,154

|

|

|

|

43,791

|

|

|

chief operating officer (3)

|

|

2017

|

|

|

87,500

|

|

|

|

19,250

|

|

|

|

0

|

|

|

|

2,606

|

|

|

|

109,356

|

|

|

|

(1)

|

Mr.

Wu’s 2018 compensation consisted of cash salary of $36,261 and 115,000 shares of common stock valued at $34,500.

|

|

|

(2)

|

Ms.

Xu has been our chief financial officer since March 1, 2016.

|

|

|

(3)

|

Mr.

Yip has been our chief operating officer since June 3, 2017 and resigned as chief operating officer on April 1, 2018.

|

Employment

Agreement

On

June 19, 2017, the Company entered into an employment agreement with Parkson Yip to serve as our chief operating officer. Pursuant

to the employment agreement, Mr. Yip would receive an annual salary of $150,000 and received a signing bonus of $19,250. On April

1, 2018, Mr. Yip resigned as the chief operating officer and was re-designated as vice president of strategic business development

of the Company under a consultant agreement.

Directors’

Compensation

We

do not have any agreements or formal plan for compensating our current directors for their service in their capacity as directors,

although our board may, in the future, award stock options to purchase shares of common stock to our current directors.

The

following table provides information concerning the compensation of each member of our board of directors whose compensation is

not included in the Summary Compensation Table for his or her services as a director and committee member for 2018. The value

attributable to any stock grants is computed in accordance with ASC Topic 718.

|

Name

|

|

Fees earned or paid in cash

($)

|

|

|

Stock

awards

($)

|

|

|

Total

($)

|

|

|

Ping Kee Lau (1)

|

|

|

23,077

|

|

|

|

3,000

|

|

|

|

26,077

|

|

|

Cho Fu Li (2)

|

|

|

58,462

|

|

|

|

1,950

|

|

|

|

60,412

|

|

|

Xue Leng (2)

|

|

|

24,000

|

|

|

|

0

|

|

|

|

24,000

|

|

|

Ying Ying Wong (2)

|

|

|

27,692

|

|

|

|

9,900

|

|

|

|

37,592

|

|

|

|

(1)

|

A

director since March 20, 2017

|

|

|

(2)

|

A

director since December 14, 2017.

|

Long-Term

Incentive Plans

In

September 2016, the board of directors adopted, and in November 2016, the stockholders approved the 2016 long-term incentive plan,

covering 125,000 shares of common stock. The 2016 plan provides for the grant of incentive and non-qualified options and stock

grants to employees, including officers, directors and consultants. The 2016 plan is to be administered by a committee of not

less than three directors, each of whom is to be an independent director. In the absence of a committee, the plan is administered

by the board of directors. The board has granted the compensation committee the authority to administer the 2016 plan. Members

of the committee are not eligible for stock options or stock grants pursuant to the 2016 plan unless such stock options or stock

grant are granted by a majority of our independent directors other than the proposed grantee. As of December 31, 2018, we had

issued a total of 120,000 shares of common stock pursuant to this plan.

The

following table sets forth information as options outstanding on December 31, 2018.

|

|

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

|

|

|

|

|

OPTION AWARDS

|

|

|

STOCK AWARDS

|

|

Name

(a)

|

|

Number

of

Securities

Underlying

Unexercised

options

(#)

(b)

|

|

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

(c)

|

|

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

(d)

|

|

|

Option

Exercise

Price

($)

(e)

|

|

|

Option

Expiration

Date

($)

(f)

|

|

|

Number of

Shares or

Units of

Stock that

have not Vested

(#)

(g)

|

|

|

Market

Value of

Shares or

Units of

Stock that

Have not Vested

($)

(h)

|

|

|

Equity Incentive

Plan Awards:

Number of

Unearned Shares,

Units or

Other

Rights that

have not

Vested

(#)

(i)

|

|

|

Equity Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units

or other

Rights that

have not

Vested

($)

(j)

|

|

|

Jianhua Wu

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

Communications

with our Board of Directors

Any

stockholder who wishes to send a communication to our Board of Directors should address the communication either to the Board

of Directors or to the individual director c/o Wanfen Xu, Chief Financial Officer, M03, Room 302, 3/F, Eton Tower, No. 8 Hysan

Avenue, Causeway Bay, Hong Kong. Mr. Xu will forward the communication either to all of the directors, if the communication is

addressed to the Board, or to the individual director, if the communication is directed to a director.

