Lagardere Adjusts 2011 Guidance; Postpones Canal Plus IPO

August 31 2011 - 11:36AM

Dow Jones News

French media group Lagardere SCA (MMB.FR) Thursday adjusted its

full-year guidance to account for the recent sale of the group's

international magazines business and lower-than-expected earnings

at its sports marketing business Lagardere Unlimited.

MAIN FACTS:

- For 2011, the group now expects recurring EBIT from media

activities guidance to decline by about 5% to 7% on a constant

exchange rate basis. Without the PMI deconsolidation and given the

revision of expected results for Lagardere Unlimited, recurring

EBIT for 2011 would have risen slightly, the group said.

- Lagardere had previsouly targeted recurring EBIT from media

activities to grow around 10% at constant exchange rates. This

guidance was based on the group's structure as of Jan. 1, so

included the international magazine assets it is in the process of

finalizing the sale of to U.S. media giant Hearst Corporation.

- Lagardere also said that the planned initial public offering

of its stake in Canal Plus France "does not appear to be feasible

on good terms in light of the current market environment." The

group said that it remains committed to selling the stake in the

pay-TV, the rest of which is owned by Vivendi SA (VIV.FR), once

market conditions allow.

- Lagardere said net profit for the first half dropped to EUR28

million from EUR80 million last year.

- Recurring EBIT from media activities, which is the main focus

for analysts, fell 7.9% to EUR168 million in the first six months.

This figure was below the EUR183 million forecast by analysts.

- Revenue in the first half rose 0.2% to EUR3.72 billion,

meeting analyst views.

- By Paris Bureau, Dow Jones Newswires; +331-4017-1740;

ruth.bender@dowjones.com

Order free Annual Report for Vivendi Universal SA

Visit http://djnweurope.ar.wilink.com/?ticker=FR0000127771 or

call +44 (0)208 391 6028

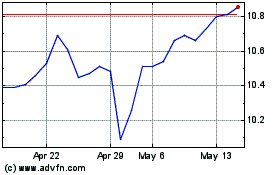

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024