UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

SEARCHLIGHT MINERALS CORP.

(Name of Issuer)

Common stock, $0.001 par value per share

(Title of Class of Securities)

812224 20 2

(CUSIP Number)

CHARLES A. AGER

3500 Lakeside Court, Suite 206

Reno,

NV 89509

Telephone: 775-826-1115

(Name, Address

and Telephone Number of Person Authorized to Receive Notices and Communications)

September 24, 2009

(Date of Event Which

Requires Filing of this Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition which is the subject

of this Schedule

13D, and is filing this schedule because of Rule 13d-1(b)(3) or (4), check the

following box [ ].

*The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to

the subject

class of securities, and for any subsequent amendment containing information

which would alter the

disclosures provided in a prior cover page.

The information required in the remainder of this cover page

shall not be deemed to be “filed” for the purpose of

Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities

of that section of the

Act but shall be subject to all other provisions of

the Act (however, see the Notes).

__________

|

1.

|

Names of Reporting

Person:

CHARLES

A. AGER

.

|

|

|

|

|

|

|

|

2.

|

Check the Appropriate Box if a

Member of a Group (See Instructions):

|

|

|

(a)

[

]

|

|

|

(b)

[ ]

|

|

|

Not applicable

.

|

|

|

|

|

|

|

|

3.

|

SEC Use Only:

|

|

|

|

|

|

|

|

4.

|

Source of Funds (See

Instructions):

OO

.

|

|

|

|

|

|

|

|

5.

|

Check if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

|

|

|

Not applicable

.

|

|

|

|

|

|

|

|

6.

|

Citizenship or Place of

Organization:

Canada

.

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person

With:

|

7.

|

Sole Voting

Power:

None

.

(1)

|

|

|

|

|

8.

|

Shared Voting

Power:

17,645,190 Shares

.

(1)

|

|

|

|

|

9.

|

Sole Dispositive

Power:

None

.

(1)

|

|

|

|

|

10.

|

Shared Dispositive

Power:

17,645,190 Shares

.

(1)

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting

Person:

17,645,190 Shares

.

(1)

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions):

|

|

|

Not applicable

.

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row

(11):

14.8% (based on 1,118,757,123 shares of the Issuer’s common stock being

issued and outstanding as at November 18, 2009)

.

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions):

IN

.

|

|

|

(1)

|

The filing of this statement by the Reporting Person

shall not be construed as an admission that the Reporting Person is, for

the purposes of Sections 13(d) or 13(g) of the Act, the beneficial owner

of any securities covered by the statements

herein.

|

__________

Page 2 of 7

This Schedule 13D/A (Amendment No. 1) is being filed by Charles

A. Ager (the “Reporting Person”) pursuant to Rule 13d-2(a) of the Securities

Exchange Act of 1934 to amend and supplement the Schedule 13D of the Reporting

Person filed with the United States Securities and Exchange Commission on April

15, 2008 (the "Original Schedule 13D"). Except as specifically amended hereby,

the disclosure set forth in the previously filed Schedule 13D remains unchanged.

Unless otherwise defined herein, the capitalized terms used herein have the

meaning ascribed to them in the Original Schedule 13D.

ITEM

2. IDENTITY

AND BACKGROUND.

|

A.

|

Name of Persons filing this Statement:

|

|

|

|

|

|

This statement is filed by Charles A. Ager (the

“Reporting Person”).

|

|

|

|

|

B.

|

Residence or Business Address:

|

|

|

|

|

|

The address of the Reporting Person is 3500 Lakeside

Court, Suite 206, Reno, NV 89509.

|

|

|

|

|

C.

|

Present Principal Occupation and

Employment

|

|

|

|

|

|

The Reporting Person is the sole executive officer and

sole director of Nanominerals Corp. (“Nanominerals”) and is also a

self-employed geophysical engineer.

|

|

|

|

|

D.

|

Criminal Proceedings:

|

|

|

|

|

|

The Reporting Person has not been convicted in any

criminal proceeding (excluding traffic violations or similar misdemeanors)

during the last five years.

|

|

|

|

|

E.