AMENDMENT

TO 2016 LONG-TERM INCENTIVE PLAN

Summary

and Purpose of the Amendment to the Plan

In

September 2016, the Board of Directors adopted, and in November 2016, the stockholders approved the Plan, covering 125,000 Shares.

The Plan provides for the grant of incentive and non-qualified options and stock grants to employees, including officers, directors

and consultants. The Plan is administered by a committee of not less than three directors, each of whom is to be an independent

director. In the absence of a committee, the Plan is administered by the Board of Directors. The Board has granted the compensation

committee the authority to administer the Plan. Members of the committee are not eligible for stock options or stock grants pursuant

to the Plan unless such stock options or stock grant are granted by a majority of our independent directors other than the proposed

grantee. As of December 31, 2018, we had issued a total of 120,000 Shares pursuant to the Plan. The Board of Directors has voted

to amend the Plan to increase the number of Shares authorized for issuance under the plan to 2,500,000 Shares.

Increase

in Number of Authorized Shares under the Plan

As

of the record date, the Company has granted 120,000 Shares of restricted stock under the Plan. As a result, the Company presently

has 5,000 Shares available for future issuance under the Plan. The Board of Directors believes that the proposed increase in the

number of Shares available for issuance as provided in the Plan will provide the compensation committee with greater flexibility

in 2019 in the administration of the Plan and is appropriate in light of the growth of the Company.

Eligibility

and Participation

The

Plan, filed as Appendix A to the Company’s October 3, 2016, Definitive Proxy Statement, is incorporated by reference herein,

as is the section of that Definitive Proxy Statement discussing “Approval Of The 2016 Long-Term Incentive Plan.” The

Plan provides for the grant of incentive and non-qualified options and stock grants to employees, including officers, directors

and consultants. The basis for participation is that the Board of Directors believes that in order to attract and retain the services

of executive and other key employees, it is necessary for us to have the ability and flexibility to provide a compensation package

which compares favorably with those offered by other companies.

Classes

of individuals who are eligible to participate in the Plan

As

of the record date, we had approximately employees. However,

as of the record date, employee actually participated in the

Plan.

As

of the record date, we had executive officers eligible

to participate in the plan. However, as of the record date, only

executive officer actually participated in the Plan.

As

of the record date, all five (5) members of our Board, three (3) of whom are non-employee directors, were eligible to

receive awards under the Plan. However, as of the record date,

member of our Board participated in the Plan.

As

of the record date, we had approximately consultants who

were eligible under the Plan. However, as of the record date, only

consultants actually participated in the

Plan.

Our

current practice for awarding incentive and non-qualified options and stock grants to full-time employees, part-time-employees,

officers, Directors and consultants is subject to the discretion of the compensation committee, which is comprised of our three

independent directors. The committee has full authority under the Plan to determine whether and to what extent awards are to be

granted pursuant to the Plan, to one or more eligible persons.

Equity

Compensation Plan Information

The

following table summarizes information, as of December 31, 2018, with respect to Shares that may be issued under the Company’s

existing equity compensation plans.

|

Plan Category

|

|

Number of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

(a)

|

|

|

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b)

|

|

|

Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in

Column (a))

(c)

|

|

|

Equity compensation plans approved by security holders

|

|

|

0

|

(1)

|

|

$

|

N/A

|

|

|

|

5,000

|

|

|

Equity compensation plans not approved by security holders

|

|

|

0

|

|

|

|

N/A

|

|

|

|

0

|

|

|

Total

|

|

|

0

|

|

|

$

|

N/A

|

|

|

|

5,000

|

|

|

|

(1)

|

Consists

of options and restricted stock granted under the Plan.

|

APPROVAL

OF AMENDMENT TO ARTICLES OF INCORPORATION

The

Board of Directors has adopted a resolution proposing an amendment to the Company’s Articles of Incorporation to increase

the number of authorized Shares of Company from 12,500,000 Shares to 250,000,000 Shares, and to increase the number of shares

of Preferred Stock which the Company is authorized to issue from 10,000,000 shares of Preferred Stock to 50,000,000 shares of

