Robert D. Heuchan, President and CEO of Third Century Bancorp

(OTCBB: TDCB), the holding company of Mutual Savings Bank,

announced net income of $311,000 for the year ended December 31,

2013, or $0.24 per share, as compared to net income of $242,000, or

$0.18 per share for the year ended December 31, 2012.

The increase in net income for the year ended 2013 as compared

to the year ended 2012 was primarily due to a decrease of $287,000

in the provision for loan losses to $12,000 for the year ended

December 31, 2013 from $299,000 for the year ended December 31,

2012. In evaluating the adequacy of the allowance for loan losses,

Management considers factors such as delinquency trends, portfolio

composition, past loss experience and other factors such as general

economic conditions. For the year ended December 31, 2013, Mutual

Savings charged-off loans, net of recoveries, of $268,000 which

represents a decrease in the level of charge offs of $330,000, or

55.24%, from the year ended December 31, 2012. At December 31,

2013, non-performing assets totaled $4.7 million, or 3.76% of total

assets, and included $4.0 million of non-performing loans. At

December 31, 2012, non-performing assets totaled $6.9 million, or

5.40% of total assets, and included $6.2 million of non-performing

loans. The decrease in non-performing loans was a result of

increased collection efforts with delinquent borrowers prior to

loans becoming non-performing. Loans are considered non-performing

when one or more of the following occur: borrowers fail to make

scheduled payments causing loans to become delinquent by 90 days or

more; borrowers default on original loan terms and the Bank

restructures such loans; or Management classifies loans as

“substandard” in regards to full repayment according to loan

agreements.

Non-interest income decreased $90,000, or 9.93%, to $816,000 in

2013 from $906,000 in 2012. The primary reason for the decrease in

non-interest income was the decrease of $92,000, or 95.83%, in net

gains on sale of other real estate owned to $4,000 for the year

ended December 31, 2013.

Non-interest expense decreased $164,000 or 3.61% to $4.4 million

during 2013 from $4.5 million during 2012. The decrease in

non-interest expense was primarily due to a decrease of $63,000 in

salaries and employee benefits to $2.3 million for the years ended

December 31, 2013 and 2012. During 2013, the Bank continued to

absorb duties of positions vacated due to retirement or turnover

into existing positions.

Total assets decreased $4.1 million to $123.7 million at

December 31, 2013 from $127.8 million at December 31,

2012, a decrease of 3.22%. The decrease in assets was primarily the

result of a decrease in cash and cash equivalents of $6.8 million,

or 50.90%, to $6.6 million at December 31, 2013 from $13.3 million

at December 31, 2012. The decrease was primarily due to the

repayment of $5.0 million of Federal Home Loan Bank borrowings.

Deposits totaled $90.4 million at December 31, 2013, which

represented a decrease of $390,000 or 0.43% from $90.8 million at

December 31, 2012. Time deposits decreased $592,000, or 2.12%, to

$27.2 million at December 31, 2013 from $27.9 million at December

31, 2012 and savings, NOW, and money market accounts decreased

$474,000, or 1.00%, to $46.9 million at December 31, 2013 from

$47.4 million at December 31, 2012. Demand deposits increased

$677,000, or 4.35%, to $16.3 million at December 31, 2013 from

$15.6 million at December 31, 2012.

Borrowed funds decreased $4.0 million, or 18.6%, to $17.5

million at December 31, 2013 from $21.5 million at December 31,

2012. During 2013, the Bank borrowed $1.0 million from the Federal

Home Loan Bank and repaid $5.0 million in borrowings to the Federal

Home Loan Bank. At December 31, 2013 the weighted average rate of

all Federal Home Loan Bank advances was 1.85% and the weighted

average maturity was 3.2 years compared to the weighted average

rate of 2.22% and the weighted average maturity 3.1 years at

December 31, 2012.

Stockholders’ equity increased $237,000 to $15.4 million at

December 31, 2013 from $15.2 million at December 31, 2012. The Bank

recorded net income of $311,000 and paid cash dividends of $76,000

for the year ended December 31, 2013. Stockholders’ equity as a

percentage of assets increased 0.59% to 12.51% at December 31, 2013

compared to 11.92% at December 31, 2012.

On February 27, 2014, the Board of Directors declared a

quarterly cash dividend of $0.03 per share, payable to share

holders of record March 15, 2014. The dividend will be paid on

April 1, 2014.

Founded in 1890, Mutual Savings Bank is a full-service financial

institution based in Johnson County, Indiana. In addition to its

main office at 80 East Jefferson Street, Franklin, Indiana, the

bank operates branches in Franklin at 1124 North Main Street and

the Franklin United Methodist Community, as well as in Edinburgh,

Nineveh and Trafalgar, Indiana.

Selected Consolidated Financial

Data

At December 31, At

December 31,

2013

2012

Selected Consolidated Financial

Condition Data:

(In Thousands)

Assets $ 123,674 $ 127,786 Loans receivable-net 96,045 96,964 Cash

and cash equivalents 6,561 13,363 Interest-earning time deposits

7,169 4,465 Investment securities 7,154 5,863 Deposits 90,431

90,821 FHLB advances and other borrowings 17,500 21,500

Stockholders’ equity-net 15,469 15,232

For the Year Ended December 31,

2013

2012

(Dollars In Thousands, Except Share

Data)

Selected Consolidated Earnings

Data:

Total interest income $ 4,795 $ 5,200 Total interest expense 701

844 Net interest income 4,094 4,356 Provision of losses on loans 12

299

Net interest income after provision for

losses on loans

4,082 4,057 Total other income 816 906 General, administrative and

other expenses 4,380 4,544 Income tax expense 207 177 Net income

311 242 Earnings per share basic $ 0.24 $ 0.18 Earnings per share

diluted $ 0.24 $ 0.18

Selected Financial Ratios and Other

Data:

Interest rate spread during period 3.16 % 3.49 % Net yield on

interest-earning assets 3.35 3.70 Return on average assets 0.25

0.20 Return on average equity 2.02 1.58 Equity to assets 12.51

11.92

Average interest-earning assets to average

interest-bearing liabilities

133.77 129.82 Non-performing assets to total assets 3.76 5.40

Allowance for loan losses to total loans

outstanding

2.03 2.27

Allowance for loan losses to

non-performing loans

49.55 36.24

Net charge-offs to average total loans

outstanding

0.27 0.60

General, administrative and other expense

to average assets

3.45 3.71 Effective income tax rate 39.96 42.24 Number of

full service offices 6 6 Tangible book value per share $ 12.05 $

11.95 Market closing price at end of quarter $ 6.40 $ 3.50

Price-to-tangible book value 53.10 29.30

Third Century BancorpRobert D. Heuchan, President and CEO,

317-736-7151orDavid A. Coffey, Executive Vice President, CFO and

COO, 317-736-7151Fax 317-736-1726

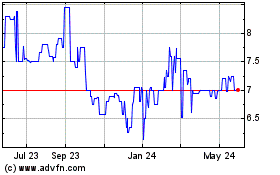

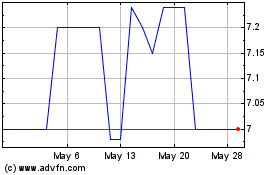

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Feb 2024 to Feb 2025