|

Civil Proceedings:

|

|

|

|

|

|

The Reporting Person has not been, during the last five

years, a party to any civil proceeding of a judicial or administrative

body of competent jurisdiction where, as a result of such proceeding,

there was or is a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such

laws.

|

|

|

|

|

F.

|

Citizenship:

|

|

|

|

|

|

The Reporting Person is a citizen of

Canada.

|

ITEM

3. SOURCE

AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

On October 24, 2005, the Issuer issued to Nanominerals a

warrant to purchase 10,000,000 shares of the Issuer’s common stock at an

exercise price of $0.375 per share expiring June 1, 2015, pursuant to Section

4(2) of the Securities Act of 1933 (the “2005 Warrants”). The 10,000,000 shares

of common stock are restricted shares as defined in the Securities Act. The 2005

Warrants were issued to Nanominerals in connection with the assignment to the

Issuer of Nanominerals’ interest in a joint venture agreement dated May 20, 2005

between Nanominerals and Verde River Iron Company, LLC, for the purpose of

funding the Issuer’s Clarkdale Slag Project.

On January 17, 2006, Nanominerals acquired 16,000,000 of the

Issuer’s shares of common stock for a total purchase price of $4,640.50 from K.

Ian Matheson, a member of the Issuer’s board of directors. Also

Page 3 of 7

Nanominerals entered into the following transactions respecting

the Warrants: (i) on January 17, 2006 Nanominerals sold 8,000,000 of its 2005

Warrants to K. Ian Matheson in consideration of $5,000, (ii) on January 31, 2006

Nanominerals sold 1,000,000 of its 2005 Warrants to Richard J. Werdesheim and

Lynne Werdesheim as trustees for the Werdesheim Family Trust for a payment of

$625, and (iii) on January 31, 2006 Nanominerals sold the remaining 1,000,000 of

its 2005 Warrants to Craigen L.T. Maine, as trustee for the Maine Rev. Family

Trust for a payment of $625. The transfers were completed pursuant to Section

4(2) of the Securities Act of 1933.

On November 12, 2009, Nanominerals purchased 400,000 Units

offered by the Issuer in a private placement financing at a price of $1.25 per

Unit. Each Unit consisted of one share of the Issuer’s common stock and one-half

of one share purchase warrant. Each full share purchase warrant (a “2009

Warrant”) entitles the holder to purchase one additional share of common stock

at an exercise price of $1.85 per share and has an expiration date of November

12, 2012. Nanominerals paid for the Units out of its own funds.

Geotech Mining Inc. (“Geotech”) and Geosearch Mining Inc. have

each acquired a total of 140,000 Shares of the Issuer’s common stock in

consideration for the transfer of their interests in the Searchlight Claims to

the Issuer. The Reporting Person is the sole shareholder, sole director and sole

officer of Geotech. The Reporting Person’s spouse, Carol Ager, is the sole

shareholder, sole director and sole officer of Geosearch. Mrs. Ager owns an

additional 765,190 Shares of the Issuer’s common stock personally, in her own

name. These shares were acquired by Mrs. Ager in a private transaction using her

own funds.

ITEM

4. PURPOSE

OF TRANSACTION

The 2005 Warrants were issued to Nanominerals in connection

with the assignment to the Issuer of Nanominerals’ interest in a joint venture

agreement dated May 20, 2005 between Nanominerals and Verde River Iron Company,

LLC, for the purpose of funding the Company’s Clarkdale Slag Project. The

16,000,000 shares acquired by Nanominerals on January 17, 2006, and the 400,000

Units acquired by Nanominerals on November 12, 2009, were acquired by

Nanominerals for investment purposes.

The Shares of the Issuer’s common stock acquired by the

Reporting Person and Mrs, Ager, including the Shares acquired by Geotech and

Geosearch, were acquired by them for investment purposes.

Subject to all relevant securities law provisions, the

Reporting Person may acquire or dispose of securities of the Issuer from time to

time in the open market or in privately negotiated transactions with third

parties.