Preferred Stock. As of the date of this proxy statement, the Company had 9,121,529 Shares issued and outstanding. In addition,

as of the date of the proxy statement, the Company has the following commitments in place relating to the potential future issuance

of securities pursuant to options, warrants, convertible notes and other contractual arrangements:

|

Names/Categories

of Recipients of Shares and shares of Preferred Stock

|

|

Number

of Shares and shares of Preferred Stock Reserved for Future Issuance

|

|

Description

of Transaction

|

|

|

|

|

|

|

|

Iliad

Research and Trading, L.P.

|

|

578,078

(1)

|

|

Private

Placement (1)

|

|

Chong

Ou Holdings Group Company Limited

|

|

900

(2)

|

|

Private

Placement (2)

|

|

Li

Tingting

|

|

133,250

Shares (3)

|

|

Tenancy

Agreement (3)

|

|

Vendors

|

|

209,050

Shares (4)

|

|

Vendor

Agreements (4)

|

|

Consultants

|

|

167,220

Shares (5)

|

|

Consultancy

Services (5)

|

|

Shortfall

Compensation (Consultants and Vendors)

|

|

216,770

Shares (6)

|

|

Shortfall

Compensation (6)

|

|

TOTAL

NUMBER OF SHARES RESERVED FOR FUTURE ISSUANCE

|

|

1,305,268

Shares

|

|

|

|

|

(1)

|

On

May 2, 2018, the Company closed a private placement of securities with Iliad Research

and Trading, L.P. (“Iliad”) pursuant to which Iliad purchased a Convertible

Promissory Note (the “Note”) in the original principal amount of US$900,000,

plus interest, convertible into 506,250 Shares at the minimum conversion price of US$2.00

per Share. The Company issued 36,621 Shares and 266,667 Shares on November 8, 2018 and

January 11, 2019 pursuant to the redemption notices dated November 7, 2018 and January

11, 2019 issued by Iliad for the redemption amounts of US$75,000 and US$50,000, respectively.

On August 2, 2019, the Note matured and is now in default. The remaining principal amount

plus interest are convertible into approximately 443,750 Shares at the minimum conversion

price of US$2.00 per Share. Iliad has agreed with the Company that it will not convert

amount due and owing under the Note at a rate of less than $2.00 per share. In connection

with the transaction, the Company also issued a Warrant to purchase 134,328 Shares to

Iliad. The exercise price of the Warrant is US$7.18 which is above the current market

price per Share.

|

|

|

(2)

|

Represents

interest on the Note for US$670,000, dated October 9, 2017, issued to Chong Ou Holdings Group Company Limited to be settled by

the issuance of 900 Shares.

|

|

|

(3)

|

Represents

Shares to be issued in connection with a Tenancy Agreement entered into by the Company and approved by the Board of Directors.

|

|

|

(4)

|

Represents

Shares reserved for future issuance to vendors for services to be rendered, including accounting services, investor and public

relationship services, IT development services, legal services, and M&A advisory work.

|

|

|

(5)

|

Represents

Shares reserved for future issuance to consultants for services to be rendered to the Company.

|

|

|

(6)

|

Represents

the maximum number of shares issuable to consultants and vendors under shortfall provisions of agreements entered into by the

Company. To date, no shares have been issued under any shortfall provision.

|

As

of the date hereof, the Company has a total of 12,500,000 Shares authorized for issuance, of which a total of 9,278,106

Shares are issued and outstanding and a total of 1,305,268 Shares are reserved for issuance pursuant to options, warrants, convertible

notes, and other contractual commitments and arrangements. In addition, as of the date hereof, the Company has a total of 10,000,000

shares of Preferred Stock authorized for issuance. As such, the Company only has 1,916,626 unissued Shares that are not reserved

for any specific use available for future issuance. The Board of Directors believes that the authorized Shares and Preferred Stock

available for issue is not sufficient to enable the Company to respond to potential business opportunities and to pursue important

objectives designed to enhance stockholder value. If the proposal is adopted, the Company will have 239,416,626 unissued Shares

and 50,000,000 unissued shares of Preferred Stock that are not reserved for any specific use available for future issuance. The

additional authorized Shares and Preferred Stock will provide the Company with greater flexibility to use its capital stock, without

further stockholder approval, for various purposes including, without limitation, expanding the Company’s businesses and

product lines through the acquisition of other businesses or products, stock dividends (including stock splits in the form of

stock dividends), raising capital, providing equity incentives to employees, officers and directors and establishing strategic

relationships with other companies. The Company currently does not have specific agreements or plans that would involve the issuance

of the proposed additional authorized Shares or Preferred Stock. The issuance of additional Shares or Preferred Stock may have

a dilutive effect on earnings per Share and, for a stockholder who does not purchase additional Shares or additional shares of

