Barclays to Create Two New M&A Teams

December 18 2015 - 8:10AM

Dow Jones News

LONDON—Barclays is planning to create two new M&A teams

focusing on cross-border structuring and activism.

Barclays is planning to create two new advisory teams as it

refocuses parts of its mergers and acquisitions business under new

European M&A head Pier Luigi Colizzi.

The U.K. bank is in the process of establishing a new team

focused on cross-border structuring and another on activist

investors, as it looks to take advantage of some of the factors

driving this year's record breaking deals boom.

Barclays currently organizes its European M&A business by

country.

The plans to establish two further specialist teams come after

Barclays appointed Pier Luigi Colizzi to lead its European M&A

business in July. Mr. Colizzi was promoted from head of banking in

Italy to replace Matthew Ponsonby, who took up the role of vice

chairman for banking.

The U.K. and Europe have seen a bout of high profile activism in

2015. New York-based P. Schoenfeld Asset Management forced French

media conglomerate Vivendi to increase a special dividend and

Elliott Management successfully forced change at Alliance Trust, a

126-year-old investment company.

With the establishment of a cross-border team, Barclays hopes to

tap into one of the biggest drivers of the surge in M&A

activity.

Barclays provided financing to three of the biggest deals in the

region in 2015: Brewer Anheuser-Busch InBev's acquisition of the

U.K.'s SABMiller, Royal Dutch Shell's deal to buy BG Group, and

Israel's Teva Pharmaceuticals acquisition of Allergan's generic

drugs business.

"We have noticed a very significant acceleration of the business

in second half of this year. There has been a continuation of the

strong cross border theme, both between Barclays' two home markets

of the U.S. and the U.K., and into and out of Europe," Mr. Colizzi

said in an interview.

During Mr. Collizi's first six months, Barclays has also

expanded its senior European advisory team.

In September the bank hired Axel-Sven Malkomes, previously Socié

té Gé né rale's head of health care and chemicals, as vice chair of

health care banking.

It has also hired Thomas Westin from Bank of America to co-head

its Nordics business, and earlier this month moved Gavriel Lambert

from the U.S. to plug a gap at the top of its consumer and retail

team.

This post is from WSJ City: Fact-packed news for London's

financial markets and beyond in one fast, smart app. Made for

iPhone. Download free from the App Store now.

(END) Dow Jones Newswires

December 18, 2015 08:55 ET (13:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

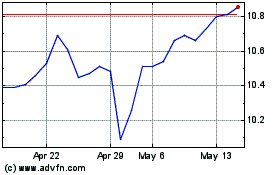

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024