Except as otherwise described herein, the Reporting Person does

not have any plans or proposals as of the date hereof which relate to or would

result in any of the transactions described in clauses (a) through (j) of Item 4

of Schedule 13D.

ITEM

5. INTEREST

IN SECURITIES OF THE ISSUER.

(a)

Aggregate Beneficial Ownership:

The filing of this statement by the Reporting Person shall not

be construed as an admission that the Reporting Person is, for the purposes of

Sections 13(d) or 13(g) of the Act, the beneficial owner of any securities

covered by the statements herein.

|

Title of Security

|

Amount

|

Percentage of Shares of Common Stock

|

|

Common Stock

|

17,045,190

(1)(2)

(indirect)

|

16.0%

(1)(2)

|

Page 4 of 7

|

|

(1)

|

Under Rule 13d-3, a beneficial owner of a security

includes any person who, directly or indirectly, through any contract,

arrangement, understanding, relationship, or otherwise has or shares: (i)

voting power, which includes the power to vote, or to direct the voting of

shares; and (ii) investment power, which includes the power to dispose or

direct the disposition of shares. Certain shares may be deemed to be

beneficially owned by more than one person (if, for example, persons share

the power to vote or the power to dispose of the shares). In addition,

shares are deemed to be beneficially owned by a person if the person has

the right to acquire the shares (for example, upon exercise of an option)

within 60 days of the date as of which the information is provided. In

computing the percentage ownership of any person, the amount of shares

outstanding is deemed to include the amount of shares beneficially owned

by such person (and only such person) by reason of these acquisition

rights. As a result, the percentage of outstanding shares of any person as

shown in this table does not necessarily reflect the person’s actual

ownership or voting power with respect to the number of shares of common

stock actually outstanding on the date of this Statement. As of November

18, 2009 there were 118,757,123 shares of the Issuer’s common stock issued

and outstanding.

|

|

|

|

|

|

|

(2)

|

Includes 16,600,000 shares beneficially owned by

Nanominerals. The Reporting Person is the sole director and sole officer

of Nanominerals. In addition, pursuant to a shareholders agreement, the

Reporting Person has control over a majority of the shareholder voting

power of Nanominerals. As such, the Reporting Person has voting and

dispositive power over the 16,600,000 shares of the Issuer listed as

beneficially owned by Nanominerals and has listed those shares as being

indirectly beneficially owned by him. In addition to the shares owned by

Nanominerals, the Reporting Person’s affiliate, Geotech Mining Inc. owns

140,000 shares of the Issuer’s common stock. Also included in the shares

listed as beneficially owned by the Reporting Person are a total of

905,190 shares beneficially owned by the Reporting Person’s wife, Carol

Ager. Mrs. Ager owns 765,190 shares of the Issuer’s common stock in her

own name, and an additional 140,000 shares of the Issuer’s common stock in

the name of her affiliate, Geosearch Inc. Mrs. Ager also owns 17.5% of the

outstanding shares of Nanominerals.

|

|

(b)

|

Power to Vote and Dispose of the Company

Shares:

|

|

|

|

|

|

For purposes of this Statement, the Reporting Person is

disclosing that he shares dispositive and voting power with respect to the

16,600,000 shares of the Issuer’s common stock held by Nanominerals as the

Reporting Person is the sole director and sole officer of Nanominerals and

the Reporting Person has the power to vote a majority of Nanominerals’

outstanding shares. In addition, the Reporting Person is disclosing that

he shares voting and dispositive power over the shares of the Issuer’s

common stock owned by Geotech Mining Inc., Geosearch Inc. and Carol

Ager.

|

|

|

|

|

(c)

|

Transactions Effected During the Past 60

Days:

|

|

|

|

|

|

On November 12, 2009, Nanominerals purchased 400,000

Units offered by the Issuer in a private placement financing at a price of

$1.25 per Unit. Each Unit consisted of one share of the Issuer’s common

stock and one-half of one share purchase warrant. Each full share purchase

warrant (a “2009 Warrant”) entitles the holder to purchase one additional

share of common stock at an exercise price of $1.85 per share and has an

expiration date of November 12, 2012.

