Trans-Lux Reports Year End Results

May 13 2014 - 8:38PM

Marketwired

Trans-Lux Reports Year End Results

NEW YORK, NY--(Marketwired - May 13, 2014) - Trans-Lux

Corporation (PINKSHEETS: TNLX) ("Trans-Lux" or the "Company"), a

leading supplier of Digital Displays and next generation LED

lighting, reported financial results for the year ended December

31, 2013 on May 13, 2014. Trans-Lux President and Chief

Executive Officer J.M. Allain made the announcement.

Year Ended December 31, 2013 Revenues for 2013 totaled $20.9

million, down from $23.0 million for 2012. Loss from

continuing operations for the year of 2013 was $2.5 million (loss

of $2.40 per share), compared with a loss of $1.2 million (loss of

$1.97 per share) in 2012. This year's loss from continuing

operations included a $1.1 million benefit for warrant valuation

adjustment and a loss of $348,000 on the sale of

receivables. The prior year's loss from continuing operations

included a $4.0 million benefit for warrant valuation

adjustment. The Company had EBITDA of $1.6 million for the

year ended December 31, 2013, compared with $3.1 million for

2012. The Company's audited consolidated financial statements

for the fiscal year ended December 31, 2013, included in the

Company's Annual Report on Form 10-K, which was filed with the

Securities and Exchange Commission on May 13, 2014, contained a

going concern qualification from its independent registered public

accounting firm.

"We are a very different company today than we were just a year

ago. We have an LED Lighting company that is producing revenue

and we have a new line of LED displays which is making inroads in

markets where we could not compete in the past. Our pipeline

is strong and I believe that 2014 will be a breakout year for us,"

said Mr. Allain. "We continue, however, to be hampered by our

cash position. We are losing deals and profit because of our

lack of cash. Fixing this is a priority for me and the Board

of Directors."

Fourth Quarter 2013 Revenues for the fourth quarter of 2013

totaled $5.8 million, compared with $4.7 million for the fourth

quarter of 2012. Trans-Lux recorded a loss from continuing

operations for the fourth quarter of 2013 of $618,000 (loss of

$0.59 per share), compared to a loss from continuing operations of

$653,000 (loss of $0.64 per share) in the fourth quarter of 2012.

The 2013 fourth quarter results include a $153,000 benefit for a

warrant valuation adjustment and the 2012 fourth quarter results

included a $765,000 benefit for a warrant valuation adjustment.

For more information, email info@trans-lux.com or visit

www.trans-lux.com.

About Trans-Lux Trans-Lux Corporation is a leading designer and

manufacturer of TL Vision digital video displays and TL Energy LED

lighting solutions for the financial, sports and entertainment,

gaming, education, government, and commercial markets. With a

comprehensive offering of LED Large Screen Systems, LCD Flat Panel

Displays, Data Walls and scoreboards (marketed under Fair-Play by

Trans-Lux), Trans-Lux delivers comprehensive video display

solutions for any size venue's indoor and outdoor display needs. TL

Energy enables organizations to greatly reduce energy related costs

with green lighting solutions. For more information please visit

www.Trans-Lux.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 This news release includes forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities and Exchange

Act of 1934, as amended. Forward-looking statements such as "will,"

"believe," "are projected to be" and similar expressions are

statements regarding future events or the future performance of

Trans-Lux Corporation, and include statements regarding projected

operating results. These forward-looking statements are based on

current expectations, forecasts and assumptions and involve a

number of risks and uncertainties that could cause actual results

to differ materially from those anticipated by these

forward-looking statements.

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| TRANS-LUX CORPORATION |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| RESULTS OF OPERATIONS |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

THREE MONTHS ENDED |

|

|

YEAR ENDED |

|

| |

|

DECEMBER 31 |

|

|

DECEMBER 31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except per share data) |

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2012 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

5,820 |

|

|

$ |

4,659 |

|

|

$ |

20,907 |

|

|

$ |

23,021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations |

|

$ |

(618 |

) |

|

$ |

(653 |

) |

|

$ |

(2,500 |

) |

|

$ |

(1,218 |

) |

| (Loss) income from discontinued operations |

|

|

(392 |

) |

|

|

23 |

|

|

|

631 |

|

|

|

(147 |

) |

| Net loss |

|

$ |

(1,010 |

) |

|

$ |

(630 |

) |

|

$ |

(1,869 |

) |

|

$ |

(1,365 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calculation of EBITDA (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net

loss from continuing operations |

|

$ |

(618 |

) |

|

$ |

(653 |

) |

|

$ |

(2,500 |

) |

|

$ |

(1,218 |

) |

| |

Interest expense, net |

|

|

235 |

|

|

|

113 |

|

|

|

333 |

|

|

|

297 |

|

| |

Income tax (benefit) expense |

|

|

(394 |

) |

|

|

91 |

|

|

|

(370 |

) |

|

|

112 |

|

| |

Depreciation and amortization |

|

|

824 |

|

|

|

1,002 |

|

|

|

3,538 |

|

|

|

4,104 |

|

| Total EBITDA from continuing operations |

|

|

47 |

|

|

|

553 |

|

|

|

1,001 |

|

|

|

3,295 |

|

| |

Effect of discontinued operations |

|

|

(392 |

) |

|

|

23 |

|

|

|

631 |

|

|

|

(147 |

) |

| Total EBITDA |

|

$ |

(345 |

) |

|

$ |

576 |

|

|

$ |

1,632 |

|

|

$ |

3,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share - basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Continuing operations |

|

$ |

(0.59 |

) |

|

$ |

(0.64 |

) |

|

$ |

(2.40 |

) |

|

$ |

(1.97 |

) |

| |

Discontinued operations |

|

|

(0.37 |

) |

|

|

0.02 |

|

|

|

0.61 |

|

|

|

(0.24 |

) |

| |

Total

loss per share |

|

$ |

(0.96 |

) |

|

$ |

(0.62 |

) |

|

$ |

(1.79 |

) |

|

$ |

(2.21 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding - basic and

diluted |

|

|

1,047 |

|

|

|

1,020 |

|

|

|

1,042 |

|

|

|

618 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

EBITDA is defined as earnings before effect

of interest, income taxes, depreciation and amortization. EBITDA is

presented here because it is a widely accepted financial

indicator of a company's ability to service and/or incur

indebtedness. However, EBITDA should not be considered as

an alternative to net income or cash flow data prepared in

accordance with accounting principles generally accepted in the

United States or as a measure of a company's profitability or

liquidity. The Company's measure of EBITDA may not be comparable to

similarly titled measures reported by other companies. |

| |

|

| |

|

Contact: Todd Dupee Vice President & CFO Email Contact

212.897.9955

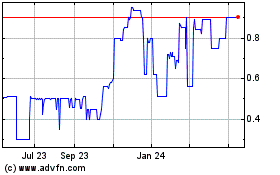

Trans Lux (PK) (USOTC:TNLX)

Historical Stock Chart

From Dec 2024 to Jan 2025

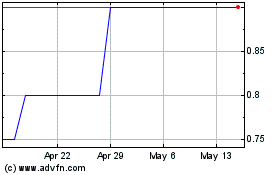

Trans Lux (PK) (USOTC:TNLX)

Historical Stock Chart

From Jan 2024 to Jan 2025