Preferred Stock to maintain his or her pro rata interest, on a stockholder’s percentage voting power.

The

authorized Shares and Preferred Stock in excess of those issued or reserved will be available for issuance at such times and for

such corporate purposes as the Board of Directors may deem advisable without further action by the Company’s stockholders,

except as may be required by applicable laws or the rules of any stock exchange or national securities association trading system

on which the Shares may be listed or traded. Upon issuance of any Shares, they will have the same rights as the outstanding Shares.

The Board of Directors shall have the right to establish the rights, preferences and privileges associated with the issuance of

any shares of Preferred Stock.

The

additional Shares and Preferred Stock that would become available for issuance if the proposal were adopted could also be used

by the Company to oppose a hostile takeover attempt or delay or prevent changes in control or management of the Company. For example,

without further stockholder approval, the Board of Directors could strategically sell Shares or Preferred Stock in a private transaction

to purchasers who would oppose a takeover or favor the current Board of Directors. Although this proposal to increase the authorized

Shares and authorized shares of Preferred Stock has been prompted by business and financial considerations and not by the threat

of any hostile takeover attempt (nor is the Board of Directors currently aware of any such attempts directed at the Company),

nevertheless, stockholders should be aware that approval of the proposal could facilitate future efforts by the Company to deter

or prevent changes in control of the Company, including transactions in which the stockholders might otherwise receive a premium

for their Shares over then current market prices.

The

proposal to amend the Company’s Articles of Incorporation to increase the number of authorized Shares and Preferred Stock

available for issuance will be implemented by filing the amendment to our Articles of Incorporation with the Nevada Secretary

of State. The amendment will become effective on the date of the filing.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND

RELATED STOCKHOLDER MATTERS.

The

following table provides information as to Shares beneficially owned as of ,

2019, by:

|

|

●

|

Each

director and each nominee for election as a director;

|

|

|

●

|

Each

current officer named in the summary compensation table;

|

|

|

●

|

Each

person owning of record or known by us, based on information provided to us by the persons named below, at least 5% of our Shares;

and

|

|

|

●

|

All

directors and officers as a group

|

For

purposes of the following table, “beneficial ownership” means the sole or shared power to vote, or to direct the voting

of, a security, or sole or shared investment power with respect to a security, or any combination thereof, and the right to acquire

such power (for example, through the exercise of employee stock options granted by the Company) within sixty (60) days of ,

2019.

|

Name of Beneficial Owner

|

|

Amount and

Nature

of

Beneficial

Ownership

|

|

|

% of Class

|

|

|

|

|

|

|

|

|

|

|

Jianhua Wu (3)

|

|

|

115,000

|

|

|

|

1.2

|

%

|

|

Wanfen Xu (3)

|

|

|

0

|

|

|

|

0.0

|

%

|

|

Ping Kee Lau

|

|

|

10,000

|

|

|

|

0.1

|

%

|

|

Cho Fu Li

|

|

|

6,500

|

|

|

|

0.1

|

%

|

|

Xue Leng

|

|

|

0

|

|

|

|

0.0

|

%

|

|

Ying Ying Wong

|

|

|

33,000

|

|

|

|

0.4

|

%

|

|

All current officers and directors as a group

|

|

|

164,500

|

|

|

|

1.8

|

%

|

|

Chan Tin Chi Family Company Limited (1)(2)

|

|

|

666,249

|

|

|

|

7.2

|

%

|

|

Man Cheung Sze (4)

|

|

|

690,000

|

|

|

|

7.4

|

%

|

|

Iliad Research and Trading, L.P.

|

|

|

753,039

|

|

|

|

8.1

|

%

|

|

Total

|

|

|

2,438,288

|

|

|

|

26.3

|

%

|

|

|

(1)

|

Mr.