|

|

|

|

|

(d)

|

Right of Others to Receive Dividends or Proceeds of

Sale:

|

|

|

|

|

|

None.

|

|

|

|

|

(e)

|

Date Ceased to be the Beneficial Owner of More Than

Five Percent:

|

|

|

|

|

|

Not Applicable.

|

Page 5 of 7

|

ITEM 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS

OR

RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER.

|

In June 2007, the Reporting Person entered into a verbal

agreement with Ian McNeil and Carl Ager, pursuant to which Mr. McNeil and Carl

Ager agreed to grant full management and operational power and authority over

Nanominerals to the Reporting Person. This included a grant of proxy to the

Reporting Person with respect to the voting rights associated with the shares of

Nanominerals owned by Mr. McNeil and Carl Ager. On September 24, 2009, this

verbal agreement was memorialized in a written shareholders agreement (the

“Shareholders Agreement”) between Mr. McNeil, Carl Ager and the Reporting

Person. Under the terms of the Shareholders Agreement, the Reporting Person has

the right to vote all of the shares of Nanominerals owned by Mr. McNeil and Carl

Ager. The Reporting Person’s right to vote Mr. McNeil’s and Carl Ager’s shares

will expire 61 days after that person ceases to be a director or executive

officer of the Issuer. As a result of these agreements, at the time of this

Amendment No. 1, the Reporting Person has the right to vote 52.6% of the

outstanding shares of Nanominerals. Carl Ager is the son of the Reporting

Person.

ITEM

7.

MATERIAL TO BE FILED AS EXHIBITS.

|

|

1.

|

Assignment agreement between Searchlight Minerals Corp.

and Nanominerals Corp. dated effective as of June 1,

2005.

(1)

|

|

|

|

|

|

|

2.

|

Amendment to Assignment Agreement Searchlight Minerals

Corp. and Nanominerals Corp. dated October 24, 2005 incorporated by

reference as exhibit 10.1 to the Company’s Form 8-K filed with the

Securities and Exchange Commission on October 28, 2005.

(2)

|

|

|

|

|

|

|

3.

|

Warrant Transfer Agreement dated January 17, 2006 between

Nanominerals Corp. and K. Ian Matheson.

(3)

|

|

|

|

|

|

|

4.

|

Share Transfer Agreement dated January 17, 2006 between

Nanominerals Corp. and K. Ian Matheson. (3)

|

|

|

|

|

|

|

5.

|

Warrant Transfer Agreement dated January 31, 2006 between

Nanominerals Corp. and Craigen L.T. Maine, TR FBO Maine Rev. Family Trust

UA June 4, 1980.

(3)

|

|

|

|

|

|

|

6.

|

Warrant Transfer Agreement dated January 31, 2006 between

Nanominerals Corp. and Richard J. Werdesheim and Lynne Werdesheim TTEES

FBO Werdesheim Family Trust DTD 10-14-86.

(3)

|

|

|

|

|

|

|

7.

|

Shareholders Agreement dated September 24, 2009 among Ian

McNeil, Carl Ager and Charles A. Ager.

|

|

|

(1)

|

Incorporated by reference as an exhibit to the Issuer's

Form 8-K filed with the SEC on June 16, 2005.

|

|

|

(2)

|

Incorporated by reference as an exhibit to the Issuer's

Form 8-K filed with the SEC on October 28, 2005.

|

|

|

(3)

|

Incorporated by reference as an exhibit to Nanomineral's

Schedule 13D filed with the SEC on June 22, 2006.

|

Page 6 of 7

SIGNATURE

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: November 18, 2009.

|

|

/s/

Charles A. Ager

|

|

|

CHARLES A. AGER

|

Page 7 of 7

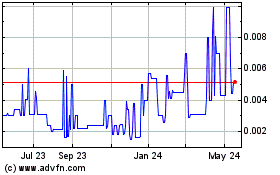

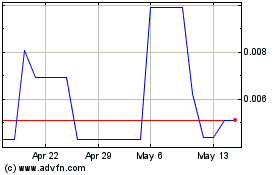

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Jul 2023 to Jul 2024