Tokio Marine: To Buy Delphi Financial Group For $2.66 Billion

December 21 2011 - 2:15AM

Dow Jones News

Tokio Marine Holdings Inc. (8766.TO) said Wednesday that it has

agreed to buy Delphi Financial Group (DFG) for $2.66 billion, or

Y205 billion, in the latest sign of how the yen's strength is

providing Japanese firms with ammunition to hook up with companies

outside Japan to offset the dim outlook at home.

Japan's largest nonlife insurer by market value said the

transaction of Delphi shares is expected to be completed in the

April-June quarter of 2012. It will include Delphi earnings in its

group results from the fiscal year beginning April 2012.

The move is the latest illustration of how the nation's

insurance sector has been actively looking for a bigger slice of

market share and growth opportunities outside of its home market

through M&A activities, in the face of the headwinds in Japan,

with its shrinking population and sluggish economy. The yen's

strength is also giving Japanese companies a catalyst to press

ahead with the buying spree.

Tokio Marine has already made significant overseas acquisitions,

buying U.K. insurer Kiln for about Y95 billion and U.S.

Philadelphia Consolidated Holding Co. for $4.7 billion in 2008.

In August, the company said it would acquire the remaining

shares it doesn't already own on First Insurance Company of Hawaii

Ltd. for about $165 million (Y12.9 billion).

-By Hiroyuki Kachi, Dow Jones Newswires; 813-6269-2789;

Hiroyuki.Kachi@dowjones.com

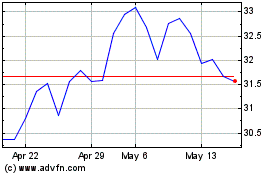

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Jul 2023 to Jul 2024