Chan Tin Chi owns 99% of the issued and outstanding ordinary shares of Chan Tin Chi Family Company Limited (formerly known as

YSK 1860 Co., Limited).

|

|

|

(2)

|

Address

is Villa Cornwall, 85 Castle Peak Road, Tuen Mun, N.T. Hong Kong.

|

|

|

(3)

|

Address

is No. 9 Yanyu Middle Road, Qianzhou Village, Huishan District, Wuxi City, Jiangsu Province, P.R.C.

|

|

|

(4)

|

Address

is Flat 209, 2/F, Shing On House, Kwai Shing East Estate, Kwai Chung, New Territories, Hong Kong.

|

MANAGEMENT

Executive

Officers

The

following table sets forth certain information with respect to our executive officers.

|

Name

|

|

Age

|

|

|

Position

|

|

Jianhua Wu

|

|

|

63

|

|

|

Chief Executive Officer

|

|

Wanfen Xu

|

|

|

38

|

|

|

Chief Financial Officer

|

All

of our officers serve at the pleasure of the Board of Directors. Mr. Wu is also a director. See “Election of Directors”

for information concerning Mr. Wu.

Wanfen

Xu has been our chief financial officer since March 1, 2016. Ms. Xu previously served as our chief financial officer from March

14, 2012 through December 12, 2012. From December 2012 until February 2016, Ms. Xu served as the financial controller of the Huayang

Companies. Ms. Xu also served as the financial controller of Huayang Companies from 2009 to 2011.

FINANCIAL

STATEMENTS

Our

audited financial statements, which include our consolidated balance sheets at December 31, 2018 and 2017, and the related consolidated

statements of income and comprehensive income, stockholders’ equity and cash flows for each of the two years in the period

ended December 31, 2018, and the notes to our consolidated financial statements, are included in our Form 10-K for the year ended

December 31, 2018. A copy of our Form 10-K for the year ended December 31, 2018, either accompanied or preceded the delivery of

this proxy statement.

Copies

of our Form 10-K for the year ended December 31, 2018 may be obtained without charge by writing to Wanfen Xu, Chief Financial

Officer, M03, Room 302, 3/F, Eton Tower, No. 8 Hysan Avenue, Causeway Bay, Hong Kong. Exhibits will be furnished upon request

and upon payment of a handling charge of $.25 per page, which represents our reasonable cost on furnishing such exhibits. Copies

of our Form 10-K are available on our website at www.seii.com. The SEC maintains a web site that contains reports, proxy and information

statements and other information regarding registrants that file electronically with the Commission. The address of such site

is http//www.sec.gov

OTHER

MATTERS

Other

Matters to be Submitted

Our

Board of Directors does not intend to present to the meeting any matters not referred to in the form of proxy. If any proposal

not set forth in this proxy statement should be presented for action at the meeting, and is a matter which should come before

the meeting, it is intended that the Shares represented by proxies will be voted with respect to such matters in accordance with

the judgment of the persons voting them.

Deadline

for Submission of Stockholder Proposals for the 2019 Annual Meeting

Proposals

of stockholders intended to be presented at the 2019 Annual Meeting of Stockholders pursuant to SEC Rule 14a-8 must be received

at our principal office within a reasonable time before the Company prints and mails its proxy statement for the 2019 Annual Meeting

to be included in the proxy statement for the meeting. If notice of any stockholder proposal is considered untimely, we are not

required to present such proposal at the 2019 Annual Meeting.

|

,

2019

|

By Order of the Board of Directors

|

|

|

|

|

|

|

Jianhua Wu

|

|

|

|

Chief Executive Officer

|

15

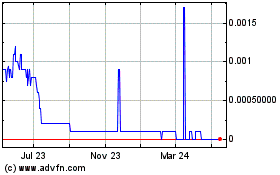

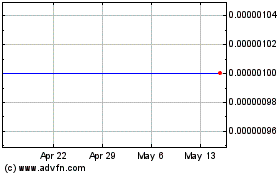

Sharing Economy (CE) (USOTC:SEII)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sharing Economy (CE) (USOTC:SEII)

Historical Stock Chart

From Mar 2024 to Mar 2025