Current Report Filing (8-k)

September 01 2022 - 8:21AM

Edgar (US Regulatory)

0001645260

false

0001645260

2022-09-01

2022-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 1, 2022

Todos

Medical Ltd.

(Exact

name of registrant as specified in its charter)

| Israel |

|

000-56026 |

|

n/a |

| (State

or other jurisdiction |

|

(Commission

|

|

IRS

Employer |

| of

incorporation or organization) |

|

File

Number) |

|

Identification

No.) |

121

Derech Menachem Begin, 30th Floor

Tel

Aviv, 6701203 Israel

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: 972 (52) 642-0126

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

On

August 30, 2022, the C

On

August 30, 2022, Todos Medical USA, Inc., a wholly-owned subsidiary of Todos Medical Ltd.. (collectively, the “Company”)

entered into an lease agreement (the “Lease”) with Industrial Property, LLC to lease approximately 15,200 rentable square

feet and land of 5.9 acres located at 112 E. Industrial Boulevard, Cleburne, TX 76031 (the “Premises”) for botanical manufacturing

facility in order to establish direct manufacturing capabilities for the Company’s newly formed manufacturing subsidiary Todos

Botanicals, LLC. The Lease provides for full building access. The actual commencement dates are subject to timely completion of the Building

and premises. The term of the lease commences on the Initial Commencement Date and runs 124 months, with a five year renewal option.

The

rent obligations over the term are summarized below. The time periods and amounts set forth below assume an occupation date of September

1, 2022, and may be subject to adjustment according to the Lease, including the Company’s right to rent abatement or lease abandonment

in certain circumstances if the premises are not adequately maintained. The Lease provides the Company with the option to purchase the

facility for $4,000,000.

| Start Date | |

End Date | |

Base Monthly Rent | |

| 9/1/2022 | |

8/31/2023 | |

$ | 19,008.75 | |

| 9/1/2023 | |

8/31/2024 | |

$ | 19,579.01 | |

| 9/1/2024 | |

8/31/2025 | |

$ | 20,166.38 | |

| 9/1/2025 | |

8/31/2026 | |

$ | 20,771.37 | |

| 9/1/2026 | |

8/31/2027 | |

$ | 21,394.51 | |

Pursuant

to the Lease, the Company will also be responsible for its proportionate share of the Building’s operating expenses, including

property taxes, of approximately $2,500 per month..

The

Lease is furnished as Exhibit 10.1 to this current report on Form 8-K and is incorporated herein by reference. The foregoing description

of the Lease does not purport to be complete and is qualified in its entirety by reference to the Lease.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

Item

8.01 Other Items

On August 31, 2022, the

Company entered into a lock up and leak-out agreement (the “Lock-up”) with an institutional investor (the “Investor”)

who now has beneficial ownership of less than 9.9% or less of the Company’s Ordinary Shares, totaling 99,124,203

Ordinary shares, and owns all remaining notes issued under financing agreements entered into in 2020 that are convertible

into Ordinary shares (the “2020 Notes”). As a result of Under the terms of the agreement, the Investor has agreed to limit

sales of Ordinary shares to no more than 15% of trading volume, and in the event the price of the Ordinary shares rises to above

$0.10 per share, then the Investor shall be limited to selling no more than 5% of the trading volume. The Investor has agreed to a moratorium

on conversion of all remaining 2020 Notes for 90 days, which may be extended for an additional 30 days. In addition, the $1,250,000

PCR equipment financing loan entered into in November 2020 has now been extinguished. The Company has agreed to pay Holder $100,000

in cash in exchange on the day that is 5 days from the execution of the Lock-Up, and an additional $100,000 on the day that is 30 days

from the Lock-Up.

In

the event the Company completes an uplisting of its common shares onto a national stock exchange in the United States during the term

of the Lock-Up, then the Holder agrees that it will convert all of its debt into Series A Preferred Shares of the Company and enter into

an additional 90-day restriction agreement on share sales with the Company’s underwriter.

Concurrently,

the Company confirms that all convertible notes issued under financing agreements entered into in 2021 (the “2021 Notes”)

have exercised their right to adjust their conversion price to $0.04792 per Ordinary share. Ordinary shares underlying the 2021 Notes

were registered on Form S-1 that was declared effective on February 4, 2022.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

September 1, 2022

| |

TODOS MEDICAL LTD. |

| |

|

| |

By: |

/s/

Gerald Commissiong |

| |

|

Gerald Commissiong |

| |

|

Chief Executive Officer |

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Nov 2024 to Dec 2024

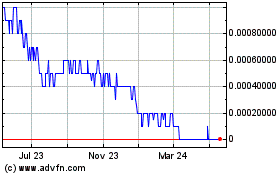

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Todos Med Ltd (CE) (OTCMarkets): 0 recent articles

More Todos Medical Ltd. News Articles